In the last week, Bitcoin suffered another correction wave with prices dropping to around $88,000 as the crypto market continues to face a weak investor appetite. While the premier cryptocurrency has experienced some slight relief, an approaching monthly close indicates the market is at a critical juncture that could define its price direction for February.

Bitcoin Market Weighs Rebalance Or Complete Breakdown

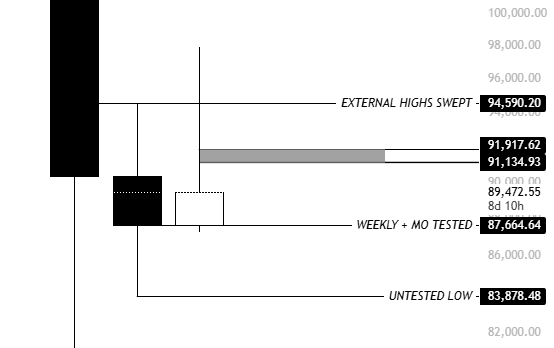

According to seasoned analyst KillaXBT, Bitcoin is heading into a pivotal monthly close next week, as recent price action suggests the market is approaching an inflection point. Notably, after sweeping external highs near $94,600 earlier in the month, BTC has since faced firm rejection, pushing price back toward the lower end of its recent range between $88,000-$90,000.

The rejection from these highs resulted in pronounced upper wicks on higher timeframes, a structure that often signals aggressive selling pressure. However, KillaXBT explains that such wicks are frequently partially or fully retraced, due to liquidity. With a full trading week still remaining before the monthly candle closes, the market analyst postulates that there are three primary scenarios that could determine price direction for February.

Firstly, Bitcoin could rise into the end of the month, allowing for a stronger monthly close. Under this scenario, February could begin with price forming the upper portion of the current wick, potentially revisiting the low-to-mid $90,000s before rolling over later in the month toward the $83,800 region.

In the second scenario, Bitcoin closes the month near current levels around $89,000, followed by an early-February move to hunt liquidity in the $91,000–$92,000 range before resuming a downward trend. Interestingly, both scenarios align with the idea that the market may first move higher to rebalance liquidity before resolving lower.

The third scenario presents a more severe outcome that aligns with a potential market breakdown. In this case, KillaXBT forecasts Bitcoin could retrace below the weekly and monthly open at $87,664 and close beneath this level before February. The analyst describes this scenario as “violently bearish”, as it increases the probability of a rapid move towards a lower support in the new month.

Notably, KillaXBT favors the first two scenarios, as the present sentiment being heavily bearish indicates that most investors are least expecting a move to the higher side. However, the analyst also emphasizes that the loss of $83,800 support in any scenario would significantly alter the outlook for any remaining long exposure.

Bitcoin Price Overview

At press time, Bitcoin trades at $89,645 following a minor 1.4% gain in the last day.