A debate broke out on social media on Saturday about the potential effects of a quantum computer hacking Satoshi Nakamoto’s Bitcoin (BTC) stash and then dumping those coins onto the market.

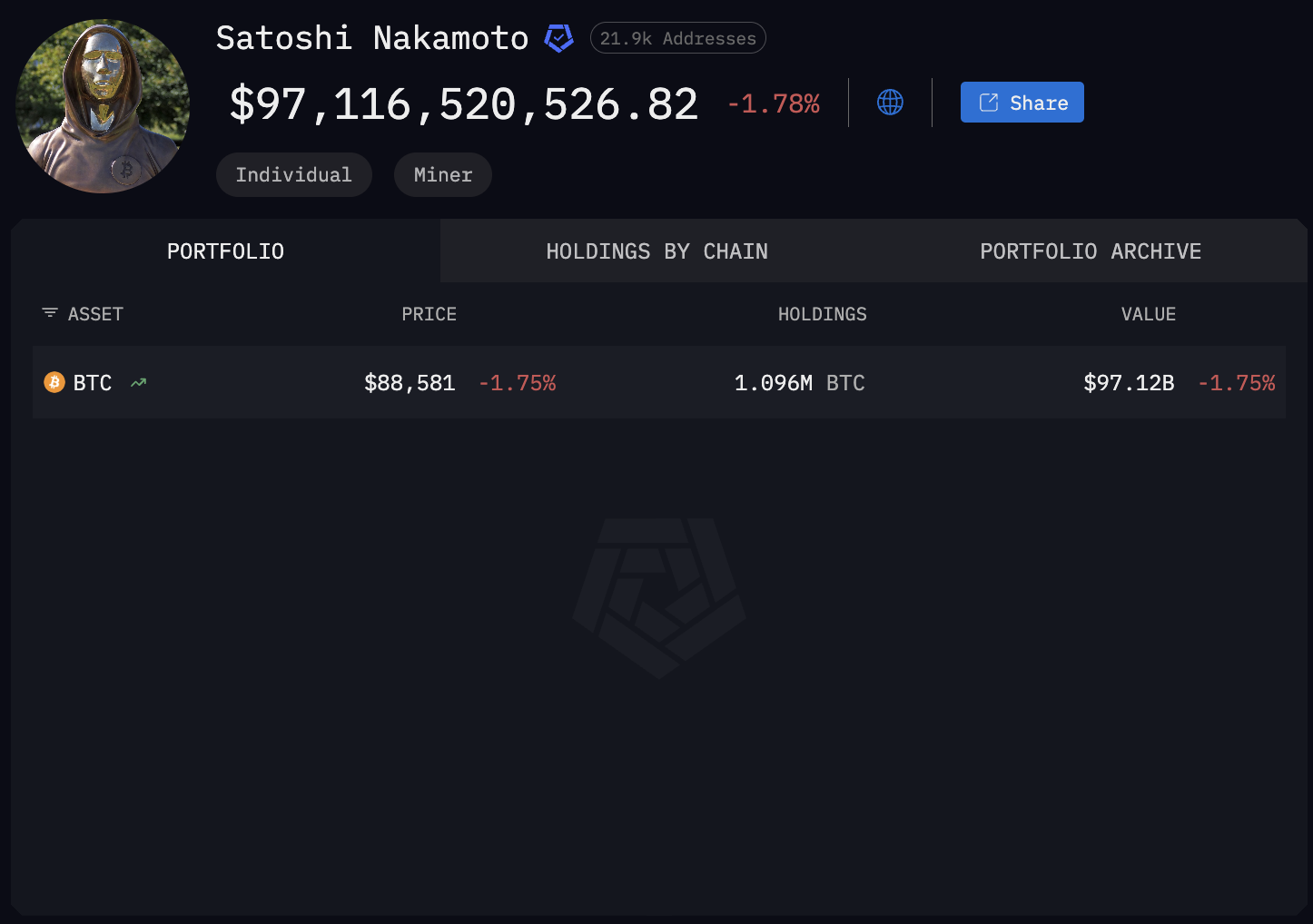

The debate began when YouTuber Josh Otten shared a price chart of BTC crashing to $3.00 and said that this could happen if a sufficiently powerful quantum computer emerges and steals pseudonymous Bitcoin creator Satoshi Nakamoto’s 1 million BTC and sells them.

“Many OGs would buy the flash crash. The Bitcoin network would survive; most coins are not immediately vulnerable,” long-term Bitcoin holder Willy Woo said.

However, there are about 4 million BTC held in pay-to-public-key (P2PK) addresses, including Satoshi’s coins, which show the full public key onchain when coins are spent, making them vulnerable to quantum attacks, Woo added.

Exposing a Bitcoin wallet’s full public key onchain exposes these wallets to quantum attacks in the future because a sufficiently powerful quantum computer could theoretically derive the private key from the public key in the future

Newer types of BTC wallet addresses are not as vulnerable to quantum attacks because they do not expose the full public keys onchain, and if the public key is not known, then a quantum computer cannot generate the paired private key from that data.

The Bitcoin and crypto communities continue to debate the potential effects of quantum computing on Bitcoin and the encryption technology that underpins cryptocurrencies, with some arguing that quantum computing will be the death of the industry.

Related: VanEck boss questions Bitcoin’s privacy, encryption against quantum tech

Bitcoin OG Adam Back says the threat of quantum computers is decades away

Adam Back, an early Bitcoin holder, cypherpunk and co-founder of Bitcoin technology company Blockstream, said that BTC will not face a quantum threat in the next 20-40 years.

Back argued that there is plenty of time to adopt post-quantum cryptography standards, which already exist, before a quantum computer powerful enough to crack modern encryption and cybersecurity standards is built.

Market analyst James Check said that quantum computing does not threaten Bitcoin’s technology because users will migrate to quantum-resistant addresses by the time a viable quantum computer emerges.

The quantum threat poses more of a threat to Bitcoin’s market price because there is “no chance” that the Bitcoin community will agree to freeze Satoshi’s coins before a quantum computer hacks his wallets and puts the coins back into circulation, Check said.

Magazine: Quantum attacking Bitcoin would be a waste of time: Kevin O’Leary