Trader Cryptollica (@Cryptollica) is arguing that an old relative-value signal is “back” in crypto markets, pointing to the DOGE/NVIDIA ratio and an unusually depressed Dogecoin RSI reading as evidence that capital could rotate from AI-linked equities into high-beta meme coins.

Dogecoin Vs. Nvidia: Rotation Incoming?

In a post on X, Cryptollica said the DOGE/NVIDIA chart has returned to a long-term support zone that previously preceded outsized Dogecoin outperformance versus Nvidia in prior cycles. “THE SIGNAL IS BACK. IT’S HAPPENING AGAIN (2017... 2021... NOW),” the trader wrote.

“The last two times this specific signal flashed on the DOGE/NVIDIA chart, we saw the biggest wealth transfer in history. The crowd is chasing the AI top. The algorithm is loading the Meme bottom. (Altcoin bottom).”

The core claim is less about Dogecoin in isolation and more about positioning on a ratio between what Cryptollica framed as two cultural extremes: “You are watching the wrong chart. This is the ratio of ‘The World’s Most Valuable Company’ (AI) vs. ‘The World’s Most Famous Meme’.” From that framing, the trader leans into a cycle-rhymes narrative, asserting that the ratio has repeatedly found channel support before a DOGE-led surge.

“Structure is repeating history,” Cryptollica wrote, attaching specific historical comparisons. “2017: Ratio hit channel support – DOGE outperformed NVDA by 100x. 2021: Ratio hit channel support – DOGE outperformed NVDA by 50x. NOW: We are back at the exact same support line.”

The posts also attach a broader liquidity-rotation story that has circulated in various forms across risk markets: when one trade stops working, capital seeks the next high-beta outlet: “When the AI Bubble exhales, that liquidity doesn’t vanish. It rotates into High-Beta Speculation,” the trader wrote. “The crowd is buying NVDA at the top. The algorithm is positioning for the DOGE reversal.”

Is Dogecoin An ‘Epic Buying Opportunity’?

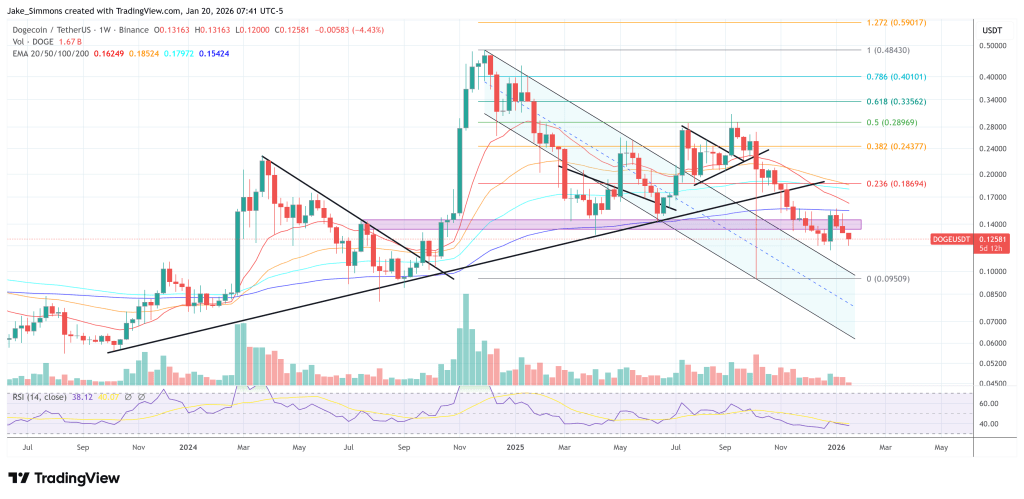

In another post, Cryptollica shifted from the ratio to Dogecoin’s weekly momentum indicator, sharing a second chart highlighting RSI levels and labeling prior cycle lows. “Here you are witnessing an opportunity that only comes around once every 12 years,” the trader wrote. “Over the past 12 years (2014–2026), Dogecoin’s RSI has dropped this low only 4 times. Every single one was an epic buying opportunity.”

The post describes those four moments as a sequence of cycle bottoms, including an “all-time low” first cycle bottom, a “cycle bottom + COVID crash,” a “last cycle bottom,” and “RIGHT NOW!” Cryptollica concluded with a blunt decision frame: “Math or emotions — which one decides for you?”

While neither post includes an explicit price target, the analyst said in early December that he expects Dogecoin to reach $1.30 over the medium term, citing a parallel channel top on the 3-day DOGE/USD chart.

At press time, DOGE traded at $0.12581.