Author|Azuma(@azuma_eth)

The leading lending protocol Aave is embroiled in a public opinion storm. The escalating tensions between the team and the community have objectively shaken the confidence of token holders in the AAVE token itself.

In the early hours of today, the second-largest AAVE whale, excluding the project team, protocol contracts, and CEXs, cut losses and liquidated 230,000 AAVE (worth approximately $38 million), causing AAVE to drop 12% short-term. It is reported that this "number two big brother" purchased their AAVE holdings from late last year to early this year at an average price of $223.4. The average selling price today was about $165, resulting in a final loss of $13.45 million.

- Odaily Note: The whale address is https://debank.com/profile/0xa923b13270f8622b5d5960634200dc4302b7611e.

Origin of the Incident: Dispute Over Fee Flow

To understand the current community crisis at Aave, we need to start with a recent change to the Aave frontend.

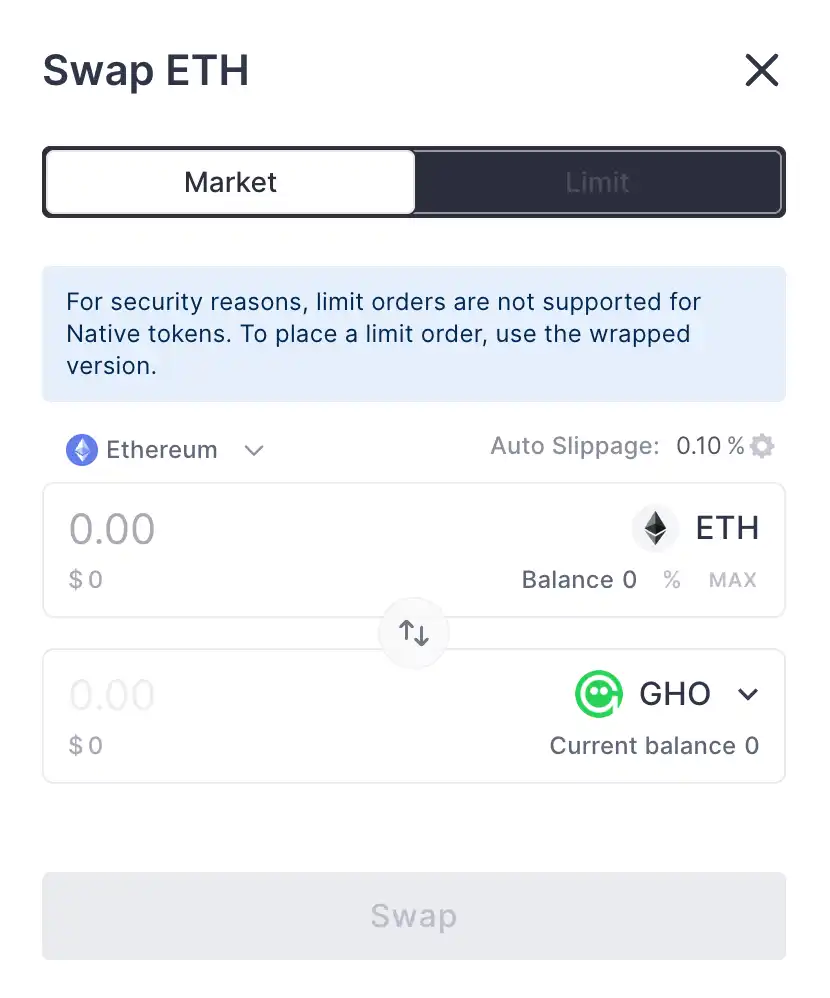

nOn December 4th, Aave announced a partnership with Cow Swap, adopting the latter as the default trading path for the swap function on the Aave frontend (Odaily Note: previously ParaSwap), utilizing its anti-MEV features for better quotes.

This seemed like a normal functional upgrade, but the community soon discovered that while the additional fees generated by this function (including referral fees or positive slippage surplus fees) previously flowed to the Aave DAO treasury address when using ParaSwap, after switching to Cow Swap, they were redirected to the Aave Labs address.

Community representative EzR3aL was the first to notice this unannounced change. They questioned the Aave team in the governance forum and estimated that, just tracking the income flow on Ethereum and Arbitrum, this change could generate approximately $200,000 in weekly revenue, corresponding to an annualized income of over $10 million — meaning Aave had quietly redirected at least tens of millions of dollars in revenue from the community address to the team address.

Core Controversy: Who Really Owns the Aave Brand?

As EzR3aL's post gained traction, a large number of AAVE holders felt betrayed, especially considering Aave made this change without community communication or any disclosure, seemingly intending to conceal it.

In response to community concerns, Aave Labs replied directly under EzR3aL's post, stating that there should be a clear distinction between the protocol layer and the product layer. The swap function interface on the Aave frontend is entirely operated by Aave Labs, which is responsible for the capital investment, construction, and maintenance. This function is completely independent of the DAO-managed protocol, therefore Aave Labs has the right to independently decide how to operate and profit... The revenue previously flowing to the Aave DAO address was a donation from Aave Labs, but not an obligation.

In short, Aave Labs' stance is that the frontend interface and its ancillary functions are essentially team products, and the revenue generated should be considered company property, not to be conflated with the protocol and its revenue controlled by the DAO.

This statement quickly sparked heated debate within the community regarding the ownership of the Aave protocol versus its products. A well-known DeFi analyst wrote an article titled "Who Really Owns 'Aave': Aave Labs vs Aave DAO," which Odaily Planet Daily also translated into Chinese for supplementary reading.

On December 16th, the conflict intensified further. Former Aave CTO Ernesto Boado initiated a proposal in the governance forum requesting the transfer of control over Aave brand assets (including domain names, social media accounts, naming rights, etc.) to AAVE token holders. These assets would be managed through a DAO-controlled entity (the specific form to be determined later) with strict anti-encroachment protection mechanisms.

The proposal received nearly ten thousand views and hundreds of high-quality replies within the Aave governance forum, with various participants in the Aave ecosystem weighing in. Although some voices felt the proposal's execution plan was imperfect and risked exacerbating divisions, the majority of responses expressed support.

Founder's Statement Fails to Placate Community

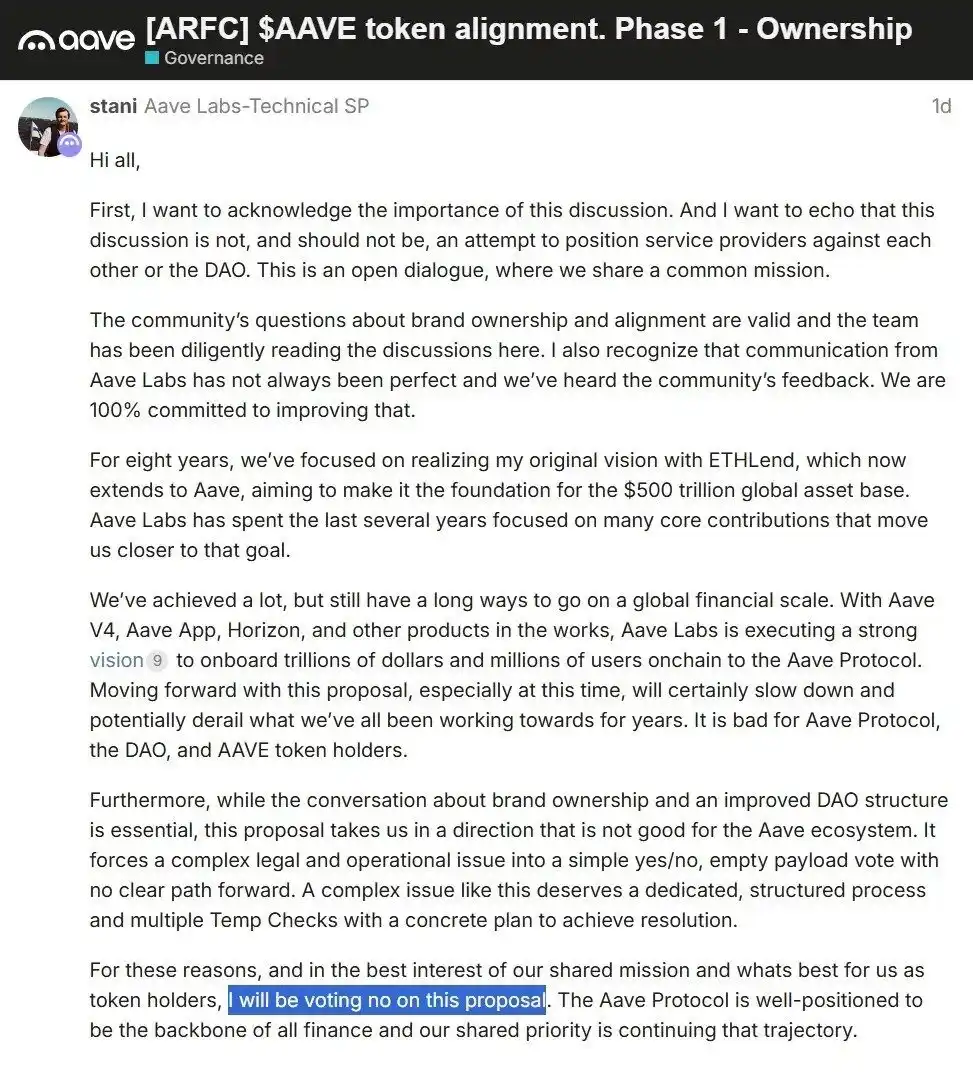

As community sentiment heated up, Aave founder Stani responded in the forum: "...This proposal leads us in a direction unfavorable to the Aave ecosystem. It attempts to reduce a complex legal and operational issue to a simple 'yes/no' vote without providing a clear execution path. Handling such a complex issue should involve a specially designed, structured process, achieving consensus through multiple interim checks accompanied by specific solutions. For the reasons above, I will vote against this proposal..."

From a business operations perspective, Stani's claim that the proposal is too rash might not be wrong. However, in the current discussion atmosphere, this statement was easily interpreted as 'the Aave founder disagrees with transferring brand assets to token holders,' which obviously further intensified the对立情绪 (oppositional sentiment) between the community and the team.

After Stani's statement, even some aggressive comments targeting Stani appeared under the original post. More users expressed their discontent via the forum or social media. An OG user mentioned it was the first time they considered liquidating their AAVE, and a loyal AAVE believer stated: "AAVE holders should realize this is just another DeFi shitcoin. It's neither better nor worse than the others."

The latest community activity is the "number two big brother" cutting losses and exiting with millions in losses mentioned at the beginning of this article.

Can AAVE Still Be Bought?

Just two weeks ago, Odaily Planet Daily wrote an article titled "What Do the Smart Money Frantically Buying AAVE at Lows See?". At that time, AAVE was still a favorite of top institutions like Multicoin Capital. Its优质的信誉 (high-quality brand reputation),雄厚沉淀资金 (substantial deposited funds),清晰的扩展路径 (clear expansion path),强劲的收入与回购流水 (strong revenue and buyback flow) all proved AAVE was a 'true value token' different from other altcoins.

But in just two weeks, a舆论危机 (public opinion crisis) spanning fee ownership, brand control, and team-community relations has rapidly plunged AAVE from "value token representative" into the center of controversy, even landing it on the short-term top decliners list due to emotional impact.

As of writing, Aave Labs has stated under Ernesto's proposal that they have initiated an ARFC snapshot vote on the proposal, allowing AAVE token holders to formally express their stance and clarify the future direction. The outcome of this vote and the subsequent handling attitude of the Aave Labs team will undoubtedly significantly impact Aave's community faith and AAVE's short-term price performance.

It is important to emphasize that this incident is not merely "bad news" or a "performance change," but a集中拷问 (集中拷问 - concentrated interrogation) of Aave's existing governance structure and the boundaries of rights.

If you believe Aave Labs will still maintain高度一致 (high alignment) with Aave DAO regarding long-term interests, and the current friction is more of a communication and process失误 (mistake), then the price pullback led by emotion might be a good entry window. But if you believe this controversy exposes not an occasional problem, but a结构性矛盾 (structural contradiction) of long-term unclear rights between the team and the protocol, lacking institutional constraints, then this storm might just be the beginning.

From a broader perspective, Aave's controversy is not an isolated case. As DeFi matures, protocol revenue becomes substantial and real, and brands and frontends begin to possess commercial value, structural contradictions between protocols and products, teams and communities will surface. Aave is under the spotlight this time not because it is more wrong, but because it has gone further.

This debate over fees, brand, and control rights poses a question that needs answering not just by AAVE, but is an inevitable question the entire DeFi industry must eventually face.