The Chainlink (LINK) network has taken a major step in expanding and growing blockchain infrastructure with the introduction of real-time U.S stock and ETF prices on-chain. The recent announcement by the firm claims to unlock $80 trillion worth of assets in equities for decentralised finance, as stated in a recent update.

By further connecting traditional markets and blockchain technology, Chainlink will confidently position itself within the primary data layer for on-chain financial product support.

Most importantly, the development will enable DeFi projects to rely on live equity prices through a support provided by Chainlink’s oracle solution.

As tokenization continues to attract widespread interest, reliable token prices remain a foundational element. Especially for token-based products that include settlements, derivatives and synthetic assets.

LINK reserve activity signals accumulation

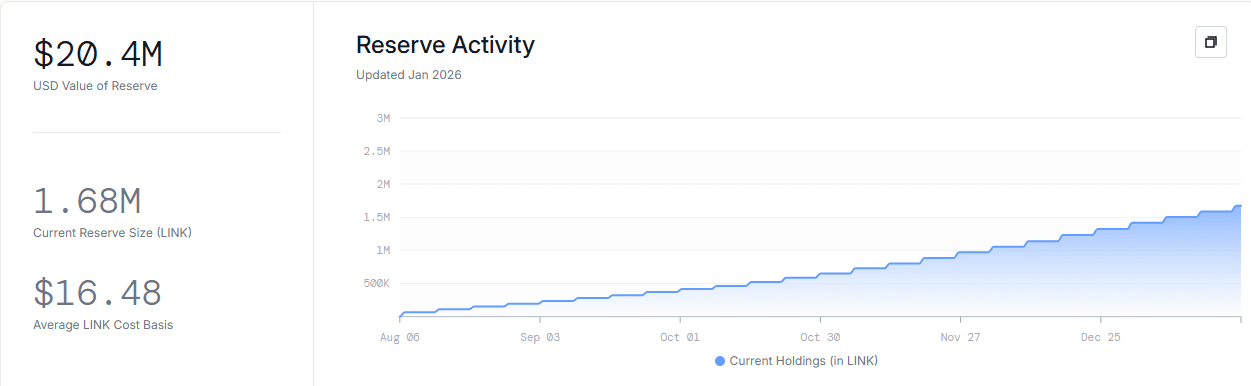

While infrastructure expansion is on its way, there has also been a considerable hike in LINK reserve balances recently. In fact, the reserve balance on the network gained by 88,845.86 LINK in just 24 hours.

At press time, the total holdings stood at 1,675,112.67 LINK – Reflecting a steady increase in reserve-controlled supply.

Historically, such movements have highlighted active treasury management during a period of growing network adoption. For LINK, the reserve accumulation coincides with periods of structural expansion. Especially as infrastructure providers align resources with long-term usage growth.

Derivatives point to a rising institutional participation

Adding to the aforemential bullish indicators, the token’s market participation metrics have also shifted. LINK’s Open Interest, for instance, had climbed to $233 million at the time of writing.

The hike in Open Interest levels highlight LINK’s growing capital mobilization in the derivative markets as traders and investors ramp up their trading activities.

Also, the institutional demand increase aligns with the timing of Chainlink’s latest infrastructure rollout. In the long rum, this can seen as a positive signal for LINK’s price.

What about the number of holders?

Beyond derivatives data, holders’ metrics is worth looking at too. The number of LINK holders has continued to rise steadily, indicating growing distribution across the network.

In fact, the number of holders stood at 177k at press time. LINK holders’ count surge mirrors broader participation, especially during periods when adoption narratives gain visibility.

The expansion into real-time equity pricing, the hike in reserve balances, the upswing in derivatives interest, and the sustained growth in holders all highlight the growing relevance of Chainlink’s network in the context of the tokenized finance industry.

As the line between traditional markets and DeFi continues to blur, Chainlink’s role as a data backbone will remain firmly in focus.

Final Thoughts

- LINK is strengthening its infrastructure role as it brings real-time U.S. stock and ETF prices on-chain.

- Network also recorded greater participation as reserves, Open Interest, and holder counts all registered an uptick.