Author: Nikka / WolfDAO (X: @10xWolfdao)

Against the backdrop of the ongoing correction in the crypto market in early 2026 (BTC hovering around $89,000-$90,000, ETH around $3,200), corporate coin hoarding strategies have become one of the most important narratives in the market. This article will analyze the coin hoarding behaviors of two representative companies, Strategy (formerly MicroStrategy) and Bitmine Immersion Technologies, revealing their strategic differences, financial models, and their multi-faceted impact on the market.

Part One: In-Depth Interpretation of Coin Hoarding Behavior

1.1 Strategy (MSTR): Leveraged Conviction Injection

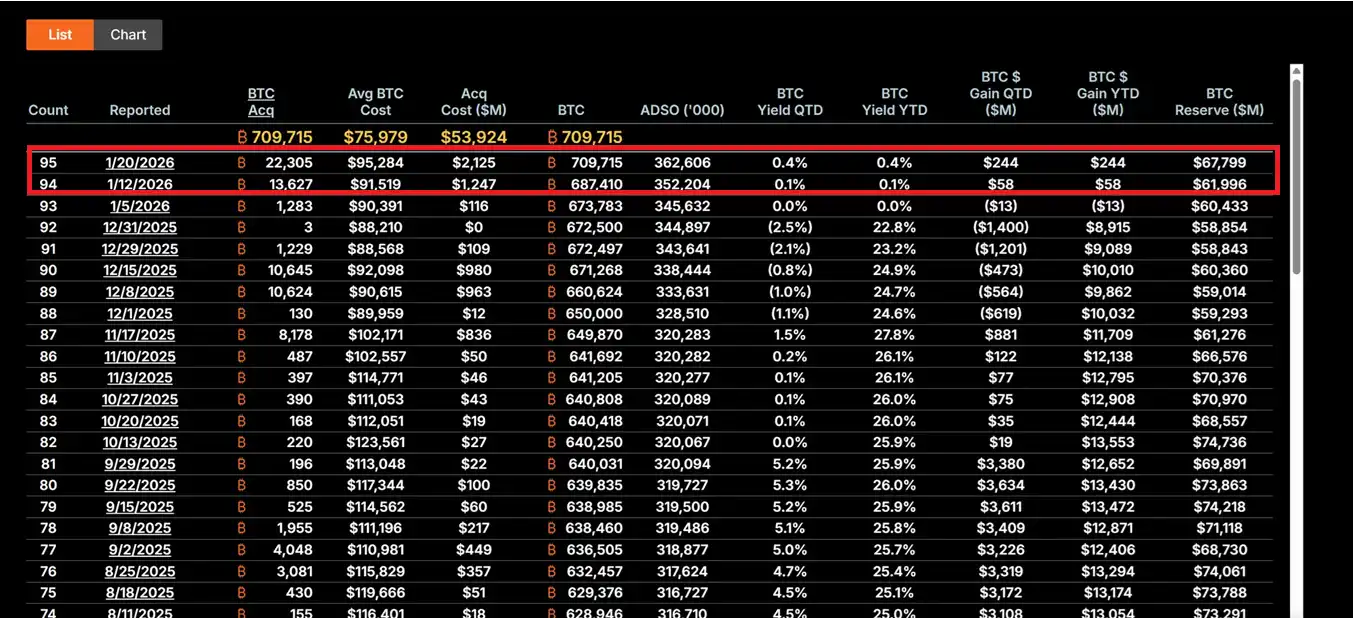

Under the leadership of CEO Michael Saylor, Strategy has completely transformed the company into a Bitcoin holding vehicle. Between January 12-19, 2026, the company purchased 22,305 BTC at an average price of approximately $95,500, with a total value of $2.13 billion, marking the largest single purchase in the past nine months. To date, MSTR's total holdings amount to 709,715 Bitcoin, with an average cost of $75,979 and a total investment of nearly $53.92 billion.

Its core strategy is built on the "21/21 Plan," which involves raising $21 billion each through equity financing and fixed-income instruments to continuously purchase Bitcoin. This model does not rely on operational cash flow but utilizes the "leverage effect" of capital markets—converting fiat debt into deflationary digital assets by issuing stocks, convertible bonds, and ATM (At-The-Market) instruments. This strategy causes MSTR's stock price volatility to typically be 2-3 times that of Bitcoin's price volatility, making it the most aggressive "BTC proxy" tool on the market.

Saylor's investment philosophy is rooted in extreme confidence in Bitcoin's scarcity. He views BTC as "digital gold" and an inflation hedge. In the current environment of macro uncertainty (including fluctuating Fed interest rate policies, tariff trade wars, and geopolitical risks), this counter-trend increase demonstrates institutional-level long-termism. Even though the company's stock price has retreated 62% from its high, MSTR is still seen by value investors as an "extreme discount" buying opportunity.

If the Bitcoin price rebounds to $150,000, MSTR's holdings would be worth over $106.4 billion, and its stock price could potentially see 5-10 times elasticity due to the leverage amplification effect. However, the reverse risk is equally significant: if BTC falls below $80,000, debt costs (annual interest rates of 5-7%) could trigger liquidity pressure, forcing the company to adjust its strategy or even face liquidation risk.

1.2 Bitmine Immersion Technologies (BMNR): Staking-Driven Productivity Model

BMNR, under the leadership of Tom Lee, has taken a distinctly different path. The company positions itself as the "world's largest Ethereum Treasury company," holding 4.203 million ETH as of January 19, valued at approximately $13.45 billion. More crucially, 1,838,003 of these ETH are staked, generating an estimated annual cash flow income of about $590 million based on the current 4-5% annualized yield.

This "staking-first" strategy provides BMNR with an intrinsic value buffer. Unlike MSTR's pure price exposure, BMNR gains continuous income through network participation, similar to holding high-yield bonds but with the added bonus of Ethereum ecosystem growth. The company added 581,920 staked ETH between Q4 2025 and Q1 2026, showing a sustained commitment to the network's long-term value.

BMNR's ecosystem expansion strategy is also noteworthy. The company plans to launch the MAVAN staking solution in Q1 2026, providing ETH management services for institutional investors and building an "ETH per share" growth model. Furthermore, a $200 million investment in Beast Industries on January 15th and shareholder-approved share limit extensions pave the way for potential acquisitions (such as acquiring smaller ETH-holding companies). The company also holds 193 BTC and $22 million in equity of Eightco Holdings, with total crypto and cash assets reaching $14.5 billion.

From a risk management perspective, BMNR's staking yield provides downside protection. Even if the ETH price fluctuates around the $3,000 range, staking yields can cover part of the opportunity cost. However, if ETH network activity remains sluggish leading to a decline in staking APY, or if the price falls below key support levels, the company's NAV discount could widen further (the current stock price is around $28.85, down over 50% from its high).

1.3 Strategy Comparison and Evolution

The two companies represent two typical paradigms of corporate coin hoarding. MSTR is an offensive, high-risk/high-reward leverage model, relying entirely on Bitcoin price appreciation to realize shareholder value. Its success is built on the belief in BTC's long-term supply scarcity and macro monetary devaluation trends. BMNR is a defensive, yield-oriented ecosystem model, building diversified revenue sources through staking and services, reducing reliance on single price fluctuations.

Notably, both have learned from the lessons of 2025, shifting towards more sustainable financing models. MSTR avoids excessive equity dilution, while BMNR reduces reliance on external financing through staking yields. This evolution reflects the shift of corporate coin hoarding from "experimental allocation" to "core financial strategy," also marking the arrival of the 2026 era of "institution-led, not retail FOMO."

Part Two: Multi-Dimensional Impact on the Market

2.1 Short-Term Impact: Bottom Signal and Sentiment Repair

MSTR's massive purchases are often interpreted by the market as a confirmation signal for Bitcoin's bottom. The $2.13 billion purchase in mid-January drove single-day inflows into Bitcoin ETFs to $844 million, showing institutional funds are following the footsteps of corporate hoarders. This "corporate anchoring" effect is particularly important during periods of fragile retail confidence—when the Fear & Greed Index shows "extreme fear," MSTR's continuous buying provides psychological support for the market.

BMNR's Ethereum accumulation also has a catalytic effect. The company's strategy echoes the看好 (positive view) of traditional financial giants like BlackRock regarding Ethereum's dominant position in the RWA (Real World Asset) tokenization field. This could trigger a "second wave of ETH Treasuries," with companies like SharpLink Gaming and Bit Digital already starting to follow suit, accelerating staking adoption and ecosystem M&A trends.

Investor sentiment is shifting from panic to cautious optimism. This sentiment repair has a self-reinforcing characteristic in the crypto market and could sow the seeds for the next upward cycle.

2.2 Medium-Term Impact: Volatility Amplification and Narrative Divergence

However, the leveraged nature of corporate hoarding also amplifies market risks. MSTR's high-leverage model could trigger a chain reaction if Bitcoin corrects further. Since its stock beta is over 2 times that of BTC, any price drop is magnified, potentially leading to passive selling or a liquidity crisis. This "leverage transmission" effect triggered a similar liquidation wave in 2025 when several leveraged holders were forced to close positions during a rapid decline.

BMNR, although having a staking yield buffer, also faces challenges. Sluggish Ethereum network activity could lead to a decline in staking APY, weakening its "productive asset" advantage. Furthermore, if the ETH/BTC ratio remains weak, it could exacerbate BMNR's NAV discount, forming a negative feedback loop.

A deeper impact lies in narrative divergence. MSTR reinforces Bitcoin's positioning as a "scarce hedge asset," attracting conservative investors seeking macro hedges. BMNR promotes Ethereum's "productive platform" narrative, highlighting its application value in DeFi, staking, and tokenization. This divergence could lead to a decoupling of BTC and ETH performance under different macro scenarios—for example, BTC might perform stronger in a liquidity crunch environment due to its "digital gold"属性 (properties), while ETH might gain a premium during technological innovation cycles due to ecosystem expansion.

2.3 Long-Term Impact: Financial Paradigm Reshaping and Regulatory Adaptation

From a long-term perspective, the behavior of MSTR and BMNR could reshape corporate financial management paradigms. If the US CLARITY Act is successfully enacted, clarifying the accounting treatment and regulatory classification of digital assets, it would significantly reduce the compliance costs for corporate allocation to crypto assets. This Act could prompt Fortune 500 companies to allocate over $1 trillion in digital assets, shifting corporate balance sheets from traditional "cash + bonds" combinations to "digital productive assets."

MSTR has become a textbook case of a "BTC proxy," its market cap premium mechanism over Net Asset Value (NAV) is called the "reflexive flywheel"—using the premium from stock issuance to buy more Bitcoin, increasing the BTC per share, thereby pushing the stock price higher, forming a positive feedback loop. BMNR provides a replicable template for ETH Treasuries, demonstrating how staking yields can create continuous value for shareholders.

This may also trigger an industry consolidation wave. BMNR has already received shareholder approval for share extensions for M&A, potentially acquiring smaller ETH-holding companies to form "Treasury giants." Weaker hoarding companies might be forced to sell or be acquired under macro pressure, showing a "survival of the fittest" pattern in the market. This marks a structural shift in the crypto market from "retail-led" to "institution-led."

However, this process is not without risks. If the regulatory environment deteriorates (e.g., the SEC takes a hardline stance on digital asset classification) or the macro economy unexpectedly worsens (e.g., the Fed hikes rates due to rebounding inflation), corporate coin hoarding could turn from a "paradigm shift" to a "leverage trap." Historically, similar financial innovations have often led to systemic crises during regulatory crackdowns or market reversals.

Part Three: Core Issues Discussion

3.1 Corporate Coin Hoarding: A New Golden Age or a Leverage Bubble?

The answer to this question depends on the perspective and time scale. From an institutional investor's perspective, corporate coin hoarding represents a rational evolution of capital allocation. Against the backdrop of global debt expansion and heightened concerns about currency devaluation, allocating a portion of assets to scarce digital assets has strategic rationality. MSTR's "smart leverage" is not gambling but using capital market tools to convert equity premiums into digital asset accumulation, which is sustainable when the equity market fully recognizes its strategy.

BMNR's staking model further proves the "productive"属性 (properties) of digital assets. The annualized $590 million staking yield not only provides cash flow but also allows the company to maintain financial stability amid price volatility. This is similar to holding high-yield bonds but with added network growth红利 (dividends), demonstrating the potential of crypto assets beyond "pure speculation tools."

However, critics' concerns are not unfounded. The current leverage ratio of corporate hoarding is indeed at a historical high. The financing scale of $9.48 billion in debt and $3.35 billion in preferred stock could become a burden under macro headwinds. The lessons of the 2021 retail bubble are still fresh—many highly leveraged participants suffered heavy losses during rapid deleveraging. If the current wave of corporate hoarding merely shifts leverage from the retail to the corporate level without fundamentally changing the risk structure, the ultimate outcome could be equally severe.

A more balanced view is that corporate coin hoarding is in an "institutionalization transition period." It is neither a simple bubble (as it has fundamental support and long-term logic) nor an immediate golden age (as regulatory, macro, and technical risks still exist). The key lies in execution—can sufficient market recognition be built before regulatory clarity is achieved? Can financial discipline be maintained under macro pressure? Can the long-term value of digital assets be proven through technological and ecological innovation?

Conclusion and Outlook

The coin hoarding behavior of MSTR and BMNR marks a new stage for the crypto market. This is no longer a retail-driven speculative frenzy but a rational allocation based on long-term strategy by institutions. Although the two companies take截然不同 (distinctly different) paths—MSTR's leveraged conviction injection vs. BMNR's staking-driven productivity model—both demonstrate a commitment to the long-term value of digital assets.

Corporate coin hoarding is essentially a grand bet on "time". It bets that regulatory clarity arrives faster than liquidity dries up, that price increases come before debt matures, and that market faith is stronger than macro headwinds. There is no middle ground in this game—it will either prove that digital asset allocation is a paradigm revolution in 21st-century corporate finance or become another cautionary tale of over-financialization.

The market stands at a crossroads. To the left is an institution-led mature market; to the right is the abyss of leverage collapse and liquidation. The answer will likely be revealed within the next 12-24 months, and we are all witnesses to this experiment.