HTX Perpetual Swaps Operation Guide(App)

- Guide per i Coin-M perpetui

1. Log in to your account on HTX APP.

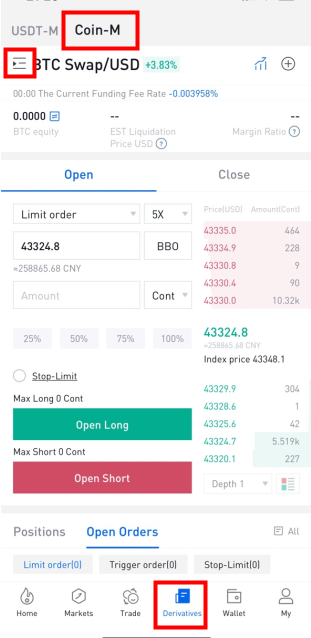

Users can find “Derivatives” at the bottom of homepage, click Coin-M Swaps on the top, and select the contract type & trading pair you prefer to trade. If you have not yet activated Coin-M Swaps trading, please do so first. >>>Derivatives Trading Activation Guide for New Users

If you have not downloaded HTX APP, please click here to download >>>

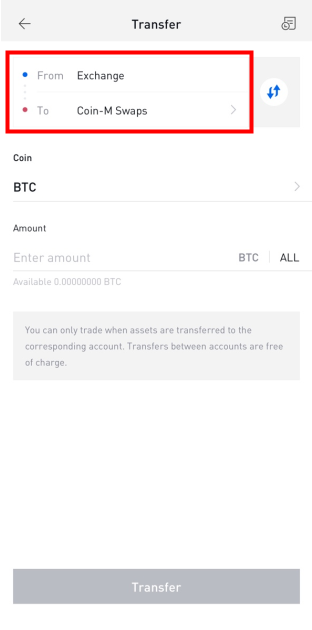

2. Asset Transfer

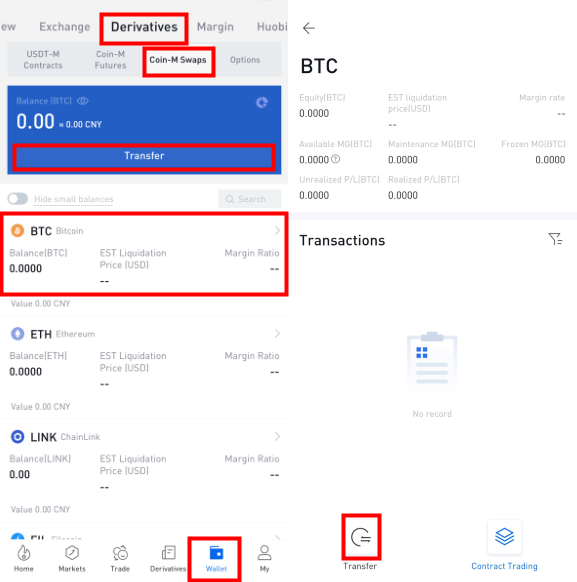

At present, all Coin-margined Swaps use the underlying asset of each contract as margin. User users have to transfer the corresponding token to trade, which is available to transfer from Exchange Account only. For example, users have to transfer BTC as margin first to trade BTC/USD swaps.

2.1 Click Transfer Button

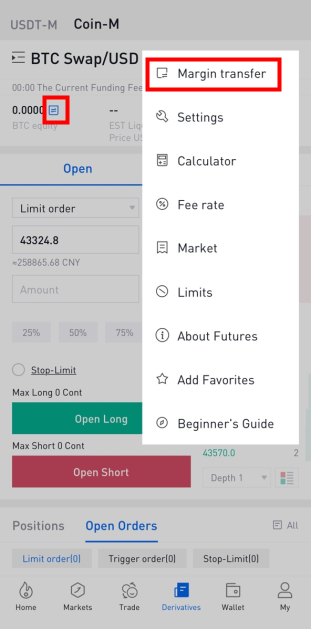

Method 1: Click the Transfer icon on the derivatives trading page.

Method 2: Click the “Margin Transfer” under the “+” icon at the top right.

Method 3: click “Wallet” at the bottom of homepage, enter the corresponding asset page you prefer under the Derivatives, and click Transfer button.

2.2 Select Transfer-in/out account and coin

If you wish to trade Coin-margined Swaps, you need to transfer underlying asset from Exchange Account to the “Coin-M Swaps Account”.

3. Switch trading unit/leverage

Unit: cont, coin

Leverage: you can change leverage before opening position or while holding positions without open orders.

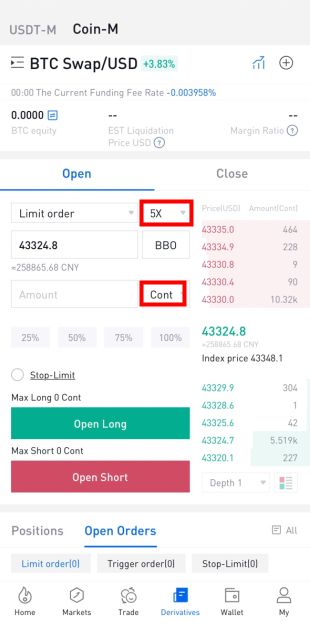

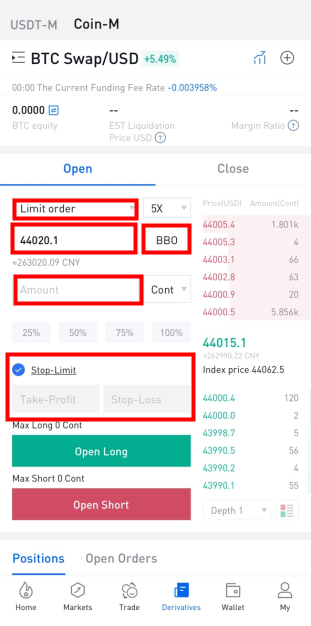

4. Place an Order

Users can optionally use limit order, trigger order to open a position.

● Limit Order: Users are required to enter a price (or choose an Optimal N price), and enter amount (or refresh the slip percent).

Limit orders can be used for opening or closing a position.

Meanwhile, you can set Stop-limit feature while opening a position. >>>Stop-limit operation Instruction

There are three effective mechanisms optional for limit orders, "Post only", "FOK (Fill Or Kill)", "IOC (Immediate Or Cancel)"; if no mechanism is selected, the limit order will be "always valid" in the market by default. >>>Limit Order Operation Instruction

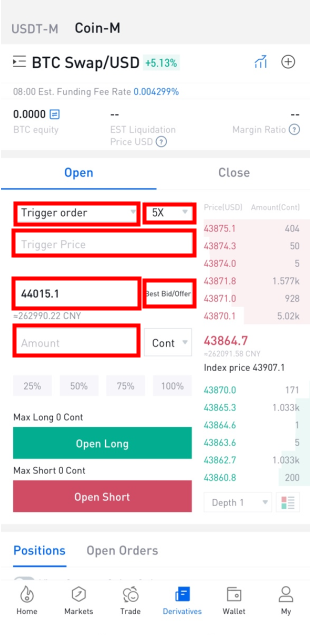

● Trigger Order:

Users are required to set trigger price, buy/sell price and amount. When the last price reaches the trigger price, the system will place a limit order with the buy/sell price and amount.>>>Trading Guide of Trigger Orders

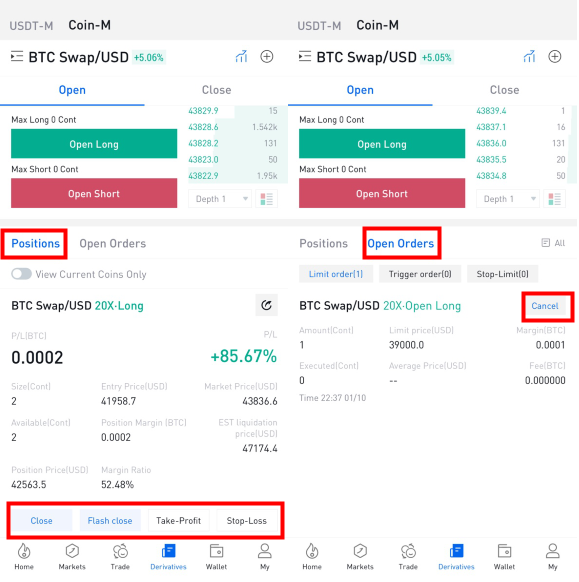

5. After the order is filled, the open position will be shown under the “Positions”, where you can execute many operations such as Close Long/Short, Stop-Limit, etc. While the unfilled part of the order will be shown under the “Open Orders”, and you can cancel it before it’s filled.

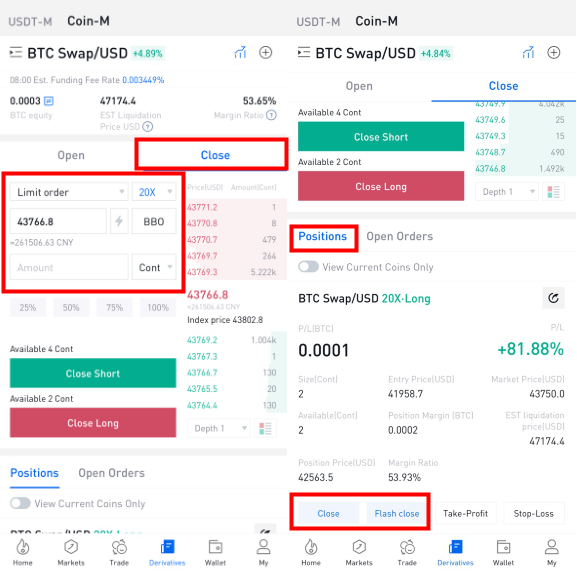

6. Assuming you wish to close a position, there are two types of options for you, that is, limit order and trigger order. Alternatively, you also can execute the “Close Long/Short” operation under the “Positions”.

At the same time, when you close a positon, Flash Close feature (lightning icon) is available for limit orders, in which the system places a position-closing order with the optimal 30 price based on the BBO price orders, so as to make the order filled as soon as possible

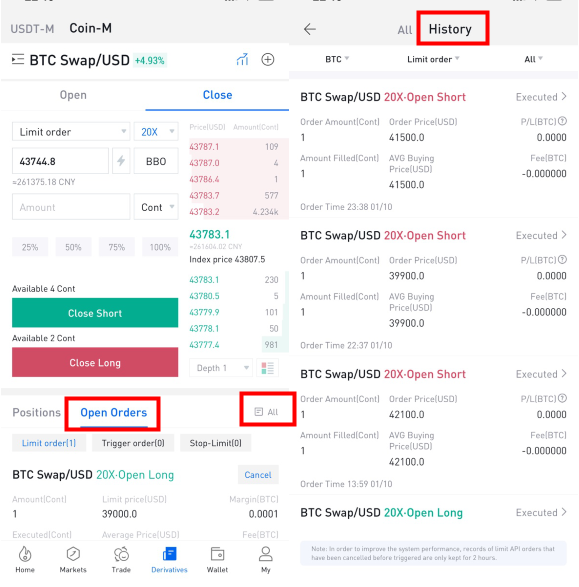

7. the “open order”page or click "All". In the pop-up interface, click "History" to view the history of the last three months.

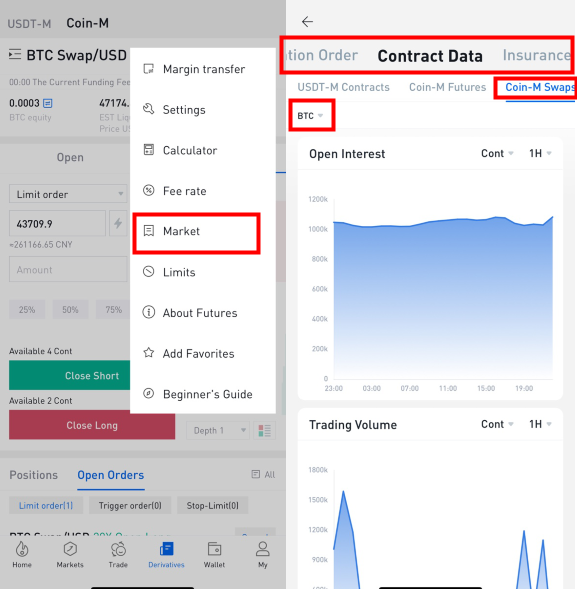

8. Click the “Market” under the [+] in the upper right corner of the derivatives trading page, and you have access to liquidation order, contract data, insurance fund, etc.

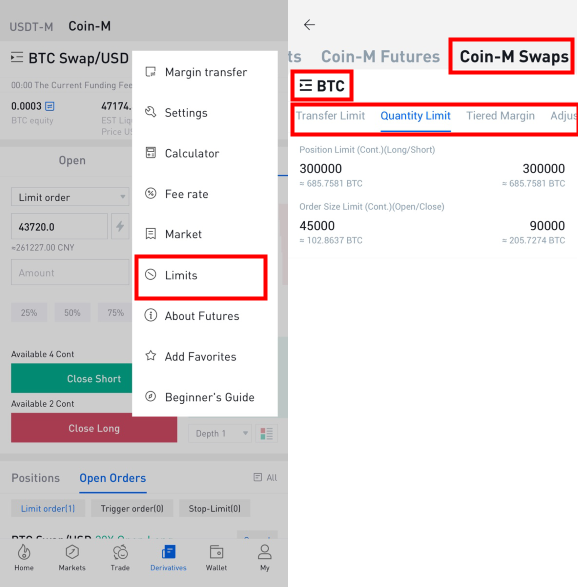

9. Click the “Limits” under the [+] in the upper right corner of the derivatives trading page, you can view many data such as quantity limit, transfer limit, tiered margin, etc.