Titre original : Frowny Cloud

Auteur original : Arthur Hayes, Co-fondateur de BitMEX

Compilation originale : BitpushNews

(Avertissement : Toutes les opinions exprimées ici sont celles de l'auteur et ne doivent pas être considérées comme une base pour des décisions d'investissement ou des conseils de trading.)

Les divinités auxquelles je crois sont incarnées en peluches adorables.

Pendant la haute saison de ski à Hokkaido en janvier et février, je prie le « petit dieu des nuages » qui gère la neige – (Frowny Cloud). La météorologie locale dicte que pendant les meilleures périodes de neige, les flocons tombent presque jour et nuit, et on ne voit jamais le soleil. Heureusement, je prie aussi le dieu des vitamines – un poney doux et mignon – qui me donne des comprimés de vitamine D3 et d'autres bénédictions.

Bien que j'aime la neige, toutes les neiges ne sont pas de bonne qualité et sûres. Le type de ski sans souci et audacieux que j'apprécie nécessite un type spécifique de neige : de faibles vents la nuit, avec des températures entre -5 et -10 degrés Celsius. Dans ces conditions, la neige fraîche adhère efficacement à l'ancienne, créant une poudreuse profonde. Le jour, Frowny Cloud bloque certaines longueurs d'onde de la lumière du soleil, empêchant les pentes sud de « cuire » au soleil et de provoquer des avalanches potentielles.

Parfois, Frowny Cloud nous abandonne, nous skieurs intrépides, la nuit. Les nuits froides et claires provoquent un « délaminage » des couches de neige après réchauffement et refroidissement, créant une couche faible persistante. Ce phénomène reste longtemps dans l'accumulation de neige, et une fois qu'un transfert d'énergie dû au poids d'un skieur déclenche un effondrement, cela provoque une avalanche mortelle.

Comme toujours, la seule façon de savoir quel type de couche Frowny Cloud a créé est d'étudier l'histoire. Sur la pente, nous le faisons en creusant de grandes fosses et en analysant les différents types de neige tombés au fil du temps. Mais comme ce n'est pas un article sur la théorie des avalanches, notre approche sur les marchés est d'étudier les graphiques, ainsi que l'interaction entre les événements historiques et les fluctuations des prix.

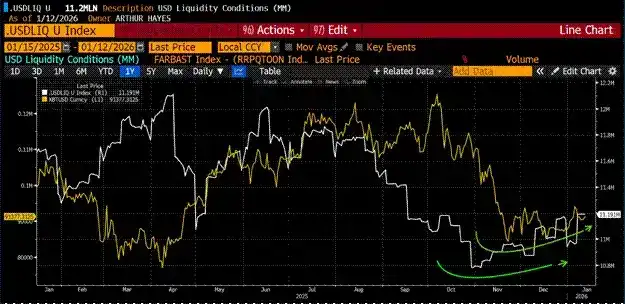

Dans cet article, j'espère étudier la relation entre le Bitcoin, l'or, les actions (en particulier les géants technologiques américains du Nasdaq 100) et la liquidité du dollar.

Les Gold Bugs (adeptes de l'or) ou les membres de l'establishment financier en écharpes Hermès et chaussures à semelles rouges (qui croient fermement à la « détention d'actions à long terme » – je n'avais pas une moyenne assez élevée à Wharton pour entrer dans la classe du professeur Siegel) (Note de Bitpush : Jeremy Siegel est une sommité de Wharton, l'un des économistes les plus respectés de Wall Street) sont ravis que le Bitcoin ait été le pire actif grand public performant en 2025.

Ces Gold Bugs se moquent des partisans du Bitcoin : puisque le Bitcoin est présenté comme un vote contre l'ordre établi, pourquoi sa performance n'a-t-elle pas égalé ou dépassé celle de l'or ? Les vendeurs d'actions en monnaie fiduciaire sales ricanent aussi : le Bitcoin n'est qu'un jouet « haute bêta » (à haut risque) du Nasdaq, mais en 2025, il n'a même pas suivi, alors pourquoi envisager les cryptomonnaies dans l'allocation d'actifs ?

Cet article présentera une série de beaux graphiques, accompagnés de mes annotations, pour clarifier les relations entre ces actifs.

Je pense que la performance du Bitcoin est totalement conforme aux attentes.

Il suit la marée de la liquidité de la monnaie fiduciaire – en particulier la liquidité du dollar, car l'impulsion de crédit de la « Pax Americana » est la force la plus importante en 2025.

L'or a grimpé en flèche parce que des États souverains insensibles au prix accumulent frénétiquement, car ils ont peur que leur richesse soit confisquée par les États-Unis s'ils restent dans les Treasuries américains (comme ce qui est arrivé à la Russie en 2022).

Les actions récentes des États-Unis contre le Venezuela ne feront que renforcer le désir des pays de détenir de l'or plutôt que des Treasuries. Enfin, la bulle de l'IA et ses industries associées ne disparaîtront pas. En fait, Trump doit doubler le soutien national à l'IA, car c'est le plus grand contributeur à la croissance du PIB de l'empire. Cela signifie que même si le rythme de création de dollars ralentit, le Nasdaq peut continuer à monter, car Trump l'a pratiquement « nationalisé ».

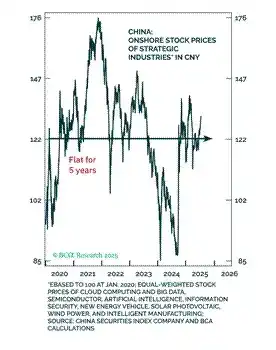

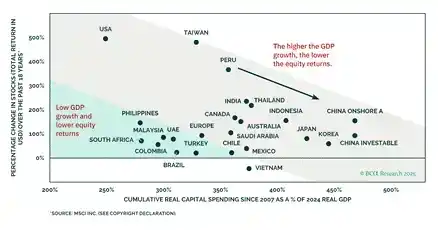

Si vous avez étudié les marchés des capitaux chinois, vous savez que les actions performent très bien au début de la nationalisation, mais sous-performent ensuite car les objectifs politiques priment sur les rendements des capitalistes.

Si les mouvements de prix du Bitcoin, de l'or et des actions en 2025 valident mon architecture de marché, alors je peux continuer à me concentrer sur les hauts et les bas de la liquidité du dollar.

Je rappelle aux lecteurs ma prédiction : Trump va injecter frénétiquement du crédit pour faire « surchauffer » l'économie. Une économie florissante aide les républicains à gagner les élections de novembre cette année. Alors que les bilans des banques centrales s'expandent, que les banques commerciales augmentent les prêts aux « industries stratégiques » et que les taux hypothécaires baissent en raison de l'impression monétaire, le crédit en dollars va considérablement s'expandre.

Compte tenu de tout cela, est-ce que cela signifie que je peux continuer à « surfer » sans souci – c'est-à-dire déployer agressivement les devises que je gagne et maintenir une exposition maximale au risque ? À vous de juger.

Un graphique pour régner sur tous

Premièrement, comparons les rendements du Bitcoin, de l'or et du Nasdaq lors de la première année du second mandat de Trump. Comment ces performances se comparent-elles aux changements de liquidité du dollar ?

Je vais détailler plus tard, mais l'hypothèse de base est : si la liquidité du dollar baisse, ces actifs devraient aussi baisser. Pourtant, l'or et les actions ont monté. Le Bitcoin a performé comme prévu : comme de la merde. Ensuite, j'expliquerai pourquoi l'or et les actions ont pu monter malgré la baisse de liquidité du dollar.

[Graphique : Bitcoin (rouge), Or (or), Nasdaq 100 (vert) et Liquidité du dollar (violet) comparés]

Tout ce qui brille n'est pas or, mais l'or brille bel et bien

Mon voyage dans la cryptographie a commencé avec l'or. En 2010 et 2011, alors que la Fed intensifiait son assouplissement quantitatif (QE), j'ai commencé à acheter de l'or physique à Hong Kong. Bien que le montant absolu était pitoyablement faible, il représentait un pourcentage étonnamment élevé de ma valeur nette à l'époque.

Finalement, j'ai appris une leçon douloureuse sur la gestion de position car j'ai dû vendre l'or à perte pour acheter du Bitcoin afin d'arbitrer en 2013. Heureusement, la fin fut heureuse. Néanmoins, je détiens toujours d'importantes quantités de pièces et de lingots d'or physiques dans des coffres-forts à travers le monde, et mon portefeuille d'actions est principalement composé d'actions minières d'or et d'argent. Les lecteurs pourraient se demander : puisque je suis un fidèle disciple de Satoshi Nakamoto, pourquoi je détiens encore de l'or ?

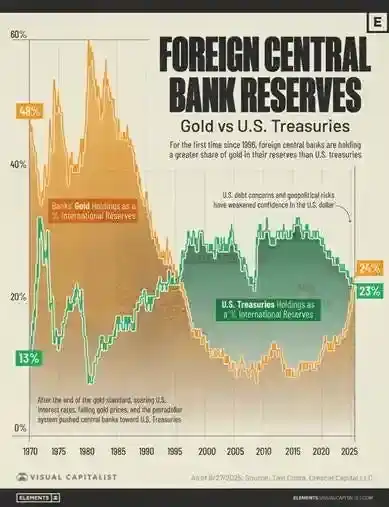

Je détiens de l'or parce que nous sommes aux débuts d'une phase où les banques centrales mondiales vendent des Treasuries américains et achètent de l'or. De plus, les pays utilisent de plus en plus l'or pour régler les déficits commerciaux, même lorsqu'ils analysent le déficit commercial américain.

En bref, j'achète de l'or parce que les banques centrales en achètent. L'or, la véritable monnaie de la civilisation, a une histoire de 10 000 ans. Par conséquent, aucun gestionnaire de réserves d'une banque centrale importante ne stockerait du Bitcoin s'il se méfie du système financier actuel dominé par le dollar ; ils achètent et achètent de l'or. Si la part de l'or dans les réserves totales des banques centrales mondiales revenait aux niveaux des années 1980, le prix de l'or atteindrait 12 000 dollars. Avant que vous ne pensiez que je délire, laissez-moi vous le prouver visuellement.

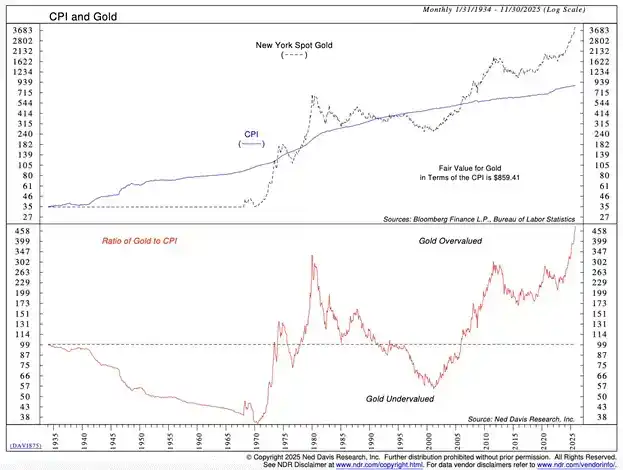

Dans le système de monnaie fiduciaire, l'opinion traditionnelle sur l'or est qu'il est une couverture contre l'inflation. Par conséquent, il devrait suivre grossièrement l'indice des prix à la consommation (IPC) manipulé par l'empire. Le graphique ci-dessus montre que depuis les années 1930, l'or a globalement suivi cet indice. Cependant, à partir de 2008 et en accélérant après 2022, le prix de l'or a augmenté bien plus rapidement que l'inflation. Alors, l'or est-il dans une bulle, prêt à m'écraser, moi, le parieur ?

[Graphique : Prix de l'or vs. IPC américain]

Si l'or était dans une bulle, les particuliers devraient affluer. La façon la plus populaire de trader l'or est via les ETF, dont GLD est le plus important. Lorsque les particuliers achètent frénétiquement de l'or, les parts en circulation de GLD augmentent. Pour comparer à travers différentes périodes et régimes de prix de l'or, nous devons diviser les parts en circulation de GLD par le prix de l'or physique. Le graphique ci-dessous montre que ce ratio diminue au lieu d'augmenter, ce qui signifie que la véritable frénésie spéculative sur l'or n'est pas encore arrivée.

[Graphique : Parts en circulation de GLD divisées par le prix spot de l'or]

Si ce ne sont pas les particuliers qui font monter le prix de l'or, qui sont ces acheteurs insensibles au prix ? Ce sont les gouverneurs des banques centrales du monde entier. Au cours des deux dernières décennies, deux moments clés ont fait réaliser à ces personnes que la monnaie américaine n'était bonne qu'à se torcher le cul.

En 2008, les grands requins de la finance américains ont créé une crise financière déflationniste mondiale. Contrairement à 1929 où la Fed n'est pas intervenue, cette fois, la Fed a violé son obligation de maintenir le pouvoir d'achat du dollar, imprimant frénétiquement de l'argent pour « sauver » certains grands acteurs financiers. Cela a marqué un tournant dans la proportion de Treasuries et d'or détenus par les États souverains.

En 2022, le président Biden a choqué le monde en gelant les avoirs en Treasuries d'un pays exportateur majeur de matières premières et doté d'un vaste arsenal nucléaire (la Russie). Si les États-Unis sont prêts à abolir les droits de propriété de la Russie, ils peuvent faire de même à tout pays plus faible ou moins riche en ressources. Sans surprise, les autres pays ne peuvent plus augmenter tranquillement leur exposition aux Treasuries américains qui risquent la confiscation. Ils ont commencé à accélérer leurs achats d'or. Les banques centrales sont des acheteurs insensibles au prix. Si le président américain vous vole votre argent, votre actif devient instantanément zéro. Puisque l'achat d'or élimine le risque de contrepartie, quel est le problème si le prix est élevé ?

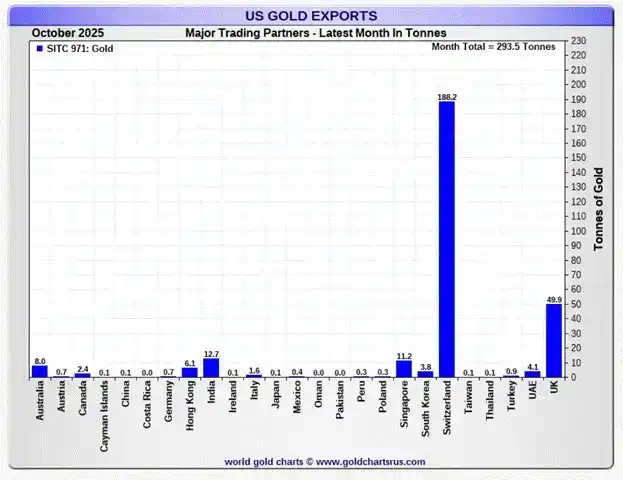

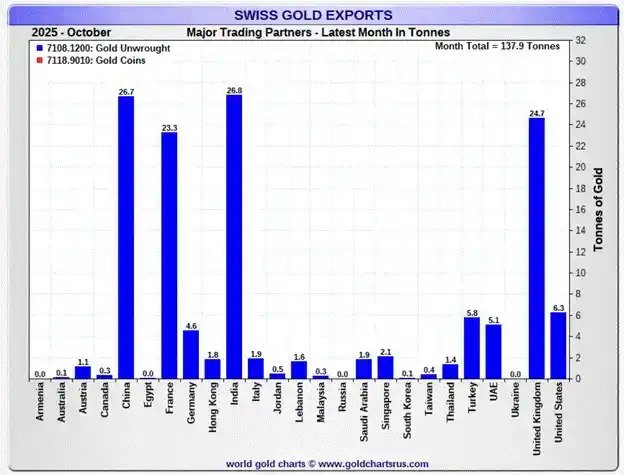

La raison la plus fondamentale de l'appétit illimité des États souverains pour cette « relique barbare » est : le règlement net du commerce se fait de plus en plus via l'or. La contraction record du déficit commercial américain de décembre 2025 est la preuve que l'or retrouve son statut de monnaie de réserve mondiale. Plus de 100 % du changement du solde commercial net américain était attribuable aux exportations d'or.

« Selon les données du département du Commerce américain publiées jeudi, l'écart entre les importations et exportations de marchandises a chuté de 11 % par rapport au mois précédent, à 528 milliards de dollars. Cela porte le déficit à son plus bas niveau depuis juin 2020...... Les exportations ont augmenté de 3 % en août pour atteindre 2893 milliards de dollars, principalement tirées par l'or non monétaire. » – Source : Financial Times

Le chemin de l'or est : les États-Unis exportent de l'or vers la Suisse, où il est affiné et refondu, puis expédié vers d'autres pays. Le graphique ci-dessous montre que ce sont principalement la Chine, l'Inde et d'autres économies émergentes manufacturières ou exportatrices de matières premières qui achètent cet or. Les produits physiques finissent aux États-Unis, tandis que l'or va vers les régions les plus productives du monde.

Quand je dis « productives », je ne veux pas dire qu'elles sont meilleures pour écrire des rapports absurdes ou annoter des signatures d'e-mail complexes, mais qu'elles exportent de l'énergie et d'autres produits industriels clés, que leur peuple fabrique de l'acier et raffine des terres rares. L'or monte malgré la baisse de liquidité du dollar parce que les États souverains accélèrent le rétablissement de l'étalon-or mondial.

[Graphique : Flux d'importation/exportation d'or par pays]

Les adeptes du long terme adorent la liquidité

Chaque époque a ses actions technologiques qui montent en flèche. Dans le bull market américain des années 1920 rugissantes, le fabricant de radios RCA était la coqueluche technologique de l'époque ; dans les années 1960-1970, IBM, fabricant de nouveaux mainframes, était sous les feux de la rampe ; aujourd'hui, les hyperscalers de l'IA et les fabricants de puces sont en vogue.

Les humains sont naturellement optimistes. Nous aimons prédire un avenir radieux : chaque dollar dépensé aujourd'hui par les entreprises technologiques apportera une utopie sociale à l'avenir. Pour réaliser cette vision dans l'esprit des investisseurs, les entreprises brûlent de l'argent et s'endettent. Lorsque la liquidité est bon marché, il est facile de parier sur l'avenir. Ainsi, les investisseurs sont heureux de dépenser aujourd'hui de l'argent liquide bon marché pour acheter des actions technologiques, en échange d'une chance de flux de trésorerie massifs à l'avenir, faisant monter les ratios cours/bénéfice. Donc, en période d'excès de liquidité, les actions de croissance technologique montent de manière exponentielle.

Le Bitcoin est une technologie monétaire. La valeur de cette technologie n'est que relative au degré de dépréciation de la monnaie fiduciaire. L'innovation de la blockchain à preuve de travail (PoW) est grande, ce qui en soi garantit que la valeur du Bitcoin est supérieure à zéro. Mais pour que la valeur du Bitcoin approche 100 000 dollars, une dépréciation monétaire fiduciaire continue est nécessaire. La croissance asynchrone du Bitcoin est le résultat direct de l'explosion de l'offre de dollars après la crise financière mondiale de 2008.

Par conséquent, je dis : Lorsque la liquidité du dollar s'expand, le Bitcoin et le Nasdaq montent.

Le seul point de contradiction actuel est : la récente divergence entre le prix du Bitcoin et celui du Nasdaq.

[Graphique : Prix du Bitcoin vs. Prix du Nasdaq]

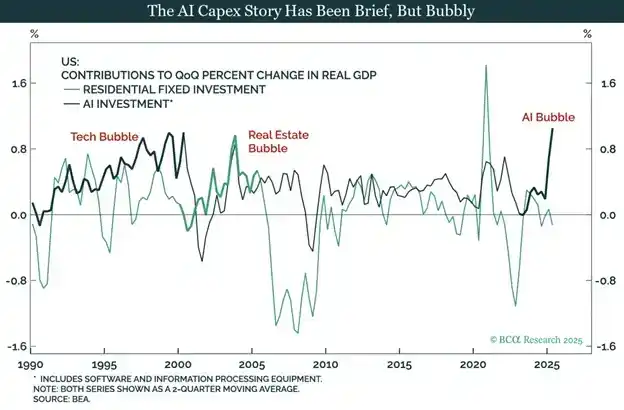

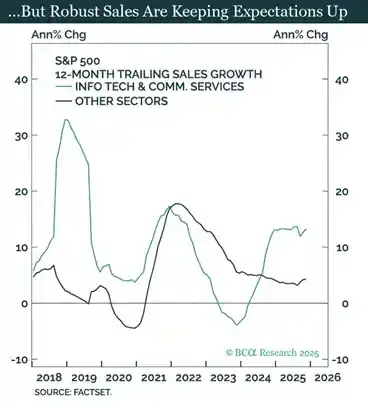

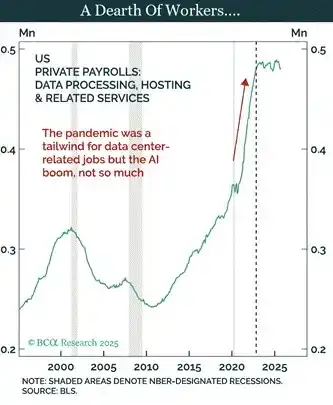

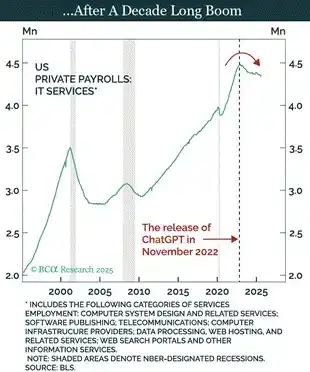

Ma théorie sur le fait que le Nasdaq n'ait pas corrigé avec la baisse de liquidité du dollar en 2025 est : L'IA a été « nationalisée » par la Chine et les États-Unis.

Les grands de la tech de l'IA ont vendu aux deux plus grands leaders mondiaux l'idée que l'IA peut tout résoudre. L'IA peut réduire le coût de la main-d'œuvre à zéro, guérir le cancer, augmenter la productivité, et surtout, assurer la domination militaire mondiale. Par conséquent, quel que soit le pays qui « gagne » dans l'IA, il règne sur le monde. La Chine l'a déjà avalé, cela correspond parfaitement à son plan quinquennal.

Aux États-Unis, cette analyse est nouvelle, mais la politique industrielle est en fait aussi ancrée qu'en Chine, juste commercialisée différemment. Trump a bu le « Kool-Aid » de l'IA, « gagner la course à l'IA » est devenu son programme économique. Le gouvernement américain a effectivement nationalisé toute composante jugée utile pour « gagner ». Par des décrets et des investissements gouvernementaux, Trump émousse les signaux du marché, faisant affluer le capital dans les domaines liés à l'IA sans se soucier des rendements. C'est pourquoi le Nasdaq s'est découplé en 2025 du Bitcoin et de la baisse de liquidité du dollar.

[Graphique : Découplage du Nasdaq par rapport à la liquidité du dollar]

Bulle ou pas, l'augmentation des dépenses pour « gagner » dans l'IA stimule l'économie américaine. Trump a promis de faire surchauffer l'économie, il ne peut pas s'arrêter simplement parce que le rendement de ces dépenses pourrait être inférieur au coût du capital dans quelques années.

Les investisseurs technologiques américains devraient être prudents. La politique industrielle visant à « gagner dans l'IA » est un excellent moyen de brûler de l'argent. Les objectifs politiques de Trump (ou de son successeur) entreront en conflit avec les intérêts des actionnaires des entreprises stratégiques. C'est une leçon que les investisseurs chinois en actions ont apprise à leurs dépens. Comme dit Confucius : « Étudie le passé pour connaître l'avenir ». Apparemment, étant donné la performance exceptionnelle du Nasdaq, cette leçon n'a pas été retenue par les investisseurs américains.

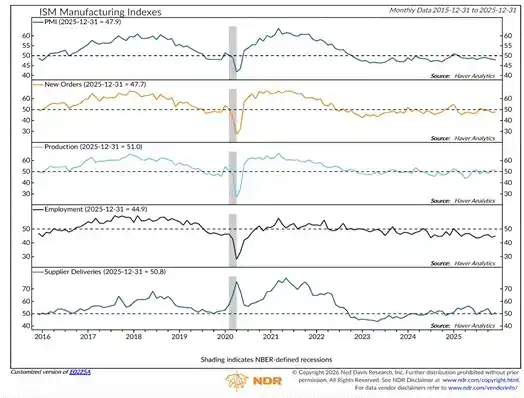

[Graphique : Données sur les PMI et la croissance économique américaine]

Les lectures PMI inférieures à 50 indiquent une contraction. Toute la croissance du PIB n'a pas apporté de renaissance manufacturière. Je croyais que Trump était pour les ouvriers blancs ? Non, mon pote, Clinton a vendu votre travail à la Chine, Trump a ramené les usines, mais maintenant les ateliers sont pleins de bras robotiques IA appartenant à Musk. Désolé, vous vous êtes encore fait avoir ! Cependant, l'ICE (Immigration and Customs Enforcement) recrute (blague dark) !

Ces graphiques montrent clairement que la hausse du Nasdaq est soutenue par le gouvernement américain. Par conséquent, même si la croissance globale du crédit en dollars est faible, l'industrie de l'IA obtiendra tout le capital nécessaire pour « gagner ». Le Nasdaq s'est donc découplé et a surperformé le Bitcoin. Je ne pense pas que la bulle de l'IA soit prête à éclater. Cette surperformance restera une caractéristique des marchés de capitaux mondiaux jusqu'à ce qu'elle ne le soit plus, ou plus probablement jusqu'à ce que l'équipe rouge perde la Chambre des représentants en 2026 (comme prédit par Polymarket). Si les républicains sont les Jetson (pro-tech), alors les démocrates sont les Pierrafeu (pro-retro).

Si l'or et le Nasdaq ont de l'élan, comment le Bitcoin peut-il reprendre du poil de la bête ? La liquidité du dollar doit s'expandre. Clairement, je pense que cela se produira en 2026, explorons comment.

Faire surchauffer l'économie

Au début, j'ai dit qu'il y avait trois piliers soutenant la forte augmentation de la liquidité du dollar cette année :

· Le bilan de la Fed s'expandra en raison de l'impression monétaire.

· Les banques commerciales prêteront aux industries stratégiques.

· Les taux hypothécaires baisseront en raison de l'impression monétaire.

[Graphique : Taille du bilan de la Fed]

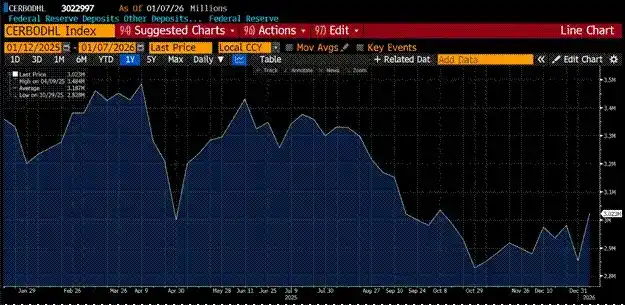

Le bilan de la Fed a diminué en 2025 en raison du resserrement quantitatif (QT). Le QT a pris fin en décembre, et lors de la réunion de ce mois, un nouveau programme d'impression monétaire appelé « achats de gestion des réserves » (RMP) a été lancé. J'en ai parlé en détail dans des articles précédents. Le graphique montre clairement que le bilan a touché un creux en décembre. Le RMP injecte au moins 400 milliards de dollars par mois, et sa taille augmentera à mesure que les fonds nécessaires pour financer le gouvernement américain augmenteront.

[Graphique : Croissance des prêts bancaires aux États-Unis (ODL)]

Le graphique ci-dessus est un indicateur de croissance des prêts bancaires (ODL) publié par la Fed. À partir du quatrième trimestre 2025, les banques ont accordé plus de prêts. Lorsqu'une banque accorde un prêt, elle crée un dépôt à partir de rien, créant ainsi de la monnaie. Des banques comme JPMorgan sont très heureuses de prêter à des entreprises soutenues par le gouvernement. JPMorgan a lancé un programme de prêts de 1,5 billion de dollars pour cela. Le processus est le suivant : le gouvernement investit dans une entreprise, la banque voit que le soutien gouvernemental réduit le risque de défaut et est heureuse de créer de la monnaie pour financer cette industrie stratégique. C'est exactement ce que la Chine a toujours fait. La création de crédit passe du système de la banque centrale à celui des banques commerciales, avec un multiplicateur monétaire initial plus élevé, créant une croissance du PIB nominal supérieure à la tendance.

Les États-Unis continueront à montrer leur force, et la production d'armes de destruction massive nécessite le financement du système bancaire commercial. C'est pourquoi la croissance du crédit bancaire connaîtra une hausse structurelle en 2026.

Trump est un homme d'affaires immobilier, il sait comment financer l'immobilier. Sa nouvelle directive est que Freddie Mac et Fannie Mae (les « GSE ») utilisent le capital de leur bilan pour acheter 200 milliards de dollars de titres adossés à des créances hypothécaires (MBS). C'est une augmentation nette de la liquidité du dollar. Si cela réussit, Trump ne s'arrêtera pas là. Faire monter le marché immobilier en baissant les taux hypothécaires permettra aux Américains de contracter des prêts sur valeur nette immobilière. Cet effet de richesse mettra les électeurs de bonne humeur le jour du vote, les faisant pencher vers les républicains. Plus important encore, cela crée plus de crédit pour acheter des actifs financiers.

[Graphique : Coïncidence des creux du Bitcoin et de la liquidité du dollar]

Le Bitcoin et la liquidité du dollar ont touché un creux presque simultanément. Alors que la liquidité du dollar augmente rapidement pour les raisons ci-dessus, le Bitcoin naviguera avec elle. Oubliez la performance de 2025, elle était due à un manque de liquidité.

Stratégie de trading

Je suis un spéculateur agressif. Bien que mon fonds Maelstrom soit presque entièrement investi, je veux encore augmenter mon exposition au risque car je suis extrêmement optimiste quant à la croissance de la liquidité du dollar. Par conséquent, j'obtiens une exposition avec effet de levier au Bitcoin en étant long sur MicroStrategy (MSTR) et Metaplanet (3350 JT), sans avoir à trader des options complexes ou des contrats perpétuels.

[Graphique : Ratio des prix de MSTR et Metaplanet par rapport au Bitcoin]

Je divise le cours des actions de ces deux entreprises par le prix du Bitcoin, elles sont actuellement au bas de leur fourchette de fluctuation des deux dernières années.

Si le Bitcoin peut repasser au-dessus de 110 000 dollars, les investisseurs auront envie d'être longs sur le Bitcoin via ces instruments. Compte tenu de l'effet de levier intégré dans les bilans de ces entreprises, elles surperformeront largement le Bitcoin à la hausse.

De plus, nous continuons à accumuler du Zcash (ZEC). Le départ des développeurs de l'ECC n'est pas baissier, je crois qu'ils peuvent livrer des produits plus impactants dans leur propre entité lucrative. Je suis reconnaissant d'avoir eu l'occasion d'acheter du ZEC à prix réduit auprès des « weak hands » (mains faibles).

Continuez, aventuriers de la crypto. Le monde est plein de dangers, restez vigilants. Que la paix soit avec vous – et priez Frowny Cloud.

Lien original