When the S&P 500 Index shows a seasonal upward trend at the end of the year, Bitcoin follows a similar rhythm, with historical data giving a rare double bullish signal.

As December passes the halfway point, Wall Street's attention is gradually turning to one of the most watched seasonal phenomena of the year—the "Santa Claus Rally."

Since 1950, the S&P 500 Index has recorded positive returns 79% of the time during the short seven-day window comprising the last five trading days of December and the first two trading days of January, with an average gain of 1.3%.

This seasonal pattern has been repeatedly validated over the past 75 years, making the last two weeks of December the best two weeks for stock market performance.

On the other hand, Bitcoin quickly rebounded to above $89,500 after dipping to $87,500 on December 15, with Bitcoin spot ETFs seeing an inflow of $286 million last week.

MicroStrategy co-founder Michael Saylor reiterated his determination to "continue hoarding Bitcoin," and the company will also retain its status as a Nasdaq 100 component.

Definition and Historical Performance of the Santa Claus Rally

The "Santa Claus Rally" was first proposed by Yale Hirsch, founder of the Stock Trader's Almanac, in 1972, referring to the stock market's upward movement during the last five trading days of the year and the first two trading days of the following year.

This seasonal pattern is highly regarded on Wall Street not only for its high success rate but also for its predictive power for the stock market in the following year.

Historical data shows that since 1950, the S&P 500 Index has risen by an average of 1.3% during this seven-day window, with a probability of increase as high as 77%.

Among them, the frequency of positive gains for the S&P 500 Index is 78%, for the Dow Jones it is 79%, and for the Nasdaq it is 75%.

This seasonal trend is not accidental.

Multiple factors contribute to this phenomenon: optimistic investor sentiment during the holidays, increased holiday spending, and lower trading volumes at year-end making the market more susceptible to bullish retail investors. More notably, the Santa Claus Rally has shown remarkable predictive power for the stock market's performance in the following year. Since 1994, over 29 years, the S&P 500 Index rose during the Santa Claus Rally 23 times, and in 18 of those years, U.S. stocks continued to rise the following year; in the six years when the Santa Claus Rally declined, U.S. stocks also fell the following year.

In other words, over the past 29 years, the Santa Claus Rally has successfully predicted the direction of U.S. stocks in the following year 24 times, with an accuracy rate of nearly 80%.

The strongest Santa Claus Rally occurred during the 2008 global financial crisis. At that time, the S&P 500 Index surged 7.4% in seven days, successfully predicting the market rebound the following year.

In 2009, the S&P 500 Index rebounded sharply after hitting bottom on March 9, rising 23% for the year and gaining as much as 67% from the low point to the end of the year.

Bitcoin's December Seasonal Pattern

Similar to U.S. stocks, the Bitcoin market also exhibits a distinct seasonal pattern, with December often being one of the strongest months in Bitcoin's history.

Looking back at data from 2015 to 2024, Bitcoin closed December with a positive gain in seven out of ten years, with an average monthly return of 4.3%.

This seasonal phenomenon is supported by multiple factors: holiday optimism boosting risk appetite, year-end bonuses flowing into cryptocurrency investments, tax-loss harvesting creating buying opportunities, and reduced institutional selling pressure during the holidays.

As late December approaches, retail traders gradually dominate trading volume, further reinforcing this trend.

Bitcoin's best December performances include a 46% surge in 2017 and a 36% rise in 2020, while the worst year, 2021, saw a 19% decline.

This indicates that even in overall bear markets, December remains a relatively strong month for Bitcoin.

However, the situation in December 2025 is more complex. Bitcoin experienced a sharp correction in November, falling from $116,000 to around $80,000.

On December 15, Bitcoin briefly fell below $88,000, with a daily decline of 2.43%.

The Fear and Greed Index once fell to 17, indicating "extreme fear," and has been in a state of fear for more than 60 consecutive days, approaching the most panicked levels of the 2022 bear market.

If Bitcoin can reclaim the $95,000 to $97,000 range as support, it will reshape the market structure. On the downside, holding above $84,000 can keep the correction orderly and prevent further selling.

The Correlation Between U.S. Stocks and Bitcoin and Future Outlook

Historically, there has been a subtle correlation between U.S. stocks and Bitcoin. When traditional financial markets face uncertainty, the cryptocurrency market is often affected as well.

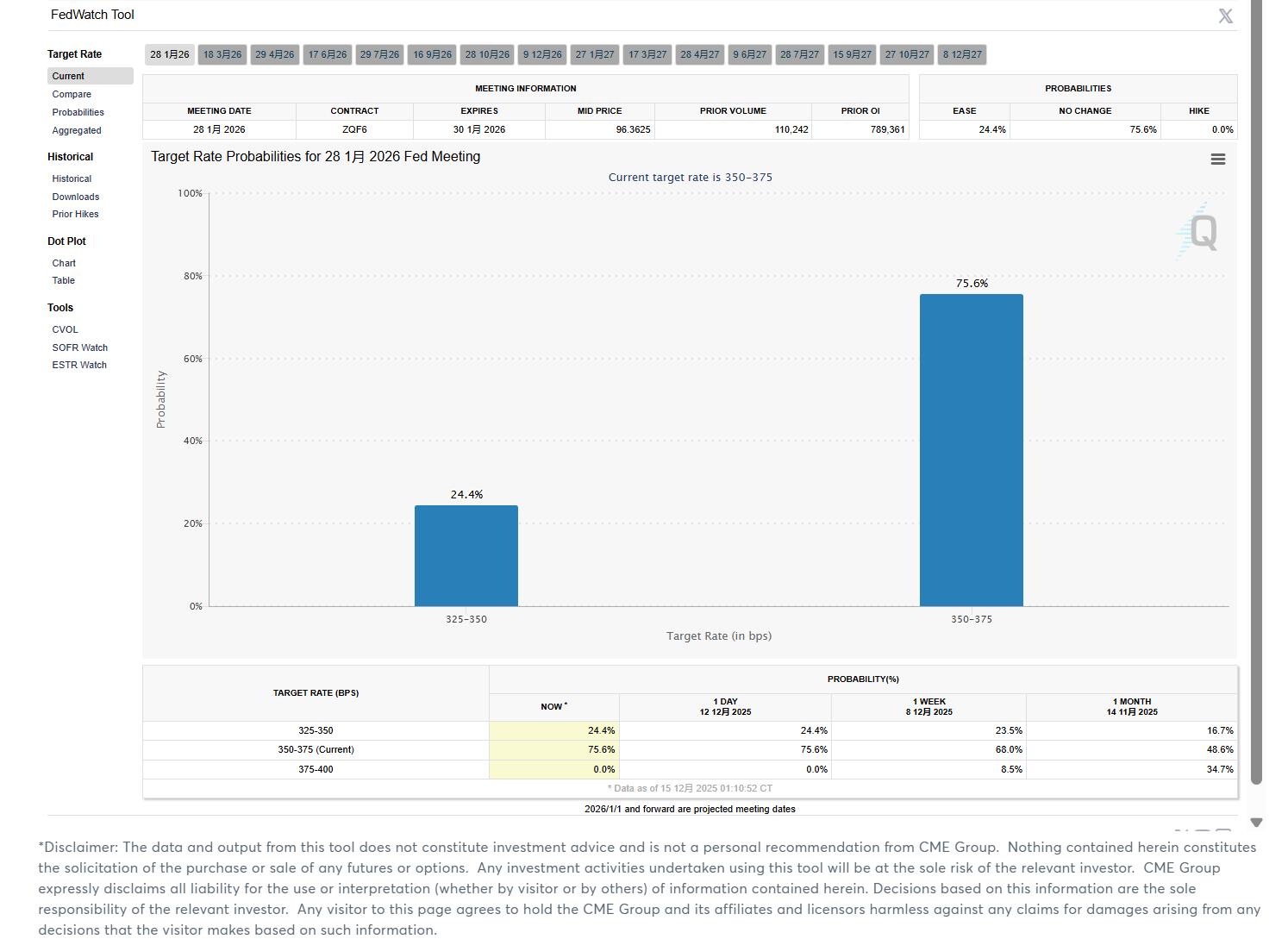

In December 2025, both markets face the key influencing factor of the Federal Reserve's monetary policy.

The Federal Reserve's interest rate policy serves as a link between the U.S. stock market and the cryptocurrency market.

Although the Federal Reserve implemented a rate cut at its December FOMC meeting, Fed Chair Powell's stance on whether to continue cutting rates in January next year was unclear.

<极 p>According to the CME "FedWatch Tool," the market's probability of a 25-basis-point rate cut by the Fed in January next year has fallen to 24.4%.

This monetary policy uncertainty has impacted both markets.

Jeff Park, Head of Alpha Strategy at Bitwise, pointed out that the core reason for Bitcoin's recent difficulty in rising is that native Bitcoin holders continue to sell options, suppressing prices and implied volatility.

While ETFs are buying spot and demanding call options, their strength is still insufficient to hedge against the selling pressure in the native market.

In the long term, both cryptocurrencies and gold will benefit from the monetization brought about by deglobalization and de-dollarization.

Cryptocurrencies have good privacy and anti-inflation properties, have grown rapidly since their inception, and are gradually becoming正规 assets. Possible regulatory relaxation under the Trump administration also provides potential benefits for the cryptocurrency market.

For the remaining trading days of 2025, the author is optimistic that the year-end rally will not be absent.