Crypto exchange-traded products (ETPs) recorded about $864 million in inflows last week, according to a report on Monday by European digital asset manager CoinShares.

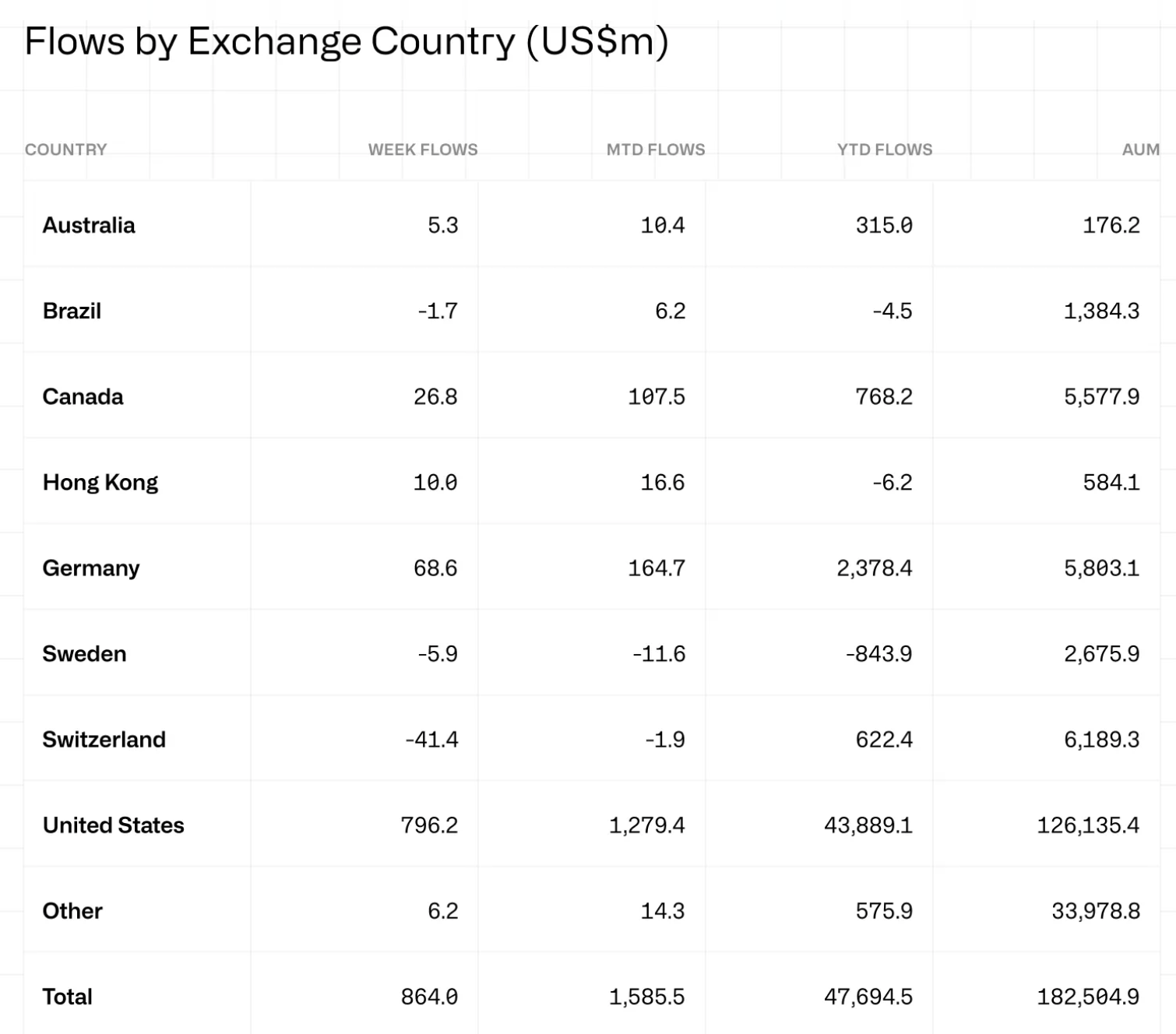

The United States led regional inflows with about $796 million, followed by Germany with roughly $68.6 million and Canada with about $26.8 million. Together, the three countries account for approximately 98.6% of year-to-date (YTD) inflows into digital asset investment products.

Switzerland-listed crypto ETPs recorded about $41.4 million in weekly outflows, while YTD net flows were about $622.4 million, according to the data.

Bitcoin and Ether dominate inflows, followed by Solana and XRP

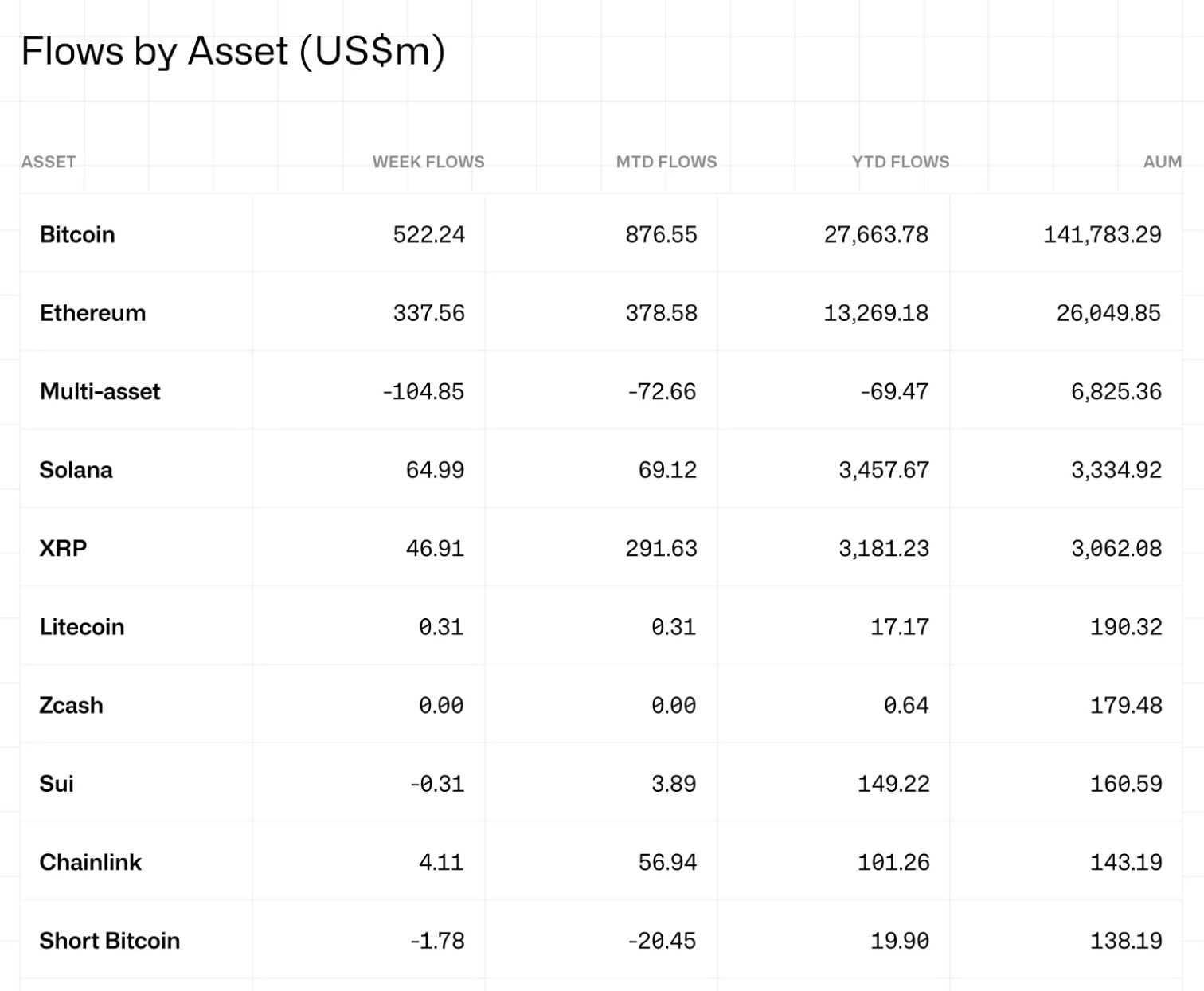

Bitcoin (BTC) investment products recorded about $522 million in weekly inflows, while short-Bitcoin products posted roughly $1.8 million in net outflows, “signalling a recovery in sentiment,” according to the report.

Ether (ETH) saw approximately $338 million in inflows during the week, lifting YTD to about $13.3 billion, up 148% from 2024.

Beyond Bitcoin and Ether, Solana (SOL) investment products recorded about $65 million in weekly inflows, bringing YTD inflows to roughly $3.46 billion, a tenfold increase from last year.

XRP (XRP) products also attracted fresh capital, with approximately $46.9 million added during the week and about $3.18 billion in inflows accumulated YTD, according to the data.

Smaller-cap products saw more mixed results, with Aave (AAVE)-linked products recording about $5.9 million in weekly inflows and Chainlink (LINK) adding roughly $4.1 million. Hyperliquid (HYPE) products posted net outflows of around $14.1 million during the period.

This is the third consecutive week of inflows for crypto ETPs, following about $716 million in inflows last week and roughly $1 billion the week before.

Bitcoin has attracted around $27.7 billion YTD, still below the $41 billion it recorded in 2024.

Related: XRP sinks below $2 despite $1B in ETF inflows: How low can price go?

Assets under management and equity ETP flows

By assets under management, Bitcoin investment products hold about $141.8 billion, while Ether-linked products account for roughly $26 billion.

Outside of single-asset products, multi-asset crypto ETPs recorded about $104.9 million in weekly outflows, extending net redemptions to roughly $69.5 million YTD, despite holding approximately $6.8 billion in assets under management, according to the data.

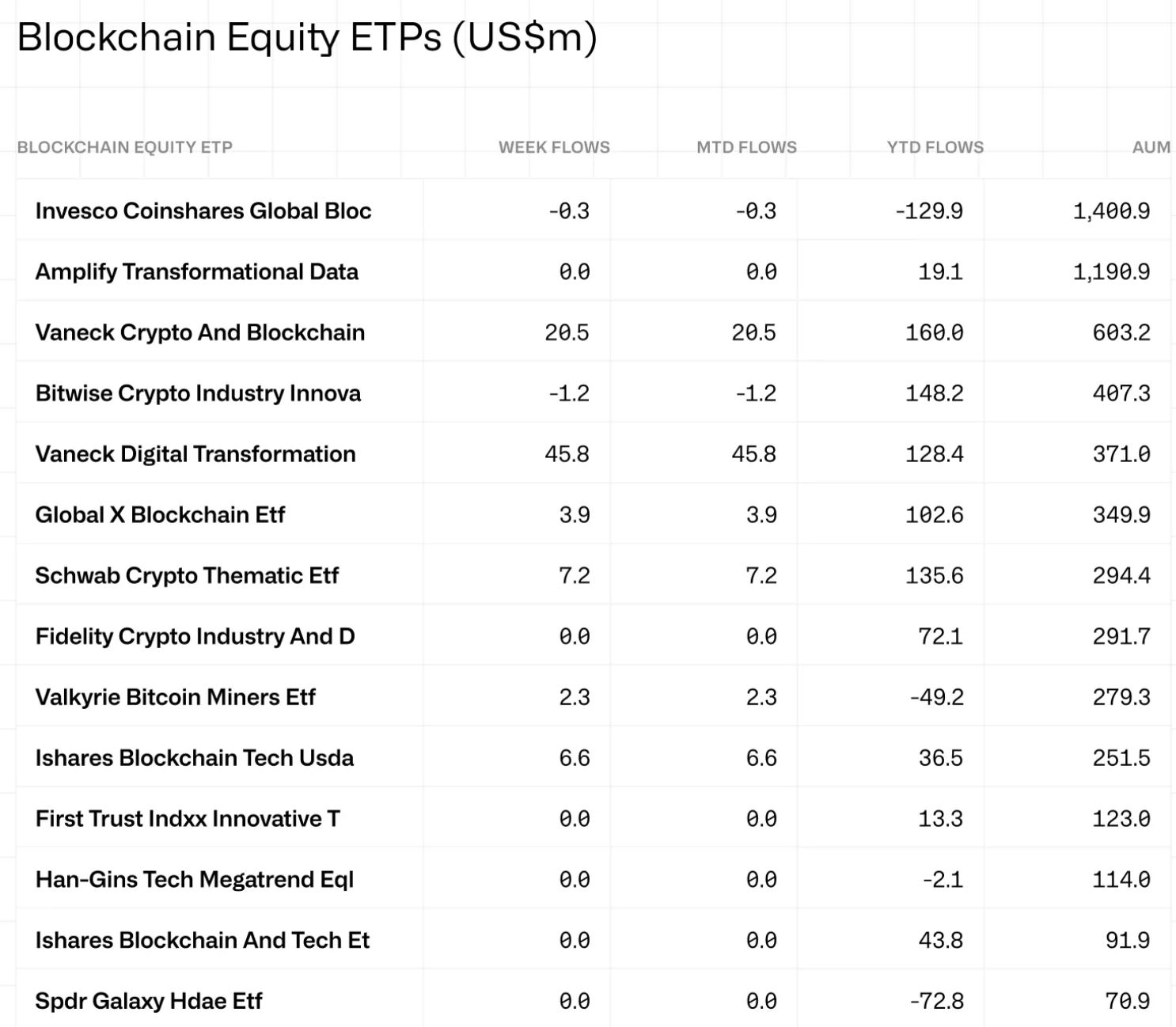

Funds that invest in publicly traded blockchain-related companies saw mixed investor flows during the week. VanEck’s Digital Transformation fund posted the largest weekly inflow at about $45.8 million, followed by VanEck Crypto and Blockchain at roughly $20.5 million and Schwab’s Crypto Thematic ETF at about $7.2 million.

Invesco CoinShares’ Global Blockchain and Bitwise Crypto Industry Innovators ETPs recorded modest net outflows during the week.

Magazine: Big questions: Would Bitcoin survive a 10-year power outage?