Editor's Note: As DeFi gradually moves beyond its early "narrative-driven" phase and strides toward scale and institutionalization, Aave stands at a critical juncture. This long-form article, penned by founder Stani Kulechov himself, is not just a retrospective but a comprehensive outline of Aave's vision for the next decade and beyond, following the gradual dissipation of regulatory uncertainty.

With the U.S. Securities and Exchange Commission (SEC) concluding its four-year investigation into the Aave protocol, Aave has crossed the most draining and uncertain phase in terms of compliance. Against this backdrop, Aave's articulation of its role has become increasingly clear: it no longer positions itself merely as a top DeFi lending platform but aims to become the global on-chain credit layer.

The original text follows:

I have spent almost a full decade building Aave, long before the concept of DeFi even existed. Along the way, I've witnessed countless cycles of hype and decline, but our mission has never changed.

When Aave was first founded, the entire DeFi space was worth less than $10 billion; today, Aave alone is over 50 times larger than that.

Over the years, many teams have come and gone. Aave Labs has been building consistently for over 7 years, and few teams can match our long-term track record. We have personally driven and delivered:

- Aave Protocol V1, V2, V3, and the ongoing V4

- Aave's native stablecoin GHO

- A 4-year compliance and regulatory battle with the SEC, defending Aave

- Continuous maintenance of Aave.com, and the upcoming Aave Pro

- Cross-chain expansion of GHO

- First non-EVM deployment

- Aave App

- Aave documentation system and developer toolkit

And many more unlisted efforts

Today, Aave Protocol has become the largest, most trusted, and most liquid lending protocol in history, occupying a unique lane with almost no comparable peers.

But even so, in my view, compared to the vast landscape we are about to unfold, we are still at "Day Zero." This article will outline our long-term vision spanning decades: to bring the next trillion dollars in assets onto Aave and onboard millions of new users onto the chain.

Aave in 2025

2025 has been the most successful year in Aave's history.

Our net deposits once reached $75 billion; even more impressively, since its launch 5 years ago, Aave has cumulatively processed a total historical deposit volume of $3.33 trillion, with total loans issued approaching $1 trillion.

Over the past year or two, we have fully embraced the cross-chain world within the Aave ecosystem. True to Aave's style, it is now the only protocol with a TVL exceeding $1 billion on four different networks.

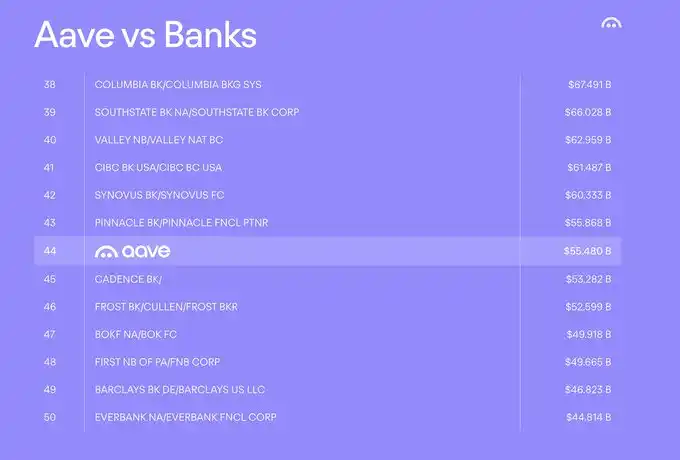

More importantly, in terms of size, the Aave protocol can now be compared to a top 50 bank in the United States—the core hub of the global financial system.

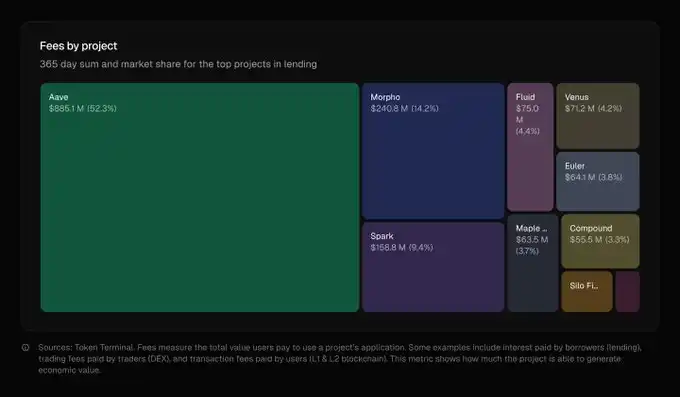

This growth has allowed Aave to capture 59% of the DeFi lending market and account for 61% of all active loans in DeFi.

This year alone, the protocol generated $885 million in fee revenue, accounting for 52% of all lending protocol fees, even exceeding the combined total of the next five largest competitors. This steady stream of fee revenue has further enabled a substantial AAVE buyback program.

A DeFi protocol operating at this scale is unprecedented in the history of the industry.

The market has made its choice with results: Aave is no longer a阶段性产物 but a long-term infrastructure.

Next, I want to discuss Aave Labs' assessment and plans for the coming year.

Looking Ahead to 2026

Currently, our overall strategy for entering the next phase will revolve around three core pillars: Aave V4, Horizon, and Aave App.

Aave V4

Aave V4 will be a key step in Aave's journey toward becoming a "global financial base." It is a complete重构 of the Aave protocol.

Its core innovation lies in: unifying liquidity through a Hub & Spoke model. The V4 architecture will replace the current fragmented pool structure, establishing a capital hub (Hub) on each network; on top of this, highly customizable "Spoke modules" can be built to provide dedicated lending markets for different types of assets.

This design will enable Aave to handle trillions of dollars in assets, becoming the preferred platform for institutions, fintech companies, and various enterprises to access deep and reliable liquidity.

Simultaneously, we will launch V4 alongside a全新的开发者体验 next year. For the past few months, Aave Labs has been building a new tooling system aimed at allowing developers to launch and scale products on Aave with unprecedented low barriers to entry.

Entering 2026, Aave will welcome a series of new markets, new assets, and new types of integrations previously unseen in the DeFi space. We will also continue to collaborate with fintech companies and work closely with the DAO and ecosystem partners to steadily advance deployments while gradually expanding TVL.

Horizon

Horizon is a bridge to the next trillion dollars.

Launched earlier this year, it is Aave's exclusive market for institutional-grade real-world assets (RWA). Through Horizon, qualified institutions can use tokenized U.S. Treasuries and other credit assets as collateral to borrow stablecoins.

This is a solution specifically crafted by Aave Labs for large global financial institutions, meeting their practical needs in compliance, risk control, and operations. By providing a secure and efficient institutional-grade on-ramp for capital, Horizon becomes the core vehicle for bringing the massive scale of traditional finance on-chain.

Horizon will introduce numerous top-tier financial institutions into the Aave ecosystem in ways previously impossible and expand Aave's reach to an asset base of over $500 trillion.

In a very short time, Horizon has grown into the largest and fastest-growing RWA collateralized lending platform. We do not believe this growth momentum will slow down anytime soon.

Currently, Horizon's net deposits are approximately $550 million. By 2026, our goal is to rapidly expand this figure to $1 billion and beyond. To achieve this, we will deepen collaborations with leading institutional partners like Circle, Ripple, Franklin Templeton, VanEck, and others to bring more global asset classes into Aave.

If Aave is to play a truly central role in the entire financial system, it must率先 bring stocks, ETFs, funds, real estate and mortgages, commodities, accounts receivable, as well as bonds and fixed-income assets into the on-chain lending system. And Horizon is the key布局 to achieving this goal.

Aave App

Aave App is the "Trojan Horse" for the next million users. It is Aave's flagship mobile application, aiming to truly bring DeFi to everyone.

The protocol itself is a highly complex financial system, and the mission of Aave App is to屏蔽 this complexity, providing an intuitive, easy-to-use product experience that addresses real needs in the current economic environment.

Aave App is deeply integrated with Push—our global, fee-free stablecoin on/off-ramp通道, covering over 70% of global capital markets. This will make Aave App the product with the best cash-to-DeFi experience on the market.

Many people don't realize that mobile fintech itself is an industry worth over $2 trillion. Apps like CashApp and Venmo have tens of millions of users but almost no real product capabilities for "saving"; Aave App has the potential to fundamentally change how people save.

Early next year, we will officially and fully launch the Aave App and embark on the journey to our first million users. This will directly inject growth momentum into the Aave protocol through a new market that has never been adequately tapped before. Without product-level mass adoption, Aave cannot scale to the trillion-dollar level.

Maintaining a clear stance, continuous innovation, and designing products freely is the most beneficial path for Aave.

At Aave Labs, we always focus on three things: bringing the next trillion dollars in assets on-chain; onboarding millions of new users into DeFi; and making $AAVE win.

This vision requires us to build not a "replacement" for the traditional financial system, but a structurally superior financial infrastructure.

More importantly, Aave Labs' long-term success is highly aligned with that of the Aave protocol. Alignment is not a verbal statement but is reflected in actions:

Aave Labs and its employees are the largest holders of AAVE

Everything we build is designed to strengthen the protocol's core fee capture mechanism, the收益 of which全部归属于 the DAO

Aave Labs has delivered more products for Aave than any other team

For 8 years, I have invested countless hours continuously driving Aave's growth—whether in product innovation, global business development, or organizing numerous community events

P.S. I bought another $10 million worth of AAVE on-chain yesterday.

I also see the various discussions on the DAO forum. Let me be very clear: no one cares more about Aave than I do. Open discussion is a feature of DeFi governance, not a sign of "misalignment."

Aave, as the Global Credit Layer

Our long-term goal, spanning decades, is to build the foundational credit layer for the on-chain economy. In Aave Labs' view, any form of value can be tokenized, used as productive collateral, or borrowed and lent without intermediaries in the future.

In such a future, Aave is the foundation for everything, the base liquidity layer upon which the next generation of financial products and services will be built.

Everything we have done over the past few years has been laying the groundwork for this goal that still lies ahead.

Here, we sincerely thank the Aave DAO, numerous service providers, and the countless developers who have contributed to Aave. This is a true collective effort, and we are also grateful for the ecosystem that has grown around the protocol. Aave Labs is ready to face the challenges of the next phase, and we will always prioritize Aave's long-term interests as our first principle.

Building in the open is not easy; governance and DeFi are inherently difficult. Aave is one of the few DeFi protocols that has stood the test of time, which is what makes it unique. Innovation must always come first—this is also why the Aave ecosystem has continued to succeed.

But it's not time to celebrate yet... We are just getting started.

Aave will win.