On Wednesday, the US Federal Reserve approved a 25-basis-point interest rate cut, marking the third this year and aligning with market expectations. Typical of its previous pre-FOMC price action, Bitcoin rallied above $94,000 on Monday, but the media’s hawkish depiction of the rate cut reflects a Fed that is divided over the future of US monetary policy and the economy.

Given the “hawkish” label associated with this week’s rate cut, it’s possible that Bitcoin price could sell on the news and remain range-bound until a new momentum driver emerges.

CNBC reported that the Fed’s 9-3 vote is a signal that members remain concerned about the resilience of inflation, and that the rate of economic growth and pace of future rate cuts could slow in 2026.

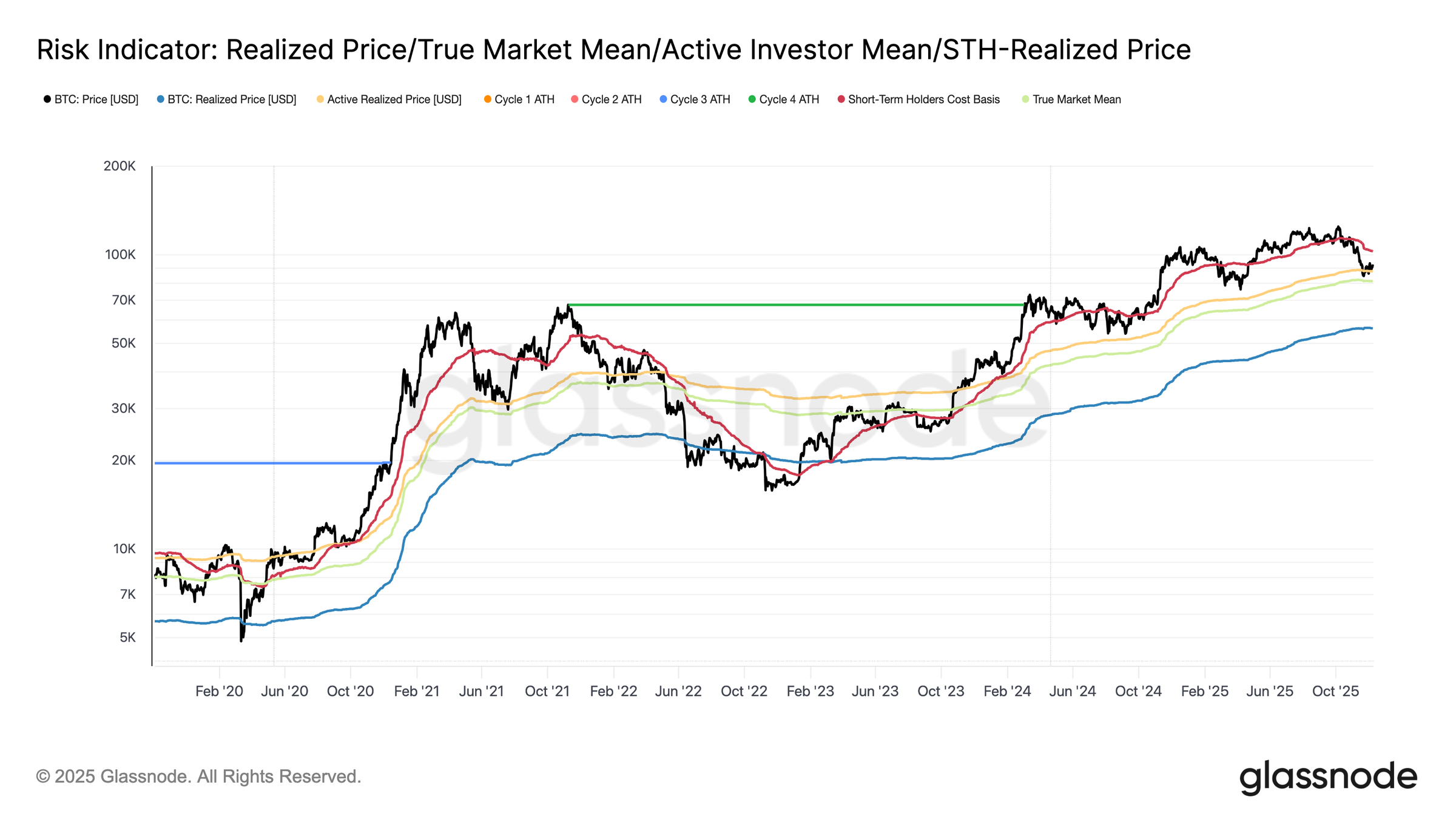

According to Glassnode, Bitcoin (BTC) remains trapped in a structurally fragile range below $100,000, with the price action constrained between the short-term cost basis at $102,700 and the “True Market Mean” at $81,300.

Glassnode data also showed weakening onchain conditions, thinning futures demand, and persistent sell pressure in an environment that continues to hold BTC below $100,000.

Key takeaways:

Bitcoin’s structurally fragile range kept the market stuck below $100,000 with expanding unrealized losses.

Realized losses have surged to $555 million/day, the highest since the FTX collapse in 2022.

Heavy profit-taking from more than 1-year holders and the capitulation of top buyers are preventing a reclaim of the STH-Cost Basis.

Fed rate cuts may fail to significantly boost Bitcoin price in the short term.

Time is running out for Bitcoin to recover $100,000

According to Glassnode, Bitcoin’s inability to break above $100,000 reflected a growing structural tension: time is working against the bulls. The longer the price stayed pinned within this fragile range, the more unrealized losses accumulated, increasing the likelihood of forced selling.

The relative unrealized loss (30-day-SMA) has risen to 4.4%, ending two years below 2% and signaling a transition into a higher-stress environment. Even with BTC’s bounce from the Nov. 22 low to roughly $92,700, the entity-adjusted realized loss continued climbing, reaching $555 million/day, a level previously seen during the FTX capitulation.

At the same time, long-term holders (above 1-year holding period) realized more than $1 billion/day in profits, peaking at a record $1.3 billion. This dynamic of capitulation from top buyers and heavy distribution from long-term holders, potentially kept BTC under the key cost-basis thresholds, unable to retake the $95,000–$102,000 resistance band that capped the fragile range.

Related: Bitcoin hikes volatility into ‘tricky’ FOMC as $93.5K yearly open fails

Spot-led rally meets declining BTC futures market

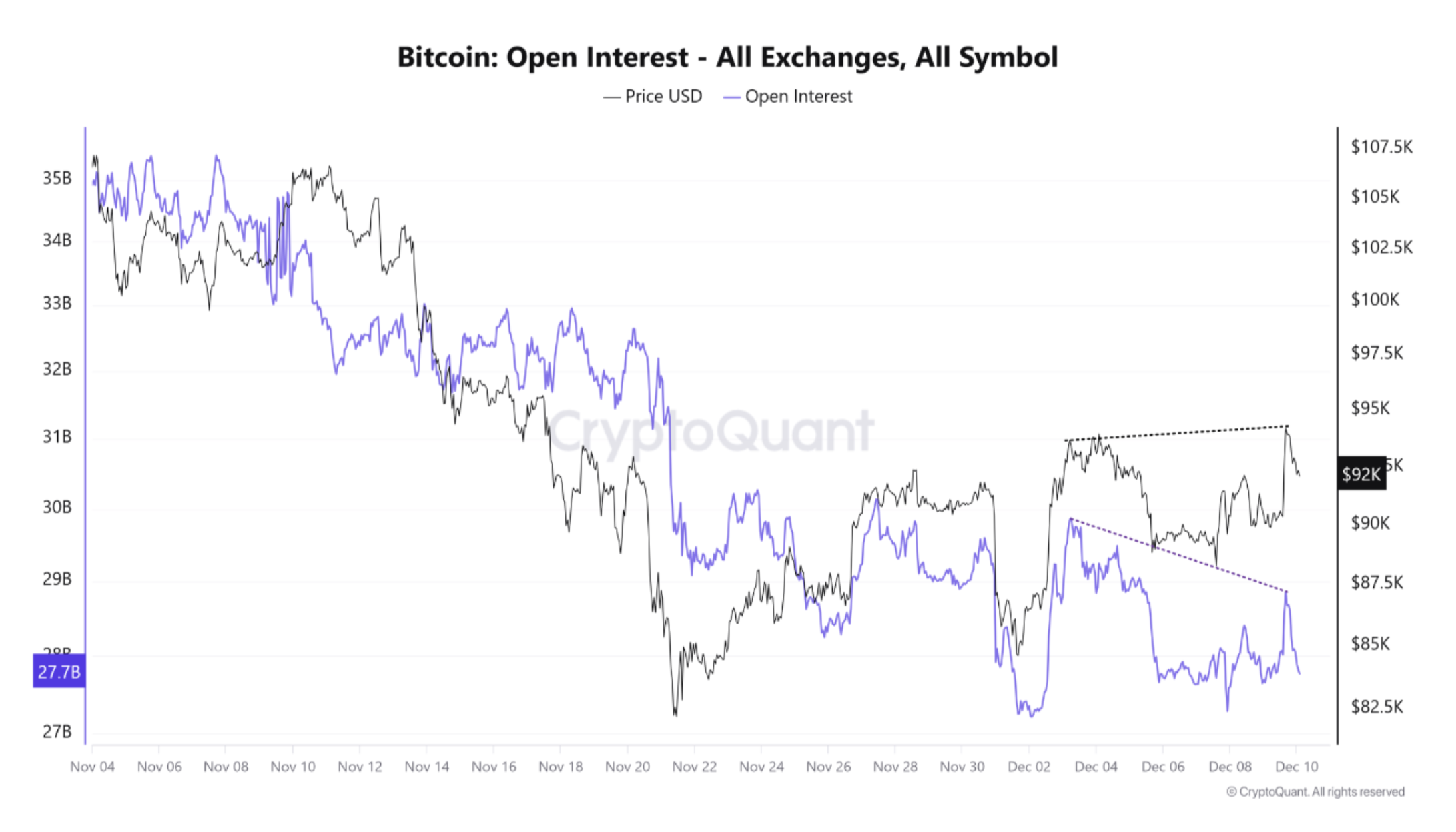

Data from CryptoQuant found that the crypto market has rallies ahead of FOMC meetings, but a notable divergence has appeared where Bitcoin’s price has risen while open interest (OI) has been on a decline.

OI declined during the corrective phase since October, but even after BTC bottomed on Nov. 21, it continued to fall despite the price moving to higher highs. This marked a rally driven primarily by spot demand, rather than leverage-driven speculation.

CryptoQuant added that while spot-led uptrends are generally healthy, sustained bullish momentum historically requires rising leveraged positioning. Given that derivatives volumes are structurally dominant, spot volume accounted for only 10% of derivatives activity, which the market may struggle to maintain if rate-cut expectations weaken heading into the meeting.

Related: Short the dip and buy the rip? What FOMC outcomes reveal about Bitcoin price action

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.