Bitcoin is struggling to break away from the bearish market structure that has been in place since late October. Despite several short-lived relief rallies, price action continues to reflect weakness, with bulls failing to reclaim key resistance levels or generate sustained momentum.

As uncertainty and fatigue spread across the market, many participants are questioning whether Bitcoin’s current behavior fits the traditional cycle framework that has defined previous bull and bear phases.

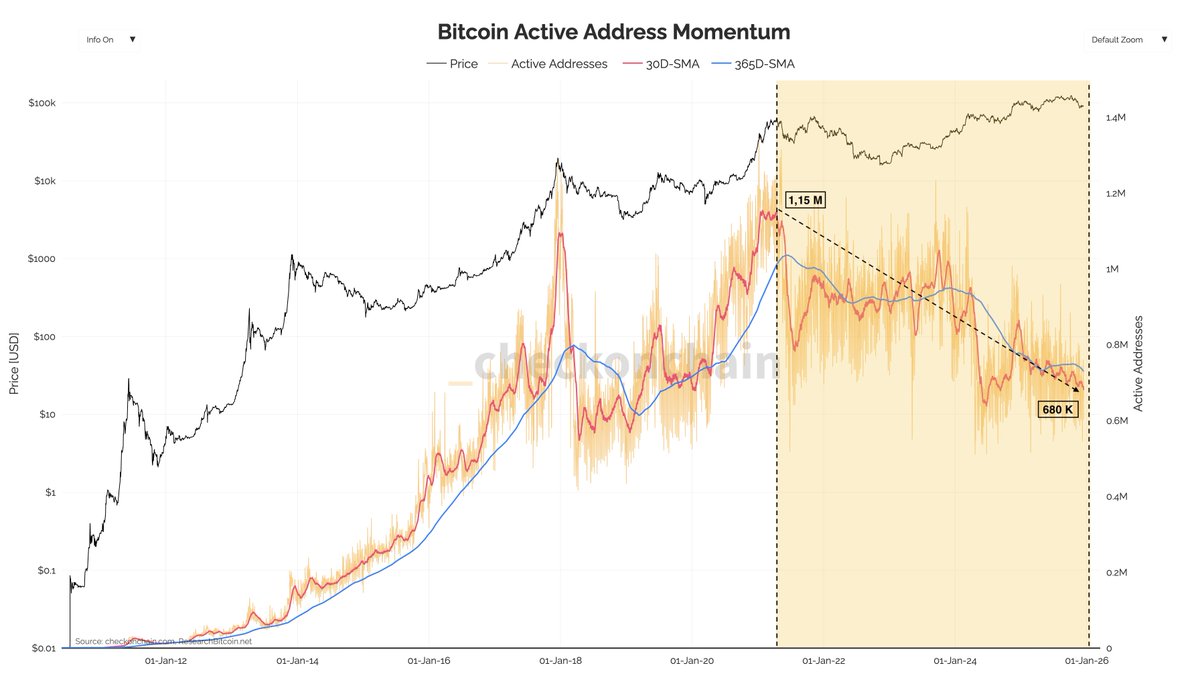

A recent analysis by Darkfost highlights a structural shift that adds important context to this debate. According to the data, the number of active Bitcoin addresses has been in a persistent decline since April 2021. Historically, bullish phases were characterized by a clear expansion in active addresses, as new investors entered the market and on-chain activity surged. This growth typically peaked near cycle tops, followed by a contraction during bear markets as participation dried up.

This cycle, however, looks markedly different. Even during periods of strong price performance since 2022, active addresses have failed to recover meaningfully and continue trending lower. This divergence suggests that Bitcoin’s market structure may be evolving away from a retail-driven, on-chain participation model toward something more concentrated and institutionally influenced.

As Bitcoin attempts to stabilize after weeks of downside pressure, understanding these structural changes is becoming critical. The decline in active addresses may not simply signal weakness, but rather a transformation in how Bitcoin is held, traded, and valued in this cycle.

Active Addresses Signal A Structural Shift In The Market

The analysis suggests that despite Bitcoin’s strong price performance since 2022, on-chain participation continues to deteriorate. Active addresses are once again approaching the lowest levels observed during this cycle, highlighting a growing disconnect between price action and network activity. At the peak in April 2021, Bitcoin recorded roughly 1.15 million active addresses. Today, that figure has nearly halved, sitting near 680,000, a contraction that cannot be ignored.

This decline is difficult to attribute to a single cause. Instead, it likely reflects a combination of structural changes in how Bitcoin is held and accessed. One contributing factor appears to be the rise in inactive addresses. While precise classification criteria vary, the broader trend points toward a stronger long-term holding mentality, where coins remain dormant rather than actively transacted on-chain. This behavior reduces visible network activity without necessarily implying bearish conviction.

At the same time, a portion of market participants may have shifted away from direct on-chain usage altogether. Centralized exchanges, custodial platforms, and financial products such as ETFs offer exposure to Bitcoin without requiring on-chain interaction. As a result, demand for block space declines even as capital allocation to Bitcoin remains significant.

Taken together, the sustained drop in active addresses suggests Bitcoin’s market structure is evolving. The network is becoming less retail-driven and more concentrated, reinforcing the idea that traditional cycle metrics may be losing some of their explanatory power in this environment.