Daily key market data review and trend analysis, produced by PANews.

1. Market Observation

Against a backdrop of complex global macroeconomics and geopolitics, the market is undergoing a profound revaluation of asset values. The U.S. Dollar Index (DXY) fell to a four-year low, and Trump expressed no concern, even stating that he could manipulate the dollar to rise and fall like a "yo-yo." Geopolitically, while the U.S. has briefed Israel on preparations for action against Iran, the two sides are currently communicating through informal channels. In this environment, gold prices surged strongly, with spot gold once breaking through $5,270 per ounce, hitting a new all-time high, up nearly 22% this month, and domestic gold jewelry prices exceeded 1,610 yuan per gram.

Silver has risen over 60% this month, with the price surge triggering a frenzy among retail investors. The world's largest silver ETF (iShares Silver Trust) recorded a record single-day inflow of funds, prompting the CME to raise margins on some silver futures contracts to cope with the extreme volatility. Institutions like Citigroup and BMO Capital Markets (BMO) have issued extremely bullish views. Citigroup predicts that silver could reach $150 within the next three months and notes that gold's pricing mechanism is shifting from traditional mining costs to being determined by global wealth allocation demand and rigid supply. In a bull scenario, gold prices could soar to $6,000. BMO similarly believes that changes in the global landscape have created a historic opportunity for precious metals, with its bullish model forecasting gold prices could reach $8,650 by the end of 2027.

However, not all seasoned investors are caught up in the frenzy. Commodities legend Rick Rule revealed he has sold most of his physical silver holdings, shifting profits into what he considers more leveraged silver mining stocks and gold as a store of value. Meanwhile, the Bank of Thailand intervened to curb trading volume and prohibit short selling in response to pressure on the Thai baht from gold trading. Looking ahead, market attention is focused on the Federal Reserve's interest rate decision at 3 a.m. ET on Thursday. Although the market widely expects rates to remain unchanged, Chairman Powell's speech will provide crucial guidance amid political pressure and mixed economic data. Additionally, Google Cloud announced price hikes, and the market awaits earnings guidance from the tech "Magnificent Seven", with industry giants broadly focused on how inflation and geopolitical risks are reshaping the macroeconomy.

Bitcoin, after falling to $86,000 on Sunday, has been approaching $90,000 and is currently hovering around $89,000, facing the risk of a rare fourth consecutive monthly decline since 2018. The main market pressure stems from continuous outflows from spot Bitcoin ETFs. Data from Wintermute and analyst Murphy show that selling pressure in the U.S. market is dominating the direction, and the net stablecoin holdings on exchanges have turned negative, indicating weakened buying power. Technically, analyst Rekt Capital pointed out that Bitcoin's weekly 21-day and 50-day moving averages have formed a death cross for the first time since the 2022 bear market. Analyst KillaXBT believes that losing the $90,000 level means the market structure has turned bearish.

Despite the cautious market sentiment, derivatives markets and some technical indicators still hint at optimism. With nearly $8.5 billion in notional value of options expiring on January 30th, data shows traders have strong interest in $100,000 call options, though analysis suggests this may be more about complex arbitrage strategies than direct bullish bets. Glassnode analysis shows that while demand for call options is strong recently, it is mainly short-term, with long-term risks not being repriced. On the other hand, a joint study by Swissblock and analyst Willy Woo found that Bitcoin's price and RSI indicator are forming a bullish divergence, suggesting a short-term rebound to $95,000 is possible. BitMEX founder Arthur Hayes proposed a macro catalyst theory, suggesting that the Fed's "stealth money printing" to intervene in the yen and Japanese government bond markets will ultimately inject liquidity into risk assets like Bitcoin. Overall, Bitcoin is in a critical consolidation range, with the support level of $85,000 being tested, while facing resistance from ETF selling pressure and bearish technical patterns. The market is waiting for a decisive catalyst to break the deadlock.

Ethereum has shown some independent resilience, with its price rebounding above $3,000. Although short-term implied volatility reached 63%, fundamental data is positive, with Layer2 weekly transaction volume surging to 128 million and network fees up 19%. Additionally, from the derivatives market, Ethereum's put/call ratio has neutralized after a brief spike in hedging, indicating recovering confidence among professional traders. Cointelegraph analysis points out that on-chain metrics suggest a potential rebound to $3,300.

In the altcoin market, three major 1INCH investor wallets sold over 36 million tokens, causing the price to plummet 20%, exposing the普遍存在的liquidity fragility in the altcoin market. Analyst Yu Jin pointed out that although 1INCH has a circulating market cap of $180 million, its liquidity is extremely poor, with its real daily trading volume on Binance being only about $340,000.

Meanwhile, some retail speculative enthusiasm has shifted to commodities, with silver ETFs seeing record inflows. VandaTrack analysts noted that silver has become a new favorite among retail investors, with trading热度 even surpassing Nvidia. Tom Sosnoff, founder of the U.S. financial platform LossDog, described the silver surge as "meme-stock"-style狂热trading.

2. Key Data (As of January 28, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

-

Bitcoin: $89,061 (Year-to-date +1.82%), Daily Spot Volume: $50.36 billion

-

Ethereum: $3,001 (Year-to-date +1.02%), Daily Spot Volume: $30.47 billion

-

Fear & Greed Index: 29 (Fear)

-

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

-

Market Dominance: BTC 59.2%, ETH 11.8%

-

Upbit 24-hour Trading Volume Ranking: SXP, AXS, XRP, BTC, ETH

-

24-hour BTC Long/Short Ratio: 50.22% / 49.78%

-

Sector Performance: Crypto market slightly up, only GameFi and DePIN sectors weak and declining

24-hour Liquidation Data: 76,134 people liquidated globally, total liquidation amount $261 million, including BTC liquidations $71.398 million, ETH liquidations $72.508 million, HYPE liquidations $22.88 million

3. ETF Flows (As of January 27)

-

Bitcoin ETF: -$147 million

-

Ethereum ETF: -$63.5334 million

-

XRP ETF: +$9.16 million

-

SOL ETF: +$1.87 million

4. Today's Outlook

-

Binance Alpha to list Moonbirds (BIRB)

-

Binance to list the fifth Prime Sale Pre-TGE project Zama (ZAMA)

-

Google will remove unregistered overseas crypto exchange apps from the Korean app store starting January 28

-

U.S. Senate Agriculture Committee to review crypto market structure bill on January 29

-

Microsoft, Tesla, Meta, IBM to release earnings after market close on January 28

-

U.S. Federal Reserve FOMC Interest Rate Decision (Lower Bound): Expected 3.5%, Previous 3.5% (January 29, 03:00 ET)

-

U.S. Federal Reserve FOMC Interest Rate Decision (Upper Bound): Expected 3.75%, Previous 3.75% (January 29, 03:00 ET)

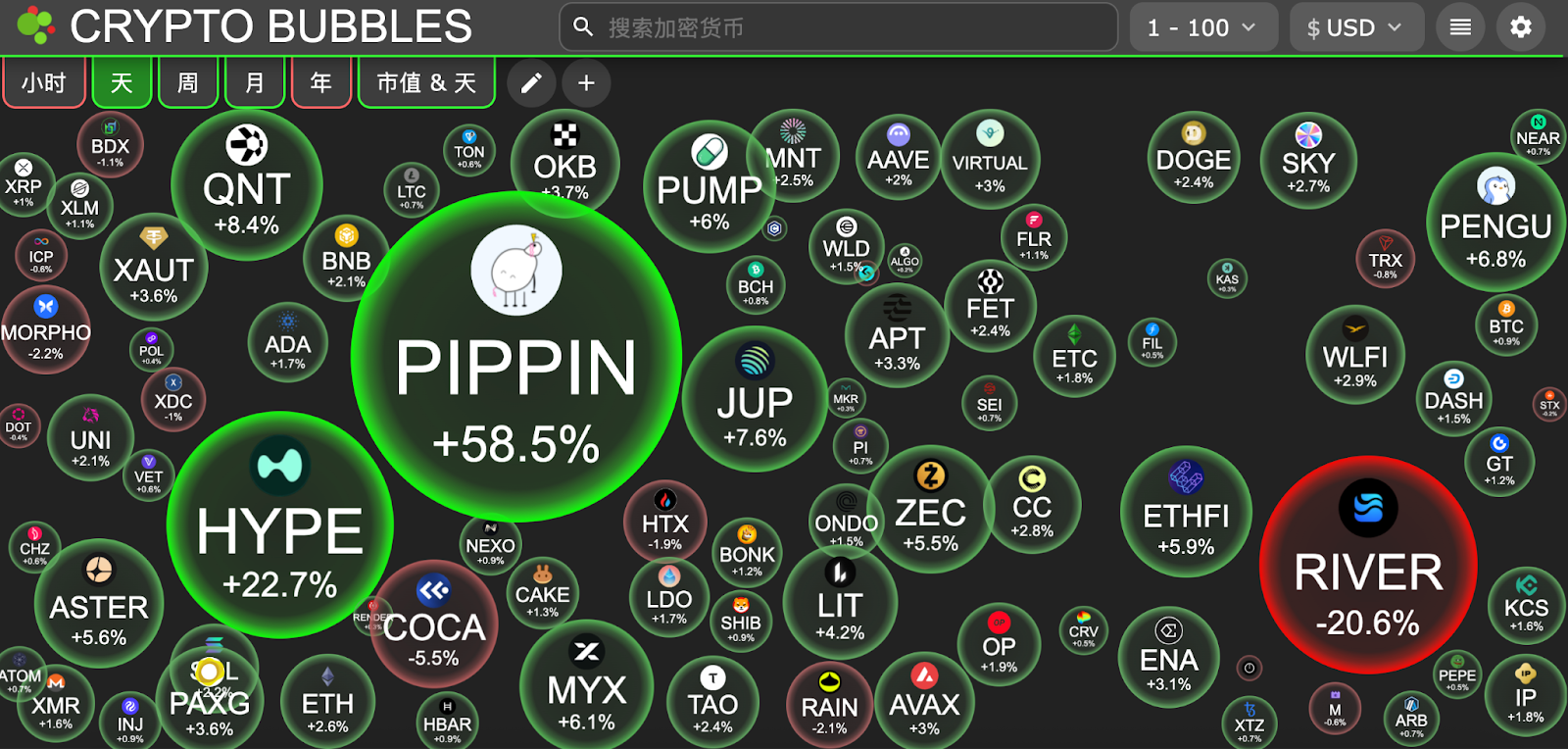

Today's Top Gainers Among Top 100 Coins by Market Cap: Pippin up 58.6%, Hyperliquid up 22.5%, Quant up 8.4%, Jupiter up 7.4%, Pudgy Penguins up 6.6%.

5. Hot News

-

Bitwise has registered the "Bitwise Uniswap ETF" in Delaware

-

ERC-8004 to launch on Ethereum mainnet, supporting AI agent cross-organizational interaction and reputation flow

-

A whale withdrew 1,000 BTC from OKX in the past 17 hours, worth $89.2 million

-

Bitmine staked approximately 113,200 ETH again, cumulative staked value reaches $6.82 billion

-

A whale holding HYPE long positions has unrealized profits exceeding $12 million

-

Spot gold breaks above $5,200 for the first time

-

Tether holds approximately 140 tons of gold, worth about $23 billion

-

CME crypto derivatives traded nearly $3 trillion in notional principal in 2025

-

1INCH liquidity concerns, one sell order causes a top market cap token to plunge 13%

-

American Bitcoin added 416 BTC, total holdings reach 5,843 BTC

-

Dormant Ethereum whale transferred 135,000 ETH to Gemini this week