Key takeaways:

US-listed Ether ETFs saw heavy outflows, signaling fading institutional interest as network fees, staking and leverage demand declined.

ETH futures premiums and open interest declined, indicating cautious positioning and limited confidence, without a clear shift to outright bearishness.

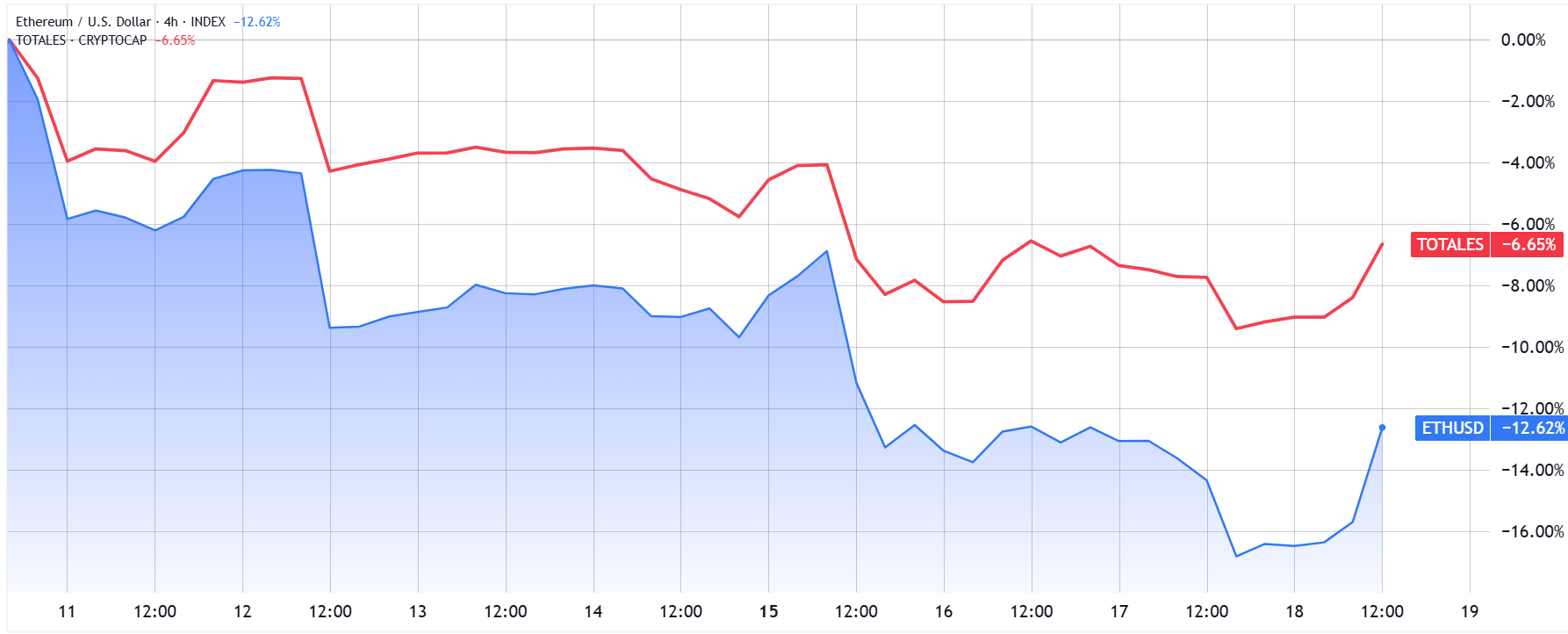

Ether (ETH) plunged to $2,800 on Wednesday, triggering $165 million in liquidations across bullish futures positions. The 13% weekly decline in the ETH price was accompanied by strong outflows from Ethereum exchange-traded funds (ETFs), as risk aversion intensified amid concerns about the artificial intelligence sector.

The tech-heavy Nasdaq index fell 1.8% on Wednesday, reinforcing fears among Ether investors that further downside could follow.

Oracle (ORCL US) shares dropped 5.5% on Wednesday after private lender Blue Owl Capital (OWL US) reportedly withdrew support for a planned $10 billion data center partnership. Investor sentiment weakened after reports that Blue Owl Capital had previously participated in Oracle facilities in Texas and New Mexico. The rising cost of Oracle’s debt protection has sparked a broader risk-off movement.

Markets are now focusing on Thursday’s release of the US Consumer Price Index (CPI) report, a pivotal event for risk assets. November’s weaker-than-anticipated 2.7% CPI growth allowed Ether price to reclaim the $2,950 level. Traders suggest this cooling inflation could prompt the Federal Reserve to introduce additional economic stimulus, especially as recent figures indicate growing stress within the labor market.

What is keeping ETH price down?

Ether has underperformed the broader cryptocurrency market by 6% over the past week, with part of the bearish sentiment tied to demand for Ether ETFs.

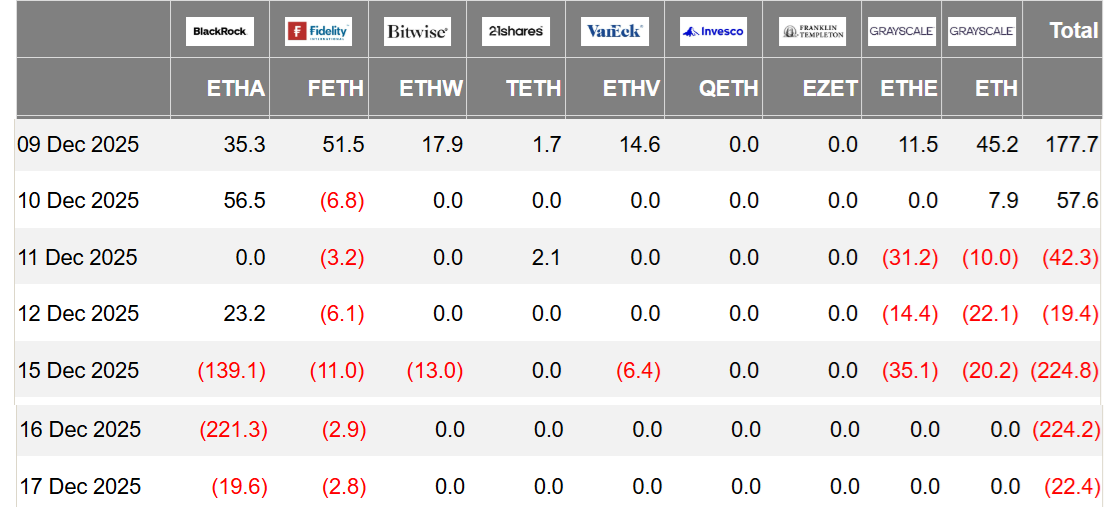

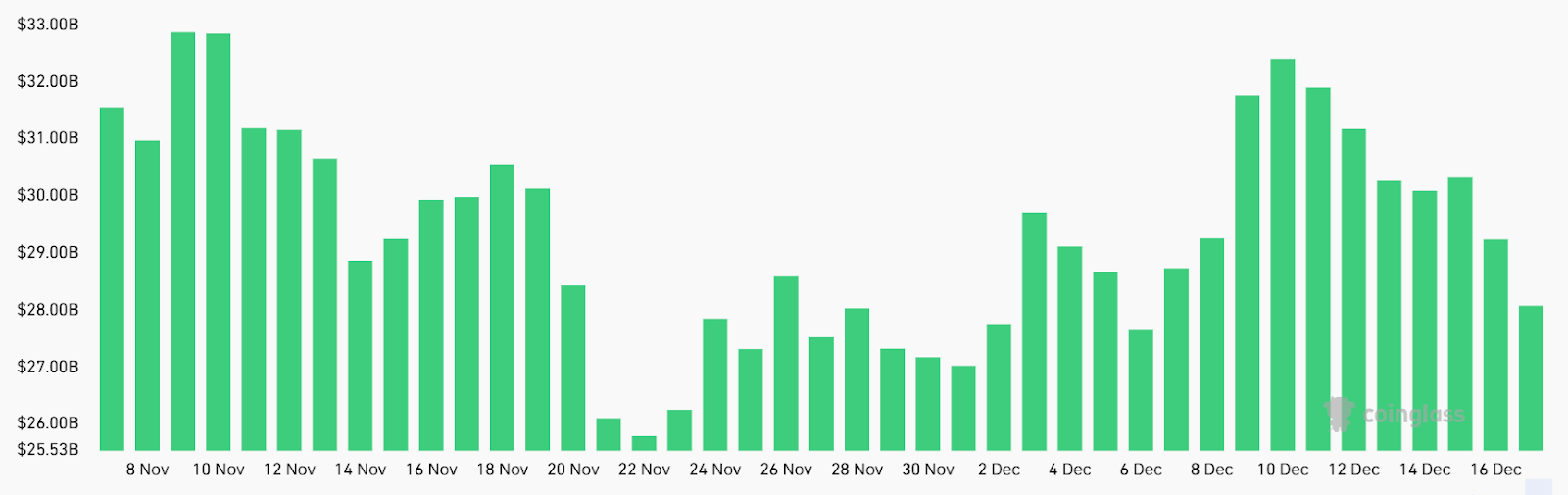

US-listed Ethereum ETFs recorded $533 million in net outflows since Thursday, reversing the inflow trend seen over the prior two days. These instruments currently hold $17.5 billion worth of ETH and are typically associated with institutional investor demand. More concerning, however, is that demand for leveraged positions in ETH futures declined by 13% over the past week.

Aggregate open interest in ETH futures fell to $28.1 billion across major exchanges, down from a peak of $32.4 billion on Dec. 10. While a drop in leveraged positioning does not automatically signal bearish sentiment, it does put bullish conviction under pressure, especially as ETH traded 41% below its $4,957 all-time high. To determine whether bears are gaining control, investors often look to the monthly futures premium.

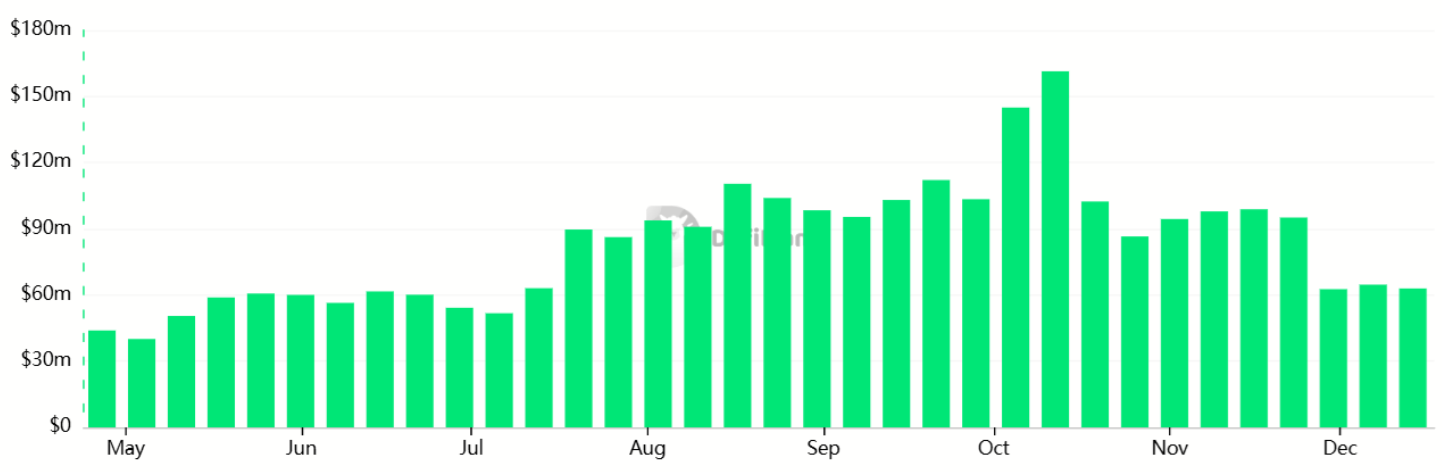

Ether monthly futures traded at a 3% premium relative to spot markets on Wednesday, signaling weak demand from long positions. Under neutral market conditions, this premium typically ranges between 5% and 10% to account for capital costs. Declining activity on the Ethereum network has also weighed on investor expectations for Ether’s price.

Fees generated by decentralized applications (DApps) on the Ethereum network fell to $68 million over the past seven days, down from $98 million four weeks earlier. Demand for ETH is closely tied to onchain activity, as higher usage creates stronger incentives for long-term accumulation. Total Ether locked in staking also slipped to ETH 35.69 million from ETH 35.76 million a month ago, signaling a reduced willingness to hold.

Ether’s ETF outflows in the US reflect weaker investor interest amid slowing Ethereum network activity and declining demand for leveraged positions. For traders to rebuild confidence, more than just a few days of inflows will likely be required, given the broader lack of economic visibility and rising risk aversion across markets.

Related: Crypto ETPs to enter ‘cheesecake factory’ era in 2026–Bitwise

This article is for general information purposes and is not intended to be and should not be taken as, legal, tax, investment, financial, or other advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.