Crypto exchange Binance has added new features to its application programming interface (API), indicating that the platform is preparing to introduce stock trading capabilities.

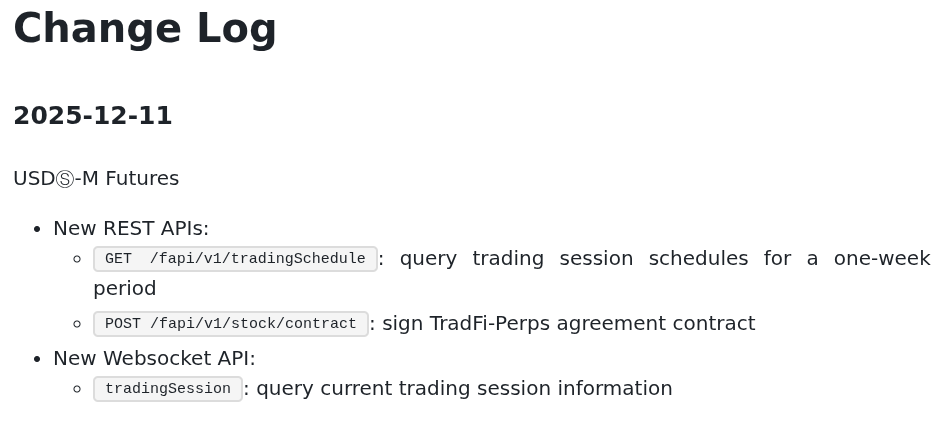

Binance’s changelog notes that on Dec. 11, the exchange introduced three new API endpoints, one of which — with a URL including stock/contract — allows users to “sign [a] TradFi-Perps agreement contract.” The two other endpoints introduced on the same day allow users to query “trading session schedules for a one-week period” or “current trading session information.”

Together, this information suggests that Binance is introducing perpetual futures trading on its platform. The existing trading schedule endpoints also suggest trading will likely occur in sessions, as in traditional finance, rather than following crypto’s 24/7 nature.

This follows Binance’s launch of tokenized stocks in 2021, in a relatively short-lived initiative. Following their announcement in late April, Binance halted tokenized stock sales just months later in mid-July 2021 after immediately attracting the attention of regulators.

Binance acknowledged Cointelegraph’s request for comment, but had not responded by publication.

Related: Ondo wins Liechtenstein approval to offer tokenized stocks in Europe

Tokenized stocks are all the rage

Binance’s initiative follows a series of similar efforts by players in both traditional and crypto finance, taking stock tokenization out of the fringes of finance. Friday reports indicate that top US-based crypto exchange Coinbase is days away from unveiling its push into tokenized stocks and prediction markets.

However, not everyone is enthusiastic about how stock tokenization is being rolled out. Market maker Citadel Securities caused uproar earlier this month when it recommended that the US Securities and Exchange Commission tighten regulations on tokenized stock trading on decentralized finance (DeFi) platforms.

According to the market maker, DeFi developers, smart-contract coders, and self-custody wallet providers should not be given “broad exemptive relief” for offering trading of tokenized US equities. Citadel argued that DeFi platforms likely fall under the definitions of an “exchange” or “broker-dealer” and should be regulated under securities law.

It also claimed that allowing those platforms to operate free from regulations “would create two separate regulatory regimes for the trading of the same security.” The World Federation of Exchanges (WFE) also argued in late November that the SEC shouldn’t grant broad regulatory relief to companies launching tokenized stock offerings.

The WFE said tokenization “is likely a natural evolution in capital markets” and that it was “pro-innovation.”Still, the organization argued that it “must be done in a responsible way that does not put investors or market integrity at risk.”

The comments follow tokenized stocks making their way not only to centralized crypto exchanges, but also to the DeFi ecosystem. At the end of June, more than 60 tokenized stocks launched on Solana-based DeFi platforms as well as crypto exchanges Kraken and Bybit.

Related: Robinhood tokenizes nearly 500 US stocks, ETFs on Arbitrum for EU users

Not all of traditional finance sees an issue

Other traditional finance players appeared to follow the “if you can’t beat them, join them” approach to the issue.

Last month, Nasdaq’s head of digital assets strategy, Matt Savarese, said the stock exchange is making SEC approval of its proposal to offer tokenized versions of stocks listed on the exchange a top priority.

The race intensified after the SEC was reported to be developing a plan to allow blockchain-registered versions of stocks to trade on cryptocurrency exchanges by the end of September.

SEC Chair Paul Atkins recently described tokenization as an “innovation” the agency should seek to advance, not restrict. The SEC issued a “no-action” letter Thursday to a subsidiary of the Depository Trust and Clearing Corporation that specializes in tokenizing securities, indicating that the regulator intends to allow the company to offer a new securities market tokenization service.