Original | Odaily Planet Daily (@OdailyChina)

Author | Asher (@Asher_ 0210)

Last night, a blockbuster news rocked the community—YZi Labs has invested "tens of millions of dollars" in DEX Genius, and CZ will also personally join as an advisor.

Odaily Planet Daily is here to give you the first look at Genius, a step-by-step guide to interacting with Genius, and the current interaction strategy based on personal testing.

Project Introduction

Genius is a privacy-centric decentralized exchange (DEX) offering spot, perpetual contracts, and copy trading, supporting over 10 public chains including BNB Chain and Solana. Its goal is to become an on-chain alternative to Binance—bringing the speed, liquidity, and privacy experience of a CEX on-chain while remaining fully self-custodial and non-custodial (users hold their private keys). The platform has already processed over $60 million in trading volume during its testing phase and plans to launch a public test of its privacy protocol in Q2 2026. Back in October 2024, Genius announced the completion of a $6 million seed funding round led by CMCC Global, with participation from Cadenza Ventures, AVA Labs, Arca, Flow Traders, and other institutions.

In response to the community's view that "YZi Labs' investment in Genius is bearish for Aster," CZ posted on X, stating, "Genius is a trading terminal connected to exchanges, not a competitor to Aster."

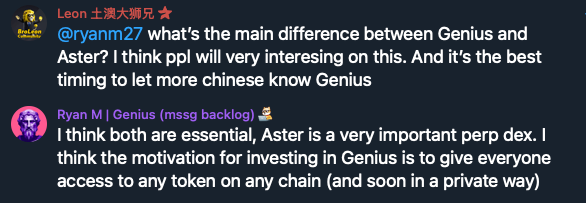

Additionally, Genius's CMO Ryan also addressed a similar question in the community—"What's the difference between Aster and Genius? Why would YZi Labs invest in another project doing Perp DEX?" Ryan stated, "I think both are important; Aster is a very important perpetual exchange. I believe YZi Labs' motivation for investing in Genius is to enable everyone to access any token on any chain (and soon, privately)."

Genius CMO Ryan discusses the relationship between Aster and Genius

It's clear that both CZ and the Genius team believe Genius and Aster have different positioning and are not in direct competition.

Step-by-Step Guide

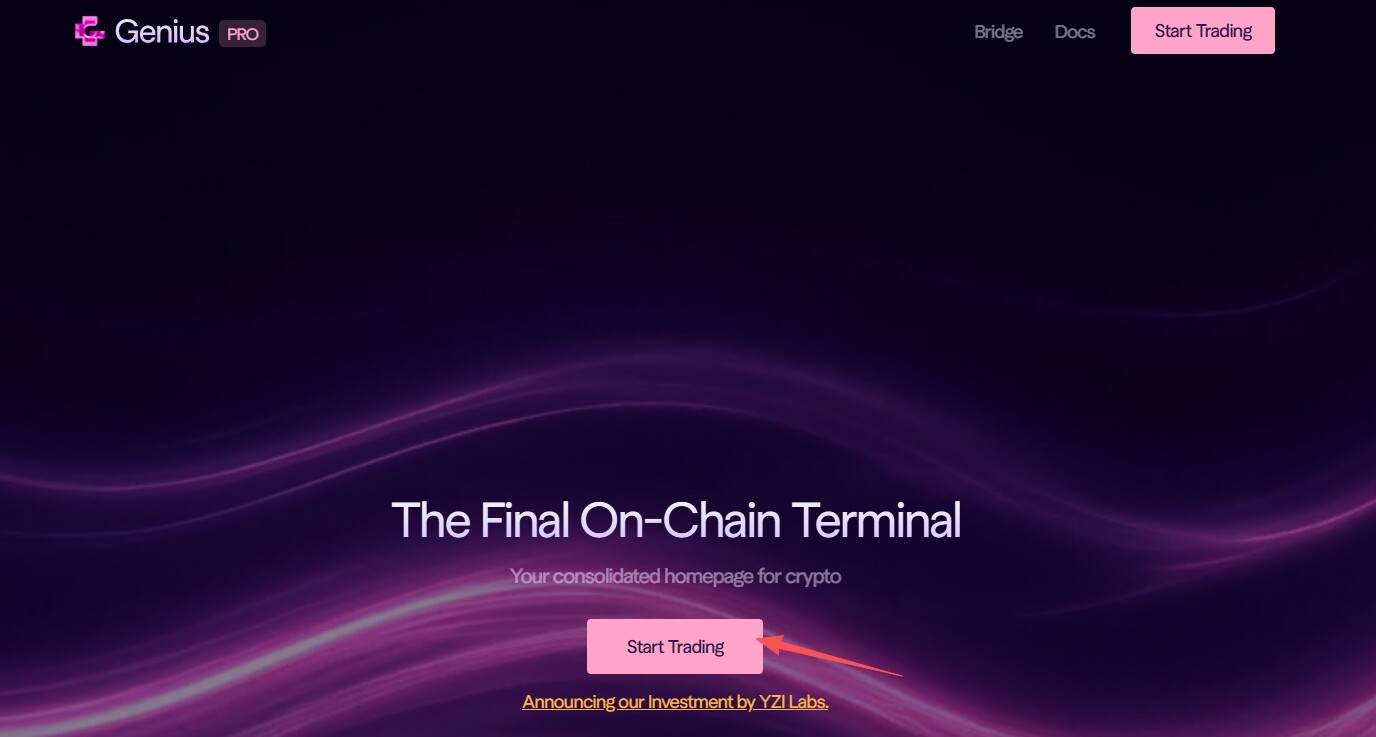

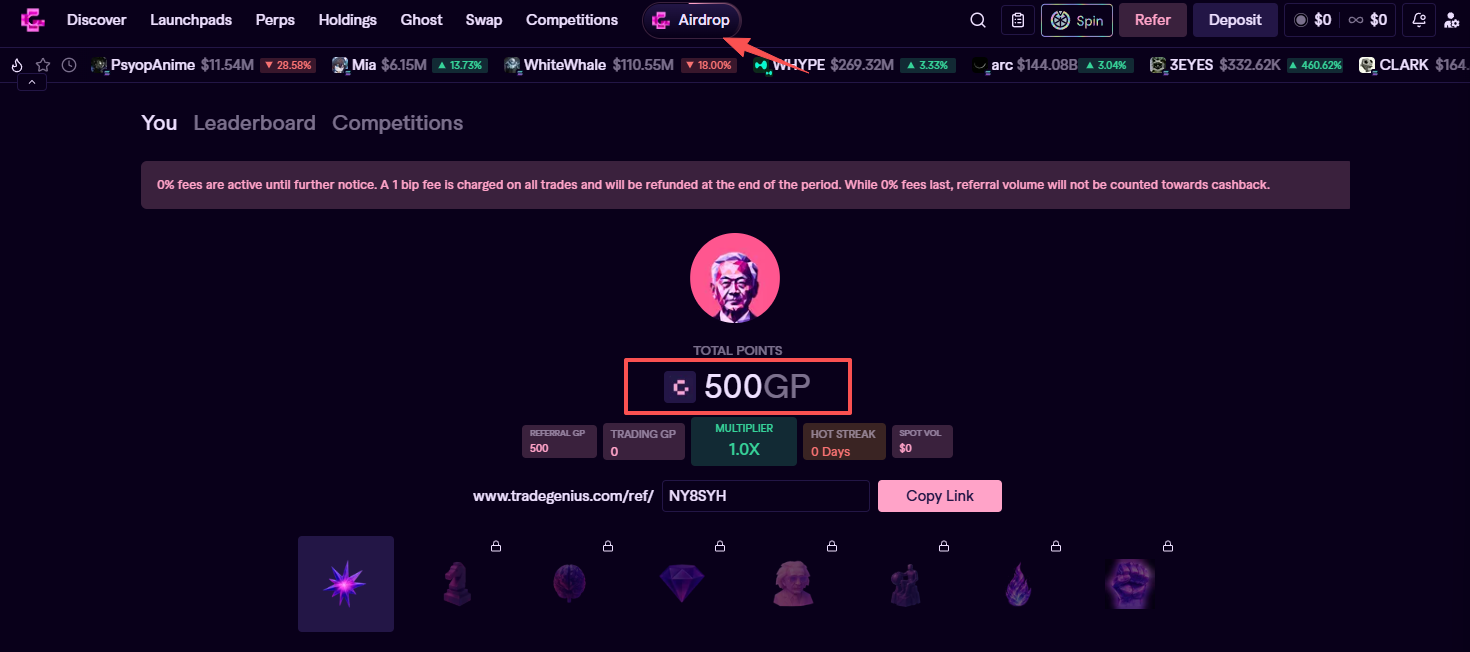

STEP 1. Go to the official website (Link: https://www.tradegenius.com/ref/NY8SYH). Using this referral link gives you 500 GP points. Click "Start Trading," then click "Sign In" at the top to log in with your wallet.

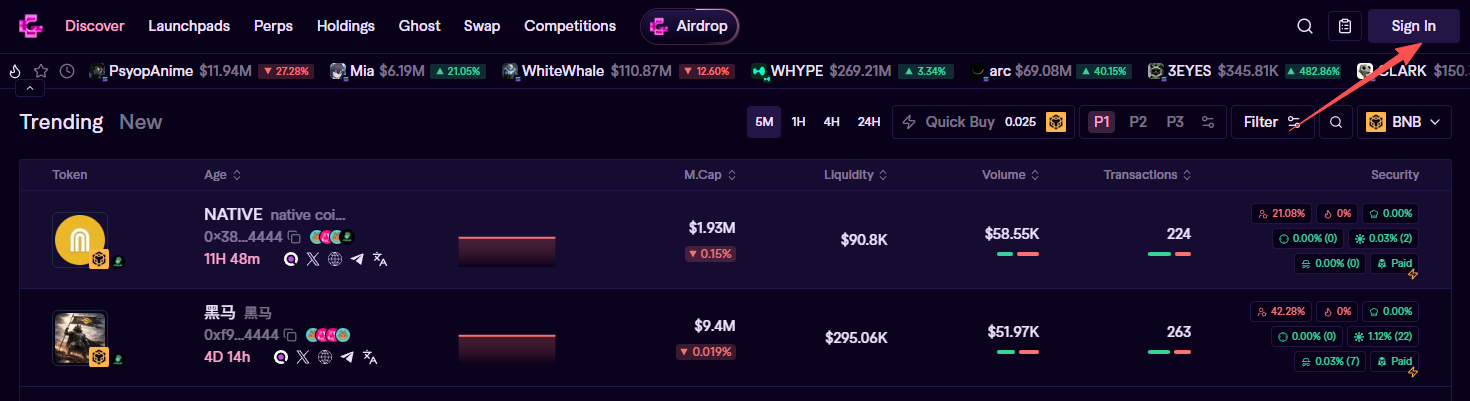

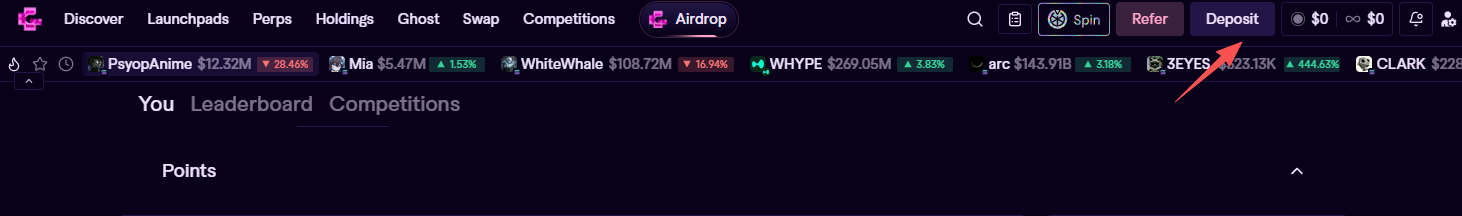

STEP 2. Click on "Airdrop" at the top to see your current GP points and personal referral link.

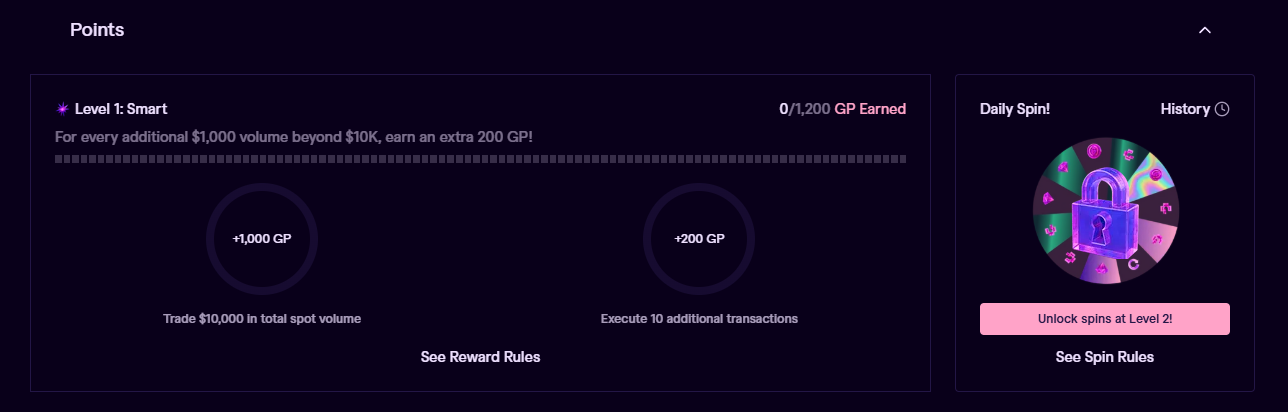

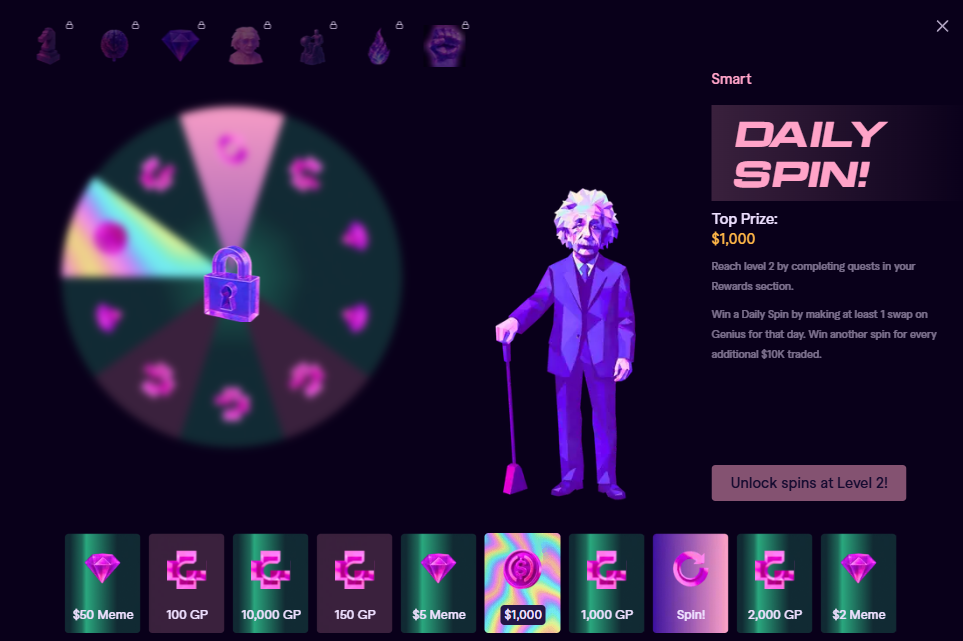

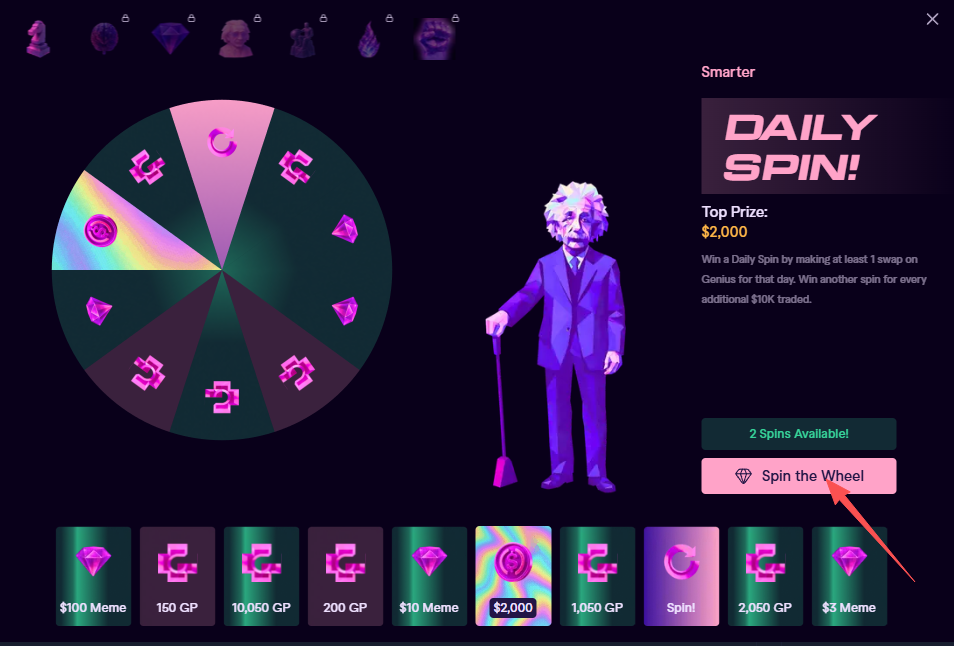

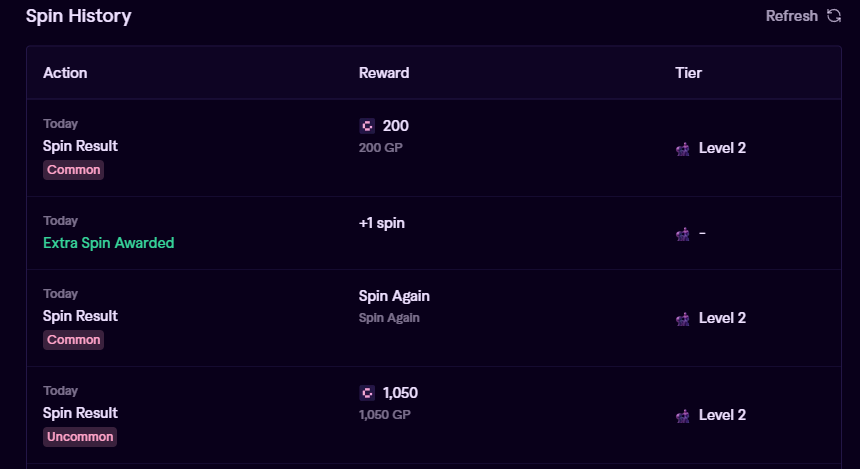

STEP 3. Under the "Airdrop" section, first is "Points." Accumulate $10,000 in trading volume to get 1200 GP points. After exceeding $10,000, every additional $1000 in trading volume earns 200 GP points. Additionally, trading at least once daily gives you one free spin on the wheel. Every additional $10,000 in trading volume grants an extra spin, with no upper limit.

Other rules for earning points through trading:

- Users earn 1 GP point for every $100 in spot trading volume / $1000 in perpetual contract trading volume;

- Trade consecutively for 7 days to earn a win streak multiplier (resets after one day without trading);

- Base multiplier and win streak multiplier apply to user's spot and perpetual contract trading (referral points not included).

STEP 4. Under the "Airdrop" section, next is "Referrals." Invite friends to earn more GP points.

STEP 5. Under the "Airdrop" section, lastly is "Social" (the "Token Rewards" section is not yet open, skip for now), which contains official social media information.

STEP 6. Click on "Deposit" at the top. Supports deposits of EVM, Solana, and SUI assets. Official recommendation is to send ETH or USDC.

Current "Basic Income Points Earning" Strategy Sharing

Based on actual interaction, I've summarized a "basic income points earning" strategy. The specific operational思路 is as follows:

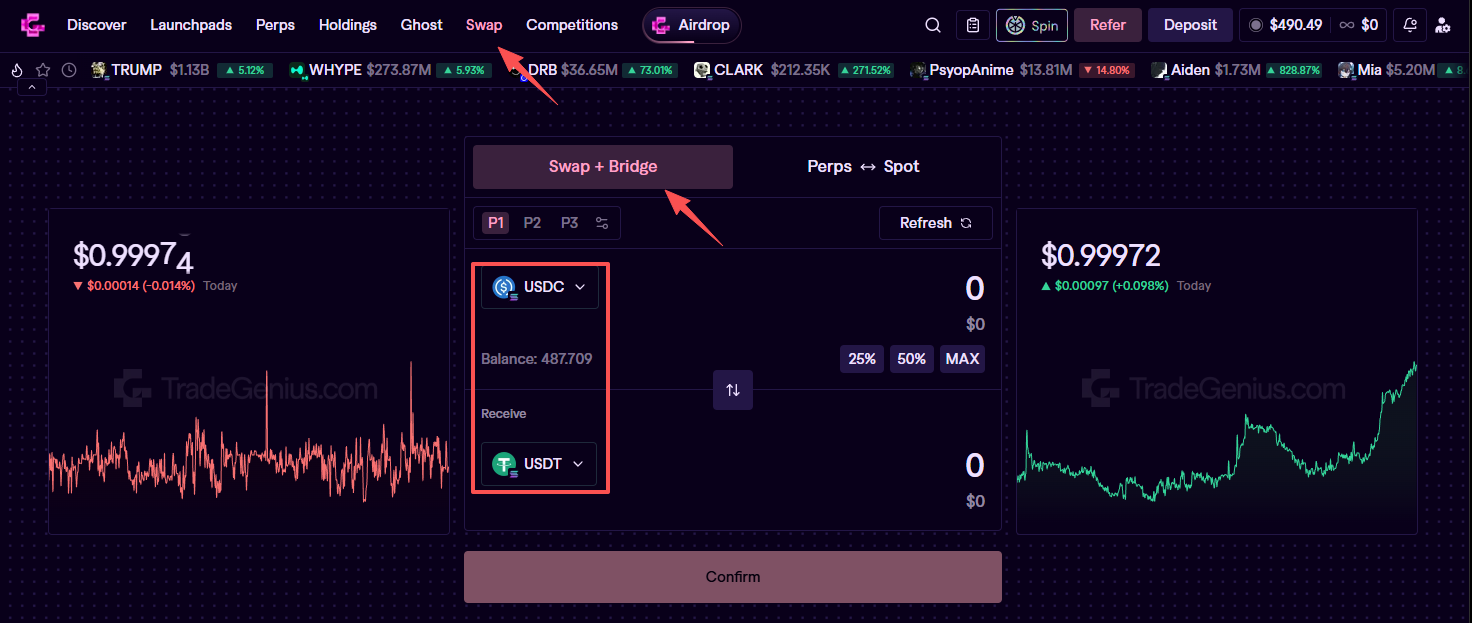

1、To minimize wear and tear from token price fluctuations, choose spot trading for USDC-USDT.

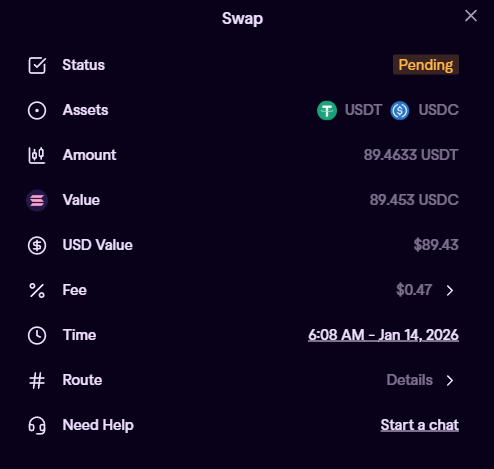

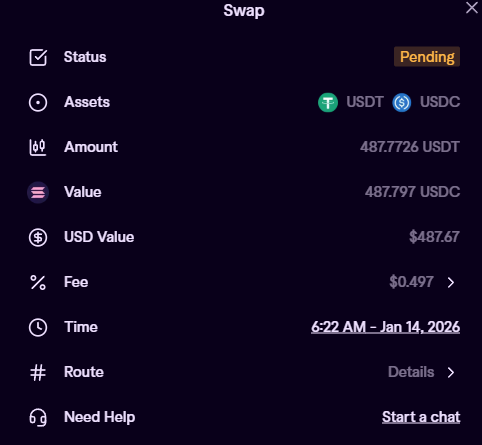

2、Try to make the single transaction amount larger. The Gas fee paid for a test transaction of $400 and $100 is almost the same, as shown below.

3、Once you unlock the wheel spin by reaching $10,000 in trading volume, just make one trade per day to qualify for the spin. There's no need to "frantically increase trading volume."