Original Author:Andrew Kang, Founder of Mechanism Capital

Compiled by: Ken, Chaincatcher

For those who have experienced at least one full market cycle, you develop an instinct to be wary of price increases that far exceed historical growth rates. Witnessing the dot-com bubble, the 2008 global financial crisis, and the rise and fall of cryptocurrencies sets off pattern recognition alarms in your brain. You are afraid to enter the market because prices are too high, and you want to sell your assets for fear of being at a peak.

But it is important to recognize that we are in one of the most profound and unique asymmetric moments in history. The only move right now is to extend your time horizon and completely abandon short-termism.

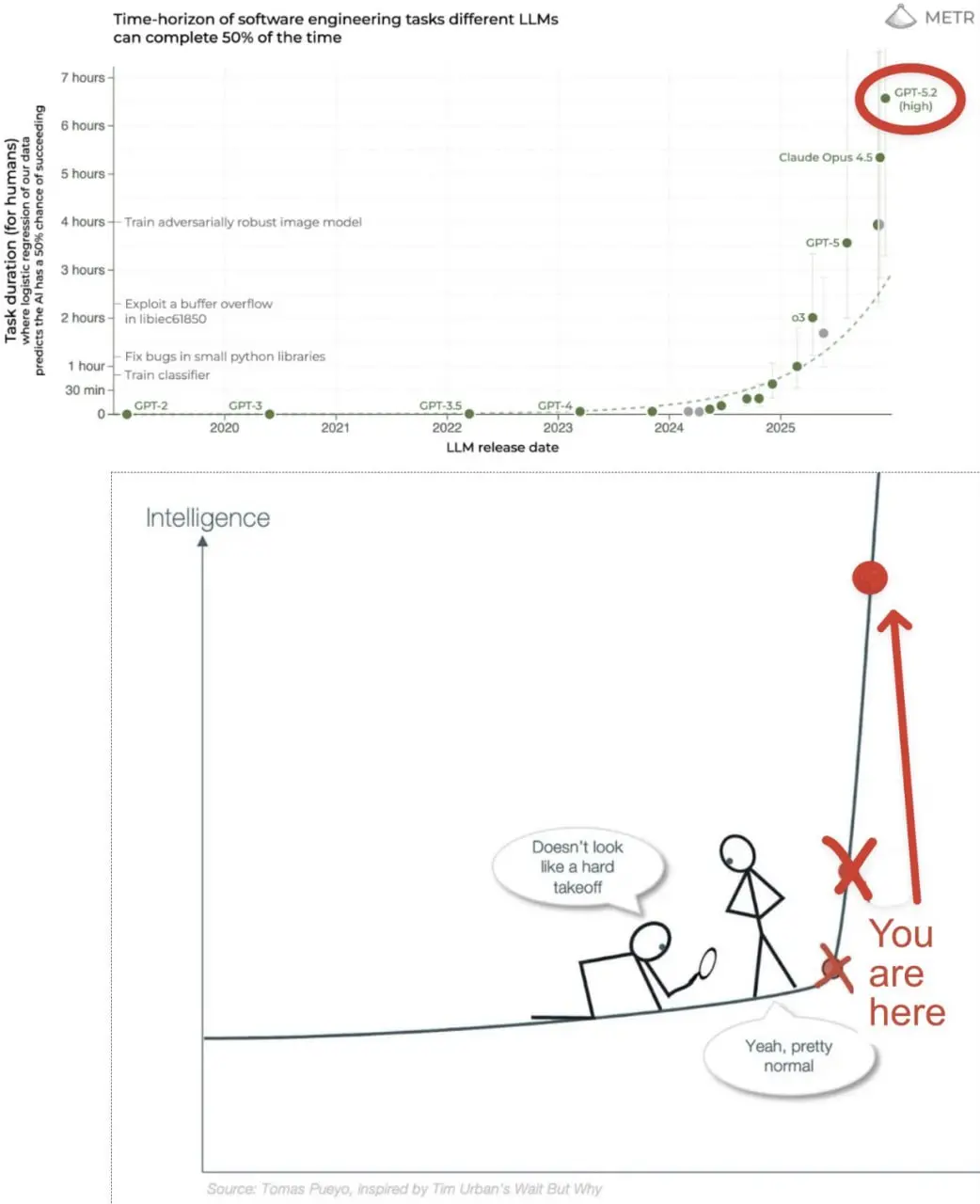

Excessive worry about bubbles is foolish. Trying to time the market is also foolish. Short-term fluctuations and corrections will always happen, but given how close we are to the "singularity," these fluctuations are completely just noise. Artificial intelligence, robotics, energy, and innovation are about to experience runaway explosive growth.

Within the next decade, we will have billions (or more) of AI agent workforces, humanoid robots, space data centers, multi-planetary colonization, and significantly improved medical therapies; we will fundamentally change the development pace and output of technological breakthroughs in all fields. The technological progress and economic growth we compress into the next twenty years will exceed the sum total of all human civilization history.

We are already in an extremely steep phase of the J-curve, but this is hard to perceive when we zoom in to the micro level of daily or weekly views. 100% of Anthropic's product code is now written by Claude. Product managers have a virtual team of software engineers, so efficient it's as if they can change time. The improvement in product iteration speed for companies that efficiently utilize AI is not single-digit, not double-digit, but triple-digit.

Moreover, the capabilities of these tools are still evolving at an even faster rate. Whether we officially achieve Artificial Superintelligence (ASI) in 2027 or 2029 doesn't really matter. It will happen. By the time it's officially announced, the assets you want to own will have already multiplied in price.

It is highly likely that the actual economic growth over the next 3-10 years will be on the order of 20 standard deviations (20-sigma) in any historical distribution model. This growth, once considered almost impossible, will be driven by unprecedented second and third-order changes. Traditional valuation models cannot price these transformations. The potential upside is so vast that traditional present value calculations struggle to capture them.

The speed of wealth appreciation will be staggering, much like how cryptocurrencies initially created numerous billionaires and millionaires in a short time, but the magnitude this time will be far more extreme. If you have no exposure, it will be difficult to pull the trigger and buy into such vertically rising asset prices; but unlike previous bubbles, the creation of real economic value will better keep pace with the vertical rise in asset prices. Over the past three years, those operating in the market with the cognition of an "exponential perspective" have reaped significant rewards. If you haven't adopted this perspective yet, it's not too late.

While it's important to always be mindful of downside risk, this is the largest upside risk in world history. Learn to bear risk over longer time horizons. Now is not the time for swing trading. For the vast majority of people, long-term investing typically outperforms short-term trading, but the gap in expected value between "trading" and "investing" will be wider than ever before. Ask yourself, what is the value of the call option embedded in the singularity?