Bitcoin is holding firm above the $92,000 level after rebounding from a brief dip to $90,000, but market sentiment remains decisively bearish. Despite the crypto market stabilization, confidence is fragile as traders brace for heightened volatility ahead of the December FOMC meeting. Bulls are attempting to regain momentum, yet the broader market continues to position defensively.

According to a detailed report by XWIN Research Japan, crypto hedge funds and large institutional players are shifting into clear risk-off mode. On-chain data reveals a notable divergence: BTC balances on centralized exchanges are falling, while USDT and USDC reserves are steadily climbing.

This behavior indicates that professional investors are reducing direct crypto market exposure and instead building up stablecoin liquidity on exchanges—capital that can be deployed rapidly depending on the FOMC outcome.

This rise in Stablecoin Exchange Reserves is a textbook sign of event-driven hedging. Institutions are preparing for volatility rather than betting outright on a directional move. Historically, such positioning emerges when markets expect meaningful policy decisions that could reshape short-term liquidity conditions.

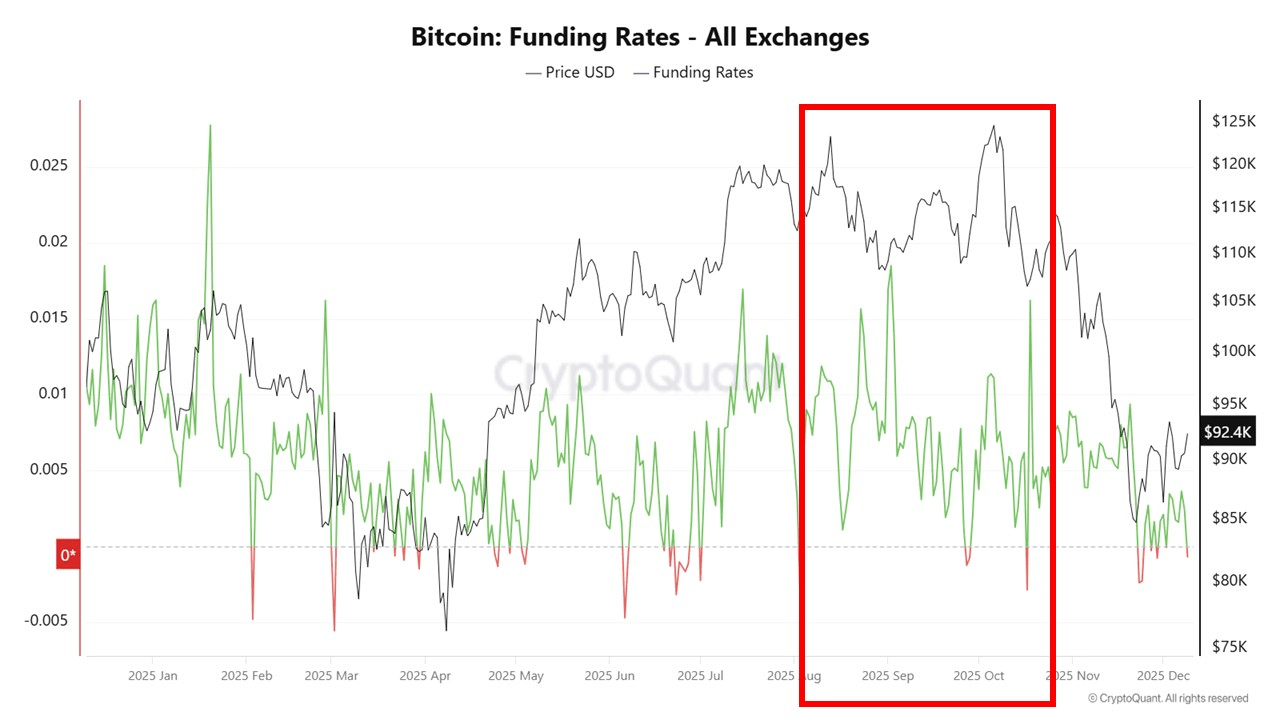

Funding Rates Reveal the Market’s True Positioning

According to the XWIN Research Japan report, Funding Rates make the current crypto market structure even clearer. During the August–October 2025 period, funding surged as short-term traders aggressively loaded into long positions ahead of the FOMC decision, only to collapse sharply once the announcement was released.

Bitcoin’s price followed the same pattern: a strong pre-event rally driven by expectations, followed by a swift reversal as leveraged traders were forced to unwind. This fits the historical sequence of rate-cut expectations followed by a temporary rally, and a post-announcement deleveraging and decline.

The report highlights that today’s crypto market is showing similar behaviors. CME futures open interest has stalled, signaling that institutional traders are avoiding high-conviction directional bets. Whale spot holdings remain flat, suggesting that major players are positioned defensively rather than accumulating. At the same time, stablecoin inflows are accelerating, a hallmark of event-driven hedging as capital waits on the sidelines for clarity.

As XWIN Research Japan notes, whether the Fed cuts rates or not, one pattern remains consistent: volatility expands sharply during FOMC week. The danger lies in chasing the pre-meeting bounce without respecting the historical tendency for post-announcement shakeouts. In this environment, risk management—not prediction—is the winning strategy.

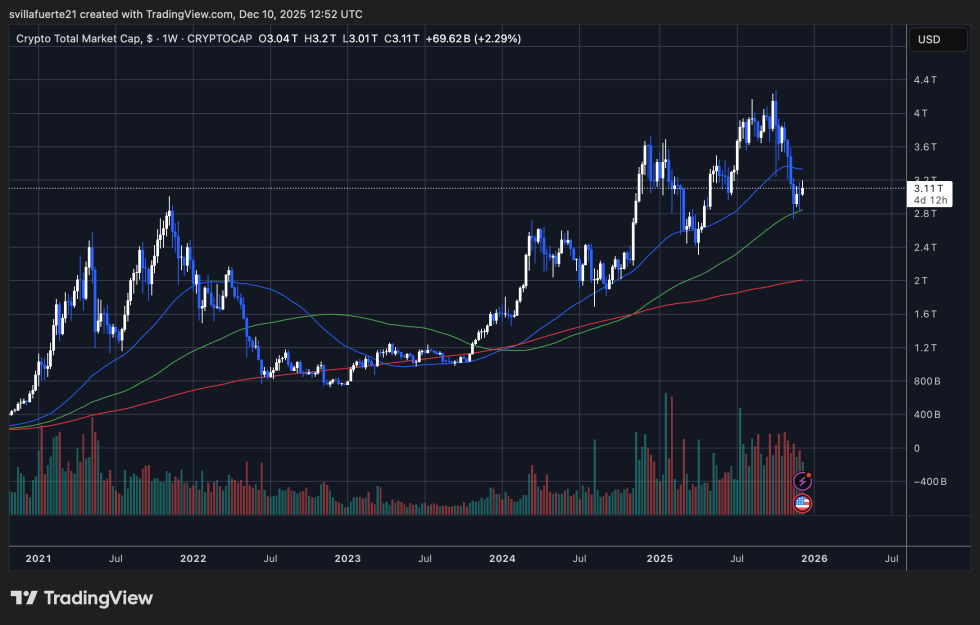

Total Crypto Market Cap Holds Key Support But Lacks Momentum

The Total Crypto Market Cap chart shows the market stabilizing around the $3.1 trillion level after a sharp multi-week decline. This area sits just above the 100-week moving average, a historically important dynamic support zone that often defines whether the broader cycle maintains bullish structure or shifts into deeper corrective territory. For now, buyers have stepped in to defend this region, preventing a breakdown that could have opened the door to a retest of the $2.7T–$2.8T area.

Despite the bounce, the structure remains fragile. The market is still trading below the 50-week moving average, which has now begun to bend downward—a sign that momentum has weakened across major assets like Bitcoin, Ethereum, and key altcoins. Volume has not shown a strong surge on the rebound either, suggesting that institutional conviction remains cautious ahead of the FOMC meeting and macro uncertainty.

A decisive reclaim of the $3.3T–$3.4T zone would shift momentum back in favor of bulls, opening room for a broader recovery. However, failure to break above this cluster of resistance could reinforce the idea that the recent bounce is only corrective. For now, the total market cap hovers at a crossroads, with macro events likely to determine the next major move.

Featured image from ChatGPT, chart from TradingView.com