Three Binance Bitcoin Charts Point to the Direction of BTC's Next Major Move

Data from Binance shows that liquidity patterns are changing, and the unique positioning of traders may influence the direction of Bitcoin's (BTC) next price trend.

BTC's short-term trend may depend on order flow on the Binance platform and changes in on-chain activity. Three Binance-related indicators show rising selling pressure, shifting liquidity behavior, and the market preparing for volatility—factors that could determine whether BTC maintains support levels or enters a deeper correction.

Key Points:

BTC whale deposits to exchanges are increasing, indicating that profit-taking and risk-off sentiment are rising.

BTC inflows to Binance have reached 2025 highs, and historically, this situation often triggers prolonged corrections.

USDT deposits on the Binance platform have hit annual highs, indicating that traders are repositioning for potential market volatility.

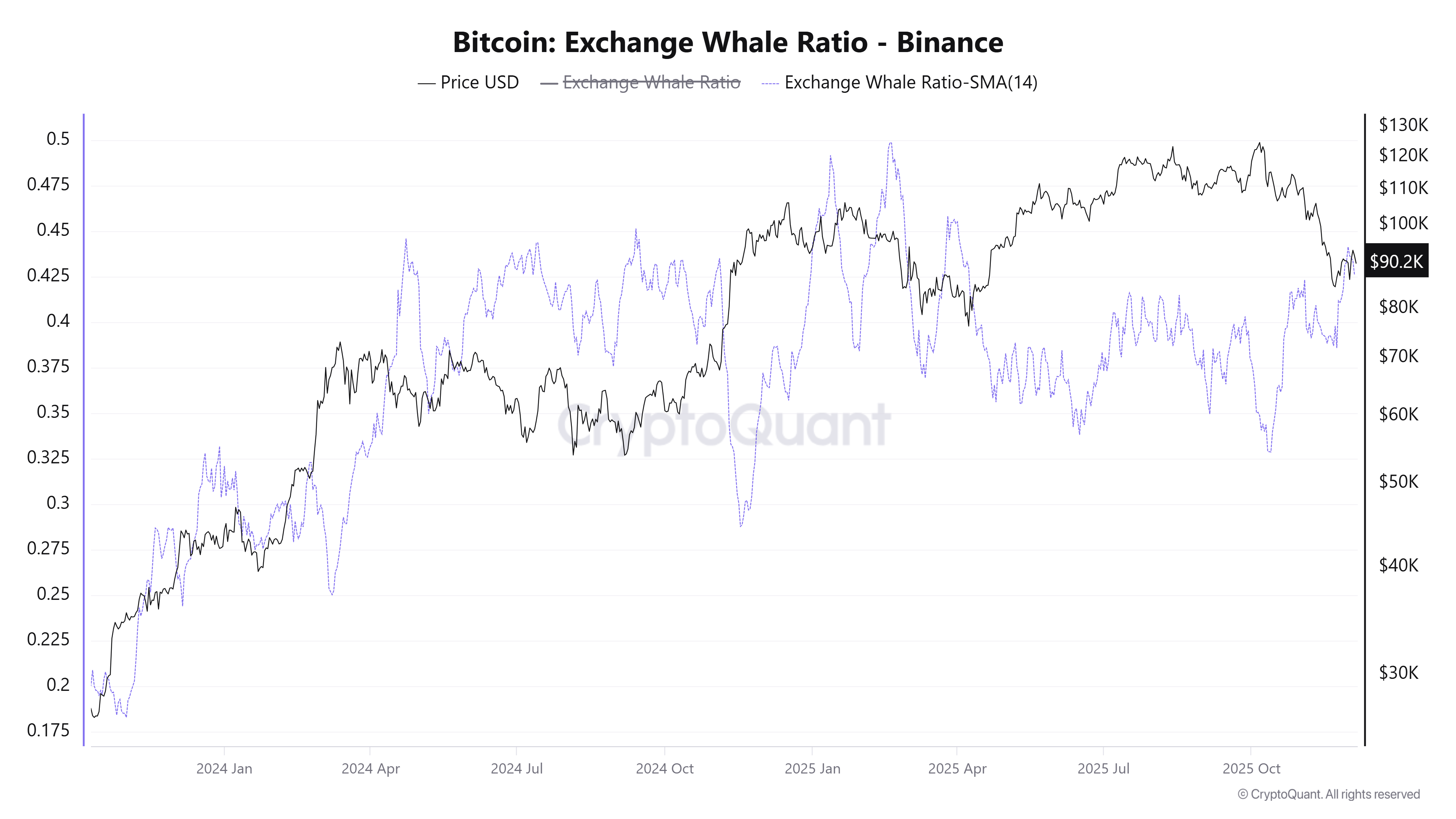

BTC Whale Ratio Rebound Warns of Distribution Pressure

The exchange whale ratio has risen significantly, currently reaching 0.47 across all exchanges, indicating that large holders are accelerating the transfer of BTC to trading platforms. Experts point out that this trend is more pronounced on the Binance platform, where its 14-day exponential moving average (EMA) has climbed to 0.427, the highest level in four months.

Whale deposits typically occur before distribution phases, as large institutions tend to use Binance's liquidity to sell large holdings. As BTC struggles to break above $93,000, this shift suggests that upward resistance is increasing. Analysts believe that if this trend continues, the price is more likely to enter a consolidation phase or retest support levels before attempting another breakout.

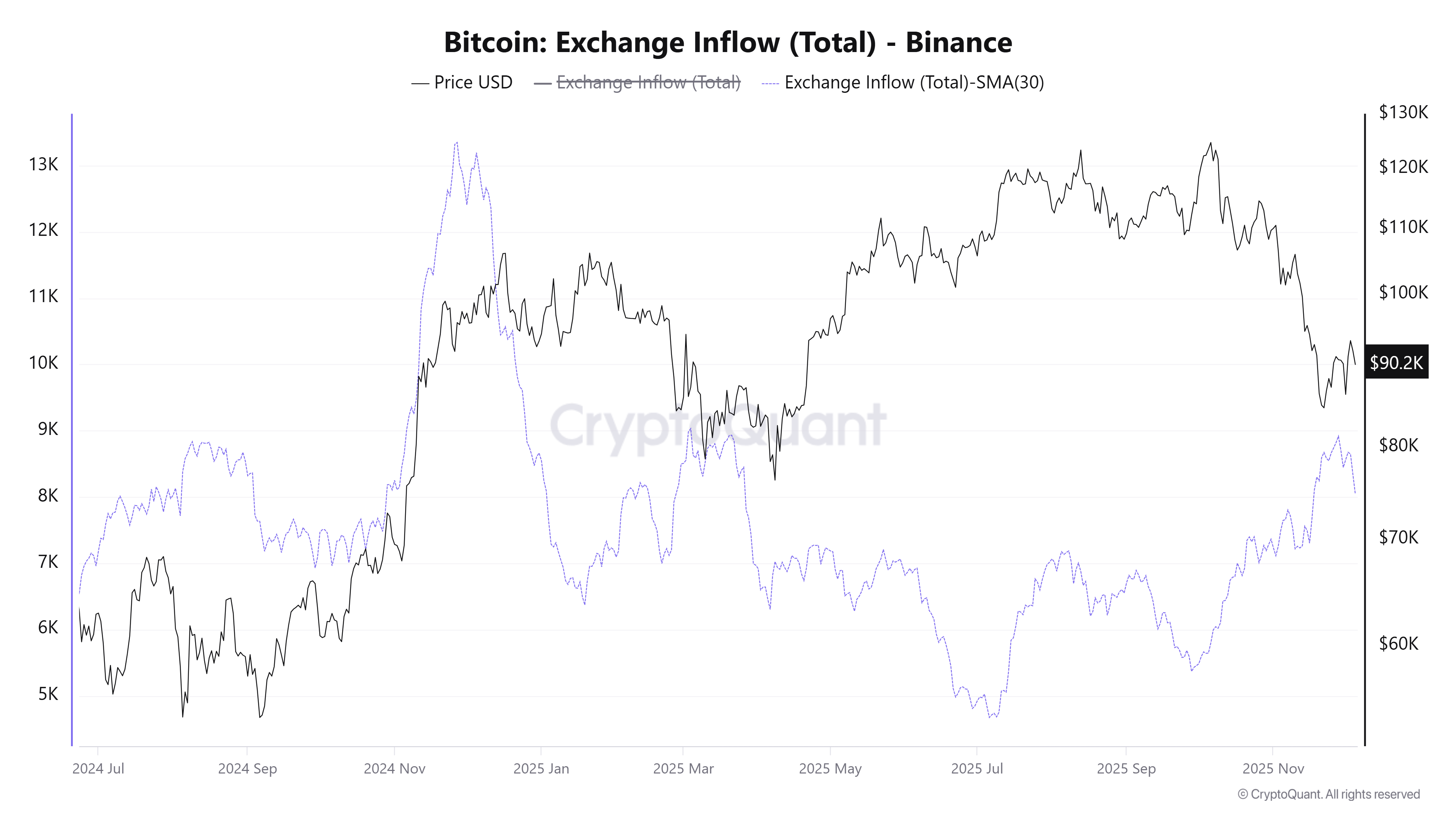

BTC Inflows to Binance Hit Annual High, Triggering Alarms

On-chain data analysis shows that the 30-day simple moving average (SMA) of BTC inflows to Binance reached 8,915 on November 28, nearly touching the historical high of 9,031 set on March 3. Market experts state that, based on historical data, peak inflow levels similar to those recorded in March are often followed by significant downward trends.

This surge indicates that holders are actively preparing to reduce risk exposure or rotate assets after Bitcoin's rally. Industry observers note that as the market attempts to stabilize above the $96,000 resistance level, Binance's growing inventory has become an immediate resistance factor. Technical analysts emphasize that until these excess supplies are fully absorbed by the market, the upward trend may be constrained.

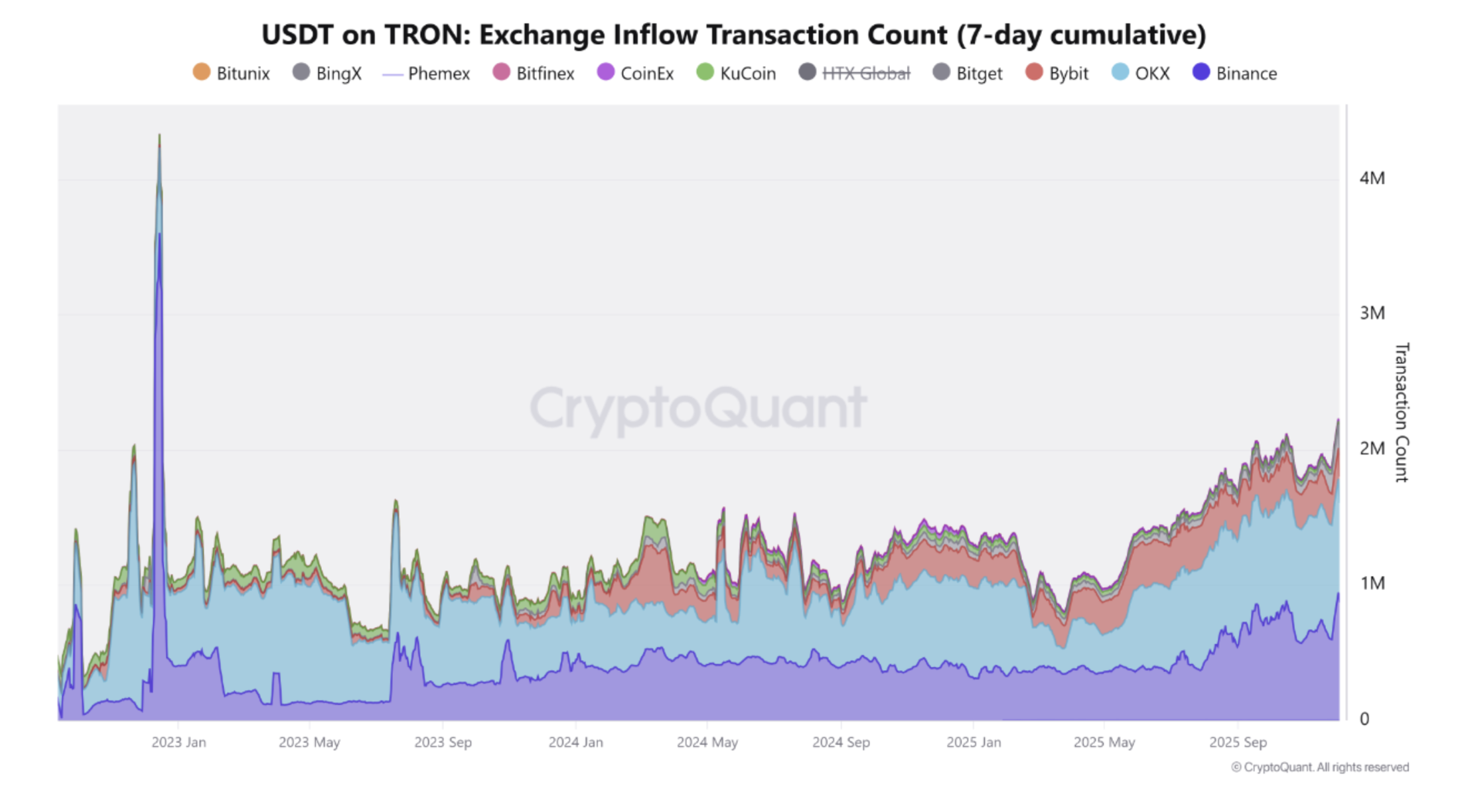

USDT Deposit Increase: Are Traders Preparing for Market Volatility?

Binance recorded 946,000 USDT deposit transactions within seven days, significantly exceeding OKX (841,000) and Bybit (225,000). Professional analysts point out that steady coin inflow increases usually indicate that traders are preparing to take action, whether for aggressive bottom-fishing or repositioning during rapid market changes.

Market observers believe that, considering the background of whale selling and large BTC inflows to exchanges, this surge is more likely a signal that traders are preparing to respond to market changes rather than a passive accumulation strategy. During periods of high market uncertainty, stable coin inflows typically trigger higher volatility and short-term price range adjustments.

If BTC's price falls below the $90,000 threshold, these liquidity factors could accelerate the decline. However, professional traders note that if support levels hold effectively, the market could experience a rapid counter-trend rebound.

Related Recommendation: 21Shares Founder Predicts: Bitcoin (BTC) Unlikely to Repeat January Rally, Low Probability of New Highs

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making decisions. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements subject to risks and uncertainties. Cointelegraph shall not be liable for any losses or damages arising from your reliance on this information.