Author: Erik Torenberg

Compiled by: Deep Tide TechFlow

Deep Tide Introduction: In the traditional narrative of venture capital (VC), the "boutique" model is often praised, with the belief that scaling up leads to a loss of soul. However, a16z partner Erik Torenberg presents a contrasting view in this article: as software becomes the backbone of the U.S. economy and the AI era dawns, the demands of startups for capital and services have fundamentally changed.

He argues that the VC industry is undergoing a paradigm shift from being "judgment-driven" to being "deal-winning capability-driven." Only "mega-firms" like a16z, which possess scaled platforms and can provide founders with comprehensive support, can prevail in the trillion-dollar game.

This is not just an evolution of the model; it is the self-evolution of the VC industry under the wave of "software eating the world."

Full Text Below:

In classical Greek literature, there is a meta-narrative above all others: respect for the gods and disrespect for the gods. Icarus was burned by the sun not essentially because his ambition was too great, but because he disrespected the divine order. A more recent example is professional wrestling. You just need to ask, "Who respects wrestling, and who disrespects it?" to tell who is the Face and who is the Heel. All good stories take this form in one way or another.

Venture capital (VC) has its own version of this story. It goes like this: "VC was, and always has been, a boutique business. Those large firms have become too big, aiming too high. Their downfall is inevitable because their approach is simply a disrespect for the game."

I understand why people want this story to be true. But the reality is, the world has changed, and venture capital has changed with it.

There is more software, more leverage, and more opportunities than before. There are more founders building larger-scale companies than before. Companies stay private longer than before. And founders have higher demands for VCs than before. Today, the founders building the best companies need partners who can truly roll up their sleeves and help them win, not just write checks and wait for results.

Therefore, the primary goal of a venture firm now is to create the best interface to help founders win. Everything else—how to staff, how to deploy capital, what size fund to raise, how to assist with deals, and how to allocate power for founders—derives from this.

Mike Maples famously said: your fund size is your strategy. Equally true is that your fund size is your bet on the future. It's your wager on the scale of startup output. Raising huge funds over the past decade might have been seen as "hubris," but this belief was fundamentally correct. So, when top firms continue to raise massive funds to deploy over the next decade, they are betting on the future and putting real money behind that commitment. Scaled Venture is not a corruption of the VC model: it is the VC model finally maturing and adopting the characteristics of the companies it supports.

Yes, Venture Firms Are an Asset Class

In a recent podcast, Sequoia's legendary investor Roelof Botha made three points. First, despite the scaling of VC, the number of companies that "win" each year is fixed. Second, the scaling of the VC industry means too much money is chasing too few good companies—therefore VC cannot scale; it is not an asset class. Third, the VC industry should shrink to match the actual number of winning companies.

Roelof is one of the greatest investors of all time, and he is a great guy. But I disagree with him here. (It's worth noting, of course, that Sequoia has also scaled: it is one of the largest VC firms in the world.)

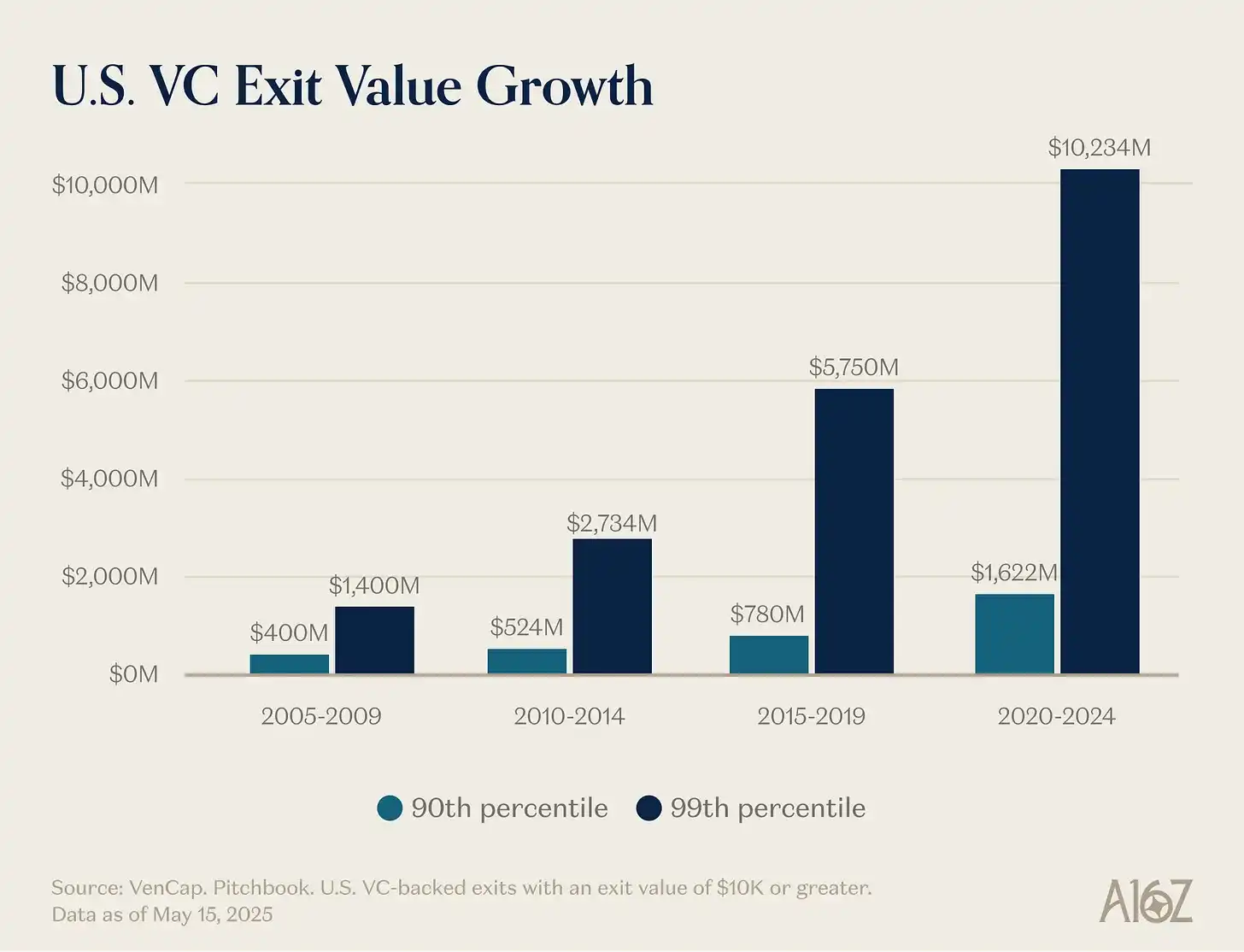

His first point—that the number of winners is fixed—is easily disproven. There used to be about 15 companies reaching $100 million in revenue annually; now there are about 150. Not only are there more winners than before, but the winners are also larger than before. Although entry prices are higher, the output is much larger. The ceiling for startup growth has risen from $1 billion to $10 billion, and now to $1 trillion or even higher. In the 2000s and early 2010s, YouTube and Instagram were considered massive acquisitions at $1 billion: such valuations were so rare then that we called companies valued at $1 billion or more "Unicorns." Now, we simply assume that OpenAI and SpaceX will become trillion-dollar companies, with several more to follow.

Software is no longer a marginal sector of the U.S. economy made up of odd, misfit people. Software now is the U.S. economy. Our largest companies, our national champions, are no longer General Electric and ExxonMobil: they are Google, Amazon, and Nvidia. Private tech companies account for 22% of the S&P 500. Software hasn't finished eating the world—in fact, with the acceleration brought by AI, it's just beginning—and it is more important than it was fifteen, ten, or five years ago. Therefore, the scale that a successful software company can achieve is larger than before.

The definition of a "software company" has also changed. Capital expenditures have increased dramatically—large AI labs are becoming infrastructure companies, with their own data centers, power generation facilities, and chip supply chains. Just as every company became a software company, now every company is becoming an AI company, and perhaps an infrastructure company too. More and more companies are entering the world of atoms. Boundaries are blurring. Companies are radically verticalizing, and the market potential of these vertically integrated tech giants is far greater than anyone imagined for pure software companies.

This leads to why the second point—too much money chasing too few companies—is wrong. The output is much larger than before, competition in the software world is fiercer, and companies are going public much later than before. All of this means that great companies simply need to raise much more capital than before. Venture capital exists to invest in new markets. What we have learned time and again is that, in the long run, new markets are always much larger than we expect. The private markets have matured enough to support top companies reaching unprecedented scale—look at the liquidity available to top private companies today—and both private and public market investors now believe that the output scale of venture capital will be staggering. We have consistently underestimated how large VC can and should be as an asset class, and VC is scaling to catch up to this reality and the opportunity set. The new world needs flying cars, global satellite grids, abundant energy, and intelligence so cheap it doesn't need to be metered.

The reality is that many of the best companies today are capital-intensive. OpenAI needs to spend billions on GPUs—more computing infrastructure than anyone imagined possible. Periodic Labs needs to build automated labs at an unprecedented scale for scientific innovation. Anduril needs to build the future of defense. And all these companies need to recruit and retain the world's best talent in the most competitive talent market in history. The new generation of big winners—OpenAI, Anthropic, xAI, Anduril, Waymo, etc.—are capital-intensive and have raised huge initial rounds at high valuations.

Modern tech companies often require hundreds of millions of dollars because the infrastructure needed to build world-changing, cutting-edge technology is simply too expensive. In the dot-com era, a "startup" entered an empty field, anticipating the needs of consumers still waiting for dial-up connections. Today, startups enter an economy shaped by three decades of tech giants. Supporting "Little Tech" means you must be prepared to arm David to fight a few Goliaths. Companies in 2021 did get overfunded, and a large portion of that capital went to sales and marketing to sell products that weren't 10x better. But today, capital is going to R&D or capex.

Therefore, winners are much larger than before and need to raise much more capital than before, often from the very beginning. So, the VC industry must rightly become much larger to meet this demand. This scaling is justified given the size of the opportunity set. If VC scale were too large for the opportunities VCs invest in, we should have seen the largest firms underperform. But we simply haven't seen that. While expanding, top VC firms have repeatedly achieved extremely high multiples—as have the LPs (limited partners) who can get into these firms. A famous venture capitalist once said that a $1 billion fund could never achieve a 3x return: it was too big. Since then, some firms have returned over 10x on a $1 billion fund. Some point to underperforming firms to indict the asset class, but any power-law industry will have huge winners and a long tail of losers. The ability to win deals without competing on price is why firms can sustain returns. In other major asset classes, people sell products to or borrow from the highest bidder. But VC is the quintessential asset class that competes on dimensions other than price. VC is the only asset class with significant persistence in the top 10% of firms.

The final point—that the VC industry should shrink—is also wrong. Or, at least, it would be bad for the tech ecosystem, for the goal of creating more generational tech companies, and ultimately for the world. Some complain about the second-order effects of increased VC funding (and there are some!), but it also comes with a massive increase in startup market cap. Advocating for a smaller VC ecosystem is likely also advocating for smaller startup market caps, and the result would likely be slower economic development. This perhaps explains why Garry Tan said in a recent podcast: "VC can and should be 10x bigger than it is today." Admittedly, it might be good for an individual LP or GP if there were no more competition and they were the "only player." But having more venture capital than today is clearly better for founders and for the world.

To elaborate further, let's consider a thought experiment. First, do you think there should be many more founders in the world than there are today?

Second, if we suddenly had many more founders, what kind of firm would best serve them?

We won't spend too much time on the first question because if you're reading this, you probably know we think the answer is obviously yes. We don't need to tell you much about why founders are so great and so important. Great founders create great companies. Great companies create new products that improve the world, organize and direct our collective energy and risk appetite toward productive goals, and create a disproportionate amount of new enterprise value and interesting jobs in the world. And we are nowhere near an equilibrium where every person capable of founding a great company has already done so. This is why more venture capital helps unlock more growth in the startup ecosystem.

But the second question is more interesting. If we woke up tomorrow and there were 10x or 100x more entrepreneurs than today (spoiler: this is happening), what should the world's startup institutions look like? In a more competitive world, how should venture firms evolve?

Come to Win, Not to Lose

Marc Andreessen likes to tell a story about a famous VC who said the game is like a sushi conveyor belt: "A thousand startups go by, you meet them. And occasionally you reach out, pick a startup off the belt, and invest in it."

The kind of VC Marc described—well, that was almost every VC for most of the past few decades. Winning deals was that easy back in the 1990s or 2000s. Because of that, the only skill that really mattered for a great VC was judgment: the ability to distinguish good companies from bad ones.

Many VCs still operate this way—basically the same way VCs operated in 1995. But the world has changed dramatically under their feet.

Winning deals used to be easy—as easy as picking sushi off a conveyor belt. But now it's extremely difficult. People sometimes describe VC as poker: knowing when to pick companies, knowing at what price to enter, etc. But this perhaps obscures the full-scale war you must wage to earn the right to invest in the best companies. Old-school VCs miss the days when they were the "only player" and could dictate terms to founders. But now there are thousands of VC firms, and it's easier than ever for founders to get term sheets. So, more and more of the best deals involve extremely fierce competition.

The paradigm shift is that the ability to win deals is becoming as important as picking the right companies—or even more important. What good is picking the right deal if you can't get in? A few things contribute to this change. First, the proliferation of venture firms means VCs need to compete with each other to win deals. Because there are more companies than ever competing for talent, customers, and market share, the best founders need strong institutional partners to help them win. They need firms with the resources, networks, and infrastructure to give their portfolio companies an advantage.

Second, because companies stay private longer, investors can invest later—when the company is more proven, so deal competition is fiercer—and still achieve venture-style returns.

The last reason, and the least obvious, is that picking has gotten slightly easier. The VC market has become more efficient. On one hand, there are more serial entrepreneurs consistently creating iconic companies. If Musk, Sam Altman, Palmer Luckey, or a genius serial entrepreneur starts a company, VCs quickly line up to try to invest. On the other hand, companies reach insane scale faster (and have more upside because they stay private longer), so product-market fit (PMF) risk is lower relative to the past. Finally, with so many great firms now, it's easier for founders to reach investors, so it's hard to find deals that other firms aren't pursuing. Picking is still core to the game—selecting the right enduring company at the right price—but it is no longer the most important part by far.

Ben Horowitz hypothesizes that winning repeatedly automatically makes you a top firm: because if you can win, the best deals come to you. Only when you can win any deal do you have the privilege of picking. You might not pick the right one, but at least you have the chance. Of course, if your firm can repeatedly win the best deals, you attract the best pickers to work for you because they want access to the best companies. (As Martin Casado said when recruiting Matt Bornstein to a16z: "Come here to win deals, not to lose deals.") So, the ability to win creates a virtuous cycle that improves your picking ability.

For these reasons, the game has changed. My partner David Haber described the shift that venture capital needs to make in response to this change in his article: "Firm > Fund".

In my definition, a Fund has only one objective function: "How do I generate the most carry with the fewest people in the shortest time?" And a Firm, in my definition, has two objectives. One is to deliver exceptional returns, but the second is equally interesting: "How do I build a compounding source of competitive advantage?"

The best firms will be able to plow their management fees into strengthening their moats.

How Can We Help?

I entered venture capital a decade ago, and I quickly noticed that among all VC firms, Y Combinator was playing a different game. YC was able to get favorable terms in great companies at scale, while also seemingly serving them at scale. Compared to YC, many other VCs were playing a commoditized game. I would go to Demo Day and think: I'm at the table, and YC is the house. We're all happy to be there, but YC is the happiest.

I quickly realized YC had a moat. It had positive network effects. It had several structural advantages. People used to say VC firms couldn't have moats or unfair advantages—after all, you're just providing capital. But YC clearly had one.

That's why YC remained so powerful even after scaling. Some critics didn't like that YC scaled; they thought YC would eventually fail because they felt it had no soul. For the past 10 years, people have been predicting YC's death. But it hasn't happened. In that time, they changed their entire partner team, and death still didn't happen. A moat is a moat. Like the companies they invest in, scaled VC firms have moats that are more than just brand.

Then I realized I didn't want to play the commoditized VC game, so I co-founded my own firm, and other strategic assets. These assets were very valuable and generated strong deal flow, so I got a taste of playing a differentiated game. Around the same time, I started watching another firm build its own moat: a16z. So, when the opportunity to join a16z arose a few years later, I knew I had to take it.

If you believe in venture capital as an industry, you—almost by definition—believe in the power law. But if you truly believe the VC game is governed by power laws, then you should believe that venture capital itself will also follow power laws. The best founders will cluster around the firms that can most decisively help them win. The best returns will concentrate in these firms. Capital will follow.

For founders trying to build the next iconic company, scaled VC firms offer a highly attractive product. They provide expertise and full-service support for everything a rapidly scaling company needs—recruiting, go-to-market strategy (GTM), legal, finance, PR, government relations. They provide enough capital to actually get you there, rather than forcing you to pinch pennies and move slowly against well-funded competitors. They provide massive reach—access to every person you need to know in business and government, introductions to every important Fortune 500 CEO and every important world leader. They provide access to 100x talent, with a network of tens of thousands of top engineers, executives, and operators globally, ready to join your company when needed. And they are everywhere—for the most ambitious founders, this means anywhere.

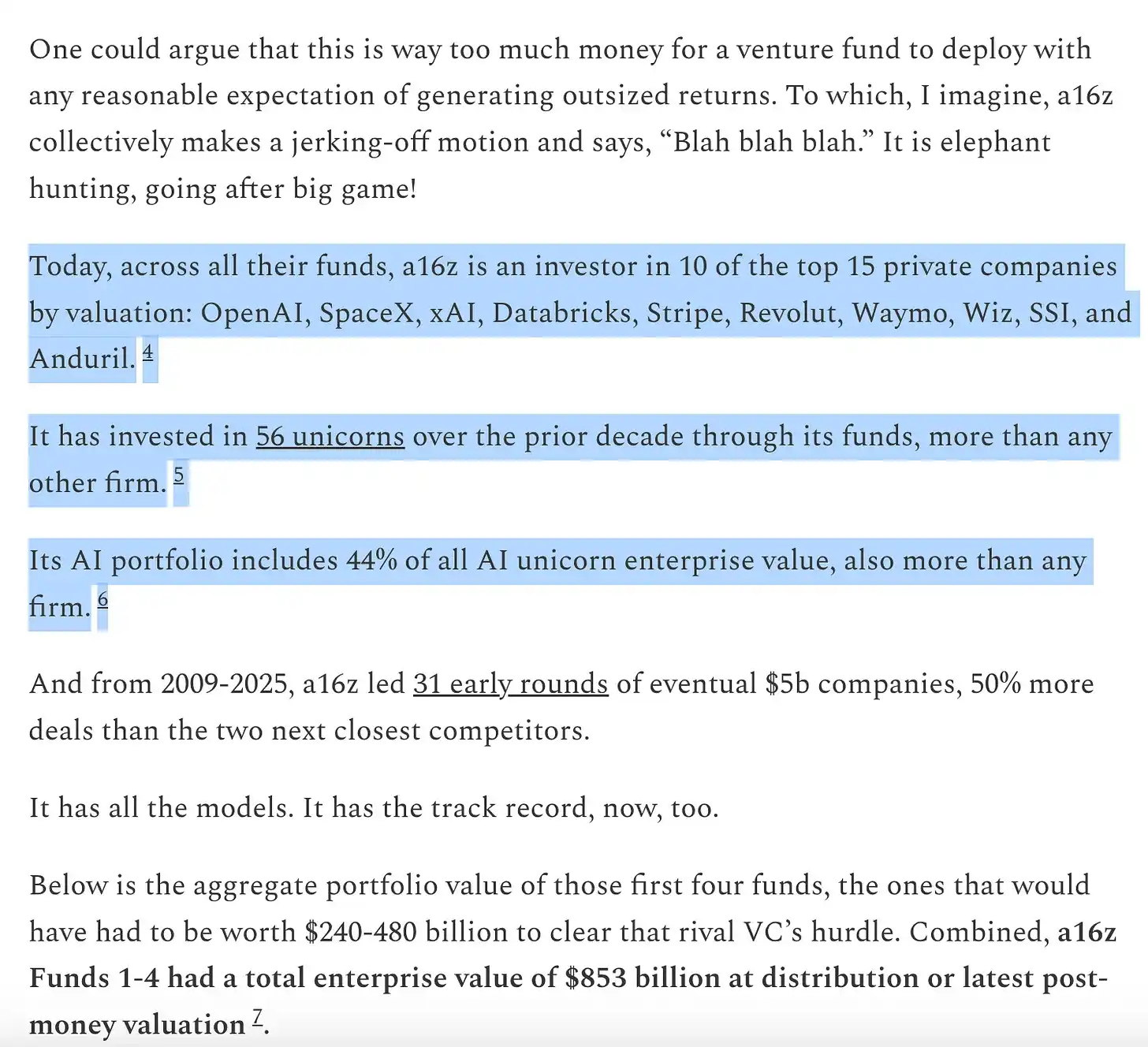

Meanwhile, for LPs, scaled VC firms are also a highly attractive product on the most important simple question: are the companies driving the most returns choosing them? The answer is simple—yes. All the large companies are working with scaled platforms, often at the earliest stages. Scaled VC firms have more swings at bat to catch the important companies and more ammunition to convince them to take their money. This is reflected in the returns.

Excerpt from Packy's work: https://www.a16z.news/p/the-power-brokers

Think about where we are right now. Eight of the world's ten largest companies are West Coast-based, VC-backed companies. These companies have provided the majority of global new enterprise value growth over the past few years. Meanwhile, the world's fastest-growing private companies are also predominantly West Coast-based, VC-backed companies: those born just a few years ago are rapidly heading toward trillion-dollar valuations and the largest IPOs in history. The best companies are winning more than ever, and they all have the support of scaled firms. Of course, not every scaled firm has performed well—I can think of some epic blowups—but almost every great tech company has a scaled firm behind it.

Go Big or Go Boutique

I don't think the future is solely scaled VC firms. Like every area touched by the internet, VC will become a "barbell": a few ultra-scaled players on one end, and many small, specialized firms on the other, each operating in specific domains and networks, often partnering with scaled VC firms.

What is happening in venture capital is what typically happens when software eats a service industry. On one end are four or five large, powerful players, often vertically integrated service firms; on the other end is a long tail of extremely differentiated small providers, whose existence is enabled precisely because the industry was "disrupted." Both ends of the barbell will thrive: their strategies are complementary and empower each other. We have also backed hundreds of boutique fund managers outside our firm and will continue to support and work closely with them.

Both scaled and boutique will do well; it's the firms in the middle that are in trouble: funds that are too large to afford missing the giant winners, but too small to compete with the larger firms that can structurally offer a better product to founders. What's unique about a16z is that it sits on both ends of the barbell—it is both a set of specialized boutique firms and benefits from a scaled platform team.

The firms that can best partner with founders will win. This might mean super-scaled dry powder, unprecedented reach, or a huge complementary services platform. Or it might mean irreplicable expertise, great advisory services, or simply incredible risk tolerance.

There's an old joke in the venture world: VCs think every product can be improved, every great technology can be scaled, and every industry can be disrupted—except their own industry.

Indeed, many VCs simply don't like that scaled VC firms exist. They think scaling sacrifices some soul. Some say Silicon Valley is too commercial now, no longer a haven for misfits. (Anyone claiming there aren't enough misfits in tech surely hasn't been to a tech party in San Francisco or listened to the MOTS podcast). Others resort to a self-serving narrative—that change is "disrespectful to the game"—while ignoring that the game has always been in service of founders, and always will be. Of course, they would never express the same concerns about the companies they back, whose very existence is built on achieving massive scale and changing the rules of the game in their industries.

Saying scaled VC firms aren't "real venture capital" is like saying NBA teams shooting more three-pointers aren't playing "real basketball." Maybe you think that, but the old rules no longer dominate. The world has changed, and a new model has emerged. Ironically, the game is changing here in the same way that the startups VCs back change the rules of their industries. When technology disrupts an industry and a new set of scaled players emerges, something is always lost in the process. But more is gained. Venture capitalists understand this trade-off intimately—they've been backing it all along. The disruption process that venture capitalists want to see in startups applies to venture capital itself. Software ate the world, and it certainly won't stop at VC.