Author: CoinFound

The battle over the CLARITY Act is, in essence, not a confrontation between the crypto industry and regulation, but a redistribution of the underlying interest structure. Traditional banks rely on low-cost deposits to maintain net interest margins, while interest-bearing stablecoins, by channeling Treasury yields directly to users, are reshaping the flow of funds and the transmission path of the dollar system. The regulatory focus has also shifted from "whether to allow innovation" to "how to quantify residual risks and systemic stability." Within this framework, the true watershed will no longer be CeFi or DeFi, but rather who can establish a new balance between transparency, compliance structures, and capital efficiency. The direction of CLARITY may determine the foundational rules for the digital dollar and institutional-grade RWA for the next decade.

CLARITY: (May 2025 - December 2025)

While the GENIUS Act focuses on addressing the infrastructure security issues of stablecoins, the CLARITY Act (H.R. 3633) sets its sights on the broader and more complex structure of the secondary market for crypto assets, token taxonomy, and the delineation of regulatory jurisdiction.

Breakthrough in the House and Reshaping Jurisdictional Boundaries

On May 29, 2025, House Financial Services Committee Chairman French Hill, jointly with the House Agriculture Committee and several bipartisan members, formally introduced the Clarity for Digital Tokens Act (CLARITY Act). The fundamental purpose of the Act is to eliminate the long-standing chaos of "regulation by enforcement" in the U.S. crypto market, providing legal certainty for entrepreneurs, investors, and the market .

The CLARITY Act implements a bold jurisdictional split. It explicitly grants the Commodity Futures Trading Commission (CFTC) "exclusive jurisdiction" over the spot market for "digital commodities," while retaining the Securities and Exchange Commission's (SEC) jurisdiction over digital assets classified as investment contracts . To accommodate this vast emerging market, the Act directs the CFTC to establish a comprehensive registration system specifically for digital commodity exchanges, brokers, and dealers, and introduces a "Provisional Status" to allow existing market participants to continue operating legally during a compliance transition period .

At the House level, the Act gained significant bipartisan support. On July 17, 2025, the day before the GENIUS Act was signed by the President, the CLARITY Act passed the House by an overwhelming majority of 294 votes to 134 . This stage of victory masked the conflicts of interest lurking beneath the surface, and the market was generally optimistic that the U.S. would establish a comprehensive crypto regulatory framework by the end of 2025.

Spillover Effect: Expansion of the Commodity Pool Definition and DeFi's Compliance Challenges

Notably, the CLARITY Act, in amending the Commodity Exchange Act (CEA), introduced a clause with far-reaching implications. The Act brings spot trading activities in "digital commodities" within the scope of "Commodity Interest Activity" . Under the traditional financial regulatory framework, only derivatives (such as futures, options, swaps) trading would lead to a regulatory designation as a "commodity pool"; spot market buying and selling (like buying and selling physical gold or crude oil) were not subject to this limitation .

The CLARITY Act breaks this boundary. This means that any investment fund, collective investment vehicle, or even liquidity pools in decentralized finance (DeFi) protocols and corporate treasury management companies, as long as they involve the centralized management and trading of "digital commodities," could potentially be legally classified as a "commodity pool" . The direct consequence is that the operators and advisors of such entities must register with the CFTC as Commodity Pool Operators (CPOs) or Commodity Trading Advisors (CTAs) and comply with the extremely stringent disclosure, compliance, audit, and margin requirements of the National Futures Association (NFA) . This extremely onerous连带 compliance cost预示着 that crypto-native asset management models will face a forced assimilation process, aligning completely with traditional Wall Street financial standards.

Parallel Tracks and Undercurrents in the Senate

As the House bill moved to the Senate, the complexity of the legislation increased exponentially. The Senate did not directly adopt the House text but began an internal reshuffling of power and interests. In the second half of 2025, two parallel legislative tracks formed in the Senate:

On one track, the Senate Committee on Agriculture, Nutrition, and Forestry, under the leadership of Chairman John Boozman, drafted and advanced the Digital Commodity Intermediaries Act based on the CFTC jurisdiction parts of the House CLARITY Act . This draft focused on establishing a regulatory system for digital commodity intermediaries in the spot market under the CFTC, emphasizing customer fund segregation requirements and conflict-of-interest protections, and gained preliminary committee approval by the end of January 2026 .

On the other track, the Senate Committee on Banking, Housing, and Urban Affairs was drafting a more comprehensive revision bill encompassing banking innovation and consumer protection. It was in this committee's closed-door consultations that the lobbying power of traditional banking began to exert its full force, making blocking "interest-bearing stablecoins" its non-negotiable core strategic objective . This sowed the seeds for the legislative crisis that erupted in early 2026.

Senate Deadlock and Full Collision of Interest Groups (January 2026)

Entering 2026, U.S. crypto legislation迎来了 a dramatic turning point. On January 12, the Senate Banking Committee formally released a 278-page revised draft of the CLARITY Act (Title I was called the "Lummis-Gillibrand Responsible Financial Innovation Act of 2026") . This draft, in its Chapter IV "Responsible Banking Innovation," imposed extremely strict definitions and limitations on the reward mechanisms for stablecoin holders . The Banking Committee attempted to use legislation to completely plug the loopholes left by the GENIUS Act, proposing to prohibit digital asset service providers from offering interest or yield for users "passively holding" stablecoins .

The Systemic Defense Logic and Macro Anxiety of Traditional Banking

Traditional financial lobbying groups, represented by the American Bankers Association (ABA), the Bank Policy Institute (BPI), the Consumer Bankers Association (CBA), the Independent Community Bankers of America (ICBA), and U.S. credit unions, showed unprecedented vigilance and hostility towards interest-bearing stablecoins . Their core argument was not merely profit competition, but a systemic defense based on macro-financial stability and the credit transmission mechanism of the real economy .

The table below details the core arguments and underlying logic of traditional banking versus the crypto industry on the issue of interest-bearing stablecoins:

| Interest Group | Core Demands & Policy Positions | Supporting Deep Economic Logic & Data |

|---|---|---|

| Traditional Banking (ABA, BPI, ICBA, Credit Unions) | Demand a "comprehensive ban" on third-party platforms offering stablecoin yields be added to the CLARITY Act, with strict anti-evasion measures . | 1. Deposit Siphoning & Credit Crunch Crisis: The banking industry's net interest margin (NIM) model relies on low-cost, sticky retail deposits. If stablecoin platforms offer high yields (4%-10%), it could trigger structural deposit flight. Treasury estimates suggest up to $6.6 trillion in traditional deposits are at risk of outflow . 2. Transmission Breakdown for Local Economies: Every dollar kept in a community bank, through the multiplier effect, translates into housing loans, small business loans, or agricultural credit. Legalizing stablecoin yields would drain this grassroots liquidity, severely disrupting the funding mechanism for local实体 economies . 3. Regulatory Arbitrage & Moral Hazard: Stablecoins are marketed as extremely safe, but their high yields are not backed by the FDIC's刚性兑付 guarantee, potentially triggering contagion in extreme market conditions . |

| Crypto Asset Industry (Coinbase, Ripple, Blockchain Association) | Strongly oppose expanding the yield ban, arguing that yields originate from the risk-free rate of underlying real assets or on-chain economic activity and should rightfully be returned to token holders . | 1. Capital Efficiency & Value Return: Stablecoins are 100% backed by U.S. Treasuries or cash, assets that inherently generate substantial interest. Banning platforms from returning this yield to users essentially forcibly剥夺 consumers' property孳息, protecting traditional banks' monopoly profits . 2. Innovation Drain & Geopolitical Financial Risk: A comprehensive ban not only stifles the competitiveness of centralized exchanges but would directly destroy complex business models in decentralized finance (DeFi) that automatically distribute yields via smart contracts. This would force hundreds of billions of dollars in crypto capital and top developers to jurisdictions with more favorable regulations offshore, weakening U.S. leadership in next-generation financial infrastructure . |

Coinbase's Strong Countermeasures and Legislative Process Stalled

Facing the devastating yield ban in the Senate Banking Committee draft, the crypto industry reacted fiercely. In mid-January, the largest U.S. crypto asset exchange, Coinbase, took extreme countermeasures. Its CEO, Brian Armstrong, publicly announced the withdrawal of support for the CLARITY Act, stating bluntly that the revised draft in its current state was "worse than the status quo (i.e., no clear legislation)" .

Coinbase's强硬 posture was not a bluff but a necessary move to defend its生存基石. Financial reports showed that in Q3 2025, Coinbase's net revenue from stablecoins (primarily USDC issued through the Centre consortium co-founded with Circle) reached a staggering $243 million, accounting for 56% of its total net revenue for the quarter . This profit-sharing model, built on the risk-free yield of underlying dollar assets, has become the core cash flow for crypto exchanges to withstand cyclical trading volumes. If the CLARITY Act were to sever this financial artery, it would not only severely damage the valuation of listed crypto companies but also completely颠覆 the existing industry competitive landscape.

Coinbase's public split triggered a political domino effect. As digital asset legislation heavily relies on fragile bipartisan consensus, internal division within the crypto industry directly shook the political foundation for the bill's passage. Facing continued opposition from key Democrats and renewed consideration of community bank interests by some Republicans, Senate Banking Committee Chairman Tim Scott (R-SC) was forced, at the last moment in mid-to-late January, to indefinitely cancel the scheduled CLARITY Act markup session and vote, choosing to pause progress to avoid the embarrassing scenario of the bill being rejected at the committee stage . At this point, comprehensive U.S. digital asset legislation fell into deep paralysis.

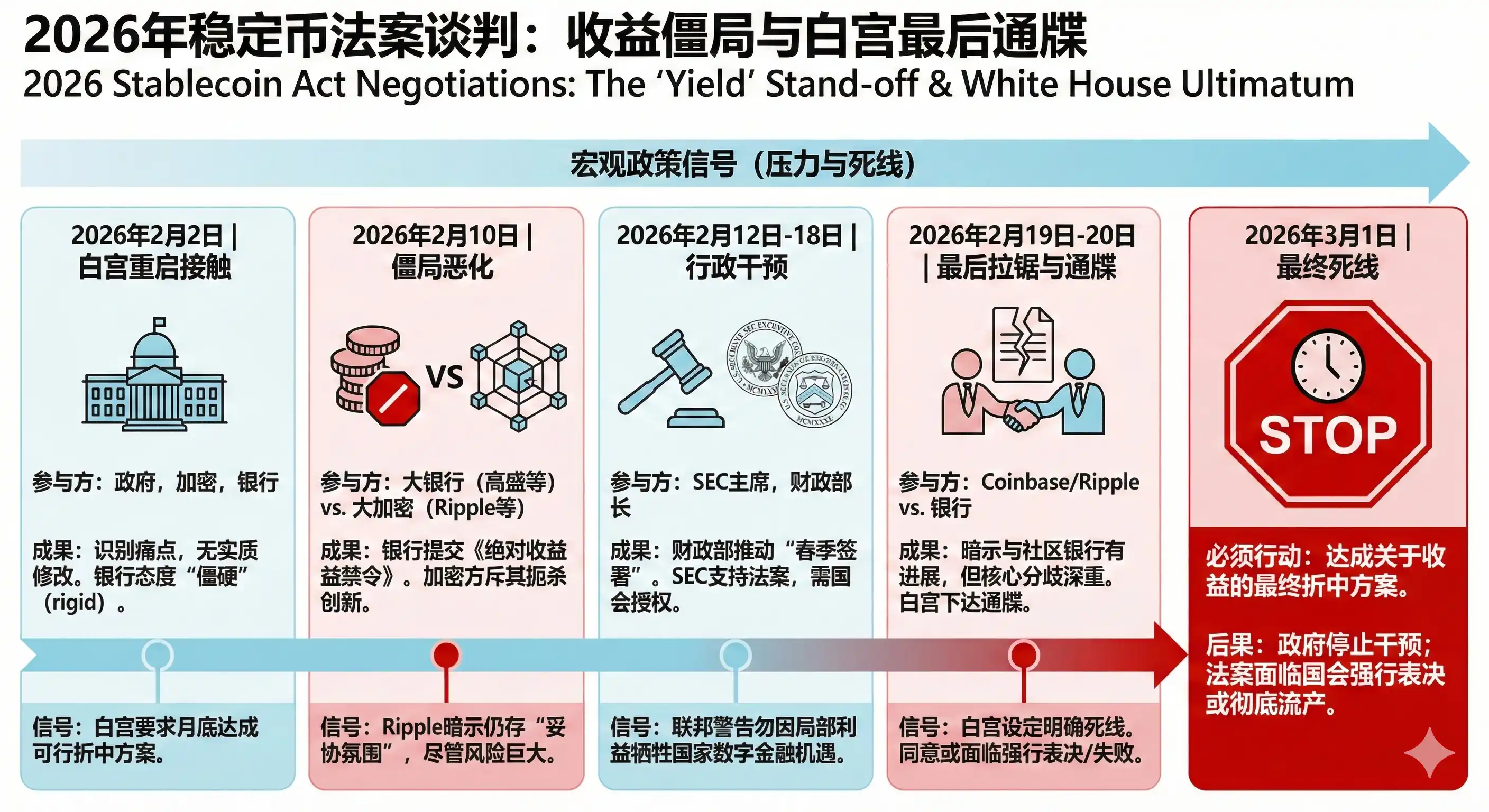

White House Emergency Mediation and High-Pressure Negotiations Full Record (February 1-20, 2026)

Faced with the potential collapse of major technology and financial strategic legislation over a single issue, the White House took unprecedented direct intervention in February 2026. With the November 2026 midterm elections approaching, the Biden administration and the Treasury Department knew that if the bill was not signed before the spring congressional recess, the legislative agenda could be completely shelved amid election-cycle political polarization . Against this backdrop, the Executive Director of the President's Digital Asset Advisory Council, Patrick Witt, took on the difficult role of mediator, beginning intensive shuttle diplomacy between traditional finance and the crypto nouveau riche .

Below is a timeline of the White House mediation in February 2026 and insider details,梳理 based on disclosures from various parties:

| Key Timeline | Participants & Event Nature | Negotiation Core Details & Stage Results | Macro Policy Signals |

|---|---|---|---|

| February 2, 2026 | First White House Closed-Door Meeting. White House reps, crypto industry (Coinbase, Blockchain Assoc., etc.), banking industry (ABA, BPI, ICBA, etc.) reps attended . | Aimed to restart the derailed bill over the yield dispute. Parties identified "pain points" and potential compromise areas, but no substantive changes (Redlining) were made to the legislative text. Crypto advocacy groups called it an "important step," but与会 sources noted banking reps' attitudes were "extremely rigid," lacking flexibility for substantive concessions on behalf of their member banks . | The White House clearly stated that both sides must reach a viable compromise within the month (i.e., by end of Feb) to clear the way for the bill's resumption in the Senate . |

| February 10, 2026 | Second White House Closed-Door Meeting. Streamlined high-level谈判, Goldman Sachs, Citi, JPMorgan Chase executives vs. Ripple, Coinbase & Crypto Council for Innovation executives . | The meeting atmosphere deteriorated sharply, reaching a serious impasse. Banking reps not only didn't compromise but adopted a tougher stance, submitting a document titled Principles for Prohibiting Yields and Interest to the meeting, demanding an "absolute comprehensive ban" on any financial or non-financial benefits for holding payment stablecoins, accompanied by extremely strict anti-evasion clauses. The crypto industry reacted极其 negatively to this document, seeing it as stifling financial innovation . | Despite the risk of breakdown, Ripple's Chief Legal Officer, Stuart Alderoty, still signaled optimism to the outside world,暗示 that with the strong bipartisan momentum pushing the market structure bill, "the atmosphere for compromise still exists" . |

| February 12-18, 2026 | Congressional Hearings & Administrative Intervention. SEC Chair Paul Atkins, Treasury Secretary Scott Bessent spoke in Congress and publicly . | Treasury Secretary Bessent emphasized the need to target a "Spring signing," using the political pressure of the midterms to force compromise. SEC Chair Atkins endorsed the CLARITY Act at a hearing, reiterating the SEC's "Project Crypto" token taxonomy,明确指出 "most crypto tokens are not securities." He also warned that relying solely on SEC no-action letters cannot achieve "future-proof" regulation, urgently needing Congress to provide solid statutory authorization . | The coordinated messaging from the SEC and Treasury sent a clear signal to the banking industry: the highest federal regulators do not want to sacrifice the historic opportunity to establish a national digital financial infrastructure over局部 profit disputes . |

| February 19-20, 2026 | Third White House Talks & Ultimatum. Coinbase & Ripple CLOs met again with bank reps . | After tough bargaining, Coinbase CEO Brian Armstrong hinted on social media that progress had been made in "exchanging interests and compromising with community banks," but did not reveal whether core policy differences were fully resolved. With divisions still deep, the White House formally issued a clear deadline . | The White House officially set March 1, 2026 as the "deadline" for reaching a final agreement on stablecoin yields. If a joint compromise proposal cannot be presented by then, the government may cease intervention, leaving the bill's fate to a forced vote in Congress or facing complete abandonment . |

As of February 20, 2026, with the March 1st deadline looming, the success or failure of U.S. crypto regulatory legislation hinges entirely on whether traditional bank capital and emerging crypto capital can design a profit-balancing model within the next ten days that both protects grassroots deposits from devastating siphoning and maintains the innovative vitality of the crypto ecosystem.

Theoretical and Legal Framework for a Breakthrough: Yield Neutrality Principle and Residual Risk Assessment Model

As White House mediation bogged down, an internal discussion draft leaked in late January 2026 from the SEC Crypto Task Force and a related interagency drafting committee—the Digital Markets Restructure Act of 2026—offered a highly sophisticated and legally/operationally coherent new regulatory paradigm to unravel the interest-bearing stablecoin deadlock . The "Yield Neutrality" and "Residual Risk Assessment" theories proposed in this draft彻底颠覆 the nearly century-old logic of financial product classification in the U.S.

Breaking the Monopoly's Foundation: Yield Neutrality Principle (Yield Neutrality for Stable Value Instruments)

Section 205 of the draft aims to fundamentally break the outdated mindset that "paying interest necessarily equates to a bank deposit or security" . This clause establishes the epoch-making legal principle of "Yield Neutrality":

- Decoupling from Bank Charter Privileges: The draft明确规定 that the act of a digital asset or stable value instrument providing yield, interest, or economic return is itself considered "neutral" in legal attribute. The distribution of such yields "shall not be conditioned upon, contingent upon, or exclusively reserved for issuance by insured depository institutions (i.e., traditional commercial banks) or their affiliates" . This directly否决, at the statutory level, the banking industry's core demand to monopolize the right to pay interest.

- Strict Conditional Licensing Mechanism: Granting non-bank institutions the right to pay interest is not a free-for-all. Non-bank entities holding the proposed "Unified Registration Certificate" (URC) are permitted to offer or facilitate stablecoin yields, but must strictly meet four non-negotiable pre-compliance conditions :

- Ultimate Transparency: The underlying logic of the stablecoin and its yield mechanism must be fully and publicly disclosed in detail in the "Unified Digital Market Registry".

- Traceable Legality: The true physical or code source of the yield must be clearly defined and publicly displayed. Yields must originate from clearly legal mechanisms, such as the risk-free spread managed by the underlying Federal Reserve, compliant permitted asset value support, real secondary market transaction fees, or publicly transparent underlying blockchain protocol operations (e.g., staking rewards) .

- Risk-Classification Controlled: The yield-bearing instrument and its transmission mechanism must be subject to the classification and dynamic supervision of the "Residual Risk Assessment Model" established by the Act.

- Absolute Prohibition of False Endorsement: Any marketing language implying or stating that the stablecoin's yield is guaranteed by the "full faith and credit" of the U.S. government or protected by the FDIC system is strictly prohibited (unless it is indeed接入 such an insurance scheme) .

- Statutory Precedence & Preemption Effect: This clause, through federal legislation, explicitly declares its效力超越 and supersedes any existing law that might be interpreted as exclusively reserving yield distribution rights to banks (directly targeting potential restrictive clauses in the GENIUS Act), achieving a comprehensive legal unbinding .

Overturning the Howey Test: Residual-Risk Assessment Model

If the "Yield Neutrality Principle" solves the qualification problem of "who is eligible to distribute yields," then the "Residual Risk Assessment Model" outlined in Sections 103 and 202 of the draft fundamentally solves the technical难题 of "how regulators should scientifically assess and quantitatively manage these yield-bearing instruments" .

For a long time, the SEC has over-relied on the "Howey Test," formulated in 1946, to judge whether crypto assets are securities. This method of "carving a mark on a moving boat" has led to endless litigation. The Restructure Act彻底摒弃 this static determination based on "technical labels" (like stablecoin, smart contract, token),转向 a modular and dynamically responsive regulatory mechanism based on underlying risk vectors .

The core idea of this model is to measure "Residual Risk"—the investment risk, leverage risk, or market integrity risk that still remains after fully applying mitigation measures like blockchain cryptographic verification, immutable smart contracts, and rigorous legal structures . The model precisely divides these residual risks into three independent but quantifiable dimensions:

| Risk Category | Risk Source & Core Definition | Digital Asset Scenario Triggering This Risk | Primary Regulatory Jurisdiction |

|---|---|---|---|

| Enterprise Risk | Stems from agent problems, information asymmetry, or management discretion of identifiable business entities, core developers, or coordinating groups . | An issuer uses pooled user stablecoins to invest, through manual decisions, in high-risk corporate bonds or non-standard assets to seek high yields. Due to high reliance on managers' "efforts and decisions," it carries极高的剩余 enterprise risk. | Securities and Exchange Commission (SEC), treated as a high-risk investment fund or security . |

| Exposure Risk | Stems from synthetic and leveraged exposure to reference assets, volatility, interest rates, or complex indices . | A user deposits stablecoins into a decentralized derivatives protocol that offers supernormal APY through high leverage, posing risks of liquidation and bad debt under extreme market volatility. | Commodity Futures Trading Commission (CFTC), treated as a derivative or commodity pool operation . |

| Market & System Integrity Risk | Involves physical and logical custody security of assets, system integrity, market manipulation, or operational failure of trading and settlement facilities . | A centralized exchange offering ordinary current account理财, even if the yield comes entirely from underlying risk-free Treasuries, but the platform may pose risks of misusing user asset pools, hacker attacks, or internal data tampering. | Prudential Regulators / Joint Market Supervision by SEC & CFTC, focusing on auditing, asset segregation, and cybersecurity . |

The operating mechanism of this assessment model is likened by the drafters to a dynamic "Smart Thermostat" . Its core regulatory logic lies in the "measurement of economic abstraction": assessing the extent to which the economic risk exposure of an asset is脱离 the user's actual control or legal recourse. Regulatory intensity介入 is proportionally scaled—when the residual risk of a yield-bearing asset膨胀 due to human manipulation or black-box operations, regulatory authority and disclosure requirements will automatically and severely expand; conversely, if decentralized technology or automated smart contracts can be proven, at a mathematical and cryptographic level, to perfectly neutralize or even eliminate human management risk and counterparty credit risk, regulatory intervention will proportionally收缩 and recede . To ensure the SEC, CFTC, and prudential bank regulators can seamlessly share data and execute this model, the Act also proposes establishing a "Market Structure Coordination System" (MSCS) .

Applying this theoretical framework to the current interest-bearing stablecoin deadlock, a logically clear path to a breakthrough emerges: If third-party platforms like Coinbase merely act as transparent "conduits," passing on the "risk-free yield" from assets held 100% at the Fed or in short-term U.S. Treasuries to end-users proportionally and transparently through automated code, and strictly enforce asset segregation without any pool maturity mismatch, leverage amplification, or active risk/credit downgrading behavior. Then, according to the "Residual Risk Assessment Model," the "Residual Enterprise Risk" and "Exposure Risk" of this business practice would be judged to be extremely low. In this case, the duty of regulators should not be to outright ban it or treat it as an illegal money market fund based on outdated doctrines protecting traditional bank interests, but merely to continuously verify, through technical means, the absolute security of its custody and the truthfulness of its disclosures. This classification method, based on technical facts and objective risk characteristics rather than institutional identity and historical licenses, provides a solid technical and legal retreat for bridging the political divide on Capitol Hill.

CLARITY Act Success or Failure Impact:

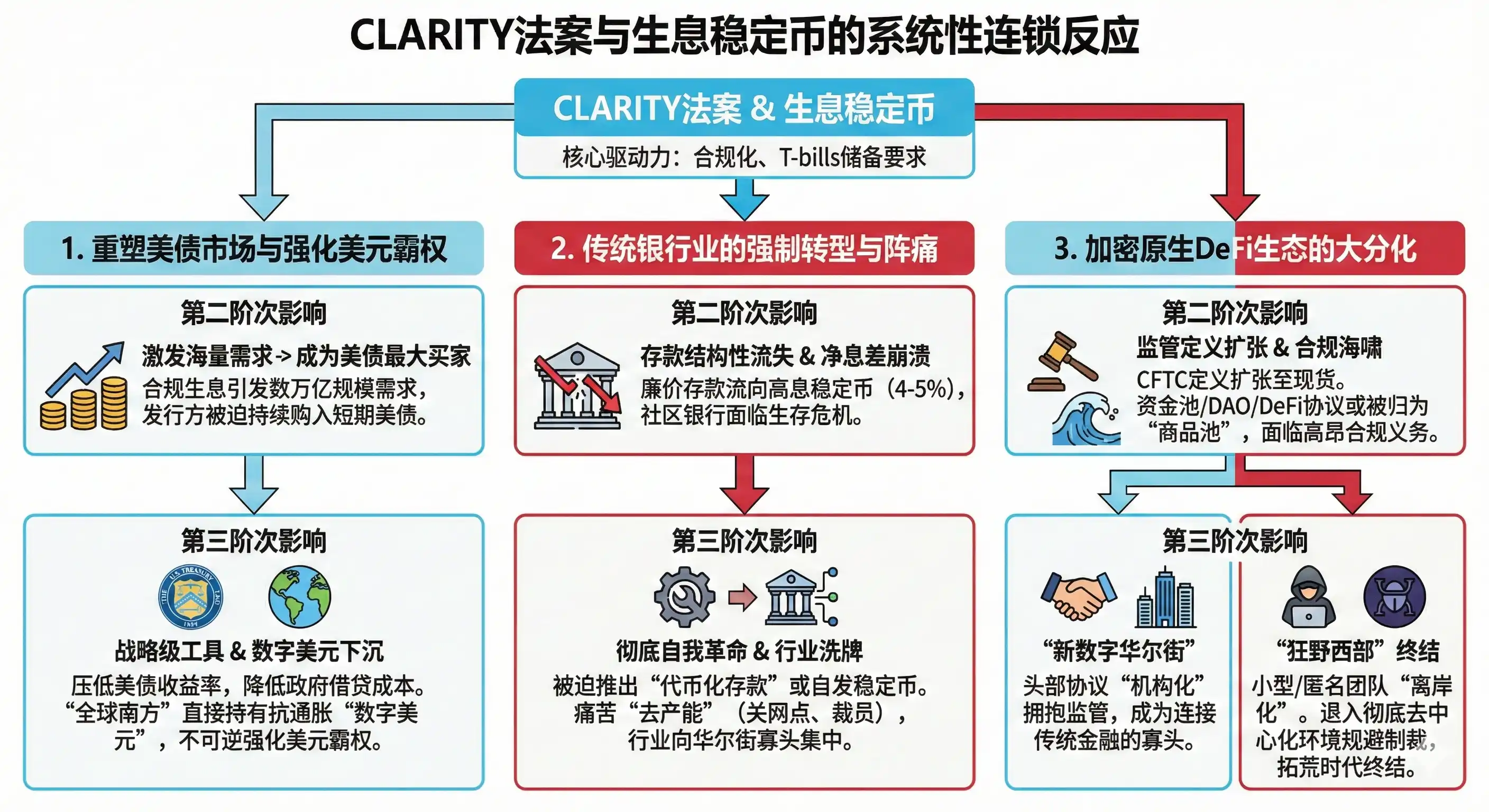

The success or failure of the CLARITY Act, and the ultimate归属 of interest-bearing stablecoin profit rights, is far from a simple redistribution of industry profits. The spillover effects of this legislation will penetrate the crypto圈层, having profound systemic ripple effects on U.S. macro debt financing, the global hegemony of the dollar, and the evolution of the traditional financial system.

1. Deep Binding and Reshaping the U.S. Treasury Market, Strengthening Digital Dollar Hegemony

By the end of 2025, the total market capitalization of global interest-bearing stablecoins of various types had exceeded $15 billion, while the broader payment stablecoin market size approached the hundreds of billions of dollars . According to the compliance requirements of the GENIUS Act, all future dollar stablecoins must be primarily backed by U.S. short-term Treasuries (T-bills) and U.S. dollar cash .

- Second-Order Impact: If the CLARITY Act ultimately adopts the "Yield Neutrality" principle, allowing interest-bearing mechanisms to operate normatively under strong regulatory guardrails, it will极大地 stimulate massive demand for dollar stablecoins from institutional investors (e.g., corporate treasury management) and global retail users. Macroeconomic think tanks predict that a compliant and interest-bearing stablecoin ecosystem could rapidly膨胀 to a staggering multi-trillion dollar scale in a short time . To maintain the 1:1 reserve requirement, compliant issuers of stablecoins (like various non-bank trusts and asset management companies) will be forced to become one of the largest and most stable institutional buyers of U.S. short-term Treasuries in the open market, continuously injecting astronomical liquidity into the U.S. Treasury market.

- Third-Order Impact: This structurally driven, highly certain, massive buying power for Treasuries, fueled by global digital demand, will become a strategic tool for the Federal Reserve and the U.S. Treasury Department to manage the sovereign debt curve. Sustained massive buying will effectively压低 the yield on U.S. short-term Treasuries (i.e.,压低 the front end of the yield curve), thereby substantially reducing the U.S. government's overall borrowing costs and significantly ameliorating the worsening national fiscal situation and deficit pressure at a macro level . More profoundly, in "Global South" countries long plagued by high inflation and fiat currency devaluation, a "digital dollar" that can legally generate anti-inflation yields will become the ultimate wealth避险 asset. Hundreds of millions of overseas citizens will be able to directly convert their national wealth into digital assets backed by U.S. Treasury credit without the繁琐 process of opening offshore bank accounts . This is not only a dimensional打击 against other vulnerable sovereign currencies but also represents a digital下沉 of dollar hegemony to the global grassroots society without the U.S. establishing any physical overseas bank branches, further and irreversibly strengthening the dollar's霸主地位 as the world's sole core reserve currency .

2. Forced Transformation and Pains of Traditional Commercial Banking

The banking industry is using its highest-level political lobbying power to try to strangle interest-bearing stablecoins because they clearly foresee that this emerging financial infrastructure will deal a毁灭性的降维打击 to the net interest margin (NIM) model they rely on for survival.

- Second-Order Impact: If the attempt to completely ban third parties from offering interest-bearing stablecoins fails, the structural outflow of cheap deposits from the traditional banking system—especially from small and medium-sized community banks with weak risk resistance—will become an irreversible historical tide. Capital is inherently and冷酷ly profit-seeking. Faced with compliant digital dollars that have no minimum门槛, support 7x24 global real-time cross-border settlement, and offer stable APYs around 4% to 5%, traditional banks' zero-interest checking accounts or微息 savings accounts will instantly lose all market appeal .

- Third-Order Impact: To avoid elimination in this brutal battle for liquidity, traditional commercial banks will be forced to undergo thorough self-revolution, shifting their strategic focus from policy defense to full-scale offense through technology. In the foreseeable future, we will witness mainstream commercial banks launching "Tokenized Deposits" based on consortium or public blockchains on a large scale, or leveraging their massive balance sheets to issue bank-grade compliant high-yield stablecoins themselves . To消化 the cost pressure of paying higher deposit interest, the banking industry will have to undergo painful "de-capacity," massively cutting physical branch networks and redundant human resources to drastically reduce overall operating costs through extreme digitization. This process will trigger a reshuffle of the cost structure and profit expectations of the U.S. and global banking industry, with further concentration towards Wall Street oligarchs possessing top-tier fintech capabilities.

3. The "Institutionalization" Watershed and Great Divergence of the Crypto-Native DeFi Ecosystem

The CLARITY Act not only redistributes interests but also fundamentally reshapes the structure of the crypto industry. The Act designates the CFTC as the direct regulator of "digital commodities" and极度扩张 the traditional definition of "Commodity Pools" to directly cover the spot digital commodity market .

- Second-Order Impact: This slight legal change will trigger a tsunami in the crypto asset management field. Any investment fund, Decentralized Autonomous Organization (DAO) treasury management body, or even DeFi protocol characterized by aggregated liquidity that engages in pooled fund operations in the spot digital asset space or offers users complex structured yield strategies could potentially be forcibly classified as a "commodity pool" by law . Their operators will be compelled to register fully with the CFTC and bear high audit and compliance obligations .

- Third-Order Impact: The decentralized finance (DeFi) ecosystem will face an inevitable and severe polarization. Those well-capitalized leading DeFi protocols and giant centralized exchanges that can afford high legal compliance costs will actively embrace regulation, further consolidating their oligopolistic position in the market, transforming into "super compliant nodes" connecting traditional Wall Street liquidity with crypto assets. Those small protocols, startup development teams, or fundamentalist anonymous developers unable to meet the stringent registration requirements, to avoid legal sanctions, will utilize the limited protections and exemptions retained in the Act for "Non-controlling Blockchain Developers" to completely exit the U.S. mainstream view, retreating into more彻底 decentralized, permissionless, or even offshore/dark web environments . This means the bottom-up "Wild West" pioneering era of the crypto industry will be彻底终结 by 2026, replaced by a highly institutionalized "New Digital Wall Street" dominated by Wall Street capital, licensed compliance giants, and federal regulatory agencies .