Dogecoin is once again in the spotlight among retail traders. After a volatile autumn and a series of sharp surges, the meme segment has revived, and $DOGE has returned to top discussions alongside Bitcoin and Ethereum. Investors are asking a direct question: can the legendary meme token finally reach the $1 mark in 2026.

The current picture for $DOGE combines sustained market interest and cautious optimism from analysts. The asset's price has been fluctuating around key levels in recent weeks, forming a base after sharp upward and downward movements. Volumes on spot and derivative platforms remain significant, indicating ongoing speculative activity and traders' readiness to aggressively react to news.

The main driver for $DOGE remains the combination of meme narrative, support from prominent entrepreneurs, and phases of the Bitcoin cycle. Against the backdrop of expectations for a continued bull market, recovering risk appetite, and liquidity flow into more speculative assets, the baseline scenario remains clearly positive. Under favorable market conditions, the market could well drive $DOGE back toward historical zones and attempt to consolidate near $1.

However, the path to such a valuation will not be linear. For this, the coin needs to hold key support levels, confirm interest in derivatives without overheating funding rates, and receive a fresh impulse from meme stories. This is why some traders combine bets on the "veteran" $DOGE with aggressive presales, including new meme projects like Maxi Doge, to enhance potential portfolio returns in case the rally continues.

BUY MAXI DOGE

Dogecoin on the Path to $1: Key Levels and Scenarios

The technical picture for $DOGE remains typical for a mature meme asset: prolonged consolidation phases are followed by explosive impulses amid news and growing interest on social media. On the daily chart, important milestones are the areas of recent highs and zones where significant profit-taking occurred previously. Holding above these levels confirms bullish sentiment and forms a platform for another upward move.

From an indicator perspective, it's worth monitoring the Relative Strength Index (RSI) and volumes. When RSI rises into overbought territory with increasing volumes, it often foreshadows aggressive pumps but also increases the risk of short-term pullbacks of tens of percent. A more sustainable scenario appears when RSI remains in a moderate "bullish" zone, and volumes are consistently above average, showing healthy interest without obvious euphoria.

$DOGE's fundamental story relies not only on meme culture. An important role is played by its status as the "oldest" meme token with broad recognition and relatively deep liquidity on major CEXs and DEXs. This facilitates entry and exit for large players, reduces slippage, and makes major speculative waves more realistic. Against the likely continuation of the crypto market growth cycle, this creates a solid position for Dogecoin to attempt another assault on psychological levels.

Scenarios can be divided into three trajectories. The bullish variant assumes holding key supports, growing interest in meme assets, and a new wave of hype, where $DOGE could test $1 and potentially exceed its previous all-time high. The baseline scenario is a prolonged range with fluctuations within several tens of percent around current levels, as the market digests past movements. The bearish variant triggers if key support is broken downward and overall sentiment deteriorates, which could return the price significantly below local highs and postpone reaching $1 indefinitely.

In the coming months, key reference points for traders will remain the price reaction to important levels and the dynamics of sentiment in the meme segment. If support holds and risk appetite strengthens, the chances of seeing $DOGE closer to $1 within the current cycle will remain substantial. It makes sense to closely watch how the price behaves when testing these zones, as well as the activity of derivatives and social metrics.

Maxi Doge as a Bet on Dogecoin

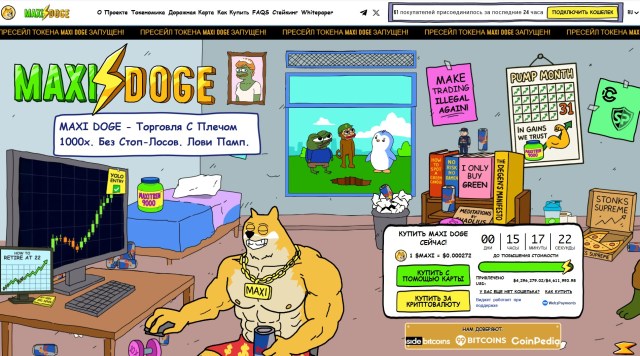

Amid renewed interest in Dogecoin, some retail traders are turning their attention to more aggressive meme tokens. One such project is Maxi Doge ($MAXI) with a culture of maximum leverage and competitive trading. The idea is simple: to give small market participants a tool and community aimed at hyper-profitable strategies in a bull cycle.

Such projects traditionally see maximum interest in their early rounds. According to the team, about $4.3 million has been raised in the pre-sale stage, with a token price of $0.0002725. For retail investors, this creates a feeling of an "affordable entry" with the potential for large multiples of growth if the meme narrative and trading activity continue to intensify.

It's worth noting the interest from large participants separately. Two addresses purchased tokens for a total of about $503 thousand, with the largest transaction reaching $252 thousand. Such capital concentration at an early stage is usually viewed by project supporters as a signal of confidence in its potential in the upcoming bull market.

In terms of functionality, Maxi Doge bets on a culture of high leverage and constant "pumping" of results. The $MAXI token operates on the Ethereum network as a standard ERC-20, and the smart contract manages supply and distribution, including the Maxi Fund for liquidity and partnerships. Holders are offered staking rewards with dynamic APY from a separate distribution pool for up to one year, as well as profitability tournaments with leaderboards and prizes. All this is aimed at creating a "training ground" for aggressive traders within a single community.

However, this approach also means increased risks. Any presale token carries uncertainty regarding the regulatory environment, potential volatility in the first weeks of listing, and dependence on community activity. Unlike Dogecoin, which has already proven its resilience through several market cycles, $MAXI remains a speculative bet at an early stage. Therefore, a sensible approach for aggressive investors is to consider Maxi Doge as a high-risk addition to the portfolio, not a replacement for more liquid assets like $DOGE. Before participating, it is important to independently study the project, its tokenomics, and the smart contract.

The final view on the Dogecoin and Maxi Doge pairing looks like this: $DOGE remains the flagship of the meme segment with real chances to approach $1 again if the bull cycle continues. Against this backdrop, Maxi Doge acts as a potential accelerator for those willing to accept greater risk for super returns. This approach—combining a proven asset with a speculative presale—is what many market participants are choosing in anticipation of the next growth wave.