The price of XRP may be declining as volatility extends, but a lot of the leading altcoin has been observed leaving cryptocurrency exchanges at a rapid rate. With the token heavily leaving exchanges during the bearish phase, this raises the possibility of an anticipated supply shock.

Is An XRP Supply Shock Incoming?

As XRP battles with bearish movements, its presence on centralized exchanges is subtly shrinking, which is starting to attract notable attention in the market. A report from Ripple Bull Winkle, a market expert and the founder of Lux Lions NFT, shows that the token has been consistently leaving crypto exchanges, even with fading price momentum.

This decline in supply on exchanges signals that investors may be transferring their coins into long-term storage or self-custody rather than making them easily accessible for trading. While these investors maintain the trend, it is often considered a strategic move in order to position themselves for potential upward spikes in price.

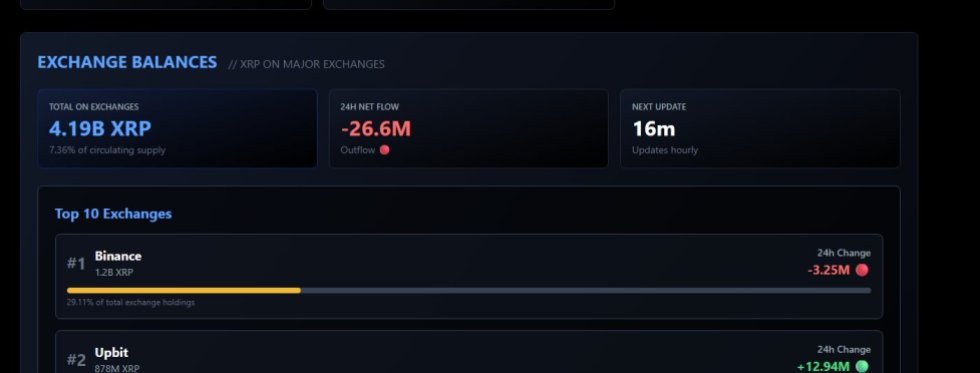

In the post on the X platform, Ripple Bull Winkle highlighted that the supply of XRP on exchanges is now totaled at 4 billion. Despite the massive coins still available on crypto exchanges, the figure only represents nearly 8% of the total supply circulating in the market.

As the altcoin exchange supply shrinks, the trend is sparking fresh debate about its possible implications for price behavior in the upcoming weeks. In the past, it has frequently preceded times of decreased sell pressure, shifting liquidity dynamics, and increased demand sensitivity.

Ripple Bull Winkle noted that the majority of the supply on exchanges is not for sale liquidity. Such thin float with growing institutional demand is likely to lead to explosive conditions, allowing XRP to kick off another sharp rally. According to the expert, this trend could be a sign of a supply shock because they do not show warnings; instead, they just detonate.

Taking a look at another post, Ripple Bull Winkle revealed a massive withdrawal from crypto exchanges, indicating rising conviction and reducing sell-offs. During the weekend, over 30 million XRP were withdrawn from exchanges, which was carried out in a single day.

The expert claims that this is how supply shocks are kicked off quietly, and the price does not move first. “Liquidity disappears first. Most people won’t notice until sellers are gone,” the expert added.

ETFs Market Is Thriving

XRP continues to experience significant demand both from retail and institutional investors via its Spot Exchange-Traded Funds. X Finance Bull highlighted that the funds are the only ETFs without any daily outflows over the last 30 days.

Currently, the funds hold the line with $1.34 billion and 669 million XRP locked. While others rotate their capital, institutions are building up on the token with conviction. According to the expert, institutional investors understand that the token is shaping up to be the liquidity layer for global finance, but retailers fail to. Meanwhile, this is how smart money moves prior to a paradigm shift.