Author:HEADBOY

Compiled by: Deep Tide TechFlow

The development of the crypto industry has always been accompanied by the evolution of trends and narratives. The ability to identify opportunities before these trends fully form is a key skill of many successful players in the crypto space. In this article, I will outline the major narratives that are likely to capture the attention of the community in 2026.

▪️ GambleFI: Prediction and Opinion Markets

Prediction and opinion markets have evolved from tools primarily for crypto enthusiasts into vital resources for everyday decision-making.

When people want to determine the truth of an event, they often have to sift through numerous articles, blogs, and social media posts, yet still struggle to find reliable insights. Opinion markets change this. They not only provide clear views on specific events but also back these views with economic stakes.

Currently, Polymarket and Kalshi are the two giants in this field, capturing most of the market attention and trading volume. However, I believe their potential is not yet fully realized, and more protocols will explore different dynamics within this narrative.

This area is worth close attention, especially because it naturally aligns with the needs of real-world users.

▪️ Launchpads: The Return of Fundraising and ICOs

As airdrops gradually cease to be the default model for community launches, we are likely to see more community-led fundraising activities, starting even from the seed stage, accompanied by a strong comeback of ICOs.

Since October 27, 2025 (62 days ago), over $341.35 million has been raised through community fundraising and community-led initiatives, with more projects expected to launch in Q1 2026:

-

MegaETH: $50 million

-

Monad: $187.5 million

-

Gensyn: $16.14 million

-

Aztec: $52.31 million

-

Superform: $3 million

-

Vooi: $1.5 million

-

Solomon Labs: $8 million

-

Solstice, Football Fun: $1.5 million

-

Makina: $1.3 million

-

Rainbow: $3 million

-

Immune fi: $5 million

-

Reya Labs: $3 million

-

Humidi fi: $6.1 million

-

Zkpass: $3 million

With the launch of some successful projects, community fundraising is expected to become the default model for community launches, fundamentally changing how projects interact with their communities.

In this process, the biggest winners will be the fundraising platforms that can offer the most investor-friendly terms while prioritizing strong protocol economics.

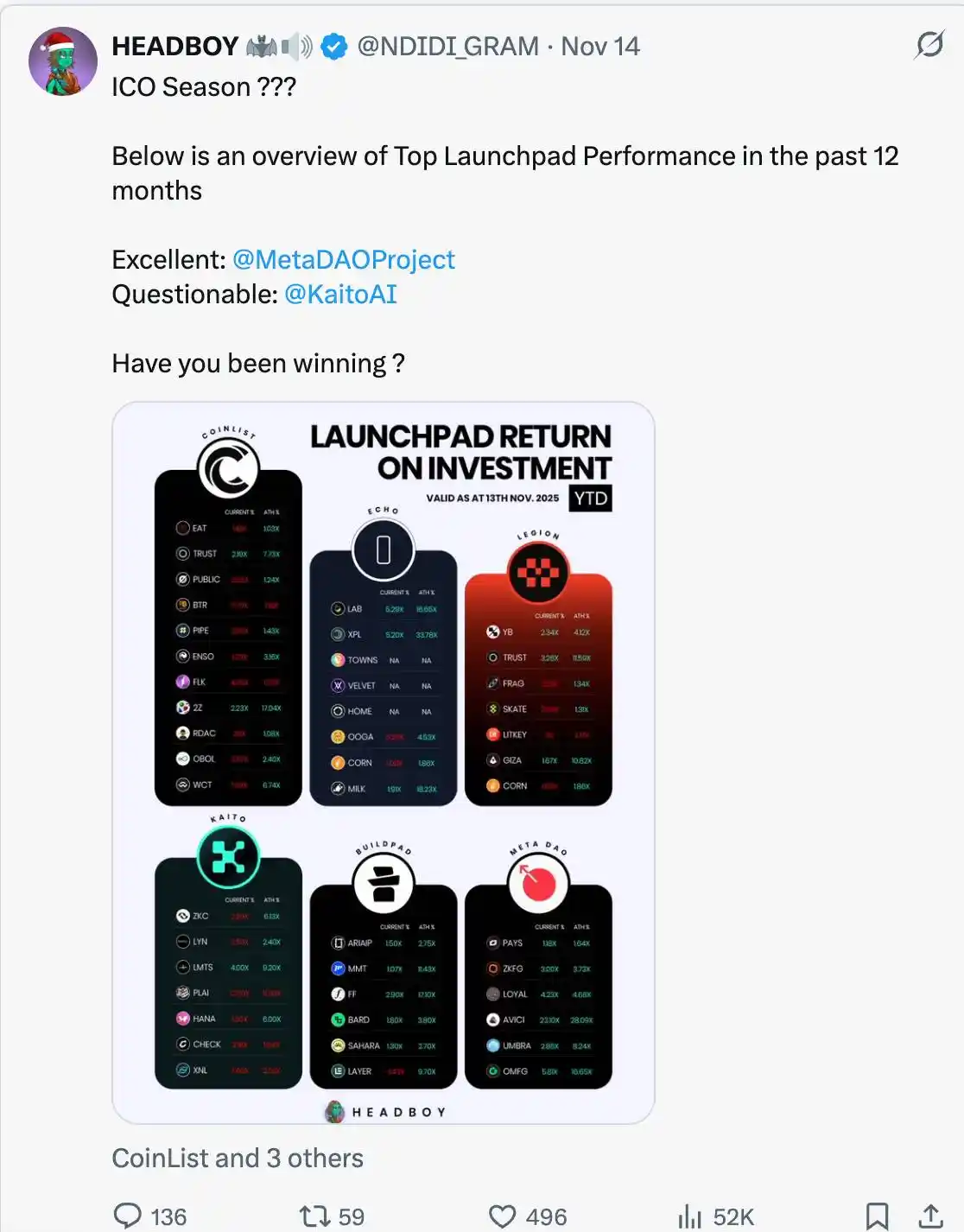

Currently, Legion, MetaDao, Buildpad, Echo, Coinlist, and Kaito are the platforms that have hosted the most token sales this year.

On November 14, 2025, I analyzed the current state of Launchpads based on their performance:

Next year, we are bound to see more new platforms exploring dynamic token issuance models to achieve community fundraising while balancing the interests of investors and protocols. This model will become a new focus in the crypto industry.

▪️ Privacy: The "Stealth" World On-Chain

The lifeblood of the crypto industry is liquidity, and institutions currently control a significant portion of it. To attract institutional capital, privacy is no longer an option but a necessity.

Some data simply cannot be made public, such as trading strategies, account balances, counterparty information, or internal fund flows, especially under the watchful eyes of competitors.

The next phase of on-chain applications will not be about merely hiding activities but achieving selective disclosure: proving legitimacy without exposing all information. This is the only way to attract serious capital on-chain.

Since early 2025, over 44 privacy-focused dApps and blockchain projects have received funding, with a cumulative fundraising amount exceeding $500 million, clearly indicating the rapid growth in demand for privacy-first applications.

Looking ahead to 2026, we are likely to see more such projects emerge, while existing protocols will unlock their full potential as privacy gradually shifts from a niche feature to a core requirement.

▪️ Neo-Banks for Digital Assets: The Full Upgrade of Wallets

The crypto industry has outgrown traditional wallet functionalities.

Tools used solely for storage and transfers are no longer sufficient. As more capital, protocols, and real-world businesses operate on-chain, the gap is evident: there is still a lack of a true bridge connecting wallets with complete financial workflows.

Next year, the industry's focus will shift from single-function wallets to wallet-native neo-banks for digital assets. These products will integrate custody, payments, yield, reporting, and compliance into a single interface.

This is not about replacing traditional banks but upgrading wallets into financial infrastructure.

This year, @Revolut led the pack in overall attention, while newcomer @AviciMoney performed exceptionally well, raising only $3.5 million through community fundraising but still delivering impressive results.

In the future, we are likely to see more such applications emerge, especially those that offer utility not only to crypto-native users (CT Natives) but also to a broader audience.

▪️ DePINs: The Decentralized Future of the Internet of Things

We witnessed the rise of Decentralized Physical Infrastructure (DePINs) in 2024, followed by a sharp decline in 2025. However, I believe next year will be when it fully realizes its potential.

Projects like Helium have proven that distributed connectivity can operate at scale; Hivemapper has shown that crowdsourced maps can compete with traditional giants; Render has pushed decentralized computing into real demand cycles. Emerging networks like Grass are turning idle resources into measurable economic output.

Even more interestingly, venture capital firms (VCs) continue to invest in these infrastructures, and some well-known projects have not only maintained usage but also successfully converted it into revenue streams.

What was once seen as a "narrative of tokenized hardware disguised as malware" is gradually transforming into networks with real users, practical use cases, and revenue. The industry is clearly shifting toward products with genuine utility and profitability, and this is where DePINs (Decentralized Physical Infrastructure) stand out.

▪️ Perpetual DEXs: The Future of the Derivatives Market

This year, Perpetual Decentralized Exchanges (Perpetual DEXs) dominated the crypto trading narrative, and this trend is far from over.

Platforms like Hyperliquid, dYdX, Lighter, and Aster have proven that perpetual contracts can generate significant trading volume and fee revenue, even competing with centralized exchanges.

Looking ahead to next year, the ultimate winners will not just be the DEX platforms with the highest trading volumes but those that offer capital-efficient products, low slippage, and innovative risk management. Such platforms will make derivative trading more accessible to both retail and institutional investors.

▪️ AI: The Crypto Evolution of Artificial Intelligence

In recent years, artificial intelligence (AI) has already dominated the broader internet landscape, and it is only a matter of time before it sparks a similar transformation in the crypto space.

We have already seen individuals use AI tools to "vibe-code" DeFi applications from scratch and successfully launch them, demonstrating how rapidly AI tools are advancing.

However, AI's role in the crypto industry goes far beyond trading bots or signal analysis. The real revolution will occur when AI becomes infrastructure—writing smart contracts, managing risk, optimizing liquidity, and running protocols faster and at a lower cost than humans.

It is foreseeable that AI will emerge as a major narrative in the crypto industry, growing only more important over time. This is an area worth watching closely.

Before 2026 arrives, you should familiarize yourself with the following emerging AI skills:

-

Vibecoding

-

Prompting

-

AI-Augmented Research

-

Automation

Additionally, here are some other narratives worth watching:

→ x402: On-Chain Simplification

→ Bots: Tokenized Automated Systems

→ Stablecoins: Tokenized Fiat

→ Real-World Assets (RWA)

The future of the crypto industry is bright. I believe 2026 will be a year of adventure for those curious about the future of crypto. Look forward to meeting you on the side of wealth creation!