Author: Wenser

Original Title: Kalshi's Trading Volume Continues to Break New Highs, What Is a Reasonable Pre-IPO Stock Price?

During the market downturn, prediction markets have become the most eye-catching sector in the crypto market. In early February, when the market plummeted, BTC and ETH once fell by over 10%, but prediction market trading remained active, with weekly transactions reaching 26.39 million, setting a historical record. Meanwhile, as the largest compliant prediction market platform in the United States, Kalshi also surged to the top of the sector with over $9.5 billion in trading volume in January this year, setting a new historical high for monthly trading volume. This has led to a new round of pricing for Kalshi's pre-IPO stock.

Today, the question we are discussing is—what should be the reasonable price range for the pre-IPO stock of Kalshi, which is poised to become the "first stock in the prediction market"?

Overview of Current Pricing on Tokenized Stock Trading Platforms: PreStocks, Jarsy

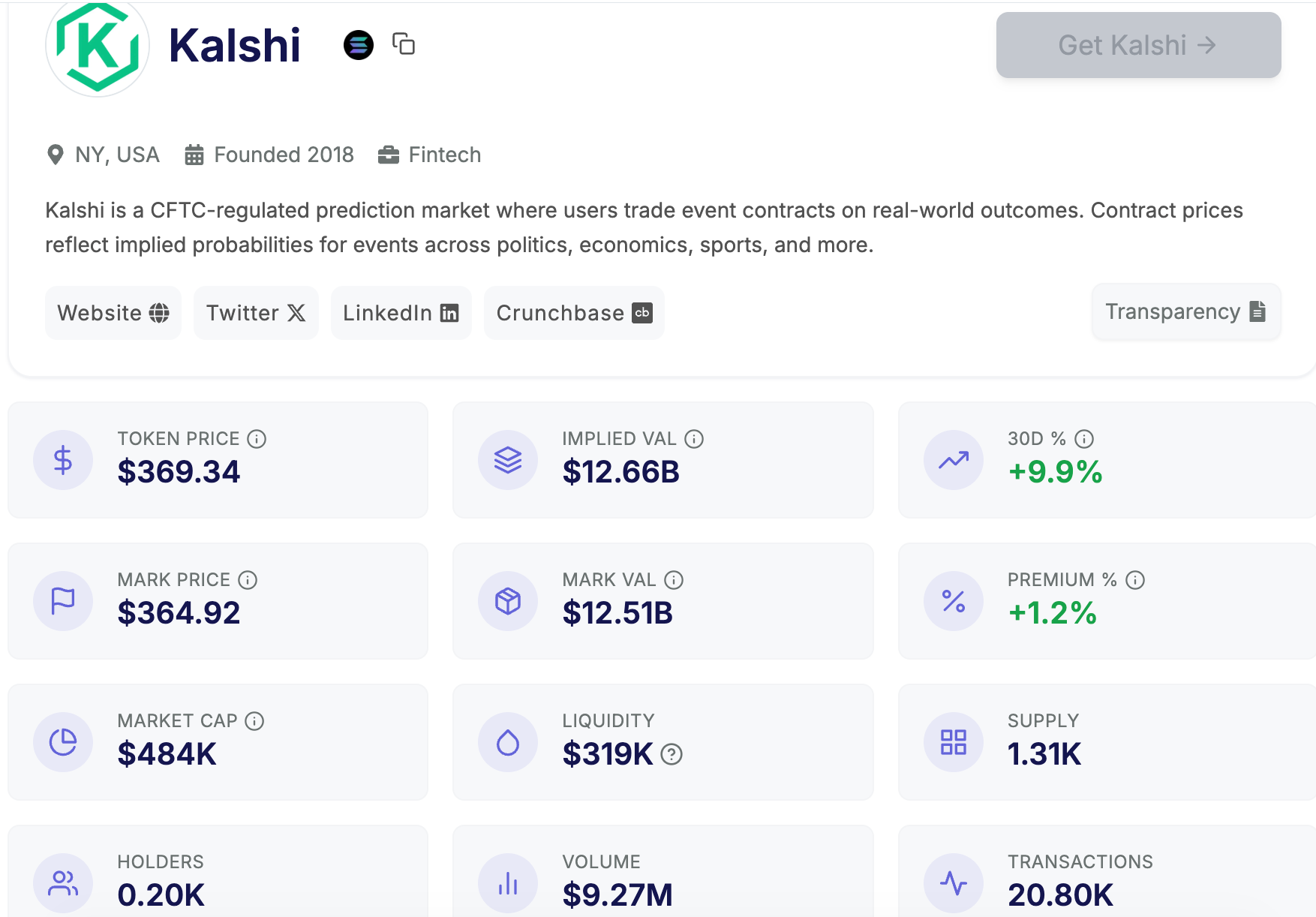

As of the time of writing, there is a significant price difference for Kalshi's pre-IPO stock on two major tokenized stock trading platforms:

On the PreStocks platform, Kalshi's pre-IPO stock pricing includes two prices—

One price is the token price under the implied market capitalization (market liquidity pricing level), with a per-share price of around $369;

The other price is the marked price under the capital market capitalization (existing financing pricing level), with a per-share price of around $364.

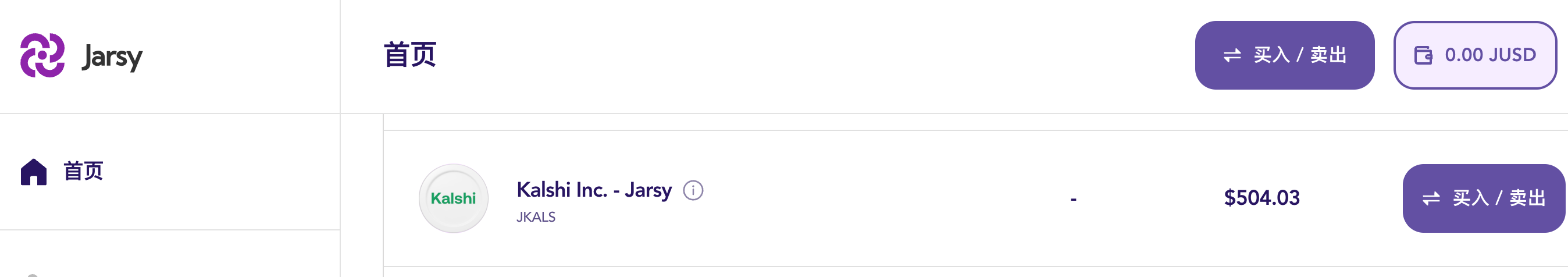

On the Jarsy platform, Kalshi's pre-IPO per-share price has already jumped to around $504.

It is worth mentioning that compared to when we previously wrote the article "Kalshi's Pre-IPO Stock Price Soars, Is It Still Worth Buying Now?", the pre-IPO prices of Kalshi stock on both platforms have experienced varying degrees of increases and decreases. The price situation at that time was as follows:

-

On PreStocks, Kalshi's implied market capitalization was approximately $14 billion, with a per-share price of around $407;

-

On Jarsy, Kalshi's market valuation was $11 billion, with a per-share price of $450.

In other words, the price on PreStocks dropped from $407 to around $369; while the price on Jarsy increased from $450 to around $504.

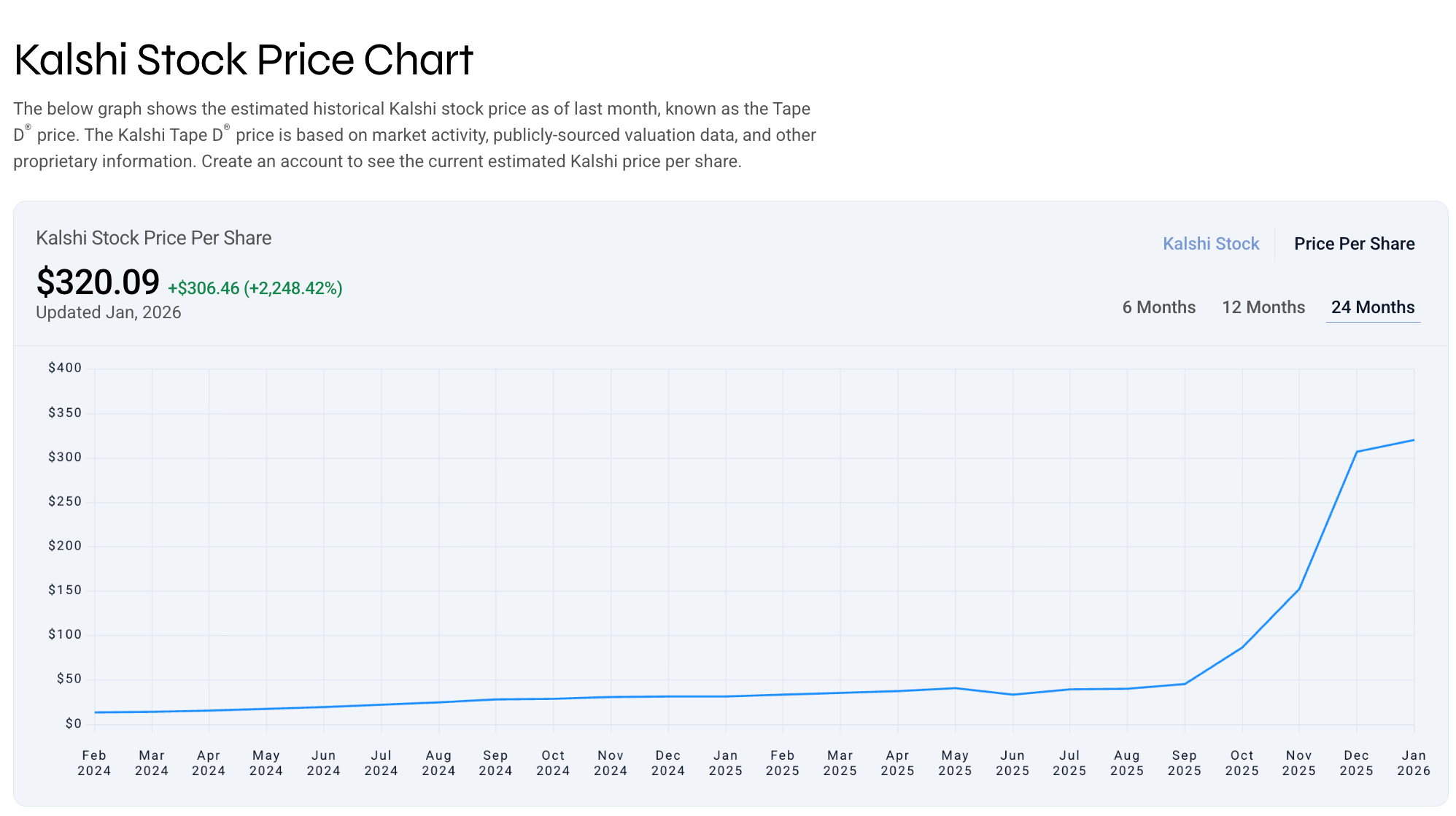

As a comparison, the pre-market pricing for Kalshi stock in traditional financial markets has also changed—

-

On Nasdaq Private Market, Kalshi's per-share price increased from around $307 to around $320;

-

On Hiive, Kalshi's per-share price increased by $1 from around $357 to around $358.

Reasonable Pre-IPO Pricing Range for Kalshi Stock: Around $320~$423

Last year, Kalshi completed a $1 billion Series E funding round, valuing the company at $11 billion.

Based on the market capitalization and corresponding stock prices mentioned above, the number of Kalshi shares is approximately between 30.72 million and 34.30 million.

Specifically, the calculation of the number of shares is as follows—

Based on a $11 billion market capitalization corresponding to pre-market prices of $320 and $358 in traditional financial markets, the number of Kalshi shares is approximately 30.72 million to 34.37 million;

Based on the implied market capitalization/token price and capital market capitalization/marked price on PreStocks, the number of Kalshi shares is approximately 34.27 million to 34.30 million;

Based on the pre-IPO purchase price per share on Jarsy, Kalshi's market capitalization caps at $18.665 billion, with a per-share price of $604.84, and the number of shares is around 30.86 million.

Based on the above information, we can make the following deductions:

First, based on the $11 billion valuation, the reasonable pre-IPO pricing range for Kalshi stock is approximately $320-$358. In other words, the current pricing on crypto market tokenized stock trading platforms like PreStocks and Jarsy is relatively high;

Second, Kalshi's trading volume in January reached $9.5 billion, close to the overall prediction market size of about $10 billion in October last year; in October last year, its market share was about 50% of the prediction market. From this perspective, Kalshi's current capital market valuation is at least above $15 billion.

Third, based on a $15 billion valuation and combined with data such as the range of Kalshi's share count, the pre-IPO pricing range for Kalshi stock is approximately $436~$488.

Therefore, if the number of Kalshi shares meets expectations, and under the premise of a $15 billion implied market capitalization, conservatively estimated, the reasonable pre-IPO pricing range for Kalshi stock might be $320~$378 (calculated based on the average of the lowest prices in the pricing range); optimistically estimated, the reasonable pre-IPO pricing range for Kalshi stock might be $358~$423 (calculated based on the average of the highest prices in the pricing range).

Based on the above data conclusions, the pre-IPO pricing for Kalshi stock on the Jarsy platform is偏高 (high), while the PreStocks platform offers some arbitrage opportunities.

In addition, the latest tokenized stock trading platform, Tessera, plans to open equity public offerings in the future, which readers can also consider as an alternative reference (invitation code can be found here).

Combined with the relevant information mentioned in the previously published Odaily Planet Daily article "Data Calculation Shows Polymarket's Annual Revenue Exceeding $100 Million Is Not Difficult, Provided That...":

Based on a static calculation of the trading volume and fee ratio in the "15-minute cryptocurrency rise and fall" market on Polymarket, under the current trading volume level and structure, if Polymarket introduces a similar fee model in all markets, it is expected to bring in $418 million in annual revenue for the platform.

As a prediction market platform with larger trading volume and higher fees, and taking advantage of the timing of the major sports year in 2026, Kalshi's annual revenue is expected to exceed this estimated revenue of Polymarket. From this perspective, the capital market may further raise the pre-IPO pricing of Kalshi stock in the future.

Twitter:https://twitter.com/BitpushNewsCN

BitPush TG Discussion Group:https://t.me/BitPushCommunity

BitPush TG Subscription: https://t.me/bitpush