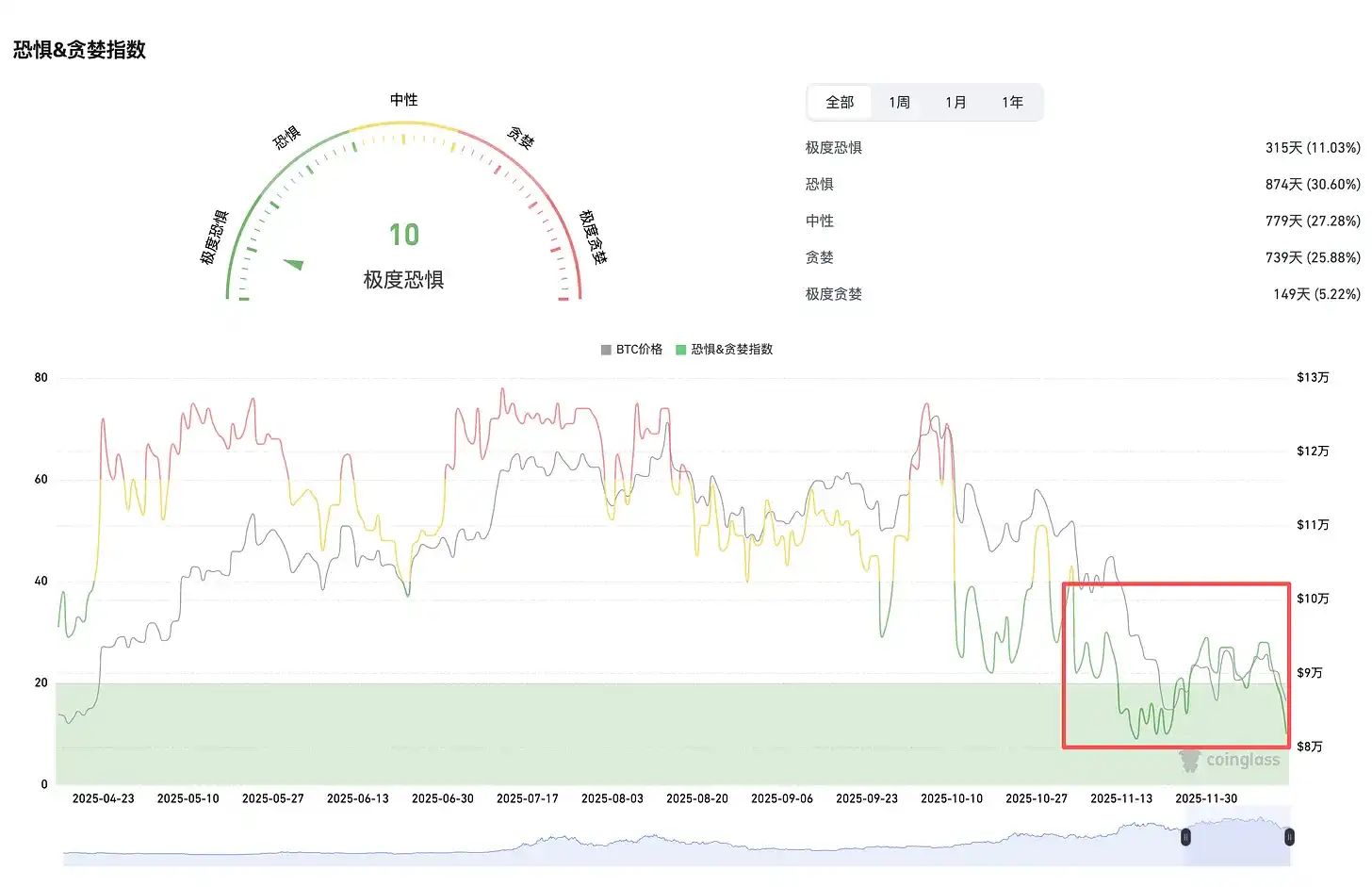

In terms of market sentiment, it's largely bearish across the board. In groups focused purely on trading charts, prices below $50,000 are already being discussed. The research-oriented crowd is also very pessimistic, generally believing that it's hard for any good innovation to emerge now, and that attention and capital are being heavily drained by the AI sector.

The strategy discussed last week was to abandon most altcoins and shift to mainstream assets, primarily concentrating on BTC and ETH. Only a portion of altcoin assets with cash-flow businesses were kept, such as AAVE and LINK. Public chains and L2s were mostly swapped for ETH.

Compared to the last cycle, I feel I've become very conservative. During the bear market after LUNA, I bought the dip on a large number of altcoins. Although the overall account was ultimately profitable, and I even witnessed projects like AAVE rise again, I also experienced too many stories of going to zero.

The situation this cycle is a bit different. I think there are very few mispriced altcoins left; the market's computational and evaluation capabilities have greatly improved, and 'bargain hunting' isn't so easy anymore.

Especially this cycle, there are a large number of projects without real business, and also reborn projects meant to fulfill previous fundraising obligations. These projects are very dangerous.

Of course, if there really is a good opportunity, I would still buy, but right now, it's basically non-existent.

Thanks for reading CM's DeFi! Subscribe for free to receive new posts and support my work.

2. Aave DAO vs Aave Labs Governance Power Dispute

This has been fiercely debated recently. I wrote an article about it, recommended reading. This also reflects the governance dilemma faced by the entire industry.

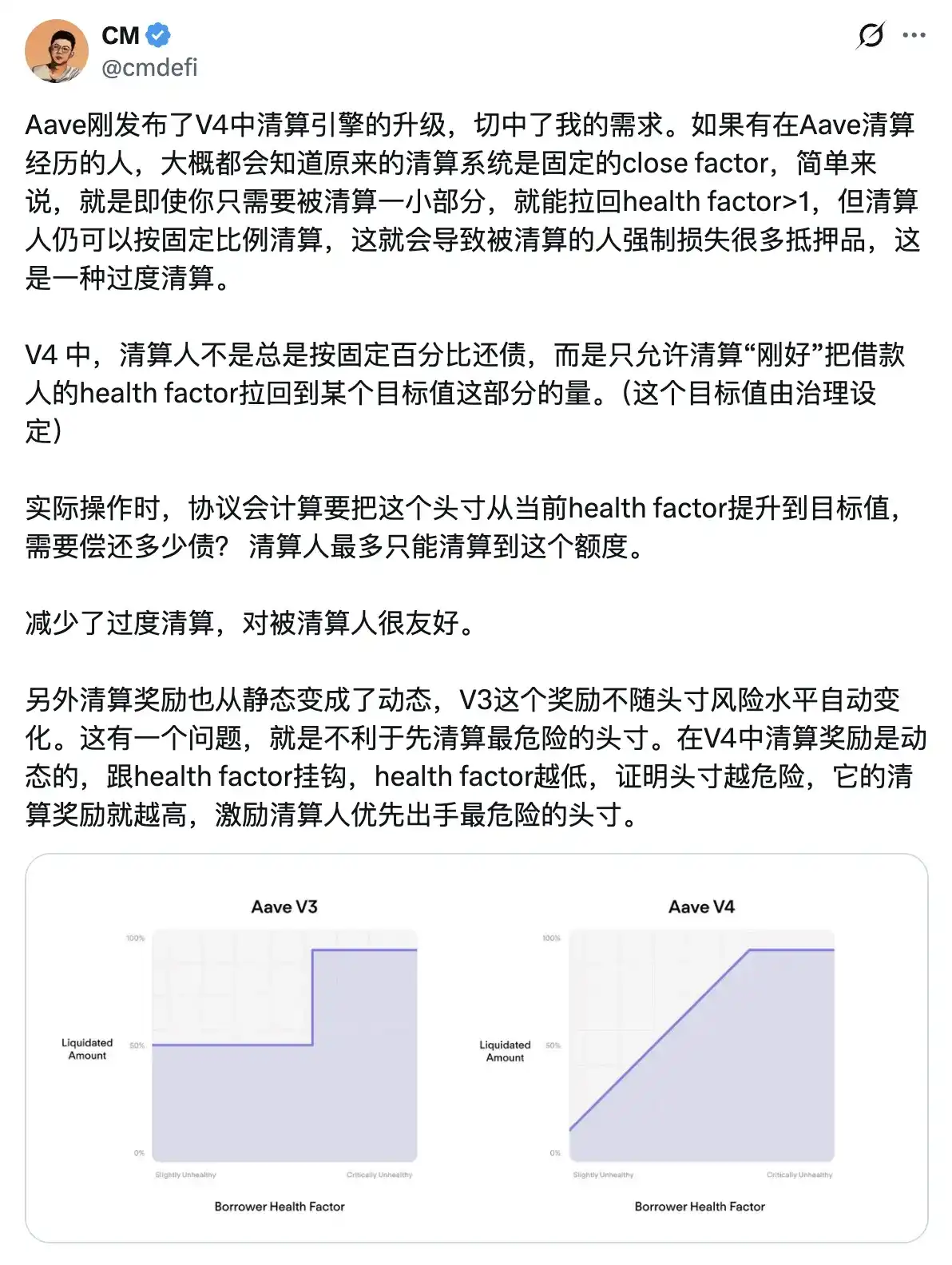

3. Aave V4 Updated Liquidation Mechanism, Reducing Over-Liquidation.

4. About the Hot Stablecoin Public Chains This Cycle

This sector is in a somewhat awkward position currently, and the market's interpretation is also problematic. When Plasma first launched, many thought it would crush other public chains and take away USDT's market share. But in reality, the impact on Ethereum and Tron has been minimal. Even with massive token rewards投放 (deployed), they haven't captured a significant market share.

The real narrative for this赛道 (sector) is to open up the stablecoin market outside the圈 (circle/crypto sphere). After all, in the context of the stablecoin compliance bill being passed this cycle, stablecoin entrepreneurship is a赛道 (sector) that occupies the right timing and conditions. However, currently, no one has been seen to successfully pull this off. Of course, the difficulty is also very high. I think this will be the key factor testing a stablecoin L1 in the future, rather than endlessly competing in the存量 (existing) stablecoin market.

5. Stock Tokenization and RWA Sector

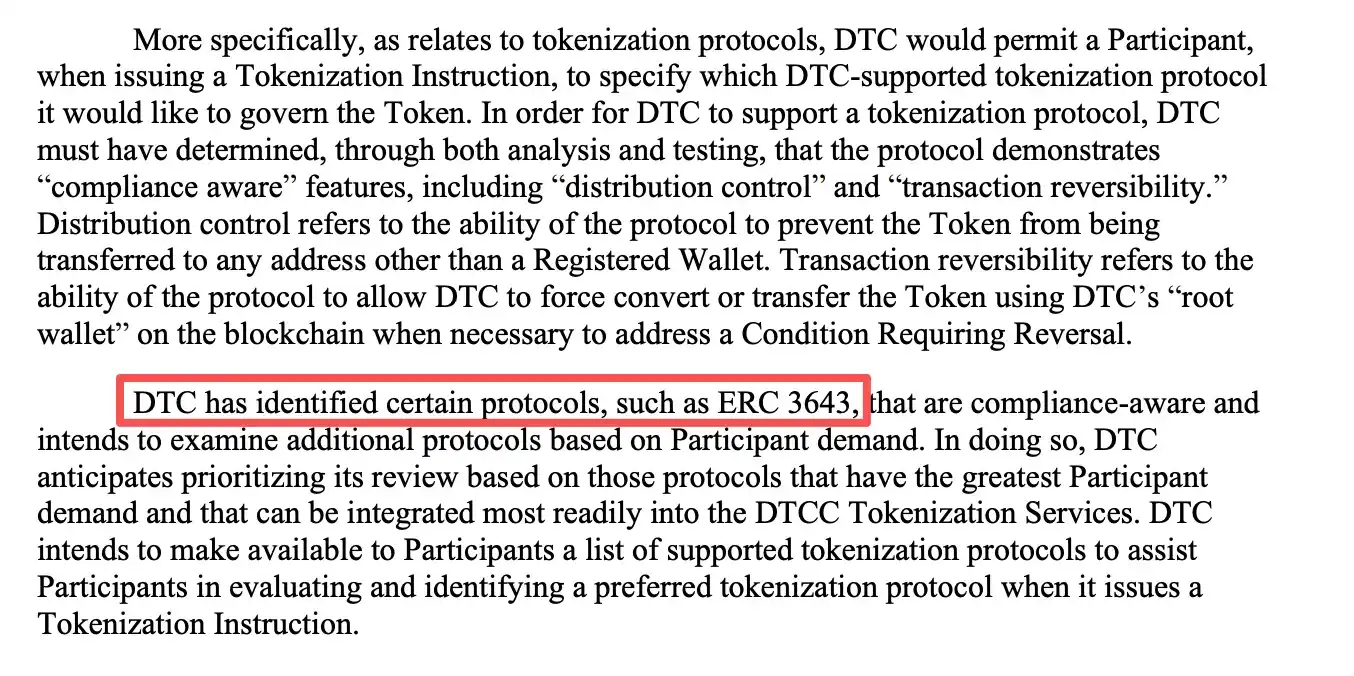

DTCC was approved by the SEC for its asset tokenization plan. This news has once again drawn market attention to this sector. In terms of trend, the SEC is taking a very open and supportive attitude to advance this matter, with documents, details, and standards.

DTCC (Depository Trust & Clearing Corporation) is a leading global provider of financial market infrastructure, processing over 90% of U.S. stock, bond, and treasury trades globally.

First, some standards defined in the SEC's No-Action Letter for 'Qualified Blockchains': (Excerpt)

-

Reliability and Resilience: The blockchain network must demonstrate high reliability and resilience, including assessments based on availability, performance, and historical outage records, to prevent operational disruptions.

-

Compliance Function Support: Only DTCC participants can register wallets and are fully responsible for wallet activity. The network must support compliance-aware functions, including distribution controls (preventing transfers to non-registered wallets) and transaction reversibility (allowing DTCC to强制转换 (force convert) or transfer via a root wallet to handle 'reversal conditions' such as erroneous entries, lost tokens, or malicious acts).

-

Observability: Even when using privacy features (like zero-knowledge proofs), the network must allow DTCC to observe all token transfers directly or through supporting technology.

-

Wallet Screening: DTCC needs to screen registered wallets itself to confirm compliance with the Office of Foreign Assets Control (OFAC) requirements.

Source document link I've posted here →Click to read

Here, I think if choosing among existing public chains, I still believe Ethereum/L2 is the most compliant, especially since the SEC's original text mentioned ERC-3643, which was explicitly cited as an example of a compliance-aware protocol supporting distribution controls and transaction reversibility. Additionally, DTCC has previously used Ethereum for pilot projects (2020's Project Whitney).

Another point is the impact on existing RWA projects. Many market interpretations are negative, but there is a misunderstanding here. My personal interpretation is still偏向利好 (leaning positive/利好).

First, this matter serves institutional clients (primarily targeting DTC participants and their clients, who are typically financial institutions like banks, brokers, and asset managers). It has no direct relationship with retail investors. Therefore, it is not conflicting with existing stock tokenization products like Ondo (this is where the market interpretation is mistaken). For institutional clients, it offers faster settlement and improved efficiency, opens the possibility of 24/7 trading, and enables some automated management through smart contracts (reducing manual intervention).

From a retail perspective, faster and cheaper institutional settlement could lead brokers (like Robinhood or Fidelity) to reduce fees or commissions, passing the savings to retail. When trading through institutional products (like ETFs or mutual funds), retail might experience faster order execution and better price discovery. Similarly, when using products like Ondo, they could theoretically benefit because its underlying efficiency also relies on the execution efficiency of off-chain institutions.

So this relationship is微妙 (subtle/delicate). The SEC is starting to support stock tokenization in attitude and is also advancing technically. But for on-chain 'gray area' businesses like Ondo, how they will be regulated is not yet clear, while they can still benefit under current policies.估计 (I estimate) it will remain in a state of benign neglect for the short term. It might be different once the scale becomes larger; we'll see then. For now, my interpretation is利好 (positive).

(This month, the U.S. Securities and Exchange Commission (SEC) formally ended its two-year investigation into Ondo Finance and confirmed it would not bring any charges.)

6. Ondo's Stock Tokens Can Support Single Transactions of $100,000 On-Chain

There isn't that much liquidity on-chain. How is this achieved?

It uses a very clever method: it mints its own stablecoin, USDon. Then, when there is buy demand, it directly mints the stock token, using its own USDon as a bridge. This eliminates the need for external liquidity because both the stock token and USDon are under its own control – theoretically offering infinite liquidity. Conversely, when someone sells, it first burns the stock token, then converts it to USDon based on the Oracle price, and finally exchanges it for the on-chain asset the user wants.

Regarding USDon, in terms of composition, its collateral is U.S. dollars and U.S. Treasuries等高流动性资产 (highly liquid assets), held in a regulated brokerage account. On-chain, it is placed together with USDC in a Swapper contract. When a transaction occurs, USDon is used as the intermediary asset.

For example, to buy NVDAon: User inputs USDC → swapper converts to USDon → uses USDon to mint NVDAon, all completed in a single transaction.

The swapper is a smart contract pool holding liquidity for USDon and USDC. If liquidity is sufficient, the conversion can be done instantly at 1:1. For very large amounts, exceeding the liquidity threshold, one would have to wait or trade in batches. The liquidity of this contract is maintained by Ondo itself.

Theoretically, Ondo can increase the supported single transaction size by injecting more USDon (or corresponding USDC) into the Swapper. The only potential issue later is that if demand picks up, high-frequency trading might expose the Swapper's bottleneck. This would test the on-chain performance and Ondo's ability to rebalance and manage the Swapper.

For Ondo, although its current implementation seems optimal with the best liquidity, it has little to do with the ONDO token. Also, whether this project can scale up and whether it will face regulatory issues is hard to say. It is still in a 'gray area' currently. But if you want to bet on the stock tokenization narrative, then Ondo is probably unavoidable.

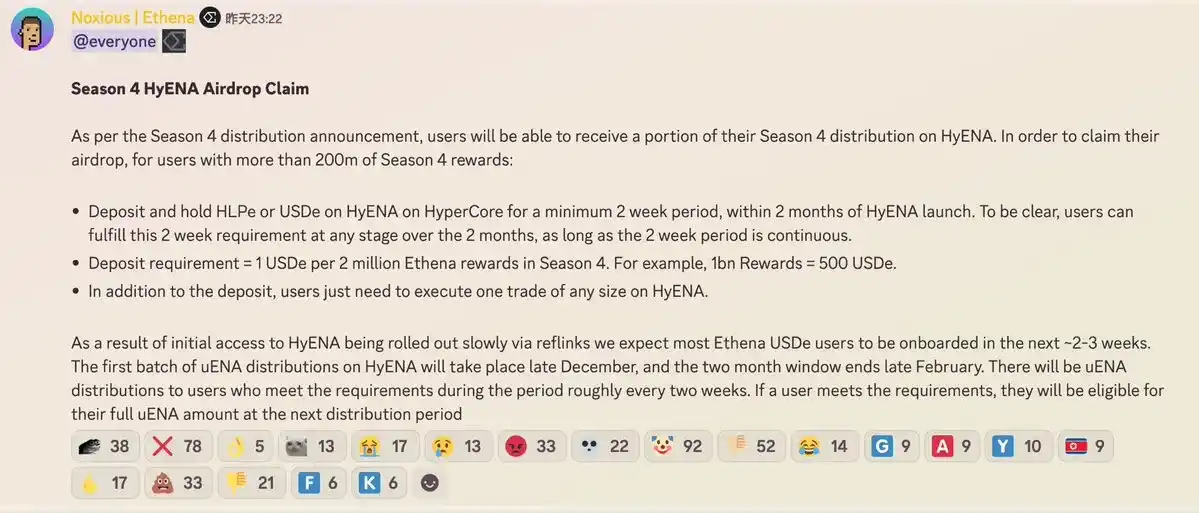

7. Ethena Updated Season 4 Airdrop, Added HyENA Related Portion

-

For users with over 200 million points, they need to deposit and hold HLPe or USDe on HyENA for at least 2 weeks, and it must be consecutive. The deposit amount required is 1 USDe for every 2 million points. Based on the minimum threshold of 200 million points, that's 100 USDe.

-

Besides depositing, users need to make a transaction of any size on HyENA. Rewards are distributed in uENA (the version of ENA on Hyper). The first batch starts in late December, with a two-month window lasting until February. This means during these 2 months, you choose any continuous 2-week period to deposit.

This is essentially forcing traffic to HyENA. Ethena places great importance on the Perps business (after all, it's very profitable).

8. Tempo Launches Testnet

Co-incubated and developed by Stripe and Paradigm. Partners include Anthropic AI, Coupang, Deutsche Bank, DoorDash, Lead Bank, Mercury, NuBank, OpenAI, Revolut, Shopify, Standard Chartered, Visa.

Tempo's goal is to solve the pain points of existing blockchains in the payment field, such as high fees, latency, and uncertainty, making stablecoins a mainstream payment tool.