Bitcoin (BTC) Year-End Push to $100,000 Largely Depends on Fed Policy Pivot Outcome

Whether Bitcoin can reach $100,000 before New Year's Eve depends on investors' reaction to the Fed's policy pivot and the market responds to the surge in debt from large tech and AI companies.

Key Points:

The Fed's shift from quantitative tightening and rate cuts to creating liquidity reduces the appeal of fixed-income assets.

Tech credit risk surges, exemplified by Oracle's high debt protection costs, prompting investors to seek scarce assets like Bitcoin.

Bitcoin fell 4% on Friday, touching a low of $88,140, extending its decline to 19% since November. Meanwhile, the S&P 500 is less than 1% from its historical high. This sharp divergence may soon be corrected through Bitcoin's strong upward movement, driven by major central bank policy shifts and rising credit pressure.

This "perfect storm" is expected to push Bitcoin to the psychologically significant $100,000 mark before year-end.

Declining Appeal of Fixed Income and Rising Tech Credit Risk May Boost Bitcoin's Rebound

The most critical factor is the Fed's pivot from quantitative tightening. Quantitative tightening is the process of withdrawing liquidity from the financial system by allowing Treasury bonds and mortgage-backed securities to mature without reinvesting the funds. The Fed officially ended this program on December 1.

Over the past six months, the Fed's balance sheet has shrunk by $1.36 trillion, removing a significant amount of cash. The market is actively anticipating the next phase based on lower interest rates. According to CME FedWatch Tool data, bond futures assign an 87% probability of a rate cut at Wednesday's Fed meeting, with three rate cuts fully priced in by September 2026.

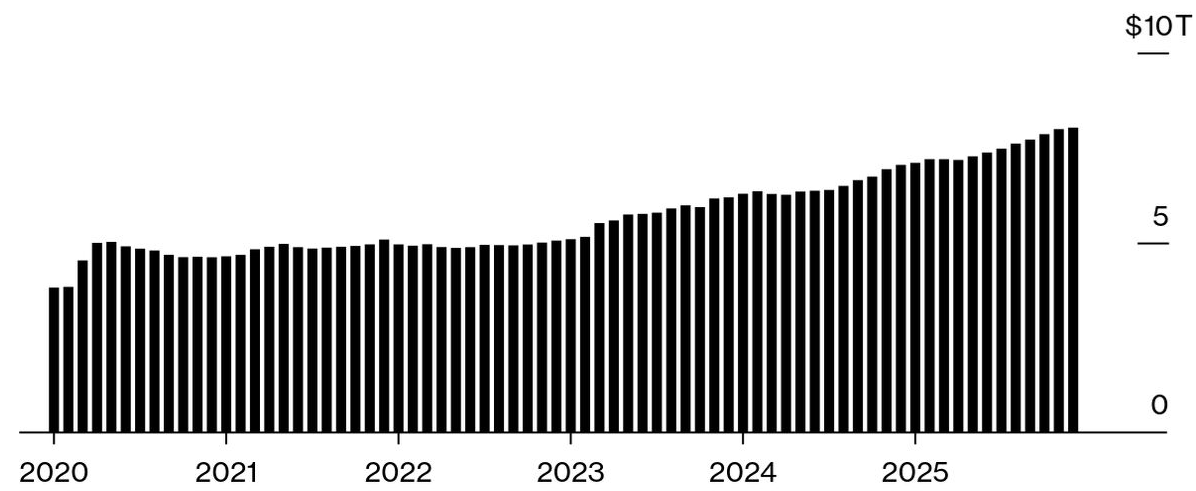

Lower interest rates and increased systemic liquidity fundamentally weaken the demand for fixed-income assets. As the Fed cuts rates, the return on new bond issuances also decreases, reducing their appeal to institutional capital. According to Bloomberg data, US money market funds have now reached a historic high of $8 trillion.

Potential capital rotation is further incentivized by the stock market, particularly structural risks in the tech sector. The cost of using credit default swaps to protect against Oracle (ORCL) debt default has surged to its highest level since 2009. As of the end of August, Oracle holds $105 billion in debt, including leases.

According to Bloomberg, Oracle relies on tens of billions of dollars in revenue from OpenAI. The company is the largest debt issuer outside the banking sector in the Bloomberg US Corporate Bond Index. "Investors are increasingly concerned about how much supply there might be in the future," according to a credit strategy report from Fitch Group.

US Bank Says Fed Rate Stability Increases Probability of Slowdown

Investors are worried about this high-risk push, including US President Trump's Genesis Mission—a national plan aimed at doubling US research productivity through AI and nuclear energy. The surge in demand for debt protection shows extreme unease that massive debt-driven spending may not generate sufficient returns.

Bank of America strategist Michael Hartnett stated that if the Fed signals maintaining stable interest rates, the probability of a broader economic slowdown will significantly increase. This uncertainty, coupled with the demand for less stimulus-dependent growth, makes Bitcoin's scarcity more attractive as institutional capital seeks to reduce its exposure to traditional tech risks.

The Fed's formal end to the "water withdrawal" style liquidity withdrawal plan, combined with the market's aggressive pricing of rate cuts, provides a strong tailwind. With tech credit risk surging due to massive AI-related debt, capital is structurally prepared to shift to scarce assets. This convergence paves a clear path for Bitcoin to break through the $100,000 milestone in the coming months.

Related Recommendation: Bitcoin (BTC) Wallet Linked to Silk Road Transfers $3 Million to New Address

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements subject to risks and uncertainties. Cointelegraph is not responsible for any losses or damages resulting from reliance on this information.

Domande pertinenti

QWhat is the main factor that will determine whether Bitcoin reaches $100,000 by the end of the year, according to the article?

AThe main factor is the outcome of the Federal Reserve's policy shift, specifically how investors react to its pivot from quantitative tightening and interest rate cuts to creating liquidity.

QHow has the Federal Reserve's balance sheet changed in the past six months, and what does this signify?

AThe Federal Reserve's balance sheet has shrunk by $1.36 trillion over the past six months, removing a significant amount of cash from the system, which is part of its quantitative tightening process.

QWhat specific event related to the Federal Reserve's policy occurred on December 1st, as mentioned in the article?

AOn December 1st, the Federal Reserve formally ended its quantitative tightening program, which involved allowing Treasury and mortgage-backed securities to mature without reinvesting the funds.

QWhy is the rising cost of credit protection for companies like Oracle (ORCL) relevant to Bitcoin's potential price surge?

AThe rising cost of credit protection, as seen with Oracle, indicates increased structural risks in the tech sector, which may drive investors to seek scarce alternative assets like Bitcoin as a hedge.

QWhat does the article suggest about the relationship between lower interest rates, increased systemic liquidity, and traditional fixed-income assets?

ALower interest rates and increased systemic liquidity fundamentally reduce the appeal of traditional fixed-income assets because new bond issuances offer lower returns, making them less attractive to institutional capital.