Ondo Finance

Project Twitter: https://x.com/OndoFinance

Project Website: https://ondo.finance/

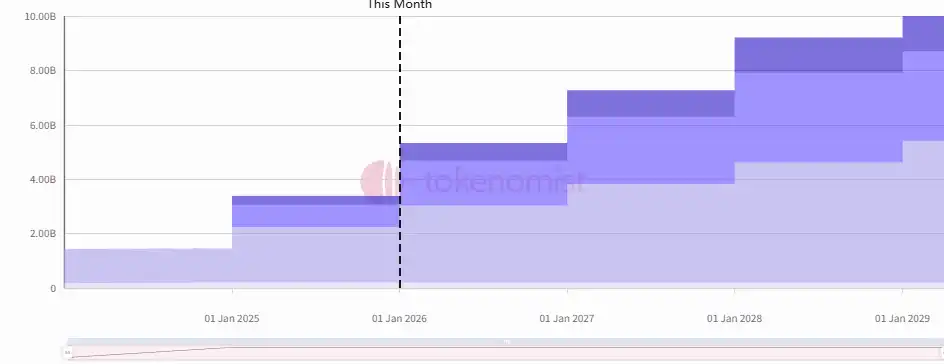

This Unlock Amount: 1.939 billion tokens

This Unlock Value: Approximately $780 million

Ondo Finance was established in 2021, initially focusing on the Laas (Liquidity as a Service) sector. However, as the market entered a downturn, the DeFi market cap and on-chain liquidity shrank, leading to a bottleneck in the project's development. Consequently, in January 2023, it pivoted to the RWA (Real World Assets) sector.

Before the pivot, Ondo Finance issued the ONDO token and conducted a public sale on Coinlist. The purchased tokens were subject to a 1-year lock-up period, followed by monthly releases. The tokens can be used for governance voting rights in Flux Finance.

Specific release schedule is as follows:

Trump

Project Twitter: /

Project Website: /

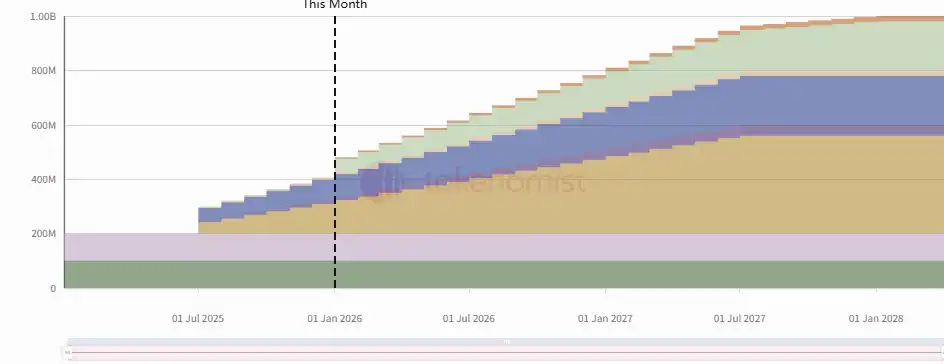

This Unlock Amount: 54.94 million tokens

This Unlock Value: Approximately $298 million

Meme token issued by Trump.

Specific release schedule is as follows:

Starknet

Project Twitter: https://twitter.com/Starknet

Project Website: https://starknet.io/

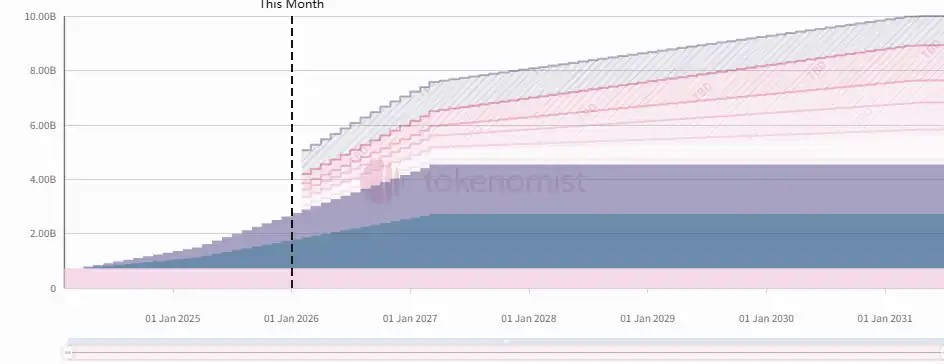

This Unlock Amount: 126 million tokens

This Unlock Value: Approximately $10.41 million

Starknet is an Ethereum Layer 2 that utilizes zk-STARKs technology to make Ethereum transactions faster and cheaper. StarkNet's parent company, StarkWare, was founded in 2018 and is headquartered in Israel. Its main products include Starknet and StarkEx. By using STARKs, Starknet verifies transactions and computations without requiring all network nodes to validate each operation. This significantly reduces the computational burden and increases the throughput of the blockchain network.

Specific release schedule is as follows: