Bitcoin is attempting to reclaim the $92,000 level as bullish momentum gradually returns after weeks of uncertainty. The market has spent nearly two months in a corrective phase, shedding roughly 36% from its highs, yet signs of stabilization are beginning to emerge. A new CryptoQuant report from analyst Darkfost highlights a striking deviation from typical mid-cycle correction behavior—one that may explain why sentiment is starting to shift.

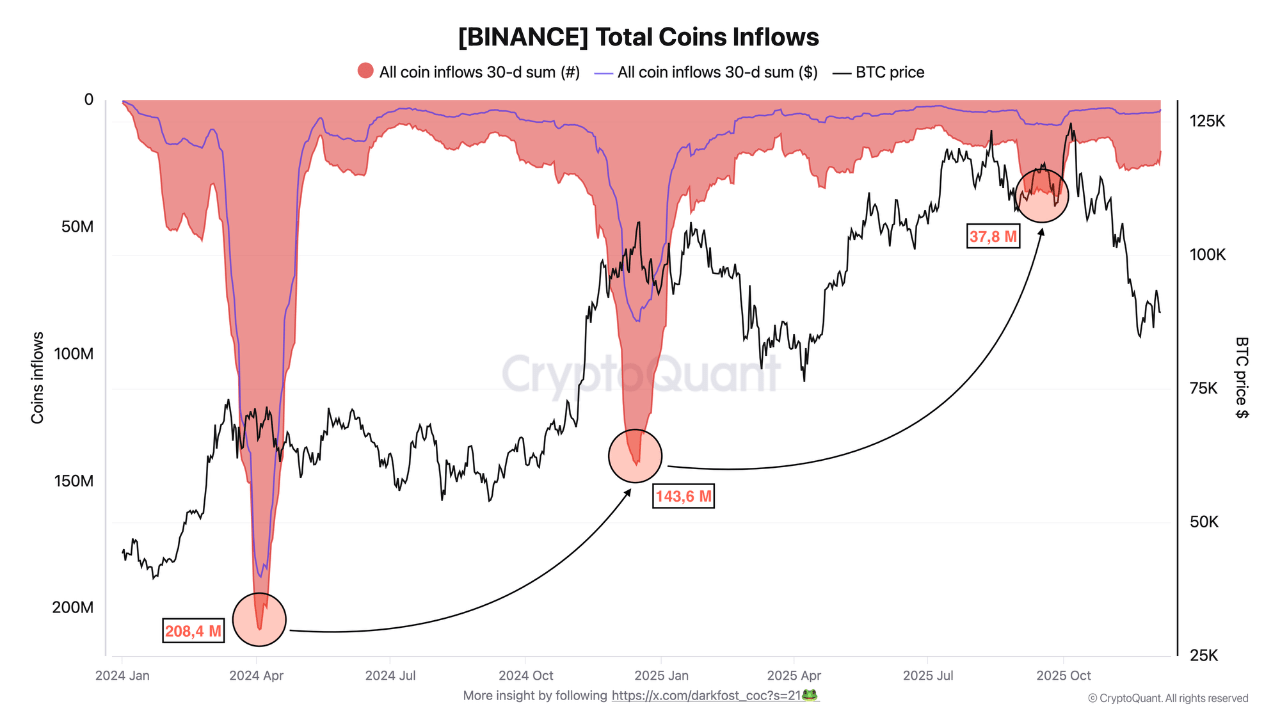

According to the report, inflows of cryptocurrencies onto Binance remain unusually low, even as Bitcoin has experienced one of its deepest pullbacks of the cycle. Historically, during significant corrections, investors tend to send large amounts of BTC and other assets to exchanges, signaling growing willingness to sell and escalating market fear. This pattern appeared repeatedly in past downturns, often marking periods of capitulation.

But this time, the data suggests something different: investors are not rushing to offload their holdings. Instead, they appear more comfortable holding through volatility, showing patience rather than panic. Such low inflows contrast sharply with prior mid-cycle resets and hint at a more resilient market structure beneath the surface—one where holders may be preparing for the next phase rather than abandoning ship.

A Shift in Inflows Reveals Unusual Investor Behavior

Darkfost notes that today’s data shows a markedly different behavior from what Bitcoin typically displays during major corrections. Instead of focusing on BTC alone, the analysis aggregates total inflows of all cryptocurrencies sent to Binance, offering a broader view of market intent. The logic behind this metric is straightforward: rising inflows signal growing selling pressure, while shrinking inflows indicate that investors prefer to hold rather than exit their positions.

During previous downturns, inflows surged. In April 2024, right after Bitcoin hit a new all-time high at $73,800, total inflows exceeded 200 million coins, reflecting intense selling pressure. A similar spike appeared in December 2024, as BTC broke above $100,000, signaling that investors were preparing to lock in profits.

Today’s environment looks nothing like those periods. Despite experiencing a much deeper correction, inflows are five times lower—and notably stable. Investors are not sending coins to exchanges, which means they’re not eager to sell. Instead, they are sitting through the decline, showing patience rather than panic.

This unusual calm suggests a more confident market structure. If selling pressure continues to fade, this investor restraint could become one of the most constructive signals supporting a future bullish recovery once the correction runs its course.