Written by: Zuo Ye

Original Title: Compliance is the Coming-of-Age Ceremony for the Underground Economy

In 2017, Binance rapidly became the world's number one through regulatory arbitrage, but in 2025, the more liberal Hyperliquid could only capture 15% of Binance's market share. Does RWA, as a source of underlying assets for DeFi, have the space for regulatory arbitrage and a scalable future?

Compliance has become the main theme of 2026. The offshore exchange Binance officially went onshore in the UAE's ADGM, Coinbase scored two major wins with the Talent Act and the Clarity Act, and even the Eastern power has "in principle" tested the waters of RWA regulation.

We are at a clear inflection point. Blockchain will not replace the internet, Web3 is just a self-righteous scam, the listing effect ended with Binance's purchase of Bitcoin. However, Hyperliquid is making strides in precious metals and prediction markets, while the tokenization of RWA—represented by currencies (stablecoins), stocks (U.S. stocks), bonds (U.S. bonds, subprime bonds), and funds (hedge, active)—is happening now.

Against this backdrop, compliance has evolved beyond the symbolic role of "holding a small country's license to arbitrage a large country's regulations" into a real framework separating trading, clearing, and custody. When the industry breaks through scale limitations, regulatory benefits will become profitable.

In the quiet moments, compliance not only signifies the end of the last era of reckless expansion, but also, amidst the rumbling thunder, there will always be tracks with arbitrage space for development in exchange for scale.

Let's start with exchanges to glimpse the economic considerations beyond compliance.

Civilized Wall Street, Crazy Barbarians

Barbarian conquerors are, by an eternal law of history, themselves conquered by the superior civilization of their subjects.

In 2022, FTX collapsed dramatically. Wall Street once harbored ambitions to dominate the exchange赛道. Citadel Securities, Fidelity, and Charles Schwab collaborated to launch EDX Markets in Singapore, operating under the Singapore MAS compliance framework based on the principle of separating trading and custody.

With Gary Gensler's SEC relentlessly pursuing Binance, Coinbase and Kraken were confined to the U.S. spot market,迟迟 unable to venture into高端 markets like futures and options. At that time, the market also had high hopes for EDX Markets.

If nothing unexpected happened, we should have witnessed Binance's fall, similar to BitMEX after the March 12, 2020 crash. But history never repeats itself. Hyperliquid was the real winner. The weakened Binance and the still U.S.-confined Coinbase were surprisingly not the protagonists of the next act.

To understand the winner's experience, one must first understand the loser's lessons.

After its establishment in 2017, Binance did at least two things right:

-

While actively embracing going overseas, it continued to accept users from mainland China, creating a seesaw effect between trading volume刷量 and user scale;

-

In 2019, it launched IEO (Initial Exchange Offering), creating real wealth effects before DeFi Summer.

After the September 4 ban, providing trading services to users in mainland China entered a "gray area." The third regulation directly targeted trading platforms, requiring them not to provide services like quotation, matching, and clearing. If we refer to He Yi's response to Cathie Wood, Binance would respond by "not providing services to users in mainland China."

From 2017 to 2019, Binance secured its position as the world's number one offshore exchange. From 2020 to 2022, Binance filled the futures market gap left by BitMEX. From 2022 to 2024, Binance dominated the global altcoin market, where the listing effect was equivalent to the "listed on Binance" effect.

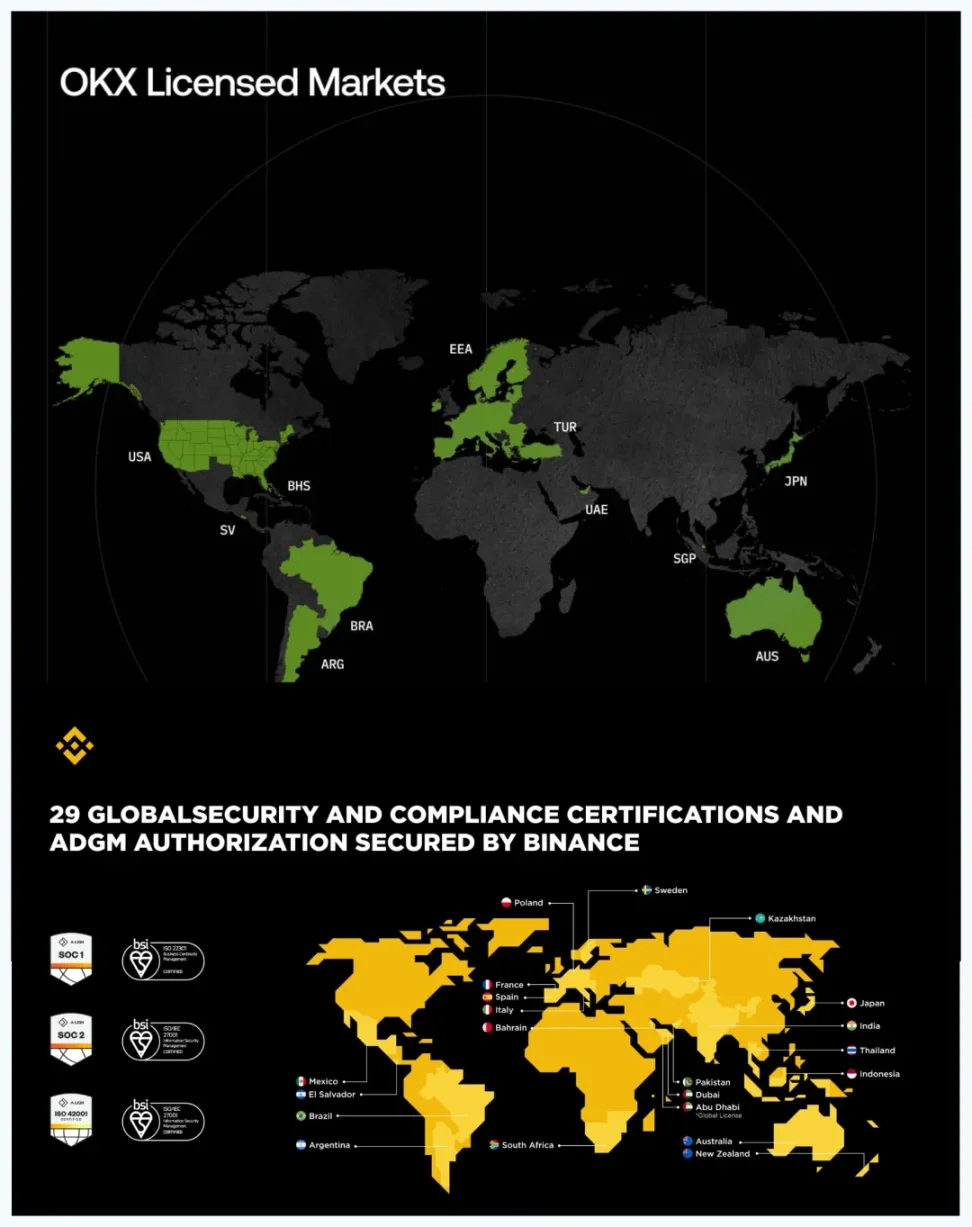

Entering 2025, Binance officially came under the compliance framework of Abu Dhabi's ADGM in the UAE, dividing itself into three entities: trading, clearing, and over-the-counter, but this still retained Binance's characteristic arbitrage.

Especially since compliance did not stop Binance's listing team from adding Meme coins. Secondly, ADGM and the entire UAE financial system simply lack the capacity to regulate a behemoth like Binance. One can refer to the Bahamas' helplessness regarding FTX's global站.

Image Caption: "Passing the Civil Service Exam" to go ashore, Image Source: @binance @okx

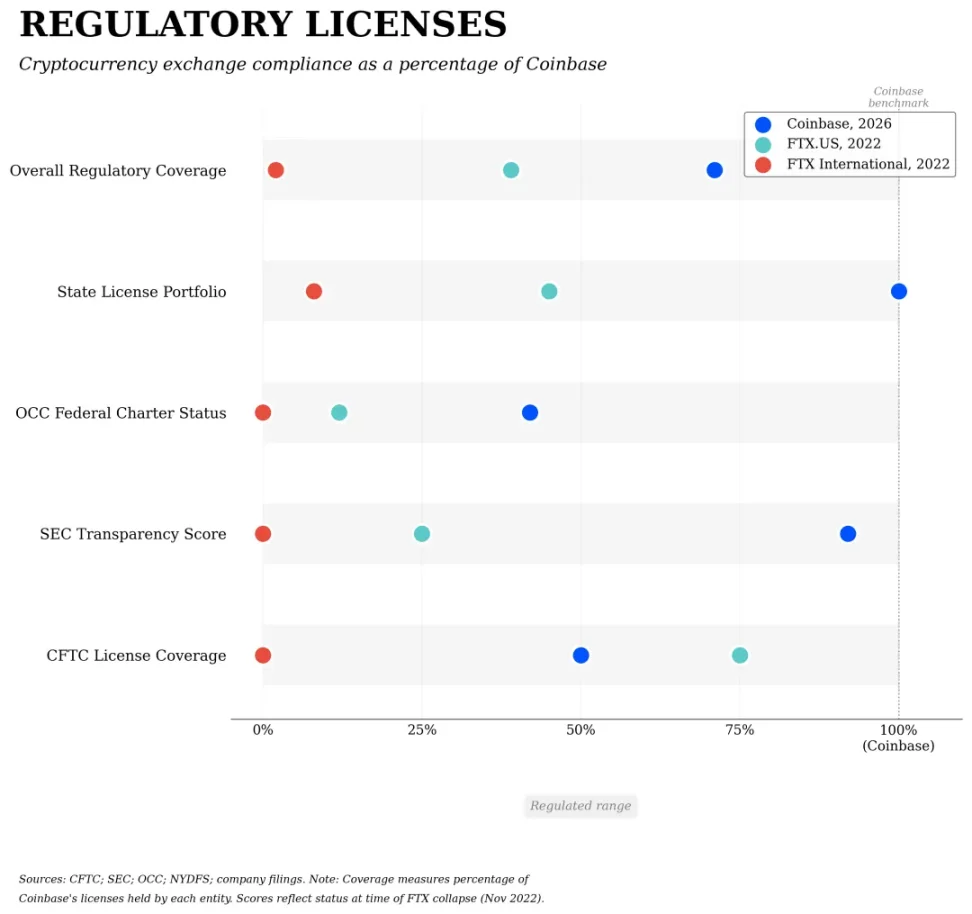

Coinbase was the most compliant after FTX's collapse, but this compliance stemmed from Trump's post-election restructuring of the SEC, CFTC, and OCC, demanding they adopt more crypto-friendly regulatory measures.

Roughly, the SEC is responsible for reviewing whether a token meets the definition of a security, the CFTC oversees derivatives trading, and the OCC manages banking licenses for custody services. The U.S. does not have a license类似 ADGM's "crypto exchange license"; it only has regulatory scopes divided by business type.

Image Caption: Regulatory Progress, Image Source: @zuoyeweb3

The construction of this regulatory framework is still ongoing, but it's certain that Coinbase will shape the U.S. compliance framework, covering listing (spot, futures), trading (spot, futures), custody (retail, institutional), clearing/settlement (fiat, crypto), audit (technical, asset)/insurance (fiat, crypto) aspects.

Binance's licensing under ADGM and Coinbase's licensing in the U.S. are completely different concepts. The latter's licensing will actually fall under the management of regulatory agencies.

Regulation is about clarifying rules, not protecting retail interests. For example, institutional clients enjoy bankruptcy isolation protection in Coinbase's custody business, corresponding to the entity Coinbase Custody Trust Company.

However, funds deposited by ordinary retail users into Coinbase correspond to the entity Coinbase Inc. If it's fiat currency, it might be protected by the corresponding bank's FDIC deposit insurance, but crypto assets could very well meet the same fate as FTX.

For instance, purchasers of the FTX token FTT were deemed equity owners and were not strictly protected in claims. Coinbase is similar. The only good news is that Coinbase has not faced a run on its funds.

Hyperliquid Enters the RWA Field "Unlicensed"

Human progress will no longer be like the terrible pagan idol, who would not drink the nectar but from the skulls of the slain.

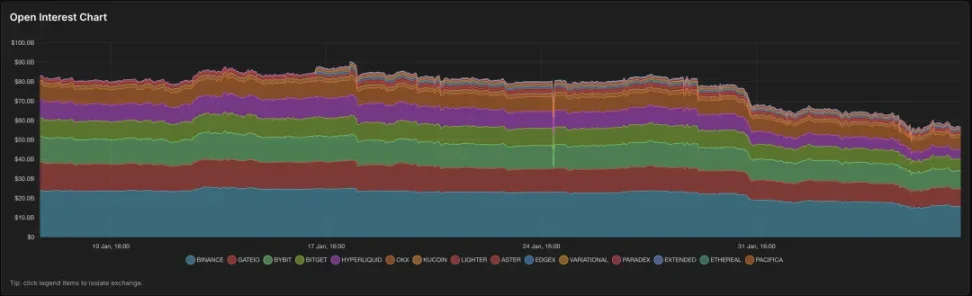

Regulatory arbitrage still exists. In the crypto asset trading field, EDX's American compatriot Hyperliquid also started in Singapore and is蚕食 (eroding) Binance's global market and Coinbase's U.S. market.

This can be called "second-order arbitrage": Binance arbitrages global regulations, Hyperliquid arbitrages Binance.

Image Caption: CEX and DEX are hard to distinguish, Image Source: @LorisTools

Hyperliquid blocks U.S. IP addresses, but this block has no practical effect. Compare this to the fact that U.S. users can almost never open an account on Binance Global站, only on Binance US.

Coinbase just began allowing futures business for U.S. users, but its business volume is almost negligible. Thus, in a bizarre space, Hyperliquid captured some European and American users outside of Binance and Coinbase, engaging in derivatives business.

But note, Hyperliquid's arbitrage cannot replicate Binance's growth miracle, nor can it learn from Coinbase to capture the U.S. compliant market. It can probably only capture about 15% of Binance's market share.

As Hyperliquid expands into non-traditional businesses like precious metals and prediction markets, its impact on the global financial market is gradually strengthening. If the U.S. can regulate Binance and Tornado Cash, then action against Hyperliquid would not meet resistance from Singapore either.

Ultimately, most "underground economy" models cannot enter the realm of scale. Take USDT as an example; it has become increasingly strict in its issuance reserves and circulation bans. The Bybit hacker放过 (spared) USDT and the freezing of black USDT after the Huione case are clear evidence.

-

Huione can support the entire underground economy of Cambodia and even Southeast Asia, but Cambodia cannot bear the cost of being placed on FATF's money laundering "grey list."

-

Binance can support the BNB chain economy dominated by altcoins, but the squeeze between China and the U.S. prevents Binance from accessing higher-quality trading assets.

This is essentially due to the U.S.'s advantage of low regulatory costs. The core of U.S. external economic sanctions is not the dollar and the U.S. military. The U.S. is the world's largest single consumer market and the most important financial market. Once Cambodia and Binance are cut off from the U.S., their fate would be like North Korea's.

This is why Binance pays a high price to become compliant, and why Hyperliquid's compliance is only a matter of time.

This leads to an extended discussion: can RWA replicate the trajectory of the crypto asset trading赛道, i.e., preserve itself through regulatory arbitrage and develop its volume within a compliance framework?

This is based on the dual premise that Hyperliquid, in the crypto asset trading field, almost certainly cannot surpass Binance, and in terms of compliance, almost certainly cannot surpass Coinbase.

If we were in 2017, CZ himself might not have believed that CEX was the future. Looking back, stamp coins, P2P, O2O, ofo were all fleeting. Looking forward, DeFi mining, NFT, GameFi, SocialFi all ended without result.

So Binance and BNB should be understood as project-based. Their光环 (halo) is constantly extended by wealth effects. They should have ended hastily, like one financial bubble after another.

But under network effects, the network effect of trading breaks free from the constraints of crypto assets and enters all financial fields, thus meeting RWA in a broad sense. Yield-bearing stablecoins冲击 (impact) CBDC, and asset-based securitization will迟早 (sooner or later) be tokenized.

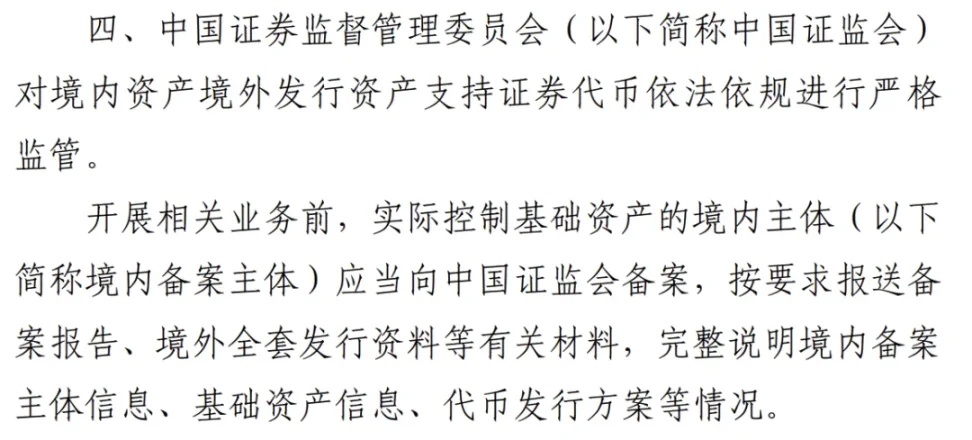

For example, the recent regulatory guidelines from the Eastern power are essentially an overflow of the U.S. impact in the financial field, which will rewrite on-chain finance in a peculiar way.

Image Caption: The flower blooms inside the wall, but its fragrance is enjoyed outside

Regarding the new regulatory measures from the Eastern power, Caixin's interpretation divides them into four categories: foreign debt, equity, asset securitization, and others. But in my view, the only meaningful aspect is the opening for security tokenization, aligning with the reform direction of "securitizing all assets." Regarding this:

-

Clearly identifies the CSRC as the competent authority

-

Requires CSRC approval for issuance

-

Only allows issuance from within the territory to outside the territory

Furthermore, these security tokenization guidelines clearly state that both rights and收益 (profits) must be compliant. This corresponds to the SEC's encouragement of the evolution of native "stock tokenization." Overseas RMB stablecoins, foreign debt, and funds are more特殊 (special cases).

-

Overseas offshore RMB stablecoin business has always existed, and Tether, the issuer of USDT, is also involved, but it lacks practical use, and the business volume is very small;

-

Overseas bond issuance and fund tokenization are already happening de facto, completely isolated from domestic assets and issued to overseas clients, unrelated to these guidelines.

This regulation involves the overseas issuance of domestic assets, essentially emphasizing this isolation: what is overseas belongs overseas, what is domestic belongs domestic. Only when the two交叉 (intersect) is there a need to enter the regulatory process.

In the current RWA field, China and the U.S. are already de facto engaged in a land grab. This liquidity溢出 (spillover) onto the chain is enough to rewrite the current financial landscape.

Conclusion

The destiny of an industry depends, of course, on self-striving, but also on the course of history.

CZ might not even believe CEX is the future himself. Even Bitcoin is just a stage of a new form of pyramid scheme, quickly becoming a historical term that vanishes with the wind, like P2P, high-interest loans.

But no one expected CEX to survive until 2026. Hyperliquid is charging into new forms like precious metals and prediction markets, but it still hasn't Flipped Binance.

If we add RWA to Hyperliquid, can it reach the other shore this time?

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush