Written by: Delphi Digital

Compiled by: Nicky, Foresight News

Solana's 2026 roadmap may be the most radical upgrade cycle in the network's history, featuring a comprehensive overhaul from the consensus mechanism to infrastructure, aiming to become the decentralized Nasdaq.

Solana's roadmap aims to transform it into an exchange-grade environment, enabling native on-chain central limit order books (CLOBs) to compete with centralized exchanges (CEXs) in terms of latency, liquidity depth, and fairness. Here are all the upgrades to achieve this goal.

Alpenglow: A Comprehensive Overhaul of the Consensus Mechanism

Alpenglow is the most significant protocol-level change in Solana's history. It introduces a completely new consensus architecture built around two core components: Votor and Rotor.

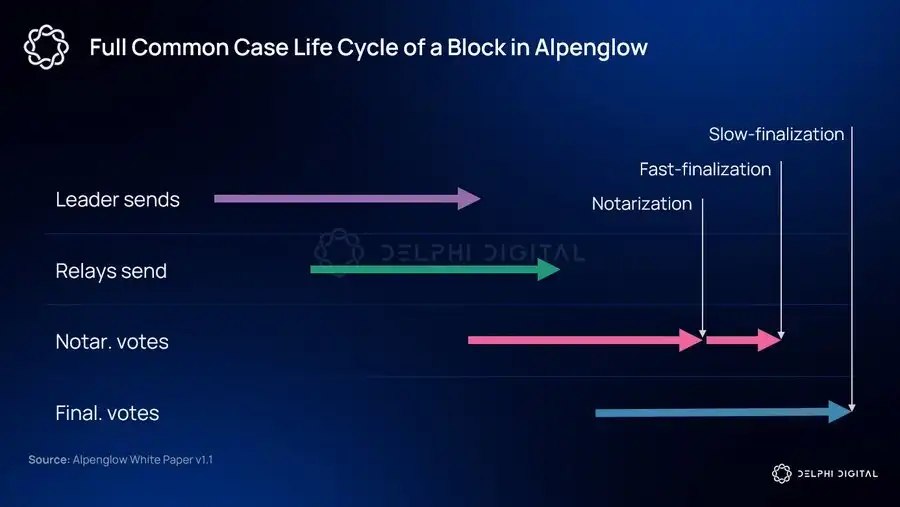

Votor completely revamps how the network reaches consensus. Instead of chaining multiple voting rounds together, it allows validators to aggregate votes off-chain and submit finality within one or two rounds. The result is a theoretical reduction in finality time from the original 12.8 seconds to 100-150 milliseconds.

Votor runs two finality paths in parallel. If a block receives overwhelming support (over 80% stake) in the first round, it is finalized immediately. If support is between 60%-80%, a second round of voting is initiated. If the second round also garners over 60% support, the block is finalized. This design ensures finality even if parts of the network are unresponsive.

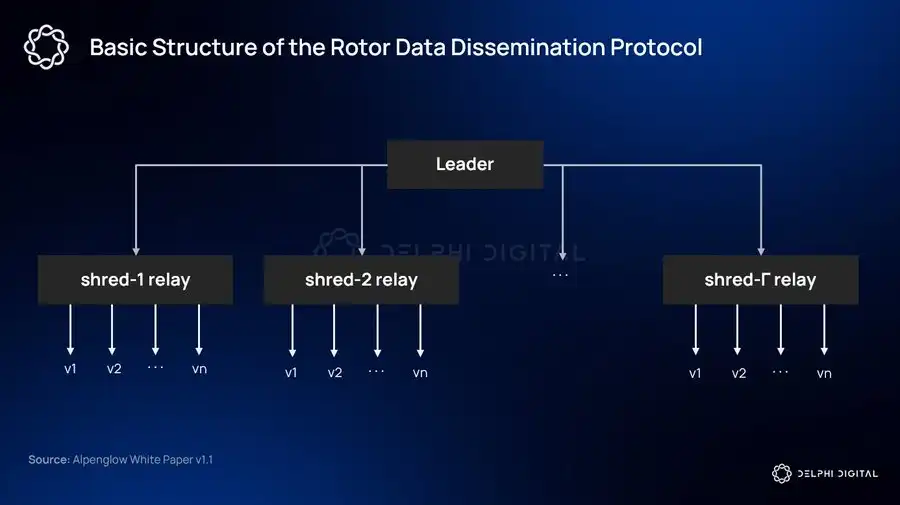

Rotor revolutionizes the block propagation mechanism by routing messages directly through validators with high stake and stable bandwidth.

Alpenglow also introduces a "20+20" resilience model: security is guaranteed as long as malicious stake does not exceed 20%; liveness is maintained even if an additional 20% goes offline. This means Alpenglow can still achieve finality even with up to 40% of the network's nodes being malicious or offline.

Under Alpenglow, the Proof of History mechanism is effectively deprecated, replaced by deterministic epoch scheduling and local timers. This upgrade is expected to launch in early to mid-2026.

Firedancer: Runtime Performance Improvements

Since its inception, Solana has relied on a single validator client (now called Agave). This monoculture has long been a core weakness of the network. Any bug or failure at the client level could lead to a full network outage.

Firedancer is a second, independent validator client developed by Jump, written in C++. Its design goal is to turn Solana validators into deterministic, high-throughput engines capable of handling millions of TPS with minimal latency variance.

Frankendancer is its transitional version, combining Firedancer's network and block production modules with Agave's runtime and consensus components. As Firedancer gradually becomes mainnet-ready, validator diversity is expected to increase significantly.

In this competitive context, both teams have been iterating heavily.

DoubleZero: High-Performance Fiber Infrastructure

DoubleZero is a private network overlay that connects validators via dedicated fiber optic cables, the same infrastructure used by traditional exchanges (like Nasdaq and CME) for microsecond transmissions.

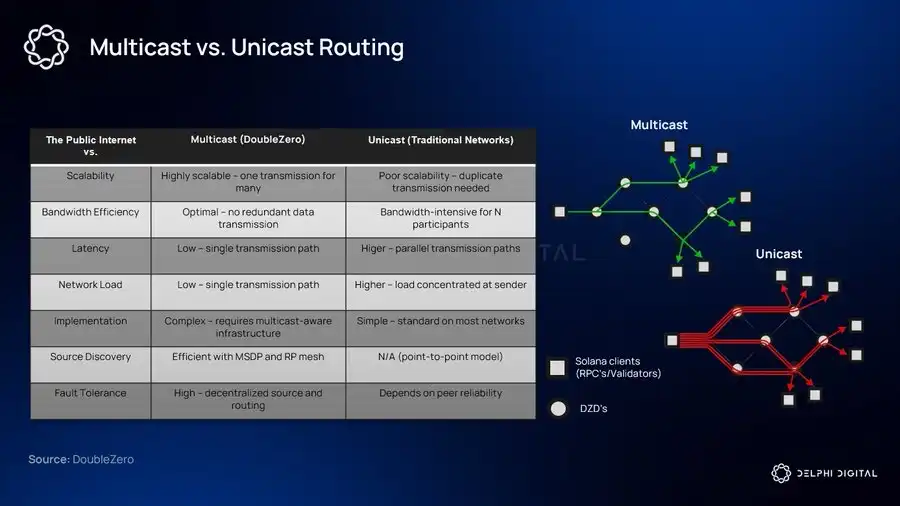

As the validator set expands, information propagation becomes more difficult. More nodes mean more destinations, introducing time inconsistencies in the network. DoubleZero eliminates this variance by routing messages along optimal paths, rather than bouncing around the public internet.

Alpenglow's finality model relies on validators receiving and responding to messages within strict time windows. If propagation is inconsistent, votes arrive late, quorums form slower, and finality takes longer. By narrowing the latency gap between validators, DoubleZero allows Votor to achieve finality faster and enables more uniform propagation for Rotor.

DoubleZero also supports multicast, replicating data within the network and delivering it to all validators simultaneously.

Block Building: BAM and Harmonic

Two complementary trends are reshaping Solana's block building layer:

BAM (Block Assembly Marketplace) is Jito's reimagining of Solana's transaction pipeline. Instead of the slot leader unilaterally deciding transaction ordering, it inserts a market and privacy layer between ordering and execution. Transactions are imported into a Trusted Execution Environment (TEE), meaning neither validators nor builders can see the raw transaction content before ordering is finalized. This prevents opportunistic pre-execution behaviors like front-running.

Harmonic targets another part of the pipeline – who builds the block. It introduces an open block builder aggregation layer, allowing validators to accept block proposals from multiple competing builders in real-time. Think of Harmonic as a meta-market, while BAM is a micro-market.

Raiku: Deterministic Execution Guarantees

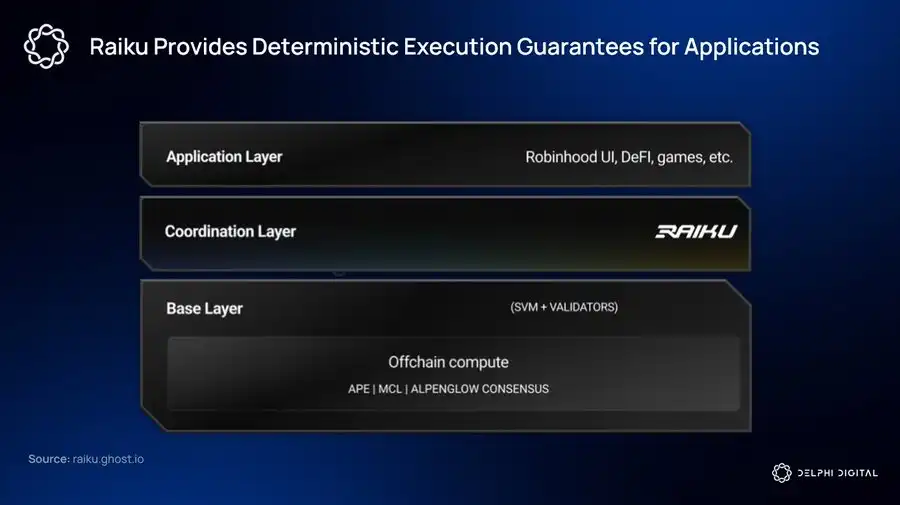

Raiku fills the remaining void. Solana has arguably solved most throughput bottlenecks, but it does not natively provide deterministic latency or programmable execution guarantees for specific applications. The granular control required for high-frequency trading (HFT)-style matching and on-chain central limit order books (CLOBs) far exceeds what an L1 can reasonably provide.

Raiku provides a scheduling/auction layer that runs parallel to the Solana validator set, offering applications a programmable, deterministic pre-execution environment without modifying the L1 consensus mechanism. It achieves guaranteed execution for pre-committed workflows through Ahead-of-Time (AOT) transactions and meets real-time execution needs via Just-in-Time (JIT) transactions.

Bringing Capital Markets On-Chain

Among high-performance public chains, Solana remains the dominant player, but this dominance is meaningless without users and efficient on-chain markets. While the vast majority of meme coins are still traded on Solana, the on-chain perpetual futures market is rapidly consolidating on a few platforms.

To compete with centralized players, performance must be on par. We believe the Solana ecosystem recognizes this issue and is optimistic about closing the gap. The upcoming upgrades are highly anticipated, and new Solana-native perpetual exchanges like BULK are set to launch early in the year.

Retail demand for trading spot assets on Solana remains huge. While Hyperliquid has temporarily captured the perpetuals market, Solana has established itself as the preferred L1 for trading any spot pair. Centralized exchanges still lead significantly, but Solana is currently the go-to solution for on-chain trading.

Products like xStocks are bringing on-chain stocks directly to Solana. Liquidity, price discovery, and speculative attention are converging onto this single chain that offers faster settlement, better user experience, and denser capital.

This is Solana's rationale for bringing capital markets on-chain.