Author: thiccy

Compiled by: Tim, PANews

In 2025, the crypto market once again staged a dramatic script of volatility, yet many suffered significant losses in their trades.

This article is not written for those who consistently lose money trading, but for those with strong profitability who have seen their profits severely draw down this quarter.

One of life's greatest pains is witnessing months or even years of effort vanish overnight.

In Greek mythology, Sisyphus is punished to endlessly push a boulder up a mountain, only to watch it roll back down each time he reaches the top. The cruelty of this punishment lies in how it precisely targets the core of the human experience—that sense of absurdity in futility and repetition. However, Camus saw another possibility in Sisyphus: when he acknowledges the absurd, ceases to hope for ultimate salvation, and instead throws himself wholeheartedly into the act of pushing the rock itself, he changes his fate through the process. True victory might not lie in the rock staying atop the mountain, but in that conscious awareness and unyielding peace each time he bends to push the stone.

Crypto trading requires this same quality. Unlike most professions, this field has no所谓的“progress bar”. One wrong decision is enough to completely destroy an entire career, a reality that has driven many to despair.

When the boulder truly rolls down, people respond in two ways.

Some double down, trying to recoup their losses. They adopt more aggressive trading styles, essentially using a Martingale strategy (a method of doubling down after losses) to try and break even. If they can quickly earn the money back, they avoid emotionally confronting the reality of the loss. This method often works in the short term, but it is an extremely dangerous strategy because it reinforces a trading habit that is mathematically destined to bankrupt you.

Others become exhausted and choose to leave the game entirely. They often already have enough funds to live comfortably and believe the market's risk-reward ratio is no longer justified. They console themselves by telling themselves that no edge exists in the market anymore, or that any edge is about to disappear. Their choice to exit is, in effect, a pronouncement of a 'death sentence' on the market, vowing to never return.

While understandable, both reactions are merely coping mechanisms that fail to address the root cause. The real problem is that there is a flaw in your risk management system. Most people overestimate the actual level of their risk management.

Risk management itself is not some unsolvable puzzle; the mathematical principles behind it are well-proven. The true challenge lies not in not knowing what to do, but in consistently executing the established strategy in the face of emotions, ego, stress, and fatigue. Aligning actions with knowledge is one of humanity's most difficult disciplines, and the market ruthlessly exposes any disconnect between this awareness and reality.

After a loss, how do you move forward?

First, you must accept one thing: you were not unlucky, nor were you treated unfairly. This loss was an inevitable result of your human weaknesses. If you don't find and fix the issue, the loss will happen again.

Second, you need to fully accept your current net worth; you cannot always anchor yourself to past all-time highs. The impulse to “make it back” is one of the most dangerous impulses in the market. Step away from the screen for a while and be grateful for what you have already achieved. You are alive, you are still in the game, you are no longer trying to recoup losses, but are simply focused on generating new profits.

View this loss as tuition paid for your own flaws, a lesson you were bound to learn sooner or later. Thankfully, you paid it now rather than at a higher cost in the future. If you handle it correctly, you will look back on this moment with gratitude. Character is often forged in extreme circumstances.

Pinpoint the exact cause of the failure. For most people, the problem usually lies in a combination of the following: excessive position sizing, entering a position without a predetermined stop-loss, or failing to execute the stop-loss when it was hit. Establishing ironclad rules for risk control and stop-losses can prevent most catastrophic losses.

Remind yourself that the only way to prevent the boulder from rolling all the way down again is to strictly adhere to those rules. They are the only barrier between you and the torment you are experiencing. Without rules, you are nothing.

Allow yourself to vent fully about the loss—scream, break things. Let the emotions out, don't let them fester inside.

Most importantly, you must transform the pain into a lesson. Otherwise, it will inevitably repeat.

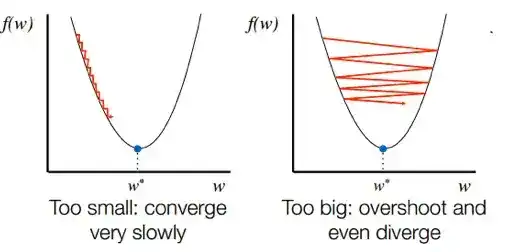

This insight about dealing with pain applies not only to trading losses but also broadly to life. The common coping mechanisms mentioned earlier are crude because, while they may solve the immediate problem, they often introduce just as many new ones. If you cannot recover from a loss in a refined, precise manner, you will end up like a gradient descent algorithm with too large a step size—oscillating wildly around the optimum, constantly overshooting, never converging to the right position.

When Napoleon lost a battle, he would immediately begin rebuilding his army and planning his next move. A single defeat is not fatal, unless it robs you of the ability to continue fighting. The primary task after a setback is to ensure this weakness can no longer be exploited and to restore your best competitive state as quickly as possible.

You should not seek redemption, nor should you seek revenge. You should not react passively, nor should you harbor anger. You must become a cold, calculating machine. You must repair yourself, then rebuild the system, ensuring the same mistake is never made again. Every failure you endure becomes a moat in your system—a moat that everyone else must pay the price to learn themselves.

Be grateful for losses that build character; they appear so you may learn. This loss did not happen without reason. Allow yourself to feel the pain, but transform it into motivation, and ensure you will never make the same mistake again.

These things are difficult because once you find the right direction, the continued growth of wealth becomes a matter of course.

Good luck.