Original Title: Mistakes to avoid while building in consumer crypto

Original Author: @rishotics

Compiled by: Peggy, BlockBeats

The author uses personal experience to reflect on the true difficulty of "building products" in the crypto industry. Compared to technical complexity and grand narratives, the article focuses more on users, distribution, and execution details. In the consumer crypto space, value is not "proven" but "used into existence."

Below is the original text:

As a first-time founder, I spent years working on three infrastructure protocols, all of which ultimately failed. By 2025, I shifted to building a consumer product that people actually wanted to use. This content shares the lessons I learned from my mistakes in user growth and fundraising.

I have been in this industry for about 4 years.

In 2023, I started a business in the EVM ecosystem when "account abstraction" was the hottest topic. Almost everyone was developing SDKs for account abstract wallets. At the same time, the Rollup ecosystem heated up rapidly. Optimism, Arbitrum, and various RaaS projects dominated the mainstream view.

As someone who loves math, I was deeply attracted to ZK and believed it would change the world (I still believe it eventually will).

A core mistake I made back then was: equating "complexity" with "credibility."

When VCs asked me about use cases, I would confidently list directions like zkML, zk identity, zk voting—but in fact, almost none of these are actually used today. I mistook "the technology looks impressive" for "this is a useful product."

Over time, I even started to believe: the more complex the idea, the higher the probability of startup success.

Many investors also told me that in the crypto industry, only infrastructure has a chance to succeed. It wasn't until nearly two years and over 500 rejections later that I realized: this path was not for me.

So, I entered the Solana ecosystem.

For me, this was a whole new world. People here care about actual use cases. Even if it's a meme, revenue matters. Speed matters. Distribution matters. (Special thanks to @superteamin for their help along the way.)

So far, we have been building consumer applications in this ecosystem for nearly 7 months. During the private testing phase, we have processed over $12 million in transaction volume. Below are some of the lessons I've summarized:

1. Build for young users willing to try new things

Try to design products for a group that is naturally more willing to accept new products.

In consumer crypto products, this usually means "trenchers" or younger users, many concentrated in the 13–21 age range.

A 2024 study by the Consumer Technology Association (CTA) on Generation Z (11–26 years old) showed: 86% of Gen Z believe technology is an indispensable part of life, a proportion higher than any older group. They adopt new technologies earlier, with an average of 13 devices per household, using about 6 of them daily, for nearly 12 hours.

Gen Z is also more likely to personally own emerging tech products, such as crypto applications (e.g., 58% own game consoles, a figure significantly higher than older groups). They have a stronger willingness to spend on new tech, subscribe to more services, and their habits change and adapt much faster than Millennials, Gen X, or Baby Boomers.

They are more willing to try new apps, experiment, and quickly change usage habits.

In contrast, older users (in many cases over 25) are generally less willing to change established workflows unless the incentives are very strong. Note: if you are building for institutions, this conclusion may not apply.

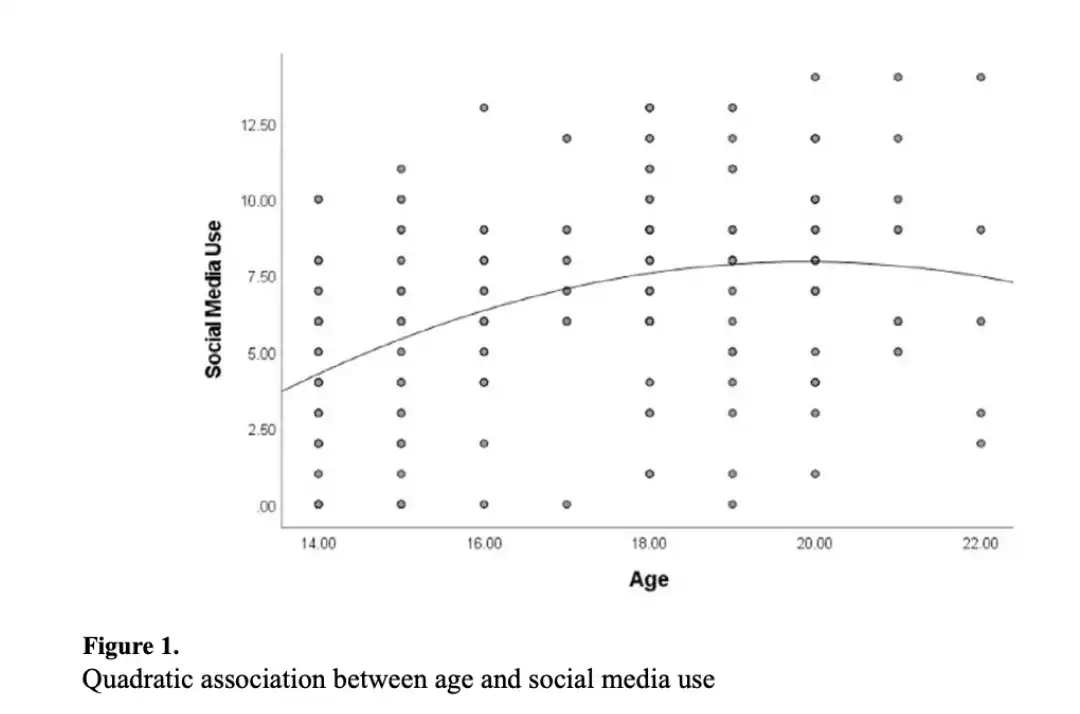

Multiple studies also show clear behavioral differences: younger users engage in social communication with more people daily, meaning they are more likely to share "interesting products they discover" with friends. Around ages 20–21, social messaging activity typically peaks, mainly related to college or school stages.

Related research provides further evidence supporting this. For example, the paper "Age-related differences in social media use, online social support, and depressive symptoms in adolescents and emerging adults" points out that after entering young adulthood, individuals' frequency of interaction on social media gradually declines.

This trend leads to a very direct implication: products designed for younger users naturally have stronger virality.

2. Make the product itself shareable to reduce marketing costs

If you don't have ample marketing or advertising budgets, your product itself must serve as the "distribution channel."

In other words, the product is the marketing, the product is the传播 (communication).

A highly shareable product can significantly reduce marketing costs.

This is particularly important in the crypto industry because:

· KOL marketing is expensive

· User trust is generally low

· Most users expect rewards or incentives before participating

In such an environment, relying on traditional marketing methods is often inefficient, while natural传播 driven by the product itself is more sustainable.

If your product can give users a reason to share spontaneously, whether with friends, groups, or communities, you can achieve distribution without spending a lot of money.

This is not easy to do in the crypto industry, but optimizing for it from day one is very worthwhile in the long run.

3. Respond to user feedback quickly

When users report issues with the user experience or encounter poor interactions, fix them immediately, especially those that directly block the usage flow.

My previous approach was to save bug fixes for the end of the day. But once, a user DM'd me saying: "Your app doesn't have this feature yet, I'll use Y for now."

I expressed understanding at the time, but the result was that the user kept using product Y afterwards. I tried multiple times to bring them back via DMs, but it was very difficult—they had already formed a habit of using Y.

Ultimately, once users establish usage habits on other products, the cost of switching them back becomes extremely high.

Therefore, try to: fix bugs within 2–5 hours.

If multiple users repeatedly request a new feature that is very important to them and technically feasible:

· Complete development and launch within 2–3 days

· Clearly tell them this was launched based on their feedback

· You can even provide some economic incentive (this might make them your product's most active promoters)

A recent user DM from a user who suggested an important feature.

Delivering features based on user needs does three things: directly improves the product itself, increases user frequency, and builds deep trust.

When users see their feedback taken seriously and actually turned into product features, they begin to feel: this product "has a part of them."

This emotional sense of "ownership" is extremely important and powerful in early-stage consumer products.

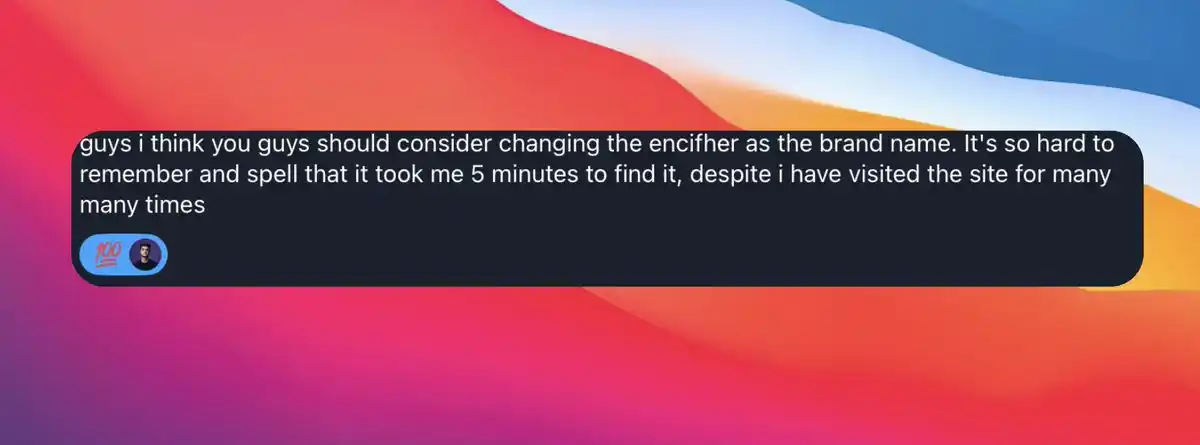

4. The App's name is very important

This might sound basic, but many people—including myself—have made serious mistakes at this step.

Your App's name must be highly memorable and easy to relay and share. Otherwise, you will often receive messages like this (users want to recommend it but can't remember the name clearly).

The fact is—the name "encifher" itself was hard to remember, I really can't blame the users.

Even many group chats created by investors or partners had the product name misspelled, which is laughable now in hindsight.

Because of this, we later changed the name to encrypt.trade.

There are many existing methods and resources online for choosing a "memorable and easy-to-share" name.

5. Communicating with users is hard, but non-negotiable

Finding users and actually talking to them is very difficult in itself, especially when your direction is not within the current mainstream narrative.

When I first worked on privacy-related products, it wasn't a popular niche. Although many retail users had real privacy needs, they were scattered and hard to find.

So I did something most people deliberately avoid: during the idea validation phase, I proactively cold-DM'd nearly 1000 people.

If lucky, about 10 out of 100 people might reply; among those replies, only 3–4 might give you useful feedback.

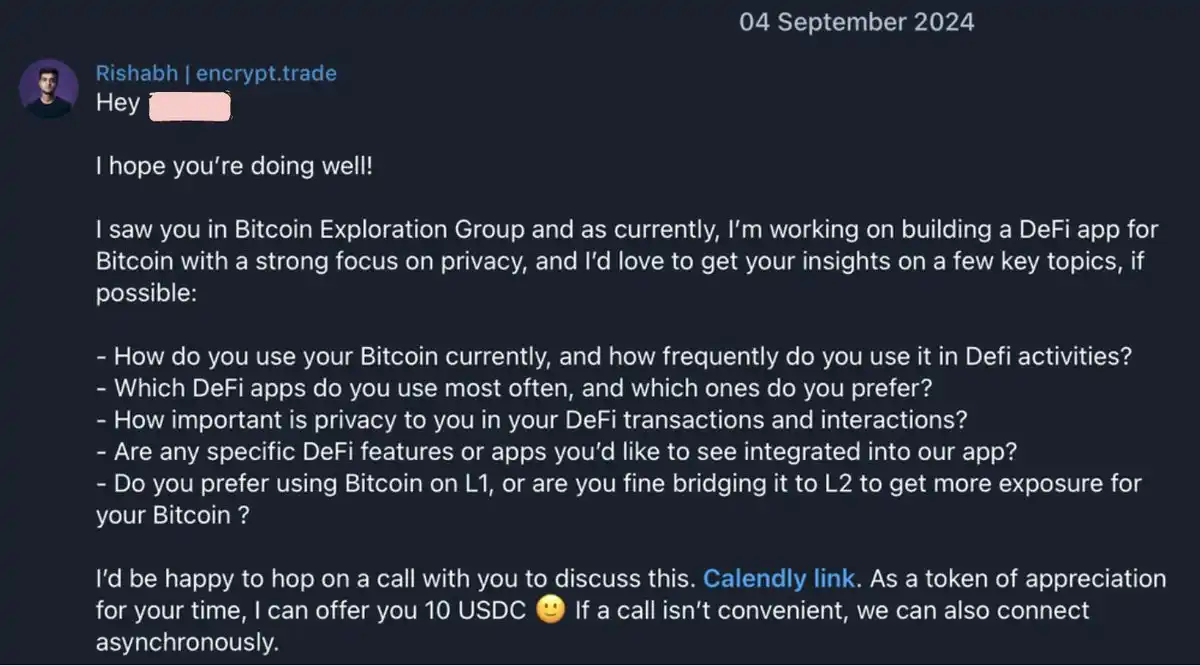

A very bad example of a cold DM.

In practice, as long as someone showed even a little interest, I would have in-depth conversations with them, iterating on the product while communicating with users.

In fact, cold DMing itself is a process that needs constant iteration. When writing and sending cold DMs, there are several key points to note: try to start with a relatively "mild" opening, put the most substantial information first (e.g., funding status, transaction volume processed, etc.), mention where you saw or learned about them, maintain a friendly, non-intrusive call-to-action (CTA), and always follow up, don't just send once and stop.

There is no such thing as a "perfect cold DM." You need to constantly A/B test different versions to find out which ones actually work for your target users.

Below is a high-quality cold DM template (thanks to @realsimon, from @alliance), which you can refer to and use directly:

But it's important to understand that this process is slow and psychologically draining.

In the crypto industry, very few people are willing to reply to cold DMs because scams are everywhere. Low reply rates are the norm (it is indeed a bit discouraging).

But even so, you still must do it.

At this stage, your goal is not to get 1000 users. Your goal is 10–20 early users who have the following characteristics: genuinely care about the problem you're solving, willing to try your product, able to give honest, direct feedback.

These early users will gradually become your support system. Early products will almost certainly have frequent problems, and it is these users who help you through the most vulnerable stages.

6. Iterate quickly

The pace of the crypto industry is extremely fast. Narratives change rapidly, and users' attention spans are even shorter.

If the product you build has no real value, it's inherently difficult to gain attention; even if you briefly gain attention without value, that focus won't last.

At best, it can only bring a short-term buzz, but the product itself cannot survive long-term.

This is toly's advice to developers at Breakpoint 2025.

The core meaning is only three points: deliver quickly, iterate frequently, dare to make radical adjustments.

I also learned something very important: users won't always directly tell you what to do next.

You need to judge by observing their behavior: what are they doing repeatedly? What workarounds or detours are they using? What are they already willing to pay for?

Many ideas sound reasonable, but most users may not be willing to pay for them.

7. Please make your website "idiot-proof"

I don't know why this needs to be emphasized repeatedly, but I'll say it again: "Don't make any assumptions about users."

If you think users should understand, you are wrong. Things that are obvious to us developers who have invested hundreds of hours building the product are completely unfamiliar to users encountering it for the first time.

Don't introduce any new concepts or operational flows. Only use simple, familiar things that can truly make users' lives easier. Click paths should be as streamlined as possible. Within 5 seconds of entering the app, users should be able to see, understand, or perceive the value of the product (this is something we are still continuously optimizing).

I can't attach a screenshot, but I've received many DMs where users completely misunderstood the purpose of a certain feature.

Conclusion

Building consumer crypto products is both fun and challenging.

Speed, extreme focus on users, and distribution capabilities are often more important than "perfect technology."

This is very different from B2B products, but I still believe it was the right choice for us.

This piece is already long enough. I'll save the experience about fundraising for the next article. Finally, just use encrypt.trade directly

If this content resonates with you, or if you are also building consumer crypto products and want to discuss GTM, distribution, or the product itself, feel free to DM me.

I'm always happy to chat with other founders and developers.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush