High-net-worth individuals in the Asia Pacific region are becoming increasingly bullish on crypto assets, with more than half planning to increase their portfolio exposure, according to a new survey.

It found that 6 in 10 of the surveyed Asian high-net-worth individuals (HNWIs) are prepared to increase their crypto allocations based on a strong two- to five-year outlook, according to Sygnum’s APAC HNWI Report 2025.

The results of the survey, released on Thursday, revealed that Asian private wealth has “moved decisively into digital assets,” and is now expecting traditional wealth managers to catch up.

The findings also revealed that an overwhelming 90% of surveyed HNWIs view digital assets as “important for long-term wealth preservation and legacy planning, not purely speculation.”

“Digital assets are now firmly embedded within APAC’s private wealth ecosystem,” said Gerald Goh, Sygnum co-founder and APAC CEO.

“Despite near-term macro uncertainty, we continue to see accelerating adoption driven by strategic portfolio diversification, intergenerational wealth planning, and demand for institutional-grade products.”

This represents a fundamental shift from crypto as a speculative asset to an institutional wealth management product.

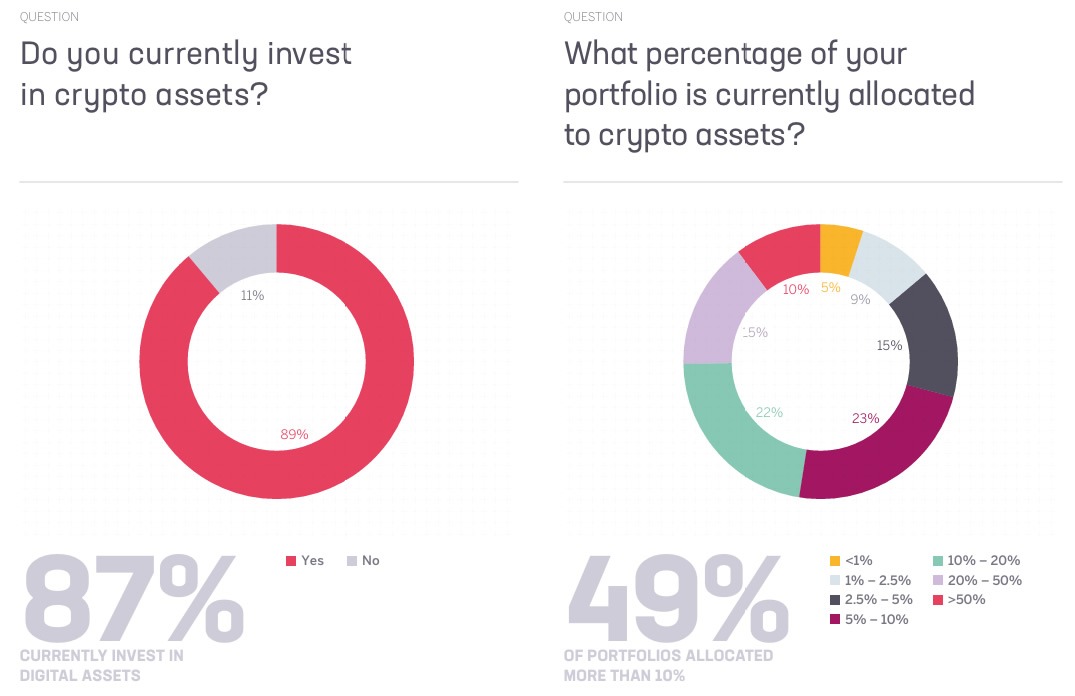

More than half of portfolios hold over 10% crypto

The survey revealed that 87% of Asian HNWIs already hold crypto, and around half have an allocation of more than 10%. The average portfolio allocation is around 17%.

87% of investors also said they would ask their private bank or adviser to add crypto services if offered through regulated partners.

Meanwhile, 80% of those actively investing reported holdings in blockchain protocol tokens, such as Bitcoin (BTC), Ether (ETH) and Solana (SOL). The most common reason for investing, according to 56% of respondents, was portfolio diversification.

“APAC is rapidly becoming one of the world’s fastest-growing and most important digital asset gateways, and we expect this momentum to strengthen further into 2026,” Goh said.

Related: Ripple’s big Singapore win: What the expanded license allows now

The survey polled 270 HNWIs with more than $1 million in investable assets and professional investors with over ten years of experience across ten APAC countries, mostly in Singapore, but including Hong Kong, Indonesia, South Korea and Thailand.

Magazine: XRP’s ‘now or never’ moment, Kalshi taps Solana: Hodler’s Digest