Ethereum has retraced below the $3,200 level following the Federal Reserve’s decision to cut interest rates by 25 basis points, a move that initially sparked volatility across the crypto market. While many expected a stronger reaction from Ethereum, the asset instead slipped lower as traders reassessed the macro environment and the implications of a potential shift toward stagflation. Despite this pullback, on-chain data suggests that the underlying market structure may be quietly improving.

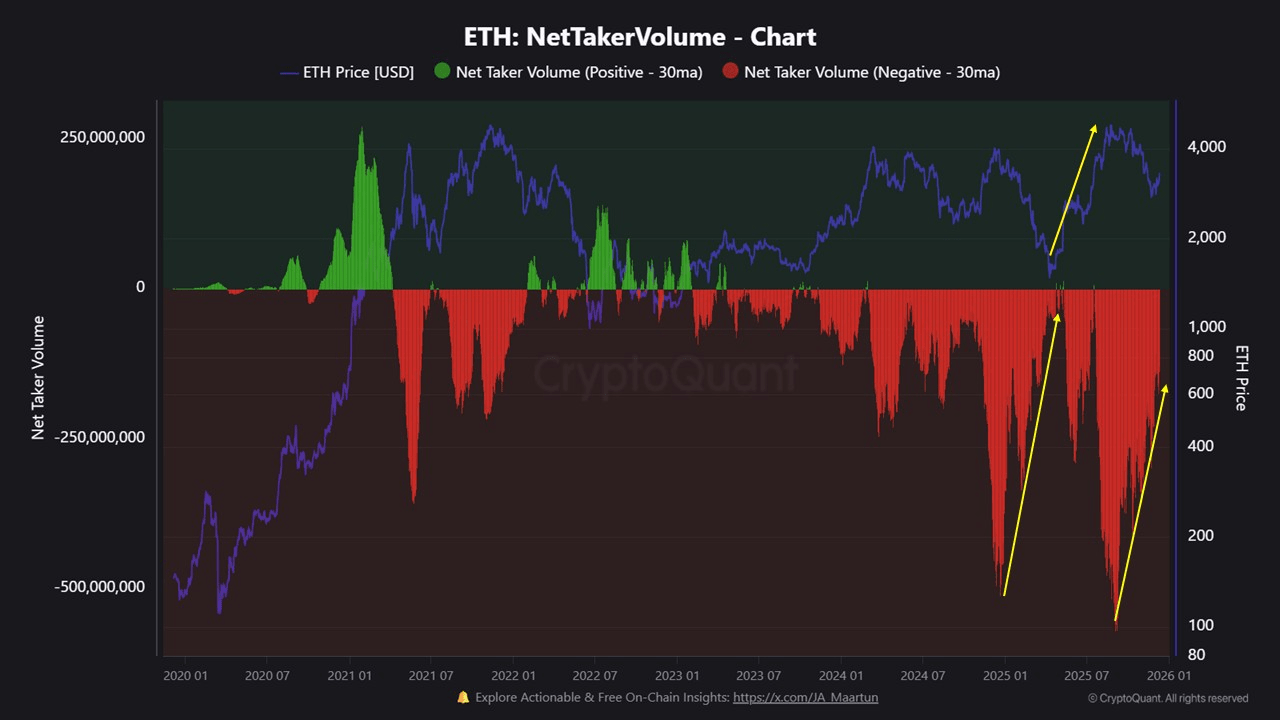

According to new insights from CryptoQuant, Ethereum’s Net Taker Volume (30-day moving average) is showing a clear upward trend in its lows. This metric tracks the balance between aggressive buyers and sellers in the derivatives market. Although ETH remains under selling pressure, the data reveals that the intensity of aggressive selling has been weakening steadily over the past several weeks. Each subsequent negative low is forming higher than the previous one, signaling that sellers are losing dominance.

While the broader sentiment remains cautious, subtle improvements in Net Taker Volume suggest that ETH’s current weakness may be masking the early stage of a larger structural shift.

Net Taker Volume Signals a Potential Structural Shift

According to CryptoQuant’s CoinCare, Ethereum may once again be approaching a pivotal turning point. The report highlights that a similar Net Taker Volume structure appeared earlier this year. After forming a clear bottom in January 2025, the metric began to trend upward—even while remaining in the negative zone—indicating that aggressive sellers were gradually losing strength.

By April, Net Taker Volume flipped decisively into positive territory. From that exact moment, Ethereum entered one of its strongest rallies of the cycle, surging more than 3x and printing a new all-time high.

Current conditions echo that same pattern. Since the peak of selling pressure in September, the market has continuously absorbed sell flows for nearly three months. Each negative low in Net Taker Volume has formed higher than the previous one, revealing improving market resilience despite the broader downtrend. If this trajectory holds, CoinCare estimates that a positive flip in Net Taker Volume may be only about a month away.

Historically, this transition from negative to positive has marked the beginning of Ethereum’s most explosive breakout phases. A confirmed move into positive territory would represent a high-probability trigger for the next expansion toward new all-time highs, signaling that momentum is quietly rebuilding beneath the surface.