Don't go heavy at key junctures! The current choppy market is suitable for buying low and selling high. Avoid unnecessary moves before a clear breakout—wrong moves can lead to deep losses. Focus on BTC and ETH resistance breakouts. A U.S. pullback is inevitable, and it’s unlikely Bitcoin and Ethereum will remain unscathed. Beware of sharp dips wiping out gains. Avoid chasing prices; focus on short-term opportunities during sharp drops or spikes.

Over the past 24 hours, 82,934 traders were liquidated, with total liquidations reaching $237 million—longs at $159 million and shorts at $77.689 million.

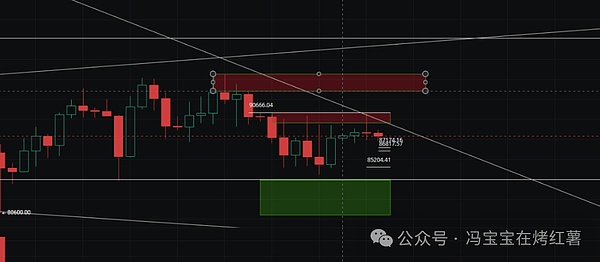

BTC

Recent price action shows Bitcoin attempting to break above a key resistance zone, but ultimately forming a high-volume candlestick with a long upper wick, indicating strong selling pressure. This candlestick appeared at the convergence of a downtrend line and a supply zone, sending a clear technical signal: the market isn’t lacking upward momentum, but the overall structure remains dominated by bears.

If it can genuinely surpass the 88,800 resistance zone, the price could target the 92,000 to 95,000 range. Key resistance levels to watch are around 89,600, 90,585, and 91,355.

Every rally could be a test. If it fails to hold above 88,800 today, the minor rebound lacks strength, and a retest of support around 87,720, 86,650, and 85,220 is likely.

ETH

Ethereum's price action essentially still follows Bitcoin. Even if it locally breaks the downtrend line, such breakouts have limited significance before the larger cycle logic changes. Overall, a cautious to bearish outlook is maintained for the medium term into the first half of next year.

Watch the 3,010 level today. Only a sustained move above this level would signal the end of this 4-hour correction and a continuation of the uptrend. Resistance above is around 3,043, 3,078, and 3,115. If it fails to close above 3,010 today, the minor rebound lacks strength, and a retest of support around 2,970, 2,943, and 2,906 is likely.

Altcoins

The market never moves according to anyone's will. A truly mature trader isn't measured by how many predictions they get right, but by having prepared responses for different scenarios. Short-term: expect volatility and potential downside. Medium-term: wait for better structures. Long-term: respect the cycle. This is the core logic for navigating bull and bear markets.

$PIPPIN

PIPPIN hit the 0.26 target directly. This isn't luck; it's respect for the trend and conviction in the charts. When everyone FOMOs in, I wait for pullbacks. When panic selling hits, I stay composed. Next time, will you still doubt it?

$SOL

SOL's support remains between 121.2 and 120. Watch for a potential dip to these levels to gather liquidity. It needs to break above the 131 resistance again to see stronger upward momentum.

$AAVE

Although the team is having internal conflicts, AAVE remains a top-tier DeFi lending project fundamentally. I see dips as opportunities. Planning to buy on further dips for a long position—likely won't get rekt.

$ASTER

The short-term decline should be over. Technically oversold, selling pressure is easing—a short-term bounce is likely. But本质上, this is still a shitcoin. Only a few hundred daily active users on-chain supporting a multi-billion dollar valuation is utterly unreasonable! The perpdex sector already has an absolute leader: HYPE. ASTER was born as an imitation, not an innovator. So after a short bounce, it will likely continue falling.

$Hakumei

Hakumei's wedge pattern is narrowing, a directional breakout is imminent—worth watching short-term. It's almost Christmas—if a Chinese language bug appears, engineers are on holiday and no one will fix it. So post-New Year might be better for Chinese spot nodes. New year, new luck. Barring unexpected events, expect a pullback first, potentially followed by a massive pump.

$LIQUID

This token automatically adds LP. It's a project by DEV leyten. Those interested in innovative mechanisms should check it out.

$GUA

An AI fortune-telling project. Just launched futures with a $100M market cap—not too expensive. The dev is actively maintaining the 0.1U price floor. Based on 26 days since Alpha launch, the six-figure cost to maintain the price is real. Looks like it's bottoming. Stop-loss space is tight—could be a good布局点 (positioning opportunity).