Digital asset platform Exodus has partnered with MoonPay to launch a US dollar-backed stablecoin for everyday payments.

The Exodus Movement, which is also behind a popular crypto wallet, announced on Tuesday that its fully reserved dollar stablecoin is planned for launch in early 2026. The stablecoin will be issued and managed by MoonPay and developed using M0.

M0 is a stablecoin infrastructure platform that allows companies to build, issue, and manage their own custom stablecoins, and MoonPay is a leading crypto payments platform and fiat on-ramp.

The new stablecoin, which was not named, aims to make digital dollar transactions simple for consumers without requiring crypto knowledge, as it will integrate into Exodus Pay, allowing users to spend and send money while maintaining self-custody.

“Stablecoins are quickly becoming the simplest way for people to hold and move dollars onchain, but the experience still needs to meet the expectations set by today’s consumer apps,” said JP Richardson, co-founder and CEO of Exodus.

The stablecoin gold rush continues

MoonPay launched its enterprise stablecoin business in November to issue and manage digital dollars across multiple blockchains while integrating with M0’s open infrastructure.

“Enterprises want stablecoins that are programmable, interoperable and tailored to a specific product experience,” said Luca Prosperi, co-founder and CEO of M0.

Related: US banks could soon issue stablecoins under FDIC plan to implement GENIUS Act

Banks and crypto firms have rushed to offer their own stablecoins this year, spurred by the passage of the GENIUS Act in July, which introduced a clear federal regulatory framework for fiat-backed stablecoins in the United States.

The Trump family DeFi platform, World Liberty Financial, launched the USD1 stablecoin in March, global payments platform Stripe introduced stablecoin-based accounts to clients in over 100 countries in May, and Tether announced a regulatory-compliant stablecoin called USAT in September.

Two stablecoin players dominate the sector

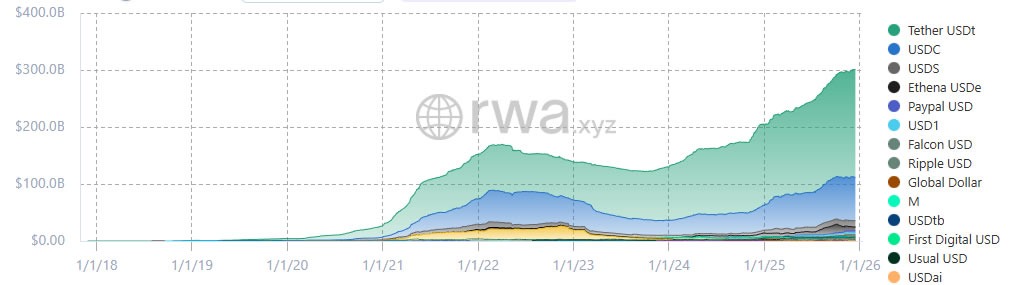

The new Exodus and MoonPay stablecoin is entering a crowded market still dominated by two primary players.

Tether (USDT) remains the biggest stablecoin issuer with a market share of around 60% and a circulating supply of $186 billion, while Circle’s USDC is second with a 25% share and $78 billion market cap.

These two alone comprise 85% of the total stablecoin market capitalization, which is over $310 billion, according to CoinGecko.

Magazine: Do Kwon sentenced to 15 years, Bitcoin’s ‘choppy dance’: Hodler’s Digest