Author: Chen Xiaomeng

Original Title: The Playground of Whales: Why Retail Investors Are Fleeing DeFi

The era of DeFi that once championed financial empowerment has effectively come to an end.

A few years ago, we were complaining that the $50+ gas fees on the Ethereum mainnet were barring retail investors. Now, Layer 2s have become ghost chains, and even the mainnet's gas fees have dropped to almost negligible levels after upgrades.

The barrier is gone. We expected a狂欢 (carnival) for retail, but instead, we got a silent mass exodus.

Why? Because everyone has finally woken up to the reality:

In this market, we worry ourselves sick ("carry the heart of selling white powder"), but only earn the meager profits of "selling flour."

I. The Low Gas Trap: From Noble Chain to Sweatshop

Because interaction costs are low, projects assume you should perform a massive number of interactions. So, for that tiny potential airdrop expectation, retail investors are forced to become proficient on-chain laborers: bridging, swapping, staking, providing LP... mechanically repeating these actions hundreds of times a day.

But this doesn't lead to higher returns. Instead, low gas has become a tool for projects to infinitely inflate their activity metrics.

This is on-chain manual labor.

II. The Capricious Dictator: Code is No Longer Law

"Code is Law" was once DeFi's most captivating narrative. But now, DeFi protocols not only have backdoors in their code, but the project teams' words have also become a sickle that can fall at any moment.

This is the current pain point retail investors hate the most—the uncertainty of the rules.

Project teams have long learned how to be ruthless. They invented undeliverable "points systems," like a carrot dangling in front of a donkey, luring you to constantly invest funds and time. After you've diligently farmed points for half a year, eagerly awaiting the payout, the project suddenly releases an announcement:

-

"For the fairness of the community, we will strictly crack down on Sybil attacks."

-

"Our VE model needs to be modified."

-

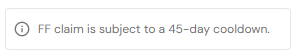

"For the development of the community, we have added a 45-day cooldown period."

Yesterday you were their cherished early supporter; today, because your IP address changed slightly, or your funds were withdrawn a day early, you are labeled a Sybil. The right to explain the rules belongs solely to the project team; they change them as they please.

In traditional business, this is called fraud. In DeFi, it's called DAO governance.

III. The Lock-up Prisoner: Capital Hunting Under High APY

Projects lure you with extremely tempting APY. It looks like high returns, but the outcome is already scripted:

-

Liquidity Drain: Your principal is locked up, frozen and immobile.

-

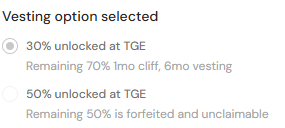

Whale Front-Running: Project teams, early investors, and whales often have special vesting schedules for their tokens, or they can hedge their profits off-chain.

-

Price to Zero: By the time you can unlock, you might find that while you earned a 50% return in token terms, the token price has already dropped by 90%.

The essence of lock-ups is retail investors using their liquidity to provide exit liquidity for the whales. You covet the interest; they have their eyes on your principal.

IV. Extreme Mismatch of Risk and Reward

Let's do a realistic calculation.

Current DeFi protocols, excluding the shady meme coins that could rug pull at any moment, offer stablecoin yields around 5% – 10% for mainstream top protocols. This seems higher than banks, but what are the underlying risks?

-

Smart Contract Vulnerabilities: Hackers could drain the pool at any time.

-

Front-end Hijacking: Phishing sites are everywhere.

-

Depegging Risk: Algorithmic stablecoins or bridged assets can go to zero instantly.

-

Project Rug Pulls: Even projects with billions in TVL can disappear with the funds overnight.

Earning 5% yield while bearing 100% risk of total capital loss. This is the classic case of high risk, low reward. This level of return doesn't even cover the mental anguish you suffer while operating. Comparatively, simply buying and holding Bitcoin, or even using centralized exchange savings products, offers far better value for effort than messing around on-chain.

Conclusion: Refuse to Become On-Chain Fuel

DeFi innovation has stalled, but the methods of extraction have evolved.

At this stage, for most retail investors with less than $100,000 in capital, DeFi has lost its golden attributes. It is no longer a wilderness of opportunity but a playground meticulously designed by whales and unscrupulous project teams.

Every button, every rule, every suggestion to lock up funds here is designed to诱骗 (induce) you to hand over your chips.

So, perhaps the best strategy now is only one: Admit that current DeFi is indeed not working. Stop those meaningless interactions. Stop locking up funds for meager returns. Protect your principal. Convert it into truly valuable core assets, and then watch coldly from the sidelines as the whales battle each other.

Stop being an on-chain laborer. Your time and capital deserve a better destination.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Group:https://t.me/BitPushCommunity

Bitpush TG Channel: https://t.me/bitpush