Quantum computing has become a durable risk narrative for Bitcoin. This week, Galaxy Digital head of research Alex Thorn sat down with Strategy executive chairman Michael Saylor addressing the issue, shortly after Saylor posted his own “Bitcoin Quantum Leap” thesis on X.

“The Bitcoin Quantum Leap: Quantum computing won’t break Bitcoin—it will harden it. The network upgrades, active coins migrate, lost coins stay frozen. Security goes up. Supply comes down. Bitcoin grows stronger,” Saylor wrote on Dec. 16, 2025.

Saylor Doubles Down On Freezing Dormant Bitcoin

In Thorn’s interview, Saylor’s argument is less a cryptography lesson than a coordination claim: when a quantum threat is broadly recognized, the response will not be optional, and Bitcoin will follow the same upgrade logic as the rest of the digital economy.

“There’s going to be a point when the world will form a consensus that there’s a quantum threat. We’re not there now, but you won’t miss it because the United States government will direct all of the defense contractors to upgrade their encryption algorithms to be quantum resistant,” Saylor said.

He described a cascade in which major platforms ship standardized quantum-resistant libraries across consumer devices and core financial systems, with enforced timelines and re-authentication requirements. In that scenario, Saylor suggested, Bitcoin’s transition would be a software upgrade problem, not an existential crisis.

“They will ship an upgrade and they will say [...] please install the new client software and reauthenticate yourself. And you’ve got X days, 90 days, 30 days... And if you don’t, we’re going to freeze your funds. For your own good,” Saylor said.

Saylor repeatedly returned to incentives as the decisive factor. In his view, owners of meaningful balances will not rationally opt out of an upgrade that preserves access to their holdings, and the same logic extends to the broader ecosystem’s ability to reach rough consensus.

“The Bitcoin network just runs on software. There’s going to be a quantum upgrade. It’s going to have quantum resistant encryption libraries,” he said, adding that he would expect those to align with widely adopted standards shipped across operating systems and enterprise infrastructure.

Where his answer becomes more explicitly market-relevant is in the downstream implication: coins that can be migrated will be migrated, and coins that cannot be migrated — because the holders are deceased or keys are irretrievable — would remain stranded. Saylor framed that as a security hardening event that also forces a clearer accounting of lost supply.

“We’re going to re-encrypt all the Bitcoin and all the wallets [...] It’s going to get re-encrypted if the holders of the private keys are alive and if they like money,” he said. “If they’re dead, they’re not going to re-encrypt. And if they’ve lost the keys, they’re not going to re-encrypt.”

Bitcoin Supply Shock Imminent

That is where the “deflationary event” language enters: the upgrade, in his view, would effectively separate recoverable BTC from unrecoverable BTC in a way the market would have to price. “This is going to be a massive upgrade to network security and it’s going to be a massive deflationary event,” Saylor said. “And we’re going to get the answer to the age old question, how much BTC has been lost?”

Saylor also addressed the common objection that decentralization makes coordinated upgrades impractical. He argued the opposite: decentralized networks still converge when sufficiently motivated, and global supply chains and defense ecosystems coordinate under pressure despite being fragmented across thousands of entities.

“You think you’re not going to get consensus? All the smart people with money in the world that thought it was smart to put their money on the crypto network, you think they’re the people too stupid to want to upgrade?” he said.

In his framing, the practical difference versus a bank-driven migration is timing. A centralized institution can enforce a short deadline; Bitcoin, because it is global and permissionless, would likely take longer, on the order of months to years, but would still converge. “We’re probably going to do this over the course of 30 days or 90 days. It’ll probably take two years or one year,” Saylor said.

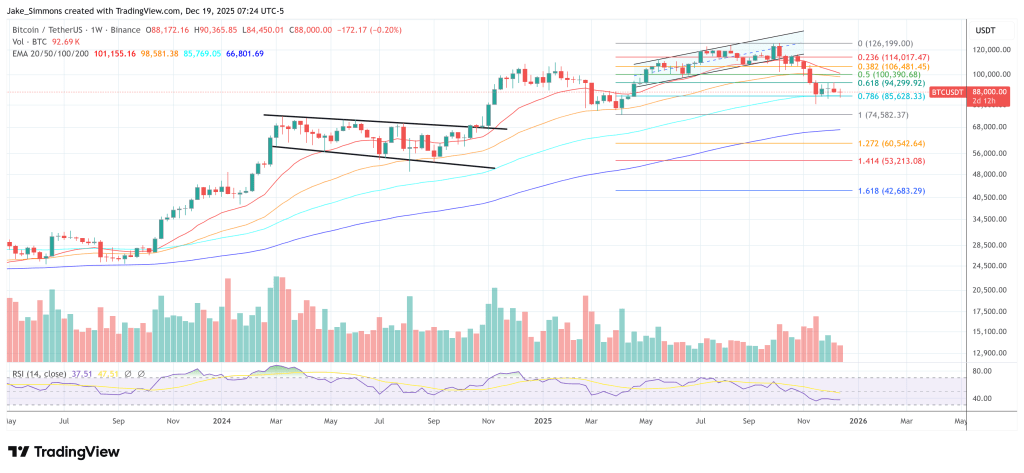

At press time, BTC traded at $88,000.