2025 was a challenging year for the cryptocurrency market and industry, and it did not spare the spot Bitcoin exchange-traded funds (ETFs). The US-based Bitcoin ETF market experienced wet and dry spells in equal proportions over the course of the year.

However, BlackRock’s spot Bitcoin ETF, iShares Bitcoin Trust (ticker: IBIT), has been a standout performer at times this year. According to the latest market data, the product’s performance in 2025 has earned it a spot among some of the best funds in the global ETF market.

BlackRock’s IBIT Records $25 Billion Net Inflow In 2025

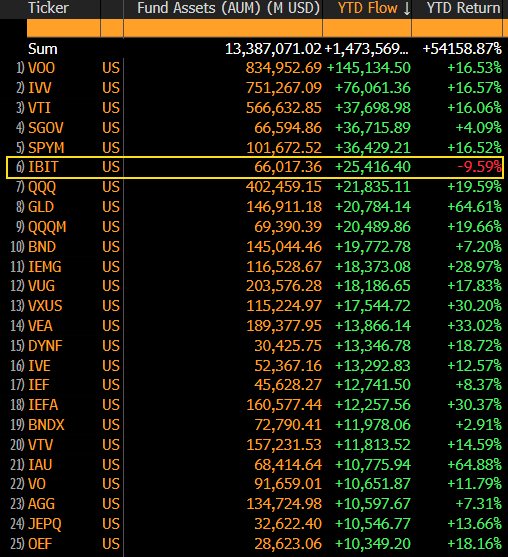

In a recent post on the social media platform X, senior Bloomberg analyst Eric Balchunas revealed that BlackRock’s Bitcoin ETF has ranked sixth in net capital inflows in the past year. This feat comes despite the BTC exchange-traded fund posting a negative return in the same period.

According to data shared by Balchunas, BlackRock’s IBIT registered a net inflow of approximately $25 billion so far this past year. What’s interesting is that the Bitcoin ETF pulled in this significant capital despite being the only fund with negative performance among the traditional equity and bond ETFs, as observed in the chart below.

Source: @EricBalchunas on X

Interestingly, SPDR’s GLD ETF, the world’s largest physically backed gold exchange-traded product, lags behind BlackRock’s IBIT in terms of capital inflows despite its 64% return in the year. Notably, Vanguard’s S&P 500 ETF (VOO) led the cohort with a year-to-date capital inflow of over $145 billion.

Furthermore, Balchunas highlighted that while the crypto community would naturally complain about the Bitcoin ETF’s yield, it is also important to recognize the significant feat of attracting the sixth-largest capital in spite of this negative return. According to the ETF expert, this yearly performance is a good sign in the long term.

Balchunas wrote:

If you can do $25b in a bad year, imagine the flow potential in a good year.

The Bloomberg analyst did credit the older, long-term investors (the boomers) in what he called a “HODL clinic” for the positive net inflows seen by BlackRock’s Bitcoin ETF.

Bitcoin ETFs Record $497 Million Weekly Outflow

According to SoSoValue data, the US-based Bitcoin ETFs closed the week with a total net outflow of $158 million on Friday, December 19. This brought the ETFs’ record to about $497.05 million in outflows over the past week.

The dismal run of performances in the Bitcoin ETF market can be seen in the price action of the premier cryptocurrency in recent weeks. The Bitcoin price is down by exactly 30% from its all-time high of $126,080.

As of this writing, the price of BTC stands at around $88,293, reflecting a 2% decline in the past seven days.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView