In-Depth Research Report on Account Abstraction (AA): Generational Leap in Ethereum’s Account System & Landscape Reshaping in the Next Five Years

I. Historical Evolution and Capability Panorama of Account Abstraction (AA)

On December 3, 2025, Ethereum underwent a major upgrade named Fusaka, marking the third milestone update since The Merge and the Dencun upgrade. The upgrade aims to significantly improve network scalability, reduce transaction costs, and optimize node operation efficiency, with a key focus on enhancing and optimizing functionality related to Account Abstraction (AA). In the Ethereum ecosystem, the evolution of account structure has essentially shaped the core logic of on-chain user experience, asset security, and industry development. The dual account system comprised of EOA (Externally-Owned Account) and CA (Contract Account), familiar to the public nowadays, is legacy technology carried since Ethereum’s launch in 2015. However, from 2023 to 2025 when user numbers exceeded tens of millions and Web3 increasingly took on asset custody and user operation infrastructure roles, this system confronts increasingly serious structural bottlenecks. These bottlenecks constrained not only industry scalability but also user growth and real application deployment. Nevertheless, Account Abstraction (AA) is precisely designed to resolve these fundamental structural defects inherent in the Ethereum account system, enabling on-chain worlds to have modern financial-grade security, experience, and autonomy, and ultimately becoming a trusted foundational infrastructure for global users’ assets. The core reason why the current system confronts a bottleneck lies in the fact that EOA hard-codes “private key = asset ownership” at the protocol level. While technically simple, this model has become the largest barrier to scaled adoption in practice.

EOA operates like a “mechanical assembly line” rather than the intuitive “one-click execution” familiar to modern internet users. Besides, in terms of access control, EOAs cannot support fine-grained settings: they cannot set daily spending limits, define multi-signature rules, create parent-child accounts, freeze specific permissions, or activate automated strategies. EOAs function as a universal key that holds all assets and all permissions. If an EOA is ever compromised, all assets and permissions become exposed.

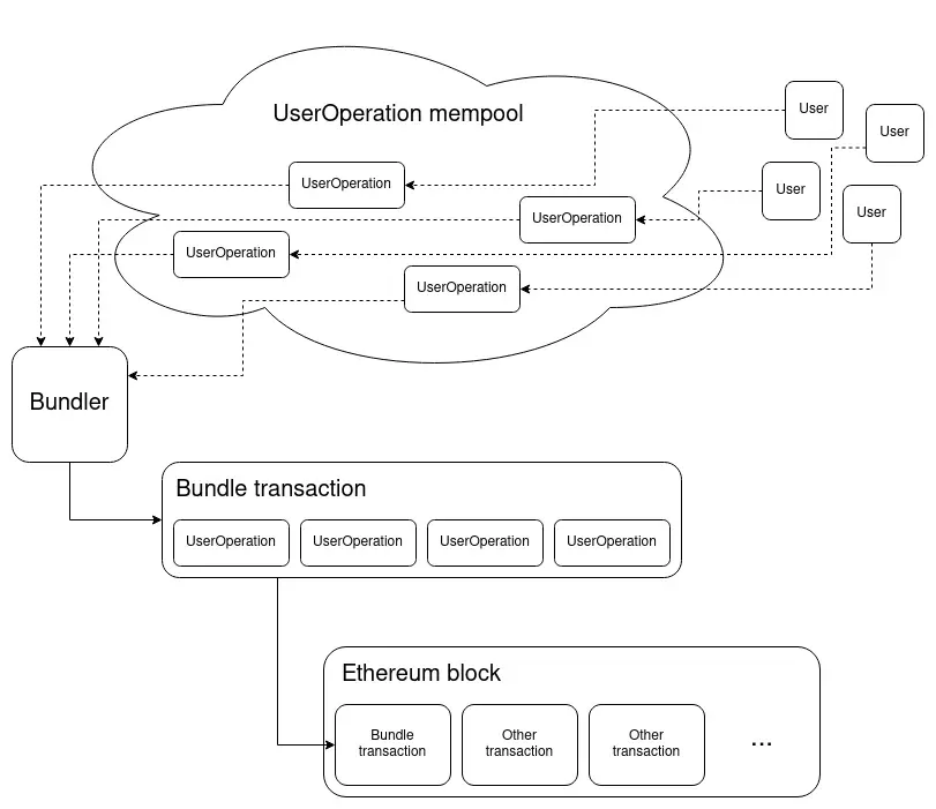

Therefore, the Ethereum community began rethinking “what an account should be", and AA’s vision that accounts should be code, not merely private keys directly addresses this problem. Under the AA paradigm, accounts can be programmed, verified, recovered, and upgraded. In other words, limitations resulted from the EOA hard-coded architecture can now be abstracted away. Wallets are no more mere signature containers, but instead become “smart accounts” with logic, strategies, and permission systems. Account Abstraction was not born overnight, but evolved through extensive design negotiations. Key proposals include EIP-86, EIP-2938, ERC-4337 and the latest EIP-7702. Specifically, both EIP-86 and EIP-2938 require consensus-layer changes, making them difficult to implement. The brilliance of ERC-4337 lies in its construction of AA through a parallel system. Using UserOperation and Bundler, it circumvents the need for base protocol changes, enabling AA to be activated seamlessly within the existing Ethereum ecosystem. In essence, ERC-4337 builds a new channel parallel to the transaction mempool: Users could submit UserOperation instead of transactions. Bundlers then package, simulate, and aggregate these operations, submitting them to the EntryPoint contract for execution. This enables contract accounts to proactively send transactions, execute them in batch, perform atomic actions, and validate multi-signatures. Although this increases engineering complexity, it currently offers the only practical route to fully enable AA without a hard fork. During the 2024-2025 evolution, Vitalik Buterin proposed EIP-7702, which aims to make transitions between EOAs and AA smoother, though ecosystem support is still needed. AA’s significance goes beyond fixing structural EOA flaws to bring generational upgrades in experience, security, and cost capabilities for the Ethereum. Firstly, on the security enhancement side, AA introduces a programmable permission system: Social recovery mechanisms could be activated so there is no need for users to worry about losing mnemonic phrases; multi-signature configurations are enabled for families, institutions and DAOs to manage their assets more securely; parent-child accounts, whitelists and spend limits could be created; and selective permission freezing and temporary keys are offered for more flexible usage. The single-point-of-failure model of EOAs is completely eliminated with AA, contributing to orders-of-magnitude improvements in security. In terms of cost, with the introduction of Paymasters, users can pay gas with any ERC-20 token or even have gas fees sponsored by a third party, enabling a truly “fee-agnostic” experience. Besides, AA also supports batch execution and transaction aggregation, significantly reducing the number of signatures required and lowering the cost impact of failed operations, thereby greatly reducing the total cost of complex user interactions. On the user experience side, AA brings Web3 interaction much closer to the ease of Web2 for the first time. Users can execute composite actions with a single click, eliminating the need to understand complex details such as nonces, gas settings, or signature ordering. New users can even create wallets without mnemonic phrases, completing account setup using biometric authentication, local recovery mechanisms, email verification, and other familiar methods. Complex on-chain logic such as strategy trading, automated liquidation, and scheduled execution can be embedded directly in account logic, enabling on-chain applications to deliver services as "smart products".

AA’s ultimate goal is to transform blockchain from an “experimental system for tech experts” into a "universal account infrastructure for global users". If the original bottleneck of Web3 was the primitive model of “key equals account” over the past decade, then the next breakthrough for Web3 in the coming decade will emerge from the new paradigm of “account equals program". AA is more than a wallet upgrade, instead, it has rewritten the entire logic of on-chain interaction. It not only improves user experience but also lowers development barriers, allowing DApps to implement Web2-style workflows, define permissions, and build trustless security at the account layer. With the widespread adoption of ERC-4337 from 2024 to 2025, components such as Bundlers, Paymasters, AA wallets, Modular security plugins, are forming an industrial chain and AA is shifting from a concept into infrastructure. Just as the evolution of mobile from Web1.0 to Web2.0 spawned super apps and trillion-dollar industries, the implementation of Account Abstraction may become the underlying driver of Web3’s next exponential growth. The limitations of the EOA era are being dismantled step by step, and AA is leading the industry into a safer, more flexible, and more mainstream-friendly on-chain world.

II. Prospects and Challenges of Account Abstraction (AA)

Account Abstraction (AA) has re-emerged as a core narrative within the Ethereum ecosystem from 2023 to 2025. However, after the initial enthusiasm and high expectations, the structural challenges it faces have progressively come into focus. The long-term prospects of AA remain highly anticipated given that it promises generational improvements in security, usability, and automation, potentially replacing the “private-key-as-account” model of the EOA era. Yet, at the implementation level, the deployment of ERC-4337 has been repeatedly questioned, often described as “big hype, few results". Viewed from four dimensions — industry structure, cost model, ecosystem collaboration, and competing protocols, AA’s future comes with both promise and challenges. It embodies the next generation of blockchain account architecture while also revealing the complexity inherent in protocol upgrades.

On the cost side, the primary resistance to AA stems from high gas fees. Compared to the 21,000 gas of an EOA transaction, the cost of a UserOperation under AA on mainnet doubles to about 42,000 gas. This overhead is not wasteful but structural: 4337 validation calls include validateUserOp, EntryPoint’s state access, wallet contract bytecode reads, log emissions, initCode deployment, and data encoding costs. Each step requires additional on-chain computation. In theory, placing complex logic inside contract wallets is the correct approach, because a true account should be programmable, verifiable, and controllable. However, Ethereum L1’s expensive resources mean that no matter how sophisticated the design, it ultimately translates into cost, which exactly has become the strongest barrier to adoption of AA. Many potential users and projects are deterred as a result. At the business model level, the Paymaster, another core component of AA faces unclear ROI. The Paymaster structure involves projects subsidizing gas on behalf of users in exchange for user growth or retention value. The problem is that there is no mechanism for projects to clearly compute the causal chain of “gas subsidy → new users → retention and monetization". Most wallets or DApps rely on subsidies early on to attract users, but once subsidies disappear, the very low switching costs for users make it difficult to build network effects. In reality, the Web3 ecosystem lacks the “advertising, retention, and traffic loop” seen in Web2 industries, leaving Paymasters’ expenditures unrewarded and preventing the formation of a sustainable business loop. Therefore, AA’s slow adoption is essentially not a technical issue, but rather a result of “lacking commercial traction". The market does not pay for notions, only for profits. Ecosystem fragmentation further exacerbates 4337’s difficulties. The full AA stack includes EntryPoint, Bundler, Paymaster, Wallet Contract, and Aggregator, and each wallet vendor and chain may implement their own variant. Because AA’s structure is complex and a user’s UserOperation is not handled directly by the chain, but via Bundler simulation and aggregation, even slight differences in implementations across ecosystems can lead to incompatibilities. Incompatibility between wallets, high integration costs for DApps, and complex on-chain testing all force project teams to re-evaluate the cost-benefit of supporting AA. Although EOA is primitive, it is extremely simple; AA is advanced, but in its early adoption phase it has confronted the problem of “ecosystem fragmentation". For the vast majority of small-to-medium DApps, supporting 4337 does not deliver obvious benefits, yet imposes extra technical costs, leading to a mindset of “using it only if necessary”.

The lack of cross-chain capability also undermines AA’s systemic value. ERC-4337 is essentially an account system upgrade for EVM Layers and it relies on EntryPoint, the UserOp pattern, and the EVM’s verification logic, making it inherently difficult to extend to non-EVM chains. Achieving a unified multichain experience would require additional intermediate layers, multiple EntryPoints, repeated verifications, and cross-chain messaging, which dramatically increases cost and complexity. The Web3 world is already fragmented across chains, and AA’s inability to form a unified account system across chains diminishes its potential to serve as the “unified standard for Web3 accounts". Users’ smart accounts on one chain cannot seamlessly map to another, significantly shrinking AA’s scalable value. Despite these structural challenges, AA remains a highly promising direction for the future. This is because the evolution of next-generation blockchain infrastructure is trending towards AA rather than away from it. In particular, the large-scale rise of L2 (Rollups) structurally alleviates AA’s cost pain points. The data compression capabilities of mainstream ZK Rollups and Optimistic Rollups can reduce 4337’s gas costs by 70%–90%, and batching UserOperations can further lower per-operation on-chain overhead. Therefore, “Rollup + AA” is highly likely to become the dominant combination in the next 35 years, easing the cost burden on the Ethereum mainnet from high-frequency AA operations. Concurrently, ERC-4337 continues to evolve, and the introduction of BLS aggregate signatures is one of the most significant advancements. By aggregating multiple user operations into a single signature and executing them in batches, the amount of data that must be published on-chain is significantly reduced, which both increases TPS and substantially cuts gas consumption. More importantly, it improves on-chain transaction throughput, turning AA into not just a “wallet upgrade solution”, but a “more efficient on-chain operations protocol". Coupled with Rollup compression capabilities, the cost bottlenecks in core performance faced by AA are being broken, and the industry is beginning to see its commercial feasibility. Additionally, Vitalik’s proposed EIP-7702 provides a “temporary conversion” path from EOAs to smart accounts, allowing users to enable AA capabilities within a transaction without migrating assets or switching wallets. EIP-7702 greatly reduces ecosystem friction by enabling wallet vendors to incrementally upgrade without fundamentally reconstructing their underlying architecture, allowing users to enter the AA world with virtually no perceptible change. This represents an important inflection point: AA no longer needs to “replace EOAs” but can instead coexist and evolve with them, guiding ecosystem migration through a gradual path.

However, AA’s future faces its greatest challenge from a sudden emergence of a competitor in 2024–2025: the x402 protocol. Compared to AA, x402 resembles more of an “Internet-scale unified payments protocol”, using HTTP 402 as an entry point to unify Web2 and Web3 payment interface logic. While AA seeks to solve “on-chain account abstraction”, x402 aims to solve “Internet-wide payment abstraction". AA targets Web3 users, while x402 could reach users across the entire Internet. More importantly, x402 has a natural business closed loop: Providers and Facilitators can charge fees directly within the payment flow, giving it clear market traction. Within the x402 framework, ERC-8004 becomes a “tooling protocol” rather than foundational infrastructure to which the entire network must migrate, and therefore its adoption difficulty is far lower than that of AA. In other words, AA must convince the ecosystem to migrate to its defined system, whereas x402 chooses to adapt to existing Internet usage habits, giving it a significant advantage in commercial adoption. Therefore, the prospects for AA are clear, but the path ahead is rugged. There is a deep tension between technical sophistication and industrial reality: The future that AA defines is indeed better, but realizing it requires overcoming multiple challenges including high cost, low commercial incentives, ecosystem fragmentation, and competing protocols. With the arrival of the Rollup era, maturation of signature aggregation technologies, and the introduction of EIP-7702 to enable a compatibility path, AA’s cost and compatibility issues will be gradually resolved. Yet breakthroughs in its business model and cross-chain capabilities remain necessary. In the coming years, the key question will not be whether AA is more advanced, but whether the industry can find a path for its organic adoption across users and projects. The future of AA belongs to those ecosystems that can seamlessly bridge protocol capability, product experience and commercial value, instead of mere technical implementers. It may not be the easiest solution to promote, but it remains the one with the greatest potential to reshape on-chain account systems.

III. Investment Value and Future Outlook of Account Abstraction (AA)

The role of Account Abstraction (AA) in the blockchain industry is gradually shifting from a “revolutionary technological vision” to a “structural infrastructure upgrade”. Accordingly, its investment value is evolving from early-stage narrative-driven premiums into a holistic assessment encompassing engineering execution, ecosystem coordination, and commercial sustainability. Over the next five years, AA will not become a unified entry point for the entire Web3 ecosystem, nor will it replace EOAs as the standard account system. Instead, it will establish itself firmly at the higher tier of wallet and account architectures, serving as the core representative of “smart accounts” and becoming deeply embedded in on-chain interaction experiences and transaction execution in the Rollup era. Therefore, from an investment perspective, the value of AA lies not in short-term user surges, but in a classic, Internet-style long-term infrastructure investment opportunity.

From a structural trend perspective, AA’s strategic importance will increase significantly with the widespread adoption of EIP-7702. EIP-7702 allows EOAs to temporarily transform into smart accounts within a single transaction, meaning existing wallet systems do not require forced migration or asset restructuring. Users can access AA capabilities such as permission controls, social recovery, multisig logic, and automated strategies, without switching wallets, backing up mnemonic phrases, or migrating assets. This “frictionless upgrade” model makes it smoother and easier for AA’s adoption and gives wallet providers stronger incentives to integrate AA into their underlying architectures. As a result, over the next three to five years, the more likely outcome will be coexistence and convergence between EOAs and AA, rather than outright replacement.

AA’s true deployment stronghold will be the Rollup ecosystem. As L2s such as zkSync, Scroll, StarkNet and Base become mainstream execution infrastructure, AA’s cost pain points will be naturally mitigated by Rollup data compression capabilities, with gas costs dropping by 70%–90% compared to L1. At the same time, BLS signature aggregation and batched UserOperations will further reduce on-chain data footprints, transforming AA-based account operations from “advanced but expensive” into “advanced and affordable". This implies that investment value lies not in L1-based AA, but in AA wallets, Paymasters, and Bundler infrastructure deeply integrated with Rollups. This direction represents tangible engineering value: It is not a conceptual narrative, but a real adoption driver enabled by verifiable on-chain cost reductions. From an industry value-chain perspective, AA’s investment opportunities are primarily concentrated in four infrastructure categories: smart contract wallets, Paymaster service providers, Bundler infrastructure, and L2s that natively support AA. Smart wallets represent the front-end entry point of future user experience. Projects such as Safe, Argent, OKX Web3 Wallet, imToken (AA version), and Zerodev are among the most structurally certain “ecosystem assets". Through modular wallet architectures, social recovery, multisig mechanisms and automation strategies, they enable the transition from “key-based wallets” to “smart account wallets”, exhibiting strong capabilities of driving self-reinforcing user retention. Paymasters are among the most commercially promising components within the AA architecture, serving as the bridge between gas subsidies and user growth. Although Paymaster's business models are not yet fully mature, Paymaster may evolve into “on-chain growth engines” as Rollup adoption expands and on-chain use cases diversify. Projects can subsidize gas fees for high-value users, implement incentive strategies, and apply whitelist-based policies, generating marketing effects analogous to Web2 advertising exposure. As such, projects like Stackup and Pimlico warrant close attention. Bundlers, as the execution layer of AA, represent another form of infrastructure with hidden value, effectively serving as the “transaction batching and logistics layer” of the blockchain world. Providers such as Biconomy and Alchemy’s AA infrastructure are positioned to benefit structurally from the growth of the ERC-4337 ecosystem. While Bundlers do not interface directly with end users, they offer scalable and relatively deterministic revenue models, making them potential candidates for low-volatility, infrastructure-style investment exposure over the long term.

At the same time, AA must contend with both competition and complementarity introduced by the x402 protocol over the next five years. x402 does not aim to replace AA; rather, it positions itself as a unified Internet payment entry point based on HTTP 402, spanning both Web2 and Web3. It features native cross-chain compatibility and a clear commercial closed loop through its Provider + Facilitator fee model. Within the x402 framework, ERC-8004 functions as a plugin rather than foundational infrastructure, granting it significantly stronger adoption potential. From an investment standpoint, AA’s value lies in on-chain account intelligence, while x402’s value lies in unifying Internet-scale payment experiences. The two are more likely to coexist and complement each other than to produce a single dominant winner.

Taken together, over the next five years, AA will form the “middle-layer infrastructure” of the Ethereum and Rollup ecosystems: EOAs remain at the base layer (weakened but persistent), smart accounts powered by AA occupy the middle layer, and x402 enables a unified interoperability network at the top layer. AA's user growth is unlikely to be explosive, but its value will increase steadily alongside rising on-chain transaction volumes, growing demand for automated strategies, professionalized asset custody and loss-prevention requirements. In a world progressively migrating on-chain, AA represents a structural investment direction withhigh-certainty. In a Rollup-driven cost-declining environment, it represents a monetizable future; and in an Internet coexisting with x402, it stands as a central force shaping the on-chain account paradigm.

IV. Conclusion

The core value of Account Abstraction lies in transforming Ethereum’s account system from the primitive model of “private key equals account” to the modern paradigm of “account equals program”. It fills a critical gap in the migration from Web2 to Web3 by enabling secure, recoverable, and programmable wallet architectures. Although AA still faces structural constraints including high costs, weak commercial closed loops, and limited cross-chain interoperability, it has already become a foundational direction for enhancing on-chain user experiences. Looking ahead, AA will persist as a long-term, high-end account layer rather than the only universal standard, while x402 complements it by addressing cross-chain interoperability and payment connectivity. Together, these two paradigms will propel Web3 from its early developer-centric phase toward broader mainstream adoption, laying a critical foundation for the vision of a unified Internet account system.