Bitcoin (BTC) battled stubborn horizontal resistance Friday with $94,000 next on bulls’ radar.

Key points:

Bitcoin keeps up pressure on familiar resistance levels as optimism over market strength increases.

The recent pullback was the result of “manipulative” forces, analysis says.

Gold on the way to new all-time highs is an “extremely bearish” macro headwind for Bitcoin.

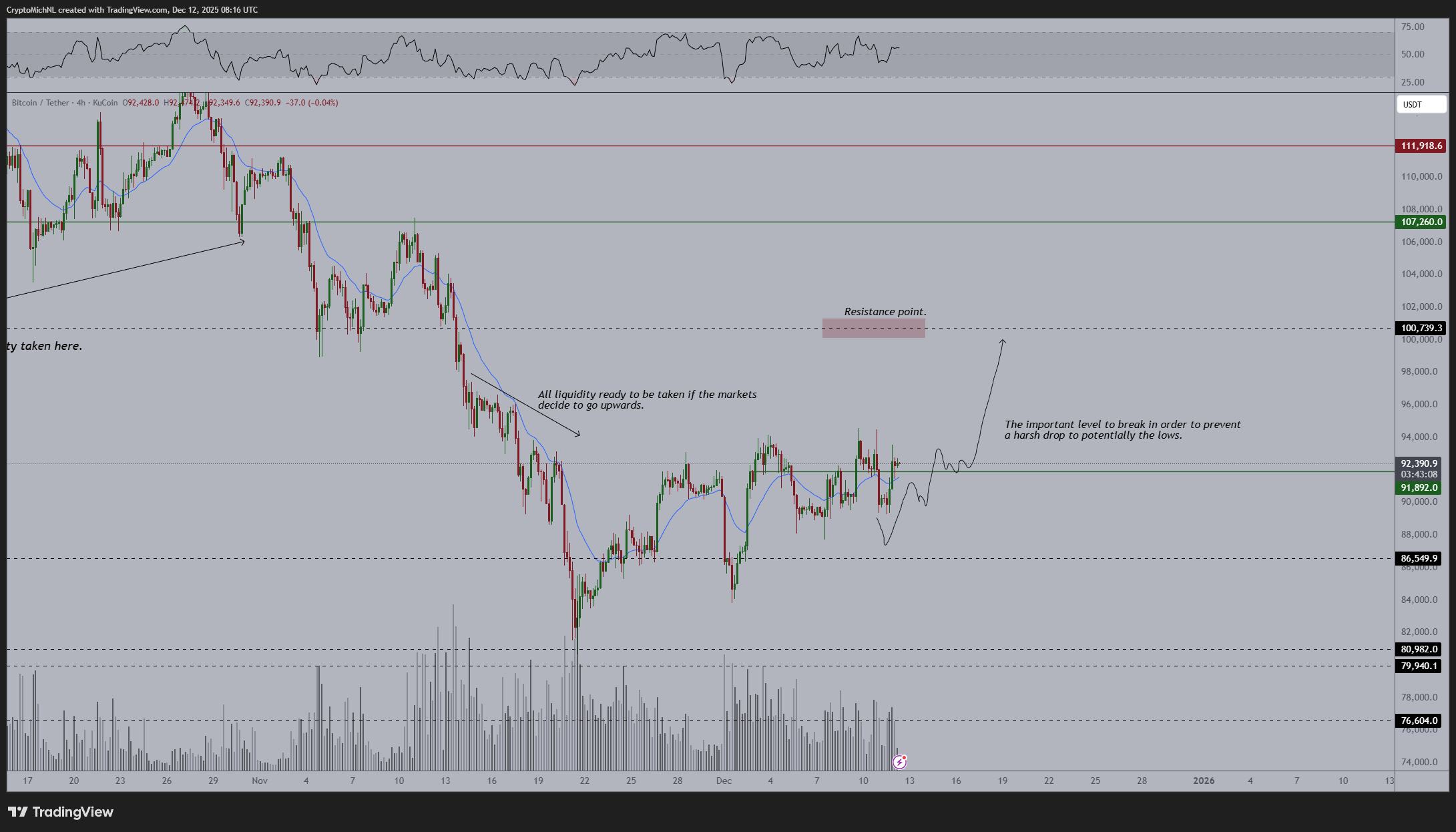

BTC price: Days or weeks until “upwards breakout”

Data from Cointelegraph Markets Pro and TradingView showed wavering BTC price action after a trip to $95,500 the day prior.

Up against several resistance features on the daily chart, BTC/USD coiled for what some said should be a breakout move.

“Bitcoin is doing the choppy dance. Illiquid books, and therefore fast moves up and down for the position on $BTC,” crypto trader, analyst and entrepreneur Michaël van de Poppe wrote in his latest analysis on X.

“Nonetheless, I think that we're still in for a new upwards breakout in the coming days/weeks.”

Upside moves failed to result in resistance flips in December, and trader Daan Crypto Trades added the 200-period simple and exponential moving averages on the four-hour chart to the list of hurdles to clear.

“Consolidating against its 4H 200MA/EMA & The ~$94K horizontal resistance which acted as range high for the past couple of weeks,” he summarized.

“This is the key area to break for bitcoin to flip the momentum around in favor of the bulls in the short to mid term.”

Despite the relative inertia, Van de Poppe argued that there was less chance of a deeper market pullback next.

“Higher lows indicate a higher structure and therefore an uptrend is being established. Price clearly doesn’t break down anymore, and my general thesis is that the recent, heavy correction was highly manipulative and not organic,” he added.

Gold steams toward new records

As the dust settled on the Federal Reserve interest-rate decision, US stocks joined crypto in losing some of their recent gains after the Wall Street open.

Related: Bitcoin new year bear flag sparks $76K BTC price target next

The S&P 500 had been within 20 points of new all-time highs, but lost 0.35% on the day, while gold headed toward $4,400 per ounce.

“Gold is on the brink of a new record high,” trading resource The Kobeissi Letter announced, noting gold futures’ 65% year-to-date returns.

At the December monthly open, Bitcoin reached its lowest levels against gold since early 2024.

Commenting, Jeremy Batchelder, co-founder of crypto automation platform Glyde, warned that strong precious metal performance would cloud the outlook for crypto.

“Gold is about to hit new ATHs. Silver is making new highs every single day,” he told X followers on the day.

“This is extremely bearish for Bitcoin. We need the metals to calm down before the crypto bull run can begin.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.