At 3:00 AM Beijing time on December 11, 2025, Federal Reserve Chair Jerome Powell finally pressed the button that had long been priced in by the market: a 25 basis point interest rate cut.

The subsequent script was supposed to follow the crypto market's playbook: the liquidity floodgates open, the US Dollar Index plunges, and Bitcoin charges towards the $100,000 mark. Indeed, for the first 15 minutes, that's exactly how it played out—Bitcoin instantly surged violently to $94,476, with the sound of alerts for liquidated short positions ringing out across exchanges.

However, the狂欢 (celebration) lasted less than an hour. As Wall Street traders finished parsing the Federal Open Market Committee (FOMC) statement and the Summary of Economic Projections (SEP) line by line, market sentiment underwent a cliff-like reversal. Bitcoin not only gave back all its gains but also bled steadily over the next few hours to $91,384, tracing out a classic inverted-V 'liquidation' pattern.

Why, under the seemingly dual tailwinds of a "rate cut + bond buying," did major capital choose to decisively flee?

This wasn't a simple case of "buy the rumor, sell the news"; it was a time-arbitrage game caused by algorithms misreading headlines and humans correcting the logic. When you dissect the three core details of this FOMC meeting—the upward revision of GDP expectations, the fake QE, and the unprecedented internal rift—you'll find that $94,000 was not the starting point for a bull market, but a trap set by macro fundamentals for the bulls.

The Algorithm's Illusion: The $40 Billion "Fake QE"

Revisiting the sharp rally at 3:00 AM, its core driver wasn't the rate cut itself (after all, the CME FedWatch Tool had already priced in an 88% probability), but a highly misleading breaking news headline: The Federal Reserve announced it would purchase $40 billion in short-term Treasury securities per month.

For high-frequency trading algorithms and headline-scanning media, the keyword scraping logic was非常简单 (very simple): "Fed" + "Buying Bonds" = "QE" = "Liquidity Injection".

Instantly, machines filled buy orders. The market mistakenly believed the Fed had launched quantitative easing alongside the rate cut—a double happiness.

But the devil was in the details of the operational guidelines subsequently released by the New York Fed. This was not QE (Quantitative Easing) aimed at suppressing long-term rates and stimulating the economy, but RMP (Reserve Management Purchases) targeting only short-term Treasuries.

The details showed that the Fed was buying bonds because reserve balances in the banking system had fallen to the edge of "ample levels," and to address potential liquidity drainage from the upcoming April tax season. In other words, this $40 billion is merely a patch to fix the "plumbing" of the interbank market, aimed at preventing repo rate spikes from causing financial system gridlock, not injecting water into the risk asset pool.

When human traders realized this capital would be locked in bank reserve accounts and wouldn't spill over into Bitcoin or the Nasdaq, the first round of valuation correction began. Those funds chasing the highs above $94,000 were essentially paying for their cognitive blind spot regarding monetary policy tools.

The "Backstab" from GDP Data: Prosperity is Bitcoin's Enemy

If the "fake QE" only triggered an emotional pullback, then the revision of GDP data in the Summary of Economic Projections (SEP) fundamentally shook the logical foundation of Bitcoin's "rate cut bull" thesis.

In the updated projections, the Fed significantly raised its 2026 US GDP growth forecast from 1.8% in September to 2.3%. Simultaneously, the 2027 unemployment rate expectation was lowered from 4.3% to 4.2%.

This data sent an extremely hawkish signal to the market: the US economy is not only not in recession but is demonstrating surprising resilience at this level of interest rates. This isn't the Fed's imagination; it's a lagging confirmation of real data.

If we look at real-time data, the situation is even "hotter."

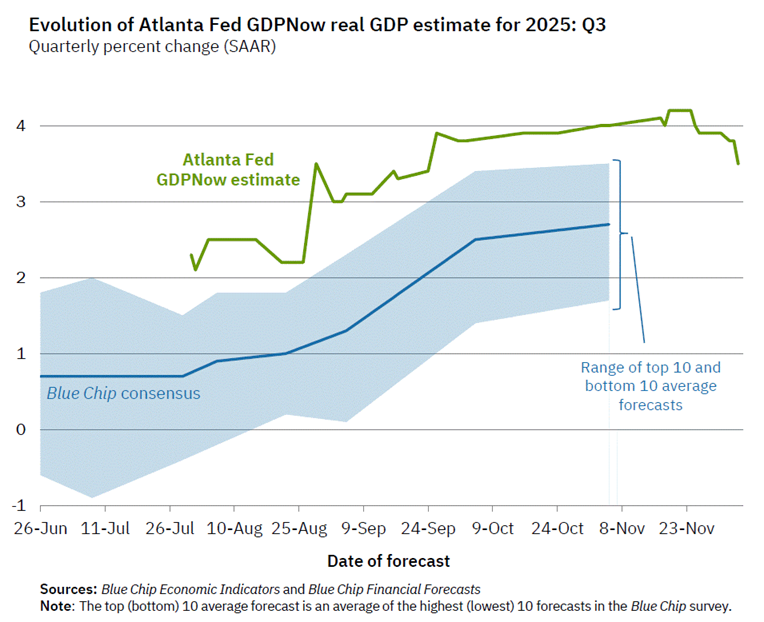

Atlanta Fed GDPNow

The model shows the Q3 2025 real GDP growth estimate once surged near 4%, far exceeding the Blue Chip consensus expectation of 2.5%. This indicates the US economy is in a period of extremely strong expansion, not on the brink of recession.

For traditional financial markets, this is good news for a "soft landing" or even "no landing"; but for Bitcoin, this is the most awkward script.

First, strong economic growth means the Fed has no urgent need to cut rates at all. Powell emphasized during the press conference that "the economy is strong but needs rebalancing," essentially hinting that the future path of rate cuts would be longer and more diluted. The market originally expected the Fed to flood the system with liquidity because the economy couldn't hold up (recessionary cuts), but instead got cuts offered as a precautionary measure because the economy is actually too strong (preventive cuts).

Second, the upward GDP revision directly pushed up the pricing of the neutral rate (R-star). When the US economy can grow at 2.3% or higher, capital can get decent risk-free or low-risk returns by staying in dollar-denominated assets (like US stocks and bonds). This削弱 (weakens) Bitcoin's appeal as an "inflation hedge" and "recession hedge" asset.

Broken Consensus: The Largest Internal Split in 37 Years

The final blow that caused Bitcoin to continue its steady decline below the $92,000 level came from the market's deep suspicion about the Fed's control.

This vote saw the most severe dissent since 2019, and arguably in 37 years. Among the 12 voting members, a staggering 3 dissented, a rate of 25%.

Even more unsettling was the composition of the opposition, showing completely opposing policy fractures: On one side was Trump-appointed Governor Miran, who thought the cut was too small, advocating for a direct 50 basis point cut, representing the aggressive easing camp. On the other side were Kansas City Fed President Schmid and Chicago Fed President Goolsbee, who believed there should be no cut at all, advocating for holding rates steady, representing the stubborn hawkish camp.

This "internal conflict" scenario is extremely rare in Fed history. It sent a dangerous signal to the market: Powell has lost absolute control of the Committee. The Fed内部 (internally) is completely unable to reach a consensus on the two core issues: "is inflation controlled" and "is the labor market deteriorating."

The dot plot further confirmed this split. Although the median suggests one more cut next year, as many as 7 officials (including non-voters) actually opposed this cut or favor higher rates next year than expected. This means every FOMC meeting going forward will become a political博弈 (game) full of variables.

Capital doesn't most fear bad news, but uncertainty. A divided Fed means the predictability of monetary policy plummets to rock bottom. For crypto markets reliant on liquidity expectations, this is a blow to the head. Institutional capital choosing to take profits around $91,000 is precisely to avoid the risks brought by this policy chaos.

The Real Interest Rate Noose Remains Tight

Looking beyond last night's candlestick, when we examine the longer-term macro environment, we find the pressure on Bitcoin hasn't eased with the rate cut.

Although the nominal rate was cut by 25 basis points, the pace of decline in inflation data remains slow (the core PCE expectation was only slightly adjusted to 2.4%). This means the inflation-adjusted "real interest rate" remains at restrictive levels.

Powell admitted during the press conference that inflation risks remain tilted to the upside and job growth might be overestimated. But he didn't provide clear guidance for subsequent cuts, instead repeatedly emphasizing "no preset path." This ambiguous stance, combined with the $40 billion "fake QE" and strong GDP expectations, creates an extremely awkward "middle ground."

In this zone, the economy is too good to need flooding, and inflation is too high to allow flooding.

Conclusion: Awaiting a New Narrative Amid Deleveraging

This rally-then-plunge script taught all crypto investors a lesson: at this point in late 2025, the macro narrative relying solely on the single factor of "Fed rate cut" has失效 (failed). The market is shifting from "hunting for liquidity" to "repricing risk."

As the Nasdaq Index meets resistance and falls back from its historical highs, traditional financial markets have already begun trading the "hawkish cut" logic. For Bitcoin, having lost its "recession hedge" halo in the short term and failing to receive the support of "flooding liquidity," a回调 (pullback) to clean out leverage might be an unavoidable fate.

Over the next 24 hours, pay close attention to ETF flow data. If institutional capital认可 (endorses) the above correction in macro logic, then the selling pressure we saw last night might just be the beginning.