The digital asset infrastructure innovation team Unitas has announced the launch of a new market-neutral yield infrastructure standard. By constructing a "Yield Layer" for digital assets, Unitas is committed to providing professional market-neutral returns to global users based on full transparency and institutional-grade risk control.

Modular Architecture: Reshaping the Accessibility of Yield Services

Unitas provides a modular yield service platform designed to achieve sustainable capital growth without taking on market directional risk. Through a unified infrastructure, the platform decouples capital access, asset custody, and yield execution, serving not only individual investors but also meeting the stringent security and compliance requirements of corporate and institutional treasuries.

Proprietary Core Engine: Mastering the Full Lifecycle of Yield Execution

Different from the "strategy outsourcing" model that relies on third-party protocols, Unitas's core competitiveness lies in its self-developed, self-operated, and self-managed yield engine. Unitas controls the entire lifecycle from signal generation and trade execution to real-time monitoring and risk response.

Currently, the platform operates multiple market-neutral strategies in parallel under a unified risk framework:

-

Liquidity-Driven Delta Neutral Strategy: Captures real transaction fees and incentives in on-chain liquidity pools, supplemented by dynamic hedging, ensuring returns stem from market activity rather than price fluctuations.

-

Funding Rate and Basis Arbitrage: Captures structural price differences between spot and futures in derivative markets.

By integrating these strategies within a single system, Unitas achieves yield diversification while maintaining extremely high control over exposure, leverage, and liquidity.

System-Embedded Risk Control: Robust Performance in Extreme Market Conditions

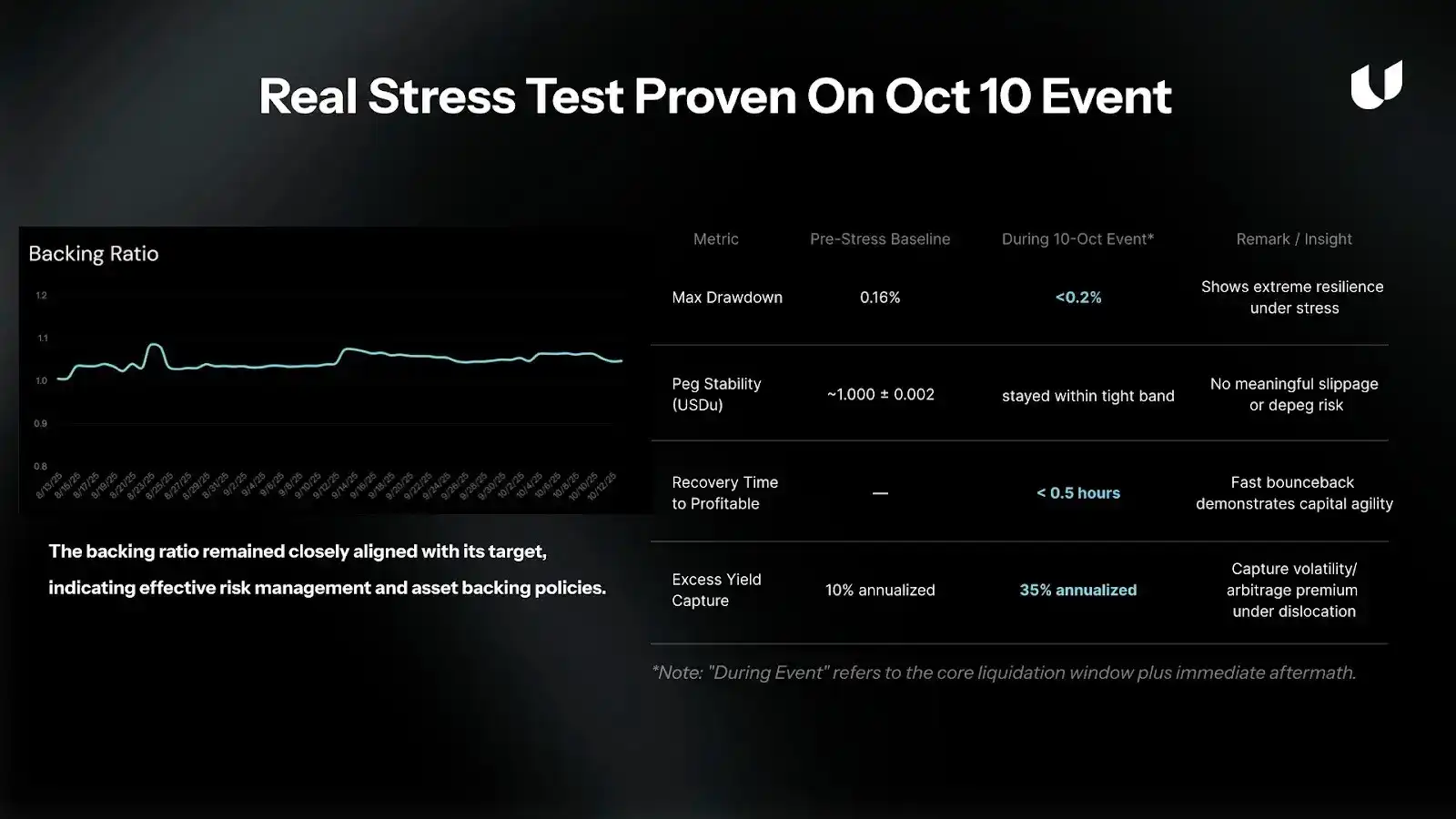

Unitas deeply embeds risk control into the strategy execution layer. The system monitors net exposure, margin utilization, and hedge deviation in real-time, using them as hard constraints for position adjustments.

Its execution mechanism prioritizes "robustness" over mere response speed. During periods of severe market volatility, the system proactively limits adjustment frequency to avoid slippage risk and combines it with a "24/7 manual real-time supervision" model to ensure precise human-machine collaborative intervention under abnormal conditions.

Practical Data Validation: Exceptional Resilience Across Cycles

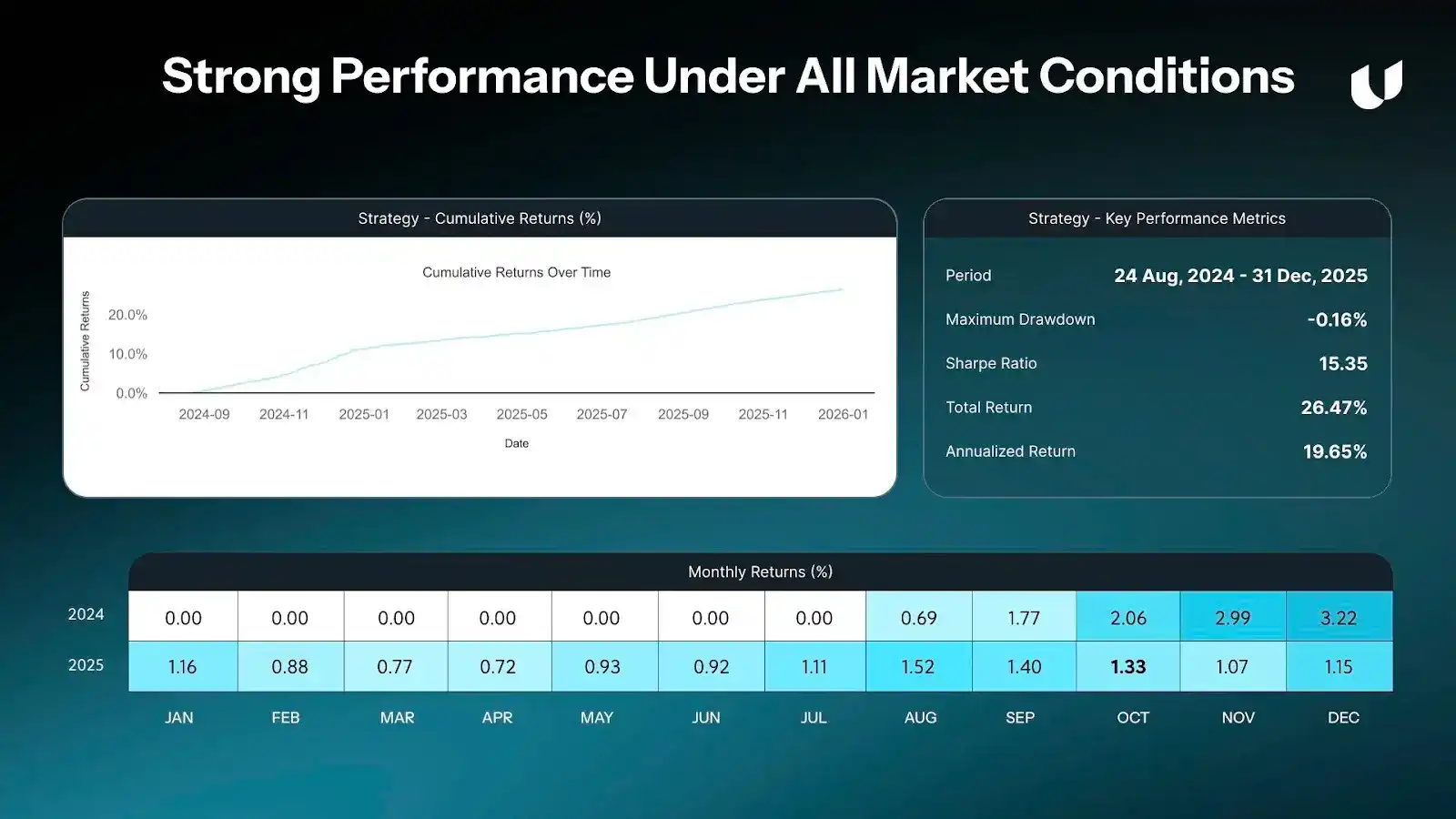

Data statistics show that throughout 2025, with a deployment scale of approximately $25 million, Unitas achieved an average net annualized yield of 16.7%, with a Maximum Drawdown of only -0.16%.

Especially during periods of extreme market volatility, such as on October 10, 2025, Unitas achieved zero actual losses through disciplined execution, with drawdowns始终控制在 0.2% 以内. This performance strongly demonstrates its实战 capability under real market depth and risk constraints, not just in experimental environments.

Transparency and Future Vision: Bridging Web3 and Traditional Finance

Unitas adheres to a high degree of audit transparency. Yield distribution is based entirely on actual performance, and collateral status and risk parameters are disclosed in real-time, eliminating "black box" concerns for users seeking long-term stable returns.

Looking ahead to 2026, Unitas's vision will extend further into the traditional finance (TradFi)领域. The platform plans deep integration with compliant institutions, treasury management platforms, and settlement systems. Its roadmap includes expanding the yield engine to real-world assets (RWA), such as tokenized stocks, commodities, and other structured notes, while maintaining consistent market-neutral logic and risk control standards.

By decoupling yield generation and distribution, Unitas aims to become the underlying cornerstone supporting savings, treasury management, and cross-border settlement, building a unified yield infrastructure spanning decentralized and traditional financial systems.