HIVE Digital Technologies has debuted on the Colombian Stock Exchange under the ticker HIVECO, becoming the first Bitcoin and AI infrastructure company to trade publicly on a Latin American exchange. The move marks another sign of the sector’s expansion as Bitcoin miners and high-performance computing (HPC) companies push deeper into global capital markets.

Announced on Thursday, the listing makes HIVE available to investors across the Andean market system, which links the exchanges of Colombia, Peru and Chile.

For a region traditionally dominated by energy and natural-resources issuers, the addition of a digital infrastructure company offers exposure to a growing sector that sits at the intersection of high-performance computing, renewable power and Bitcoin (BTC).

Colombia’s exchange is one of the Andean marketplace’s most institutionally connected platforms, giving HIVE access to a broader, more integrated investor base than is typical elsewhere in Latin America.

HIVE shares are already traded in North America and Europe, including on the TSX Venture Exchange, the Nasdaq and the Frankfurt Stock Exchange.

On the Nasdaq, HIVE shares slipped more than 1% on Thursday, though they remain up for the year.

Related: Bitcoin miners gambled on AI last year, and it paid off

HIVE’s Latin American footprint grows as Bitcoin mining economics tighten

HIVE already has an operational footprint in Latin America, having developed Tier I data centers in Paraguay powered entirely by hydroelectricity. The company began expanding its presence there in late 2024 and completed the acquisition of its Yguazú site in March of this year, as previously reported by Cointelegraph.

HIVE was among the early Bitcoin miners to pivot toward AI and high-performance computing as mining economics tightened and demand for GPU infrastructure surged.

Other major public miners, including Core Scientific, Hut 8, Riot Platforms, TeraWulf and Marathon Holdings have also expanded into AI and HPC workloads in varying degrees.

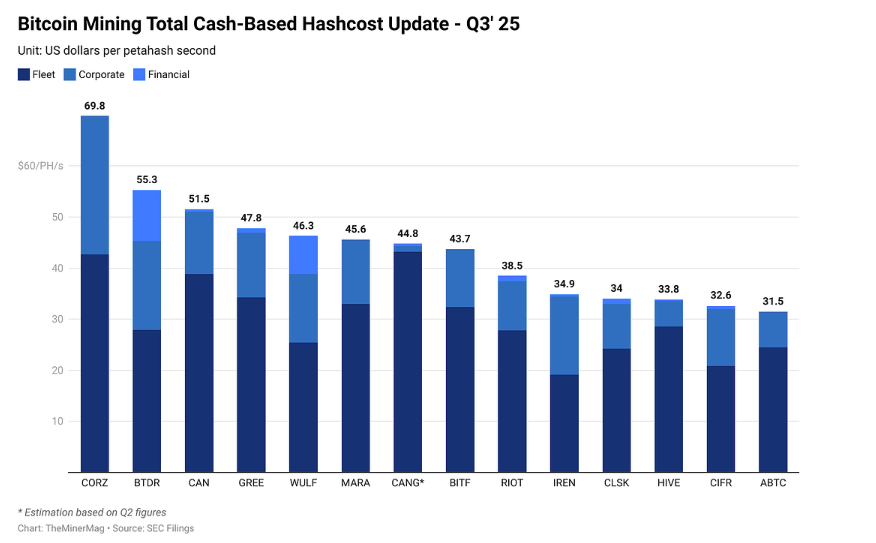

While these companies remain active in Bitcoin mining, the sector is operating in one of its toughest environments to date. Industry research describes current miner margins as historically compressed, with revenue at “structural lows” amid falling hash price and rising operating costs.

Much of the pressure stems from the 2024 Bitcoin halving, which reduced block rewards to 3.125 BTC and effectively halved mining revenue. Higher electricity costs and ongoing equipment expenses have added further strain, making diversification into AI and HPC increasingly important for many miners.

Related: Thirteen years after the first halving, Bitcoin mining looks very different in 2025