In the midst of the waning action of the Ethereum price, investor sentiment, especially those on centralized exchanges, appears to be holding remarkably strong. Despite experiencing a pullback, causing ETH to lose the $3,000 price mark, the overall supply of the altcoin on cryptocurrency exchanges has fallen sharply, reaching a new multi-year low.

Exchange-Held Ethereum Hits New Low

Ethereum is becoming less prevalent on centralized exchanges at a rate that is difficult to ignore, indicating a significant change in the way investors are placing themselves. A CryptoQuant report from Arab Chain, a market expert and author, reveals that ETH exchange supply is steadily declining, reaching one of the lowest levels in years.

Specifically, the metric has dropped to its lowest levels since 2016, indicating a shift towards long-term holding and less selling pressure. As more ETH shifts from trading platforms to long-term storage or self-custody, the amount of available sell-side liquidity keeps getting tighter.

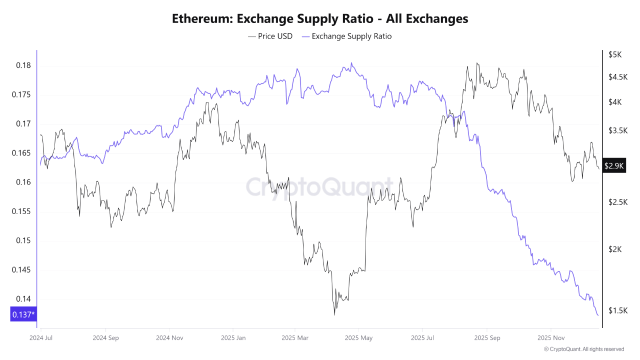

Arab Chain highlighted that the current state of ETH reflects a significant change in supply behavior across crypto exchanges, as indicated by the Exchange Supply Ratio across all platforms. The metric shows that the percentage of ETH held in exchanges has been steadily declining, which is important to comprehend the present supply and demand equilibrium.

According to the chart reading, the Exchange Supply Ratio is currently at the 0.137 level, marking one of the lowest points since 2016. This decline points to a rise in ETH outflow from exchanges to external wallets, which suggests demand for immediate selling has decreased.

Historically, such behavior signaling a growing preference for long-term holdings often emerges during periods of reaccumulation. It also manifests in the lead-up to more stable price movements following periods of volatility.

ETH Withdrawal Highly Evidenced On The Binance Platform

On Binance, the world’s largest cryptocurrency exchange, the Exchange Supply Ratio has dropped to around 0.0325, a relatively low level in comparison to previous months. What this implies is that there is a noticeable ETH withdrawal from Binance‘s wallets, which is the biggest exchange in terms of liquidity.

As a result, the supply of ETH available on the platform for immediate sale in the spot market decreases. Arab Chain noted that this dynamic reflects growing trader caution and a decline in short-term selling pressure. An interesting aspect of this trend is that withdrawals are rising even while ETH’s price is facing heightened volatility.

During the time of the research, Ethereum was trading near $2,960, a mid-range level that reflects a relative balance between supply and demand. The decreasing supply on exchanges, coupled with price stability, indicates that there is not much selling pressure on the market. Rather, it is going through a process of repositioning and absorbing liquidity.