Hyperliquid

Project Twitter: https://x.com/HyperliquidX

Project Website: https://hyperfoundation.org/

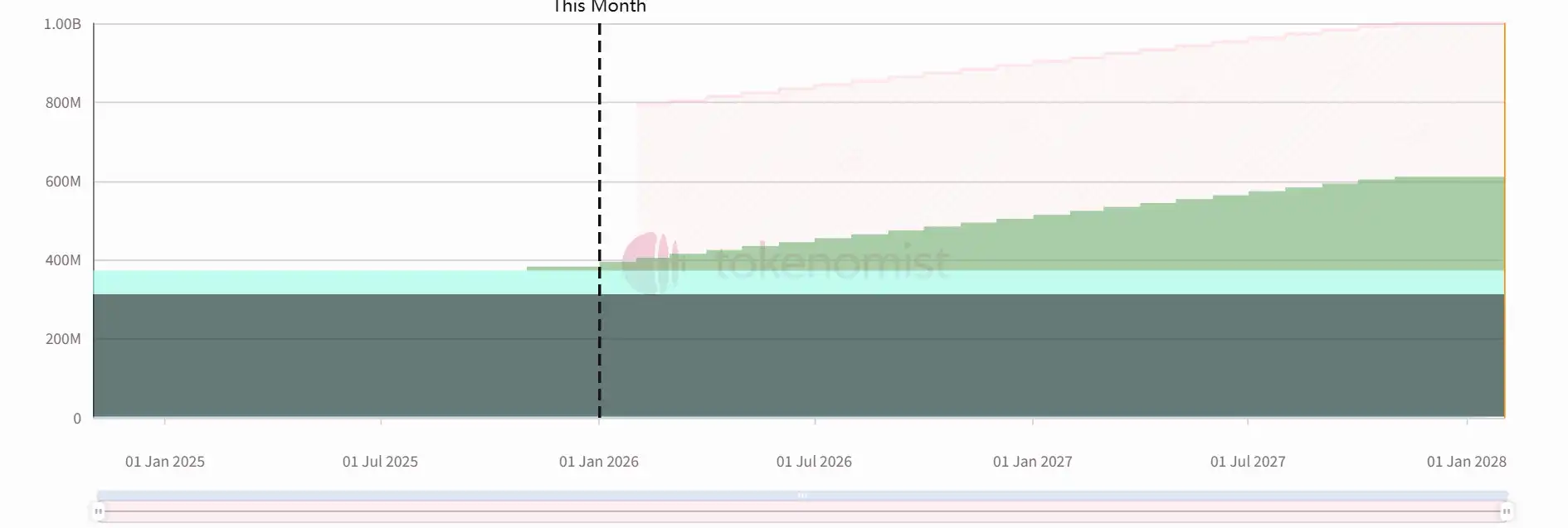

This Unlock Amount: 12.49 million tokens

This Unlock Value: Approximately $320 million

Hyperliquid is a high-performance blockchain built with the vision of creating a fully on-chain open financial system. Liquidity, user applications, and trading activities synergize on a unified platform, aiming to accommodate all financial operations.

Specific release curve is as follows:

Ethena

Project Twitter: https://x.com/ethena_labs

Project Website: https://www.ethena.fi/

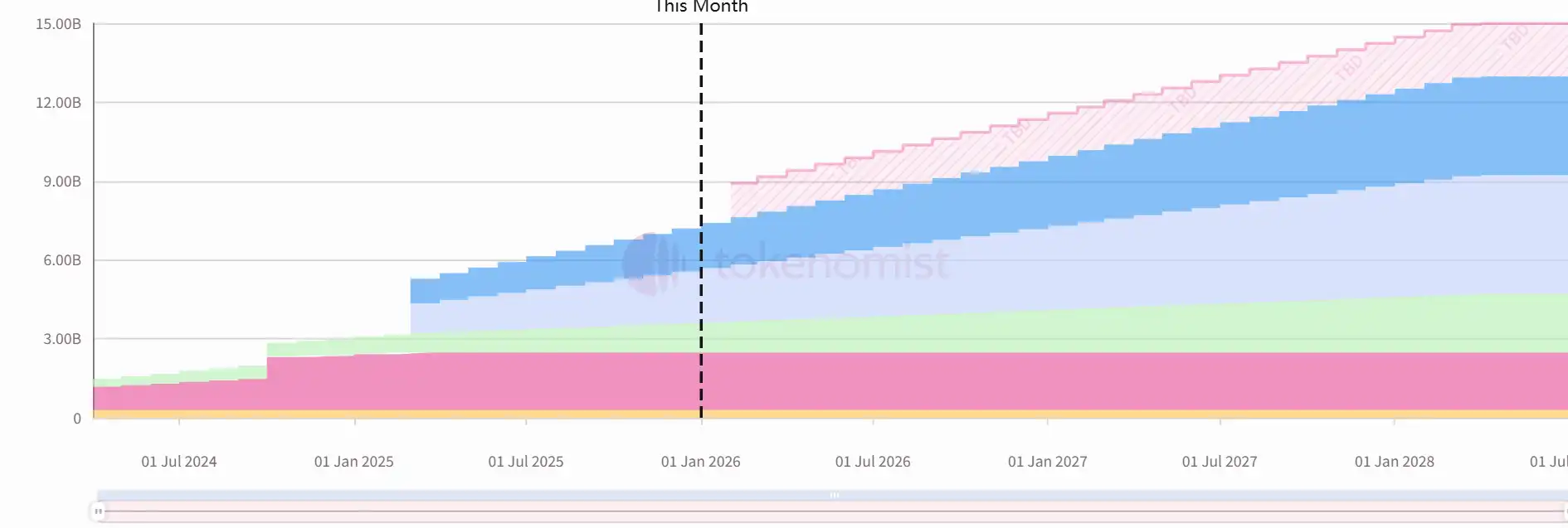

This Unlock Amount: 170 million tokens

This Unlock Value: Approximately $42.91 million

The algorithmic stablecoin USDe, launched by Ethena Labs, currently relies on collateral such as BTC and stETH, along with their inherent yields. It simultaneously creates Bitcoin and ETH short positions to balance Delta and utilizes perpetual/futures funding rates to maintain the peg and provide yields. Essentially, it uses the yield from spot positions to hedge the losses from the one-time short positions, achieving balance while capturing ETH staking yields and short position funding rates.

Specific release curve is as follows: