Ripple has become the most aggressively structured bet in blue-chip crypto after a group of major Wall Street firms wired about $500 million into the company in November, lifting its valuation to roughly $40 billion and making it one of the highest-valued private players in the sector. Bloomberg reported that Ripple’s share sale brought in some of the biggest names of Wall Street but only after investors secured a suite of downside protections.

Wall Street Goes All-In On Ripple

The investor line-up reads like a who’s who of modern market structure: Citadel Securities, Fortress Investment Group, Marshall Wace, Brevan Howard–linked vehicles, Galaxy Digital and Pantera Capital all participated, treating the round at least as much as a structured credit trade as a venture bet.

According to multiple accounts of the deal, several funds underwrote Ripple essentially as a concentrated exposure to XRP itself. Bloomberg’s reporting states that multiple investors concluded at least 90% of Ripple’s net asset value was tied to XRP, with the company controlling about $124 billion of the token at market prices in July.

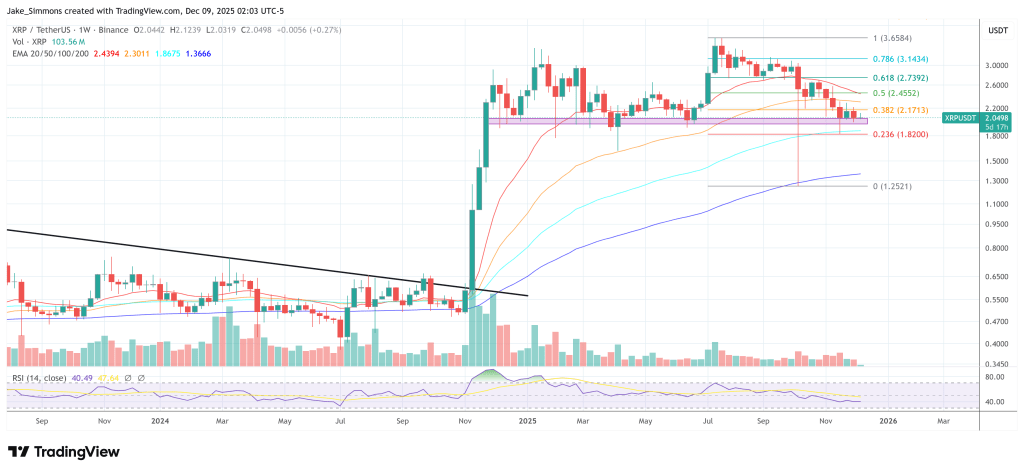

That XRP cushion has already been tested. XRP is down roughly 40% from its mid-July peak and about 15–16% since late October, yet even after that drawdown, estimates in deal coverage still put the company’s XRP treasury in the tens of billions of dollars, with a large portion locked in escrow and released gradually over time.

The protection that Wall Street insisted on has become the defining feature of the deal. Investors secured the right to sell their shares back to Ripple after three or four years at a guaranteed 10% annualized return, unless the company has gone public by then.

Ripple, conversely, can force a buyback in those same windows only by delivering about 25% annually. On top of that, the funds negotiated a liquidation preference, giving them priority over legacy shareholders in a sale or insolvency.

The numbers involved are non-trivial. FinTech Weekly estimates that if the put option were exercised in full at the four-year mark, Ripple’s cash outlay would approach $700 million–$730 million, irrespective of operating performance or token prices at the time. Those obligations sit alongside an already heavy capital agenda: Ripple has agreed to buy prime-brokerage platform Hidden Road for roughly $1.3 billion and corporate-treasury specialist GTreasury for about $1 billion, while also confirming it has repurchased more than 25% of its outstanding shares.

Banks and trading desks are now treating the November round as a new reference point for crypto credit risk. FinTech Weekly reports that “those terms are now shaping how banks, funds, and trading desks assess Ripple’s balance sheet, exit risk, and future liquidity,” with the three- and four-year exit windows being modeled explicitly alongside XRP price scenarios and rate curves.

Ripple’s management maintains there is “no plan, no timeline” for an IPO, but the structure of the deal effectively date-stamps its private capital: either the company lists or finds new liquidity on favorable terms before the put windows open, or it must fund a secured, fixed-return exit for some of the most sophisticated players on Wall Street.

At press time, XRP traded at $2.0498.