Prediction markets are emerging as a new battleground in the crypto economy, where the best-informed traders are competing against casual retail bettors for profits.

Most users are behaving more like sports bettors than disciplined traders, according to a Tuesday report from research firm 10x Research, which said they are trading “dopamine and narrative for discipline and edge.” “Accuracy and profit are driven not by the crowd, but by a tiny, informed elite who price probability, hedge exposure, and extract premium from retail-driven longshots.”

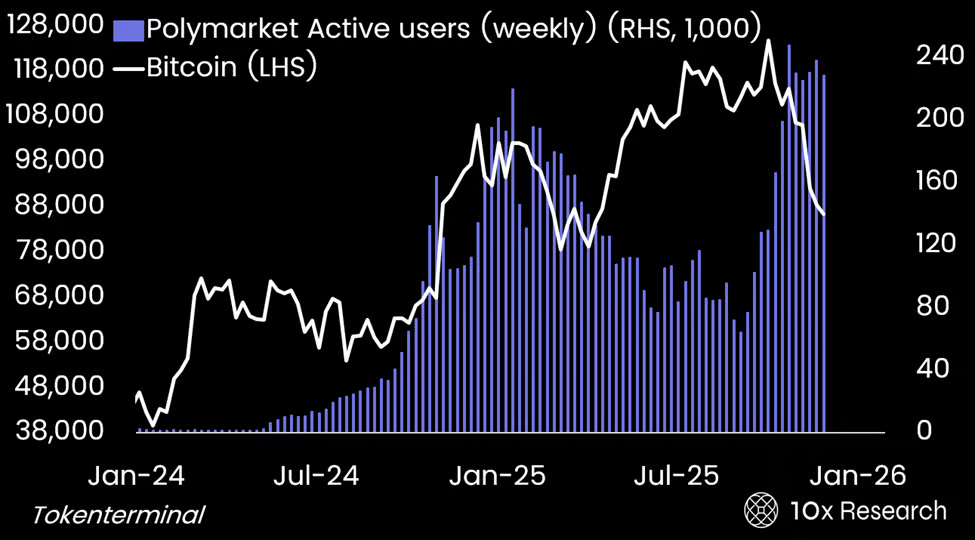

The rising liquidity and retail participation are incentivizing professional trading desks to increase their prediction market activity and capture the spread and “misinformation asymmetry” arising from this market structure, 10x added.

Related: Bitcoin now settles Visa-scale volumes, but most is for wholesale, not coffee

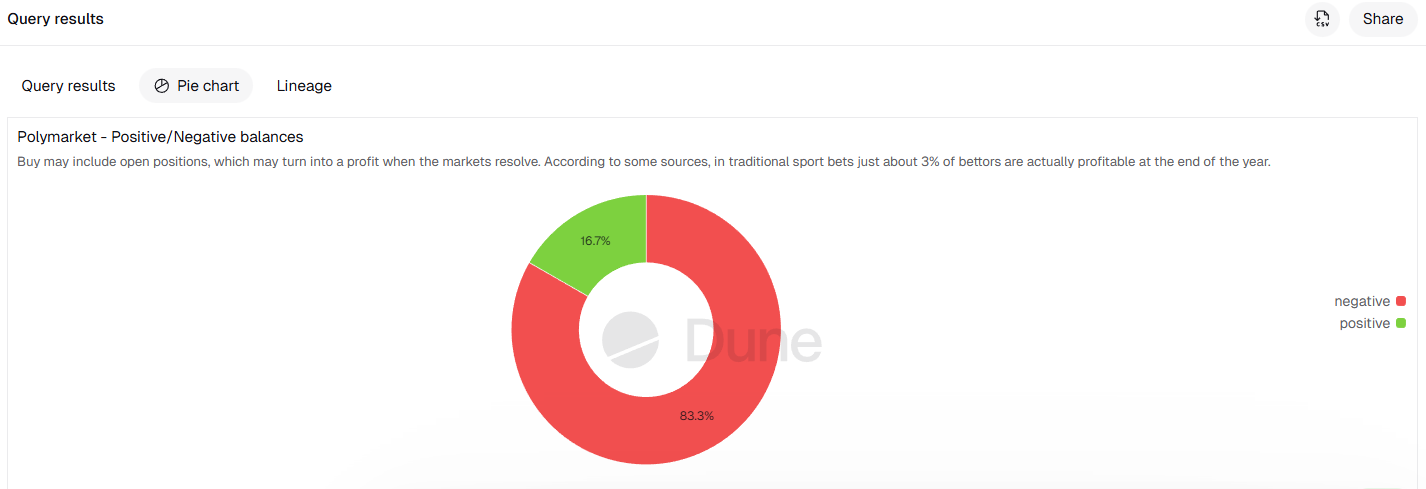

The report is a concerning sign for casual traders looking to make easy money on prediction markets, as blockchain data suggests that most users lose their initial investment.

Only about 16.7% of wallets on Polymarket are in profit, while the remaining 83% have incurred losses, according to blockchain data from Dune.

Related: Prediction markets emerge as speculative ‘arbitrage arena’ for crypto traders

Perfect win rates fuel insider concerns

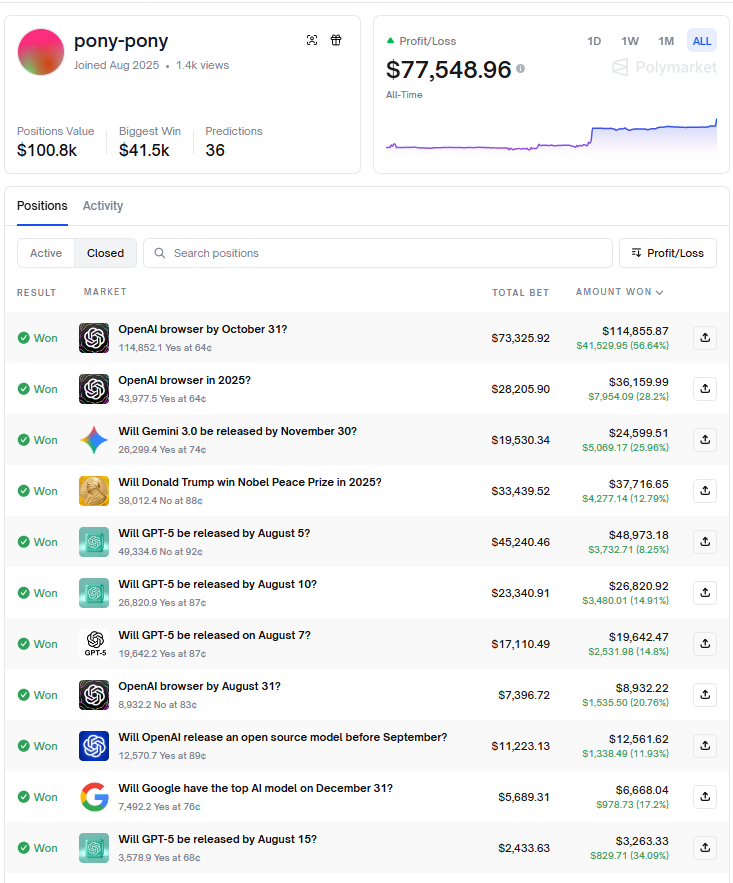

The flawless track record of some prediction market accounts is stoking concerns about possible insider trading, as certain users appear to win every time.

Polymarket user “pony-pony” boasts a 100% win rate with over $77,000 in realized profit by betting on events related to the artificial intelligence development company, OpenAI, prediction market data aggregator Polymarket Money said in a Monday X post.

Another user, “AlphaRaccoon,” also triggered insider allegations after generating over $1 million in a single day by successfully winning 22 out of 23 bets related to Google search trends.

Meanwhile, concerns are brewing over the reliability of Polymarket data on third-party data dashboards after a Paradigm researcher discovered a bug that double-counts the prediction market’s trading volume, Cointelegraph reported earlier on Tuesday.

The bug is inflating the primary volume metrics used to gauge prediction market activity, including the notional volume, which counts the number of contracts traded, and the cashflow volume, which measures the dollar value traded at the time of each trade, wrote Paradigm researcher Storm in a Tuesday X post.

However, the inflated volumes on data dashboards are due to errors in data interpretation, not wash trading, which is a deceptive and illegal practice in which entities buy and trade the same instrument to create a false impression of growing market activity.

Paradigm’s newly discovered bug was “validated” by multiple data dashboards, including AlliumLabs and DefiLlama, which are now updating their Polymarket dashboards to eliminate the double-counting error.

Magazine: Train AI agents to make better predictions... for token rewards